Case Analysis 2: Starbucks - Tori Wenzel

advertisement

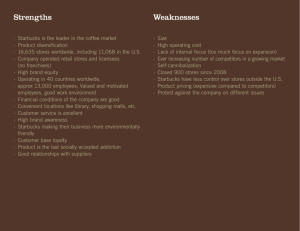

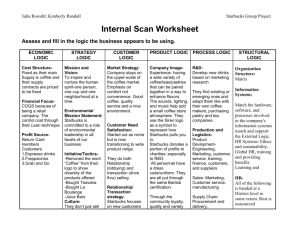

Case Analysis 2: Starbucks Tori Wenzel Simmons College MGMT 340 – Strategy Professor Raffety November 8, 2014 Wenzel 2 History & Development In 1971, Starbucks began selling whole-bean coffee at the Seattle Pike Place Market. Jerry Baldwin, Zev Siegl, and Gordon Bowher, were three entrepreneurs who developed Starbucks and named the company after the first mate in Herman Melville’s novel Moby Dick. By 1982, Starbucks had expanded into five stores and one small roasting facility that were operating as a wholesale business selling coffee to local restaurants. As Starbucks was going the three entrepreneurs decided to invest in Howard Shultz next. Shultz joined Starbucks as manager of retail sales and marketing, bringing insight into their marketing strategy that was currently non-existent. During the year of 1983, Shultz decided to take a trip Italy where he discovered the restaurant side of coffee. Italians understood coffee as an integral part of the romantic culture in Italy. Shultz noticed that Italians began their day at the espresso bar and later returned to enjoy more coffee with friends. The owners of Starbucks during this time were not interested in entering the restaurant side of coffee and wanted to continue to be suppliers. This resistance to change and growth prompted Shultz to leave Starbucks and open his own coffee bars. By 1987, Shultz had opened three II Giornale coffee barns, two in Seattle and one in Vancouver. During this year the owners of Starbucks agreed to sell the company to Shultz. That is when Shultz combined his II Giornale coffee bars and Starbucks under the name of Starbucks. Upon Shultz acquiring ownership the image of Starbucks had began. Shultz had a plan to grow Starbucks slowly with a solid foundation. Shultz transformed each of Starbucks locations into coffee bars inspired from his trips to Italy and Milan. Starbucks hired top executives from corporations like PepsiCo because Shultz knew that early losses would ensure future profits. From 1989 to 1990 Starbucks had reported losses each year; however, Shultz was not discouraged and continued with his methods of not to “sacrifice long-term integrity and values for short-term profits.” By 1991 sales had increased by 84% and Starbucks was on the rise. Early successes were down played because Shultz believed in the philosophy of under-promising and overdelivering was the best method. Starbucks continued to grow and brought in two billion dollars by 2000, above analysts’ predictions of one billion dollars a few years prior. Starbucks was able to average an annual revue growth rate of 28% per year from 1993 to 2013. As of 2013, Starbucks brought in $13 billion in annual revenues; an estimated 200,000 employees; 17,000 Starbucks-branded cafés in 40 countries. Starbucks also owns Seattle’s Best Coffee, Torrefazione Italia, Tevana’s Heaven of Tea brands, and more. Today, Starbucks is one of the leading, specialty coffee producers in the United States and expanding worldwide. First I will analyze the internal environment. Second, I will explore the external industry environment. Then I will discuss Starbucks business-level strategy. I will conclude by providing Starbucks recommendations on global expansion. I provide a Wenzel 3 quick reference that includes information corresponding to your specific questions in Appendix 1. Internal Analysis Competitive Advantage: Starbucks has been able to achieve a competitive advantage over the industry and major competitors in certain areas of profitability. The four indicators of profitability that I will be touching upon include; annual sales, return on invested capital (ROIC), return on assets (ROA), and return on equity (ROE). The annual sales for Starbucks, McDonalds, and Dunkin Donuts are $13.30 billion, $27.57 billion, and 658.18 million respectively. McDonalds has higher annual sales than Starbucks each company offers different services and quality as well as the size of each corporation varies. Starbucks focuses on having a high quality differentiated product where an experience I sold with every product. McDonalds focuses on have a large variety of products but at a lower cost and quality. Dunkin Donuts is substantially lower in annual sales, however, still a major competitor within the United States. The ROIC measures the effectiveness of a company’s usage of capital funds that are available for investment. The ROIC for Starbucks, McDonalds, Dunkin Donuts, and the industry are 25.60%, 18.33%, 2.67%, and 16.47% respectively. Out of the companies compared Starbucks is the most effective with their usage of capital funds that are available for investment. Starbucks is also above the industry average for ROIC. This concludes that out of the companies compared Starbucks is the most effective, therefore, creating the most value as of 2013. The ROA measure the profit earned on the employment of assets. The ROA for Starbucks, McDonalds, Dunkin Donuts, and the industry are 17.57%, 15.98%, 3.36%, and 11.70% respectively. Starbucks has the highest ROA of the companies and industry compared; therefore, Starbucks is the most profitable on their assets. The ROE measures the percentage of profit earned on common stockholders’ investment in their company. The ROE for Starbucks, McDonalds, Dunkin Donuts, and the industry