Helping Reverse Mortgage Borrowers at Risk of Foreclosure: The

advertisement

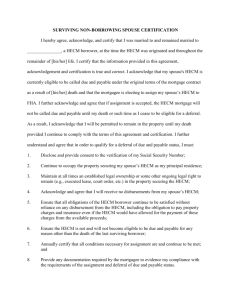

Helping Reverse Mortgage Borrowers at Risk of Foreclosure: The Role of the Aging Network A collaboration between NeighborWorks America and the National Association of Area Agencies on Aging with the Howard County AAA NOTE: Materials for this webinar were developed for NeighborWorks America and are the property of NeighborWorks. Role of the aging network • Aging network professionals may hear from borrowers at any of several stages – Initial default – seeking help to pay for taxes or repairs – During counseling – seeking any possible assistance to reduce expenses or increase income – After counseling – seeking housing options if repayment is not feasible Agenda • • • • • Introduction to reverse mortgages How borrowers may default Current state of the default problem HUD’s attempt to address it How the aging network may be involved Presenters • Christena Schafale: HECM Faculty – Director of Information Services at Resources for Seniors, a local aging agency – Reverse mortgage counselor since 2001 – NeighborWorks trainer since 2004 • Pam Bilal Howard County, Maryland Office on Aging, Supervisor of ADRC Reverse Mortgage (HECM) Counselor since 2008 • Peggy Rightnour Howard County, Maryland Office on Aging, Manager of Client Services What is a reverse mortgage? • A loan • Secured against the value of the borrower’s home • Does not require any interest or principal payments as long as borrower lives in the home Too good to be true? • • • • Significant upfront costs Interest is added to the balance each month Compounding of interest uses up home value Full payment must be made when the borrower stops living in the home Equity after 10 years Upfront Cost 62 year old borrower lump sum draw, 2% appreciation, 5.56% interest Year 10 Cost Year 9 Cost Year 8 Cost Your Total Home Value Year 7 Cost Loan Advance Year 6 Cost Year 5 Cost Year 4 Cost Year 3 Cost Year 2 Cost Year 1 Cost Why would someone do this? • Extra monthly income for basic expenses • Pay off existing mortgage to eliminate monthly payment • Home repairs or upgrades • Catch up on bills such as credit cards • Home care • Travel or other discretionary spending Who are the borrowers? • Over 62 – average was 78 but has dropped to 72 • Many are below 50% of median income and struggling • Frequently have little to no cash assets • Often facing difficult financial strains • On the other hand, some are better off and see RM as an option that will make life better What is a HECM? • HECM = Home Equity Conversion Mortgage • HECM’s are the most common kind of reverse mortgage • Insured by the federal government through FHA • Started in 1989 but grew rapidly only after 2003 • Borrowers are required to receive counseling prior to getting a HECM Role of the HECM counselor • Help the borrower consider alternatives • Explain the way the HECM loan works – Loan amounts – Payment options – Borrower obligations – Consequences of the HECM • NOT to give advice or judge suitability FHA/HUD Role • FHA makes the rules • FHA insures the loan in case loan exceeds home value – Protection for the lender Lender role • Lender originates the loan and provides the money • Lender must follow FHA guidelines in both origination and servicing of HECM loans. – Servicing = what happens after the loan is in place • Making loan advances to borrowers • Tracking whether borrower is complying with loan terms – Servicer may not be the same as original lender Who can get a HECM? • Borrower must – Be over 62 – Own a home with sufficient equity – Live in the home at least half the year – No income or credit requirements How does it work? • Borrower is allowed to access PART of the value of the home • Loan amounts are based on age and interest rate – 70 year old at 5.5% might get about 60% – 70 year old at 6% might get about 55% • The remaining percentage is NOT available to the borrower because this is where the future interest will come from. Beginning of reverse mortgage Reserved Equity Principal Limit = Total Loan Amount Payment Plans • Borrowers can access the available loan amount in different ways – Lump sum = all at once – Line of credit = as needed, amounts controlled by borrower – Monthly payment = on a scheduled basis, with amounts determined by the lender Payment plans • Borrowers can choose which plan they want at the beginning of the loan, and may be able to change later. • In the 20 year history of the HECM program, most borrowers have chosen the line of credit option. • More recently (last 2 years), many borrowers are choosing lump sum. What if the borrower uses up all the loan money? • Loan amount is set at maximum to start with. • Borrower will NOT be able to get more funds if they use up the loan amount, even if there is still equity in the home. • Taking out