Jeremy Larochelle Strategic Analysis of Live Nation Entertainment

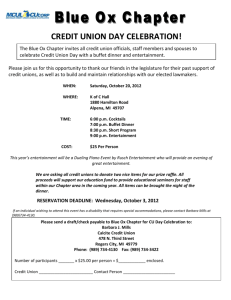

advertisement