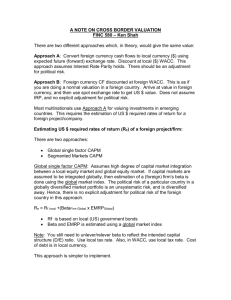

The WACC Fallacy

advertisement