additional debt on the home is usually not possible. Ownership and Obligations • Borrower still owns the home • Can choose to sell at any time • Must pay all required property charges – Property taxes – Homeowners insurance – Maintenance – HOA or condo fees Default • Failure to pay property charges is a default under the terms of the loan • Borrower is informed of this obligation at the beginning of the loan • Servicer is responsible for monitoring compliance What happens in default? • Borrower fails to pay property charges • Lender/servicer finds out and contacts borrower • If borrower has loan funds still available, these can be used to pay the charge • If no loan funds are available, servicer pays the charge in order to protect the property • Servicer then attempts to collect from borrower What if borrower can’t pay? (in theory) • Servicer must report the default to FHA and seek permission from FHA to call loan due and payable. • Borrower is then required to pay the entire loan back. • If borrower cannot pay off the loan, the lender must proceed to foreclosure. What if borrower can’t pay? (in reality) • Until recently, HUD routinely deferred foreclosure on loans in default because of property charges. • Servicers continued to hold loans in default status. Why? • Lenders and HUD both unwilling to carry out foreclosure on senior homeowners – Most amounts are relatively small (under $5,000?) – Consequences for affected homeowners could be severe. – Publicity would be terrible. Consequences • Increasing number of HECMs in default – Exact number unknown – Estimates = 30,000? – Urgency of the problem highlighted by an audit done by the HUD Office of Inspector General. • Problem appears to be increasing rapidly. – In May 2009, HUD was aware of about 8,000 loans in default – By summer 2010, OIG audit found an additional 13,000 loans in default. – These 13,000 loans were held by 4 of 16 servicers of HECM loans; total number is still to be determined. Why the rapid increase? • Many more HECM loans in the pipeline? • Effect of economic collapse? • Increasing use of lump sum draws? – Borrower has no remaining loan funds that can be used for taxes/insurance – These loans much more vulnerable to early defaults HUD takes action • January 2011, HUD issued a Mortgagee Letter with guidance to lenders on how to handle defaults. Proposed process • Servicers notify borrowers of default status and consequences (by April 29, 2011) • Borrowers have 30 days to contact the servicer to arrange payment of delinquent charges Loss mitigation counseling • Borrowers are also encouraged to contact a specialized housing counselor for help – HUD has provided funding and training to prepare a group of counselors for this task – 125 counselors have been selected to provide property charge loss mitigation counseling Proposed process • Counselor tries to help borrower work out a way to pay the required amount – Budget and resource analysis – Seek other financial assistance or social service programs to increase income or decrease expenses – Work out payment arrangement with servicer • Can be no more than 24 months • If no success, counselor attempts to help borrower prepare to find other housing Questions at this point? • Please use the Q&A function in WebEx The small button in the top right of the screen that has a question mark on it. • Ask the question to ALL PANELISTS Choose from the drop down menu available. • If you are not able to use the Q&A function, email questions to hecminfo@nw.org Role of the Area Agencies on Aging/ADRC • Pam Bilal – Howard County, Maryland Office on Aging, Supervisor of ADRC – Reverse Mortgage (HECM) Counselor since 2008 • Peggy Rightnour – Howard County, Maryland Office on Aging, Manager of Client Services Contact Numbers for Property Charge Loss Mitigation Counseling CredAbility 888‐395‐2664 Money Management International 866‐765‐3328 National Council on Aging 800‐510‐0301 National Foundation for Credit Counseling 866‐363‐2227 NeighborWorks America 888‐990‐4326* * Number is ONLY for consumers seeking counseling. When and how referrals to AAA/ADRCs will be made • The referral will be made by a Reverse Mortgage (HECM) Counselor with a “warm” handoff • The Counselor should outline why the referral is being made • The Counselor should give an overview of what has already been provided such as Benefits Check‐up and formation of a basic budget How AAA/ADRCs Can Provide Assistance Major Areas to review • Property Tax Credits • QMB/SLMB • Medicare Part D • Energy Assistance • Local Grants • Alternative Housing Information Questions? • Please use the Q&A function in WebEx The small button in the top right of the screen that has a question mark on it. • Ask the question to ALL PANELISTS Choose from the drop down menu available. • If you are not able to use the Q&A function, email questions to hecminfo@nw.org