are 28.85%, 36.83%, 19.83%, and 32.26% respectively. McDonalds has the highest profits earned from stockholders’ investment and are the only company that is above industry average of the companies compared. Even though Starbucks’ ROE is below industry average this does not indicate that they are in debt because their ROIC is below their ROE. Starbucks has been able to continue to open stores and increase revenues each year, with the exception of their decrease in 2009. This was due to store closures, however, Starbucks came back in 2010 bringing in higher revenues than in 2008. Starbucks has been able to sustain competitive advantage over the years within their industry and market segment. Distinctive Competencies: Starbucks has the resources and capabilities that it takes in order to have distinctive competencies within their company that differentiate their Wenzel 4 products from the industry. Starbucks has both tangible and intangible resources or assets of the company that are put into action with the capabilities that they possess. The tangible resources include the location of their stores, the additional companies that Starbucks owns, the location of their roasting plants, where they buy their beans from, and the employee benefit packages. Starbucks has approximately 17,000 Starbucks-branded cafés in 40 countries around the world. Approximately 9,000 of these locations are corporate owned and licensees and franchisees operate approximately 8,000 of these locations. This is an important resource to have for Starbucks because their primary goal is to bring an experience to their customers with each cup of coffee. The only way to obtain this goal is to have the store locations dispersed around the world. Starbucks is also the owner of many other companies including, Seattle’s Best Coffee, Torrefazione Italia, Teavana’s Heaven of Tea brands and many more. This has allowed Starbucks to reach different markets and to increase their profits. Starbucks also owns private roasting facilities in various locations including California, Nevada, Pennsylvania, South Carolina, Washington, and the Netherlands. These roasting facilities are strategically placed in order to serve different locations around the world. This cuts down on distribution costs to various stores due to their close proximity various markets. Starbucks has obtained an exclusive contract with a mill in Pasto, located on the side of the Volcano Galero for their Narino Supremo bean. This is an important resource because this is one of the highest quality coffee beans around the world. Starbucks takes the Narino Supremo beans and roasts them to perfection and sells them to their customers instead of blending with lower quality coffee. Allowing Starbucks to differentiate their products. Starbucks also provides employee benefits packages to all full time and part time employees. This is to create incentive and desire for their employees to perform to the best of their ability everyday. The intangible resources include the procurement process of their coffee beans, the Starbucks logo, Shultz’s knowledge and their employee training programs. The procurement process or the roasting of the coffee beans is vital to Starbucks’ product. During this process professional roasters have to watch, listen and smell the coffee beans to know when they are done perfectly and even upon completion each batch of coffee beans are checked for the correct coloring too. If batch is not perfect they are discarded. This process is one of the aspects for Starbucks’ success and reputation for high quality products over the years. The Starbucks logo is also an intangible resource because it is a display of their brand. The logo represents a mermaid who has flowing hair that afforded her more modesty. The current logo does not have the Starbucks Coffee logo on it because Starbucks wants to be able to symbolize a broader product range. Shultz’s knowledge and believes are also vital to the success of Starbucks and cannot be replicated. This is an important intangible resource for the future growth of Starbucks. The final intangible resource is the employee training programs. These programs train the employees on Wenzel 5 ideals and methods of operation at each Starbucks store. This creates consistency and employee knowledge about what Starbucks stands for. Starbucks also has the capabilities to productively use their resources. Their capabilities include the procurement process to produce their coffee as well as their hiring and training methods. The procurement process to produce their coffee was previously described as a resource; however, this process is also a capability. This is due to the skills and knowledge needed to effectively produce the highest quality coffee. Each roaster is trained to know exactly when the beans are perfectly roasted by watching, listening, and smelling each batch. This capability allows Starbucks to produce the highest quality coffee. Starbucks hiring practices are also a capability because by hiring the proper employees the company is able to build a quality business. When Shultz took over Starbucks’ he believed hiring top executives away from other large corporations would benefit the company in the long run. This allows Starbucks to build a strong foundation to work from. Starbucks also promotes their employees from within to give each employee a desire to perform their best to move up through