Kona Grill Analysis

advertisement

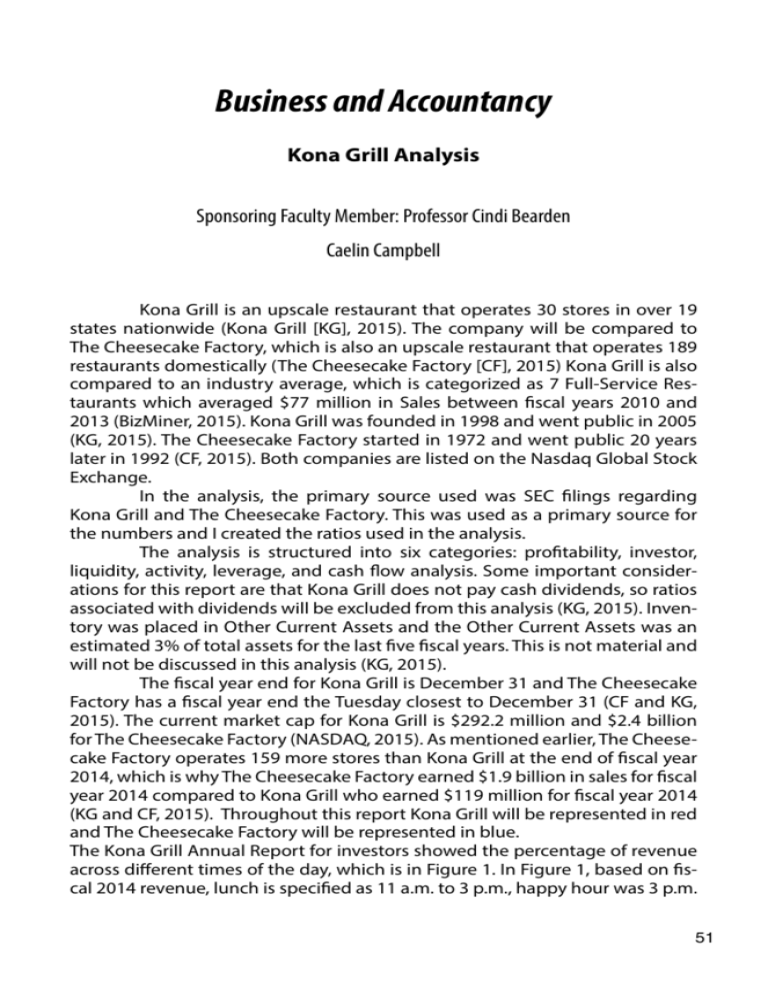

Business and Accountancy Kona Grill Analysis Sponsoring Faculty Member: Professor Cindi Bearden Caelin Campbell Kona Grill is an upscale restaurant that operates 30 stores in over 19 states nationwide (Kona Grill [KG], 2015). The company will be compared to The Cheesecake Factory, which is also an upscale restaurant that operates 189 restaurants domestically (The Cheesecake Factory [CF], 2015) Kona Grill is also compared to an industry average, which is categorized as 7 Full-Service Restaurants which averaged $77 million in Sales between fiscal years 2010 and 2013 (BizMiner, 2015). Kona Grill was founded in 1998 and went public in 2005 (KG, 2015). The Cheesecake Factory started in 1972 and went public 20 years later in 1992 (CF, 2015). Both companies are listed on the Nasdaq Global Stock Exchange. In the analysis, the primary source used was SEC filings regarding Kona Grill and The Cheesecake Factory. This was used as a primary source for the numbers and I created the ratios used in the analysis. The analysis is structured into six categories: profitability, investor, liquidity, activity, leverage, and cash flow analysis. Some important considerations for this report are that Kona Grill does not pay cash dividends, so ratios associated with dividends will be excluded from this analysis (KG, 2015). Inventory was placed in Other Current Assets and the Other Current Assets was an estimated 3% of total assets for the last five fiscal years. This is not material and will not be discussed in this analysis (KG, 2015). The fiscal year end for Kona Grill is December 31 and The Cheesecake Factory has a fiscal year end the Tuesday closest to December 31 (CF and KG, 2015). The current market cap for Kona Grill is $292.2 million and $2.4 billion for The Cheesecake Factory (NASDAQ, 2015). As mentioned earlier, The Cheesecake Factory operates 159 more stores than Kona Grill at the end of fiscal year 2014, which is why The Cheesecake Factory earned $1.9 billion in sales for fiscal year 2014 compared to Kona Grill who earned $119 million for fiscal year 2014 (KG and CF, 2015). Throughout this report Kona Grill will be represented in red and The Cheesecake Factory will be represented in blue. The Kona Grill Annual Report for investors showed the percentage of revenue across different times of the day, which is in Figure 1. In Figure 1, based on fiscal 2014 revenue, lunch is specified as 11 a.m. to 3 p.m., happy hour was 3 p.m. 51 to 5 p.m., dinner was from 5 p.m. to 9 p.m., and reverse happy hour was from 9 p.m. to close which ranged from 11 and 12 p.m. As expected dinner was the largest portion of revenue at 52%, but the important piece to take away is that by earning sales at various parts during the day shows that the company is fully utilizing the rent space. Percentage of Revenue Across Time of Day Figure 1 Restaurant Industry Outlook The restaurant industry is being driven by an improving economy. One important measure of the improving economy is how much disposable income the United States consumers have. A measure of the economy is personal disposable income, which increased from $11,000 billion in 2010 to over $13,000 billion in 2014 (The University of Michigan, 2015). Restaurant sales are largely tied to the Consumer’s Disposable Income level. One of the benefits the restaurant industry is expected to provide is creating 1.7 million jobs by 2025 (National Restaurant Association [NRA], 2015). The restaurant industry is experiencing rising food costs, which affects the profitability of a company by rising costs of goods sold (Savilonis, 2014). As of February of 2014, a pound of ground beef cost $3.55, which is a record high even after accounting for inflation (CNN, 2014). Ground beef increased by 56% since 2010. Ground beef is not the only thing rising in demand, but round steak is too, which is selling $5.28, which the government states is the highest price seen in the last 20 years (CNN, 2014). Ricky Volpe, economist with the U.S Department of Agriculture, explains that droughts in California and growing demand for beef in Asia has increased demand for beef (CNN, 2014). This resulted in beef posting the largest month to month increase in February in more than a decade (CNN, 2014). 