CATO HANDBOOK CONGRESS

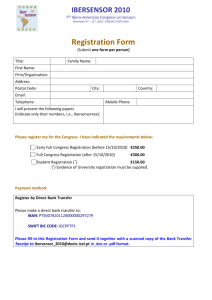

advertisement