Starbucks. This is true with the Starbucks’ roasters; each roaster is promoted from within and is trained for a year. This promotion is considered to be a great accomplishment. All of these capabilities allow Starbucks to effective utilize their resources currently and moving forward. Strengths: Starbucks strengths include product line, store locations, and their wellknown reputation. The Starbucks’ product line at the basic level is high quality coffee and pastries. The product offerings include various types of drinks that incorporate espresso and coffee as well as other customizable drink options. Their pastries are strategically chosen to compliment the coffee and espresso drinks. Starbucks’ coffee is considered a strength because of how they differentiate their product from competitors. They perfectly roast each batch of coffee beans in order to produce and sell the highest quality coffee. The store locations that Starbucks have chosen are also a strength. Starbucks strategically chooses visible locations to reduce money spend on advertising. This allows for Starbucks to be located in accessible locations for their customers as well. Starbucks has stores located in 40 countries around the world and depending on the country, government and norms they are either corporate owned stores or licensed stores. This allows for Starbucks to be globally located and decreases risks of entering new markets. The Starbucks reputation is also one of their strengths. Starbucks is viewed as offering high quality products that is associated with a higher social status as well. Customers come for the coffee and pastries and stay for the inviting and comforting environment and culture sold with each product. The Starbucks customers expect exceptional products and service during each visit. Weaknesses: Starbucks has strengths but also has weaknesses that they can approve upon. These weaknesses include global market share and private roasting facilities Wenzel 6 around the world. Their first weakness is that Starbucks does not have the majority market share in Canada, the United Kingdom, Western and Eastern Europe and Asia. In many of these markets Starbucks has either the second or third largest market share. In Canada, Starbucks has the second largest market share behind the other category that includes many local coffee shops. In the United Kingdom, Starbucks has the third largest market share behind other local coffee shops and Costa Coffee. In Western Europe, Starbucks has the second largest market share behind other local coffee shops. In Eastern Europe, Starbucks has one of the lowest market shares and is not considered established in this market. In Asia, Starbucks has the second largest market share behind other local coffee shops, that controls 2/3 of the Asian market. Having the largest market share in each market takes time but can be accomplished if done effectively. Starbucks second weakness is lack of roasting facilities in different countries. By not having their facilities located in different markets this increases their distribution costs to global markets. By implementing more roasting facilities in key markets this will increase efficiency, profitability, and market share in each market. External Environment Analysis Industry: Starbucks is currently operating in the specialty eatery industry. To be more specific Starbucks is operating in the specialty coffee segment within this industry. Their current rivals include Caribou Coffee, McDonalds, Dunkin’ Donuts, Peet’s Coffee and Tea as well as many smaller competitive companies. Porters Five Forces: Starbucks is well known throughout the United States and continuing to be known globally. The risk of new entrants is apparent for Starbucks in some markets more than others. The overall threat of new entrants include independent local coffee shops, Italian inspired coffee shops and bars, Boutique coffee bars, locally operated specialty cafés, and other fast food chains continuing to enter the specialty coffee segment. Although many of these potential competitors are not affecting Starbucks currently, they still need to be aware of up and coming competitors. Economies of scale within the industry are the ability for any company to reduce unit costs by spreading costs over large quantities of outputs. Starbucks produces products in an atypical method of mass production. This is apparent in their production of roasting their beans to perfection. The coffee beans are roasted to the Starbucks standard and each batch are evaluated and if they are not up to the standard they are discarded. This mass production process is known as the procurement process, this allows Starbucks to differentiate their products from competitors. In order for Starbucks to achieve economies of scale they have to produce a large amount of perfectly roasted coffee beans. Starbucks is able to efficiently spread their costs out by having six different roasting facilities located in California, Nevada, Pennsylvania, South Caroline, Washington, and the Netherlands. This allows for many facilities to be operating at the same time and Wenzel 7 distributing to different markets. By efficiently producing perfectly roasted coffee beans they are then able to distribute them to their markets for sale to end consumers. Starbucks also is able to achieve economies of scale by taking advantage of spreading fixed production costs by expanding the number or corporate