52 Caelin Campbell Sales Sales have increased for five consecutive years between fiscal years 2010 and 2014. See Figure 2. Restaurant sales are dependent upon consumer disposable income, which is largely tied to the economy. Kona Grill (amounts in millions) 2010 2011 2012 2013 2014 $82.7 $93.7 $96.0 $98.3 $119 Figure 2 A measure of the economy is Personal Disposable Income, which increased from $11 billion in 2010 to over $13 billion in 2014 see Figure 3. Another indicator of the economy is consumer confidence, which had a lower rating of 60 in 2011 and had a higher rating of 100 in 2014 (The University of Michigan, 2015). Figure 3 Sales are heavily influenced by foot traffic levels. Between fiscal years 2010 and 2011, the foot traffic increased by 3%, which was the highest over the five fiscal years. On average over the last five fiscal years, the foot traffic increased by roughly 1.8% (KG, 2015). The increase in foot traffic levels led to an increase in comparable store sales for the last five fiscal years. Between fiscal years 2010 and 2014, the same-store sales growth was 8.8%, 2.7%, 1.4%, and 3.8% (KG, 2015). Profitability Ratios The biggest impact on sales between fiscal years 2012 and 2013 and fiscal years 2013 and 2014 was the increase in restaurant locations (KG, 2015). See Figure 4. At the end of fiscal year 2012, Kona Grill had twenty-three restaurants, which quickly turned into twenty-five by the end of fiscal year 2013. Sales 53 increased by $1.2 million between fiscal years 2012 and 2013 as a result of the two store openings (KG, 2015). The company added five more restaurants in 2014 to have a total of thirty by the end of fiscal year 2014 (KG, 2015). The company expanded the amount of retail restaurants by 20%. Sales increased by $16.3 million between the fiscal years 2013 and 2014 because of the five new restaurants and the two restaurants that opened in 2013 in the fourth quarter that reached a full year of sales (KG, 2015). The company has seven more restaurants scheduled to be added in 2015 including one in Puerto Rico, which opened successfully in quarter one of fiscal 2015 (KG, 2015). At the end of fiscal 2015 the company will have a total of thirty-seven restaurants. 2012 23 Number of Restaurant Locations 2013 2014 25 30 2015 37 Figure 4 Gross Profit The Gross Profit Margin is one indicator of a company’s profitability. See figure 5. Kona Grill’s Gross Profit Margin was 15% in fiscal 2010 and 18% in fiscal 2014. Kona Grill had an average Gross Profit Margin over the last five fiscal years of 17.6%, which is 1% lower than The Cheesecake Factory’s Gross Profit Margin average of 18.6%. The industry average had a Gross Profit Margin of roughly 55% in 2013, which was 37% higher than Kona Grill’s Gross Profit Margin in 2013. This was a result of the industry average only including cost of sales into the Cost of Goods Sold calculation (BizMiner, 2015). Kona Grill and The Cheesecake Factory included Sales, Labor, Operating Expense, and Occupancy (rent) into Cost of Goods Sold (KG, 2015). Figure 5 54 Caelin Campbell Operating Profit Operating Profit Margin is one of the most important indicators of a company’s profitability. See Figure 6. Kona Grill’s Operating Profit Margin went from (1.3) % in 2010 to 0.8% in 2014. This was a result of sales growth from fiscal years 2009 to 2010 of 8.8% and sales growth from fiscal years 2013 to 2014 of 21%. Total Costs and Expenses in fiscal year 2010 as a percentage of sales were 101.3% and