study of regulated uses

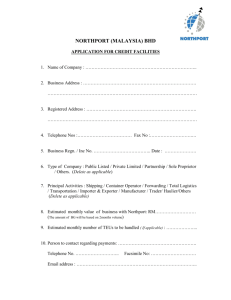

advertisement