and licensed stores around the world. By strategically locating each Starbucks store, Starbucks is able to spend only $182.4 million or 1.3% of sales on advertising their product and brand. This allows them to open more locations in the future, continue to bring innovation to their menu and build an iconic brand. Starbucks has been able to obtain brand loyalty of their consumers because of high quality products, exceptional service, and an experience served with every product. By Starbucks only spending 1.3% of their sales on advertising it has allowed them to invest in areas that have created their brand loyalty and value to Starbucks. Starbucks brand loyalty comes from their highly visible locations, innovative menu and their wellknown brand. The Starbucks brand and logo have evolved to create stronger brand loyalty with their customers. The original Starbucks logo showed a 16th century Norse woodcut of a visibly topless mermaid. This logo was used until Shultz took over Starbucks and in 1992 Starbucks released their improved logo. This logo showed a mermaids flowing hair that afforded her more modesty and was no longer visible topless. This was a necessary improvement because Starbucks was entering into countries with strong cultural taboos around nudity. This logo also showed the Starbucks Coffee nameplate. This logo was used until 2011 when the present day logo was designed. This logo removed the nameplate allowing Starbucks to symbolize a broader product range than just coffee. The Starbucks brand and logo has continued to improve and represent the emphasis Starbucks has on high quality products. Starbucks is known for high quality coffee and pastries and this has contributed to their brand loyalty with their customers. By focusing on having perfectly roasted coffee beans during the procurement process Starbucks is able to deliver these products with pride to each customer. Starbucks also is known for selling an experience with each of their products. Starbucks employees have a goal to create a long-term relationship with their customers. Employees taking extra quality time to interact with the customers when they order, when they receive their orders as well as questions concerning home brewing, achieve this. In addition the atmosphere creates dedication to Starbucks for American customers. An absolute cost advantage that Starbucks has over new entrants includes the control of the Narino Supremo bean crop in Pasto, located on the side of the Volcano Galero. This allows Starbucks the ability to produce superior coffee and differentiation of their products compared to industry competitors. Their procurement process allows for them to create perfectly roasted coffee beans increasing their competitive advantage. In addition Starbucks has access to capital from years of being in business and being profitable, that allows for future growth. Wenzel 8 There are a large number of companies operating in the specialty eatery industry and a smaller number operating in the specialty coffee segment. This allows for rivalry among the established companies because they are all fighting for market share. This industry is considered to be a consolidated industry because it is dominated by a small number of large companies that determine industry price. Each company is directly affected if another company decides to change their price, quality, or product line. The industry demand is fairly saturated and companies within the industry are fighting for market share in various markets around the world. Rivalry is sparked by the desire for the highest quality beans to produce the highest quality coffee, therefore, acquiring the largest market share. There are cost conditions that are associated with the specialty coffee industry including each company’s fixed costs. The fixed cost in the specialty coffee industry are high therefore in order to achieve economies of scale they must produce a high volume of product to be able to spread costs over a large customer base. Starbucks has a differentiated product that leverages them to achieve a higher sales volume that allows them to have the ability to be profitable and achieve economies of scale. Cost conditions associated with the specialty coffee industry can cause rivalry within the industry. The exit barriers associated with the specialty coffee industry and for particularly Starbucks include the employee benefits packages and Shultz’s emotional attachment to the specialty coffee industry. The employee benefits packages are provided to full time and part time employees. These packages include medical, dental, vision and short-term disability, as well as paid vacations and holidays, mental health and chemical dependency benefits. In addition they include an employee assistance program, a 401(k) savings plan, and stock options. For Starbucks to exit the industry all of these items would need to be addressed and paid for. In addition Schultz has an emotional attachment to the specialty coffee industry. He believes in creating an experience and having the best beans for a higher purpose. This would be emotionally draining on Schultz should Starbucks ever leave the market. The bargaining power of buyers in terms of Starbucks being the buyer is high because Starbucks has made a promise to the mill in Pasto to guarantee purchase of the entire Narino Supremo bean crop each year. This means that Starbucks is the sole income and profit