in fiscal year 2014 Total Costs and Expenses as a percentage of sales were 99.2%. Figure 6 In 2012, Kona Grill’s Operating Profit Margin was roughly 6% and by 2014 it was down to less than 1%. This was a result of Labor, Cost of Sales, and General and Administrative expenses growing at a faster rate than Sales. See Figure 7. Cost of Sales increased as a result of unit expansion and the increase in beef and dairy prices (KG, 2015). General and Administrative expense increased from additional employee costs, start-up costs associated with the international franchising strategy, and higher audit fees to ensure compliance with SOX 404 (KG, 2015). SOX 404 is part of the Sarbanes Oxley Act to protect investors from accounting fraud (KG, 2015). Sales, Labor, & Cost of Sales Growth Sales Growth from 2012 to 2013 2% Growth from 2013 to 2014 21% Labor 4% 22% Cost of Sales 2% 23% General & Administrative Expense 12% 36% Figure 7 55 Net profit The Net Profit Margin for is an important ratio for investors. Kona Grill’s Net Profit Margin was (1.9) % in fiscal year 2010 and 0.6% in fiscal year 2014. See Figure 8. The 2010 discontinued operations was a result of closing the Naples, Florida restaurant in 2008 (KG, 2012). Kona Grill recognized expenses from discontinued operations as a result of closing the restaurants in Sugar Land, Texas and West Palm, Florida on the Income Statement under Discontinued Operations Loss in 2011 (KG, 2012). There was a disagreement between the landlord in Texas and Kona Grill over lease termination costs, which led to a lawsuit. Kona Grill and the landlord reached a settlement of $950,000 in September of 2012 (KG, 2015). The litigation costs and incremental lease termination costs were included in Discontinued Operation Loss in 2012 (KG, 2015). Investor Ratios One of the most important evaluations for an investor is Earnings Per Share. Kona Grill’s Earning Per Share went from $(.12) in fiscal year 2010 to $0.7 in fiscal year 2014. See Figure 8. Earnings Per Share fluctuated because Net Income was $4.8 million in 2012 and $700,000 in 2014. Net Income decreased from fiscal year 2012 to 2014 as a result of added expenses for new restaurants. The company opened seven restaurants in the last three fiscal years, but five of the seven restaurants have not been open for a full year of sales. The company also has leases to open seven more restaurants in 2015. The annual report gave an estimate of the cost to open a Kona Grill, $3.2 million to $3.7 million and $425,000 in cash for preopening expenses (KG, 2015). A conservative estimate of $3.2 million per restaurant multiplied by seven new restaurants equals $22.4 million in costs (KG, 2015). Kona Grill will double that cost when it includes 2015. Earnings Per Share 2010 2011 2012 2013 2014 Kona Grill $(.12) $.25 $.60 $.32 $.07 Cheesecake Factory $1.39 $1.70 $1.85 $2.19 $2.04 Figure 8 This was a result of Kona Grill’s Net Income, which was $(1.6) million in fiscal year 2010 and $0.7 million in 2014. See Figure 9. This was also a result of outstanding shares increasing for Kona Grill by 700 million shares from fiscal years 2010 and 2014. Kona Grill sold shares to acquire cash for new unit expansion, 56 Caelin Campbell capital expenditures, and general corporate purposes (KG, 2015). (amounts in millions) Earnings Per Share 2010 2011 2012 2013 2014 Net Income $(1.6) $2.0 $4.8 $2.7 $0.7 Outstanding Shares 9,167 9,242 8,726 8,573 9,870 Figure 9 Stock Price The Stock Price is another indicator that investors use to make decisions. See Figure 21 page 20. Kona Grill had a selling price of $2.91 in 2010 and the selling price increased to $23.09 at the end of fiscal year 2014 (KG, 2015). This is a result of analyst’s belief in long term profitability based on historical success (NASDAQ, 2015). Kona Grill’s Sales increased for the last five fiscal years. The company has expanded the amount of