provider to these farmers each year. The bargaining power for the buyer is also low because Starbucks relies on this crop each year in order to achieve the highest quality and most differentiated product on the market. The bargaining power of buyers when customers are the buyers is low. Customers do not have control over the prices of the products offered and are willing to pay for the experience and high quality Starbucks products at a premium price. The bargaining power of the supplier in terms of the mill in Pasto is high because they offer a unique product that is known to be high quality and highly desired in regions around the world. The bargaining power is also low because they rely on Starbucks for their income and profits from their crop each year. Wenzel 9 Starbucks products are substitutable in the specialty coffee industry due to their competitors. Caribou Coffee is a substitute because they offer a specialty coffee that is also sold to many grocery stores. Peet’s Coffee and Tea is substitute they produce a high quality coffee around the same price point. McDonalds’ McCafé drinks are substitutes because they are priced lower than Starbucks but are not at the same quality level. Dunkin’ Donuts products are substitutes because they offer espresso drinks, as well as coffee, and their newest product the dark roast coffee this is aimed towards customers desiring stronger and higher quality coffee. The specialty coffee industry has complementing products that are sold in various companies’ stores. Home brewing products such as coffee bean grinders as well as coffee and espresso machines are considered complements. Addition complementing products are coffee mugs, travel mugs and travel tumblers. Many companies have taken these products and used them as promotional items by adding their logo. Threats: Starbucks has threats that include competitors increasing market share, industry competitors entering a new market prior to Starbucks, and the economy. Dunkin’ Donuts and McDonalds increasing their market share within the specialty coffee industry directly affects Starbucks. If their market share increases in a saturated market rivalry among competitors will also increase. Industry competitors entering into new markets to expand their brand and product lines are also threatening to Starbucks. Starbucks needs to continually innovate their menu and products in order to stay competitive. Lastly if the economy enters a recession this is a threat to Starbucks because some customers may choose a cheaper option. Opportunities: Starbucks has opportunities for growing the coming going into the future that include expanding into different markets as well as acquiring ownership or the creation of new brands. Starbucks has the opportunity to expand into the health and fitness markets by utilizing products and ideals associated with this market. This would give Starbucks the opportunity to innovate their menu and create healthier options of the health conscience customer. Starbucks also has the opportunity to acquire ownership or create a brand of clothing that appeal to the health and fitness consumer but continue to want to high social status of Starbucks. For example a competitor that produces high quality fitness apparel is Lulu Lemon. They are perceived as high quality and valuable to their customer’s fitness needs and is associated with higher societal status. Business-level Strategy Starbucks business-level strategy is a focused differentiation strategy because their target are customers who want customized products that fulfill their needs in the specialty coffee segment. Starbucks products are differentiated from competitors because of the procurement process of the Narino Supremo beans is used to produce high quality coffee. Another aspect that contributes to their strategy is selling the Starbucks Wenzel 10 experience with every cup of coffee or product sold to customers who require a high quality cup of coffee. There are approximately 17,000 Starbucks-branded stores around the world. There are approximately 9,000 corporate owned stores where they control the training and required features of each store. There are approximately 8,000 licensee-owned Starbucks stores worldwide. Starbucks allowing licensed stores allows for Starbucks to enter markets with no risk because the corporation does not have to provide the capital. Also the licensed stores have owners who are usually entrepreneurs and are motivated to improve the quality and profitability of their store. Starbucks does not invest in large amounts of advertising; they only used 1.3% of sales towards advertising in 2013. Starbucks prefers to invest in securing highly visible locations, innovation in its menu and building an iconic brand worldwide. Recommendations Starbucks has grown into one of the most iconic specialty coffee brands in the world. I recommend that Starbucks focus on expanding into global markets further to establish larger customer bases and to obtain more market share. In order to effectively expand Starbucks further I recommend that in markets where Starbucks is present only in corporate owned stores allowing licensed stores to enter as well. This will allow for Starbucks to create a larger presence in each market with lower risk involved. I also recommend that in markets where Starbucks are present by licensed stores entering into these markets with corporate owned stores. This will increase profits and market share in these markets. I also recommend going forward for Starbucks to eventually consider buying back licensed stores and making them corporate stores once Starbucks is well established in that market. Lastly I recommend that in order to lower distribution costs Starbucks needs to strategically place more roasting facilities around the world. This will require more roasters being trained before the new facilities are able to be operated. Wenzel 11 Appendix: Exhibit 1: Pro%itability 40.00% 35.00% 30.00% Starbucks 25.00% McDonalds 20.00% Dunkin 15.00% Industry 10.00% 5.00% 0.00% ROIC ROA ROE Analysis Questions 1. How would you characterize the specialty coffee café industry? What is the key success factors in this industry? • Starbucks is currently operating in the specialty eatery industry. To be more specific Starbucks is operating in the specialty coffee segment within this industry. Their current rivals include Caribou Coffee, McDonalds, Dunkin’ Donuts, Peet’s Coffee and Tea as well as many smaller competitive companies. • The key success factors include differentiation, economies of scale, brand loyalty, and cost advantages. 2. What are Starbucks' strengths and weaknesses? Does it have any sources of sustainable competitive advantage? • The Starbucks’ product line at the basic level is high quality coffee and pastries. The product offerings include various types of drinks that incorporate espresso and coffee as well as other customizable drink options. Their pastries are strategically chosen to compliment the coffee and espresso drinks. Starbucks’ coffee is considered a strength because of how they differentiate their product from competitors. They perfectly roast each batch of coffee beans in order to produce and sell the highest quality coffee. • The store locations that Starbucks have chosen are also a strength. Starbucks strategically chooses visible locations to reduce money spend on advertising. This allows for Starbucks to be located in accessible locations for their customers as well. Starbucks has stores located in 40 countries around the world and depending Wenzel 12 on the country, government and norms they are either corporate owned stores or licensed stores. This allows for Starbucks to be globally located and decreases risks of entering new markets. • The Starbucks reputation is also one of their strengths. Starbucks is viewed as offering high quality products that is associated with a higher social status as well. Customers come for the coffee and pastries and stay for the inviting and comforting environment and culture sold with each product. The Starbucks customers expect exceptional products and service during each visit. • Their first weakness is that Starbucks does not have the majority market share in Canada, the United Kingdom, Western and Eastern Europe and Asia. In many of these markets Starbucks has either the second or third largest market share. In Canada, Starbucks has the second largest market share behind the other category that includes many local coffee shops. In the United Kingdom, Starbucks has the third largest market share behind other local coffee shops and Costa Coffee. In Western Europe, Starbucks has the second largest market share behind other local coffee shops. In Eastern Europe, Starbucks has one of the lowest market shares and is not considered established in this market. In Asia, Starbucks has the second largest market share behind other local coffee shops, that controls 2/3 of the Asian market. Having the largest market share in each market takes time but can be accomplished if done effectively. • Starbucks second weakness is lack of roasting facilities in different countries. By not having their facilities located in different markets this increases their distribution costs to global markets. By implementing more roasting facilities in key markets this will increase efficiency, profitability, and market share in each market. • Starbucks has been able to continue to open stores and increase revenues each year, with the exception of their decrease in 2009. This was due to store closures, however, Starbucks came back in 2010 bringing in higher revenues than in 2008. Starbucks has been able to sustain competitive advantage over the years within their industry and market segment 3. Porter argues that to achieve a sustainable position, a company has to make trade-offs that its competitors are unable or unwilling to make. What tradeoffs has Starbucks made? What different activity choices has it made from its rivals? Starbucks has made trade-offs such as having the highest quality coffee. In order to achieve this goal they have to invest in trained roasters and the time it takes to train them as well as having the highest quality coffee bean. Other competitors sacrifice quality in order to keep prices low and have the ability to have a high supply. Wenzel 13 4. How is Starbucks' product positioned in the market? How do its functionallevel strategies align (or fail to align) with this positioning? Starbucks’ product is positioned as a high end differentiated product. In order to effectively achieve this product they have private roasting facilities producing perfectly roasted coffee beans. As well as their advertising tactics are to spend minimal amounts of money because Starbucks would rather invest in securing high visible locations, innovating their menu and building their brand worldwide.