restaurants by 20% from 2013 to 2014 (25 to 30 restaurants). As well, Kona Grill has signed seven more restaurant leases in 2015 to have a total of thirty-seven restaurants. Many analysts have stated that there is long-term profitability in Kona Grill (NASDAQ, 2015). The Cheesecake Factory went from selling at $21.04 in 2010 to $50.14 per share in 2014. This was a result of consistent Net Income growth for the last five fiscal years (NASDAQ, 2015). The graph in Figure 10 shows the return of $100 from Kona Grill versus the peer industry, which includes The Cheesecake Factory, BJ’s Restaurants, Bravo Rio Group, and Granite City Food and Brewery versus the NASDAQ (KG, 2015). Figure 10 57 Return on Assets and Return on Equity Ratios Another two ratios investors use to evaluate a company is the Return on Assets and the Return on Equity. The Return on Assets for Kona Grill went from above 12% in fiscal year 2012 to below 1% return in fiscal year 2014. See Figure 11. The company’s Return on Assets decreased because Net Income decreased and assets increased for the last 3 fiscal years. Kona Grill’s Net Income went from $5.2 million in 2012 to $0.7 in 2014. See Figure 12. Assets in fiscal 2012 went from $39.3 million in 2012 to $94.8 million in fiscal year 2014. Assets increased in 2014 as a result of selling 2.3 million shares of stock, which raised $40.9 million (KG, 2015). The Cheesecake Factory went from 9% Return on Assets in 2012 to a 9% Return on Assets in 2014. The Cheesecake Factory is a much larger company, so its losses do not affect the company as much as Kona Grill is affected. Figure 11 Net Income decreased from 2012 to 2013 as a result of Labor and Selling and Administrative expenses growing at a faster rate compared to Sales. Kona Grill had a sales increase of 2% from 2012 to 2013 and a Labor growth from 2012 to 2013 of 4%. General and Administrative expense grew by 12% from fiscal year 2012 to 2013. From 2013 to 2014, Sales grew by 21% and General and Administrative expense grew by 36% from 2013 to 2014. As well, Labor grew by 24% from 2013 to 2014. Assets increased from 2012 to 2013 because Property and Equipment increased by 39% or $11.4 million. In 2013 to 2014, Cash increased as a result of selling stock for $40.9 million. Percentage Growth from Year to Year Figure 12 58 2012 to 2013 2013 to 2014 Net Income (43)% (74)% Assets 27% 89% Caelin Campbell Kona Grill’s Return on Equity followed the same pattern as the Return on Assets. In 2012 the Return on Equity was 25% and in 2014 it was less than 1%. See Figure 13. This was also a result from Kona Grill’s Net Income went from $5.2 million in 2012 to $0.7 in 2014. See Figure 12. Kona Grill’s equity increased from 2012 at $18.8 million to $65.4 million in 2014. See Figure 14. This was also a result from Kona Grill selling 2.3 million shares, which totaled $40.9 million net proceeds. Figure 13 Kona Grill’s equity increased from 2012 at $18.8 million to $65.4 million in 2014 see Figure 14. This was also a result of Additional Paid in Capital increasing from Kona Grill selling 2.3 million shares of stock, which totaled $40.9 million net proceeds (KG, 2015). Kona Grill Net Income & Equity Growth Year to Year Net Income Stockholder’s Equity 2012 to 2013 (43)% 2013 to 2014 (74)% 18% 193% Figure 14 Liquidity The Current Ratio is important to evaluate if the company has enough cash to cover its short-term needs. The Kona Grill’s current ratio was 1.1 in 2012 and was 3.2 in 2014, which was 2 higher than the Cheesecake Factory in 2014. See Figure 15. Kona Grill’s most material account as a percentage of assets is Cash and Cash Equivalents, which increased by $28.7 million from 2012 to 2014. This increase was a result of the $40.9 million cash received from selling shares (KG, 2015). Another important ratio is the Quick Ratio, which was not 59 used in the analysis because inventory was not material. The only difference between Current Ratio and Quick Ratio is that the company subtracts inventory from the numerator. Kona Grill included inventory in other current assets, which was 3% average as a percentage of total assets over the last five fiscal years (KG, 2015). Figure 15 Activity Kona Grill’s most material Asset account is Property and Equipment. In 2013, it accounts for 81% of total assets. The other account that has a material effect on the assets is Cash and Cash Equivalents, which increased in 2014 because of the stock sale mentioned earlier. For those reasons Fixed Asset Turnover is an important ratio because fixed assets are the largest account as a percentage of total assets. In 2012, Kona Grill’s Fixed Asset Turnover was 3.3 and in 2014 it was 2.2. See Figure 16. This was a result of Fixed Assets growing at a faster rate as compared to Sales. See Figure 17. Kona Grill is investing in more Fixed Assets because it is expanding the number of retail restaurants (KG, 2015). Kona Grill had 23 restaurants in 2012. It will have 37 by the end of fiscal year 2015. See Figure 4 (KG, 2015). The Cheesecake Factory stayed the same at 2.4 for the last three fiscal years. Fixed Assets grew at a similar rate as compared to Sales for The Cheesecake Factory. From 2013 to 2014, The Cheesecake Factory Sales grew by 5% and Fixed Assets grew by 4%. Figure 16 60 Caelin Campbell Fixed assets increased between fiscal years 2012 and 2014 as a result of putting equipment in the seven new stores. Kona Grill also spent $21.4 million in Property and Equipment in anticipation of opening seven more stores in 2015 (KG, 2015). Fixed Asset and Sales Growth Year to Year 2012 to 2013 to 2013 2014 Sales 2% 21% (Kona Grill) Fixed Assets 39% 34% (Kona Grill) Figure 17 Leverage Ratios Kona Grill did not have any long-term debt, so the Debt to Equity Ratio is excluded from this analysis. Deferred Rent is the only liability that is material on the Balance Sheet. Kona Grill’s Deferred Rent is money Kona Grill owes the landlord and will be paid later. It is the difference between the monthly rent payment and the monthly rent expense associated with an operating lease that will be paid in the future (Simple Studies, 2015). An average of Deferred Rent for the last five fiscal years was $14 million (KG, 2015). Deferred rent has increased from $12 million in fiscal year 2012 to $17 million as a result of recording tenant improvement allowances for new restaurants (KG, 2015). Cash Flow Analysis The three sections of the Cash Flow Statement are represented in Figure 18. Cash from the Operating Section for Kona Grill increased by an estimated $3 million from fiscal year 2010 to 2011 as a result of higher net income and an increase in accrued expenses. Kona Grill’s Net Income went from $(1.6) million in 2010 to $2 million in 2011. Accrued expenses went from $292 thousand in fiscal year 2010 to $2 million in 2011. Kona Grill increased cash from the Operating Section by an estimated $7 million as result of an increase in deferred rent, depreciation, and the timing of payments for accrued expenses (KG, 2015). Deferred rent increased from $1.9 million in 2012 to $4.6 million in 2014. Depreciation was $5.7 million in 2012 and increased to $7.2 million in 2014 as a result of seven restaurant openings (KG, 2015). Accrued expenses also increased from $(1.6) million in 2012 to $1.5 million in 2014 (KG, 2015). Kona Grill’s investing section was influenced by the purchases of property and equipment. Cash from the Investing Section went from $1.8 million in fiscal year 2010 to $(21.8) million in 2014 as a result of purchasing $21.8 million in property and equipment as a result of opening five new restaurants in 2014. In 2013, Kona Grill purchased $14.4 million in property and equipment, con61 sisting of architecture and design fees, general contractor costs, and furniture and equipment costs (KG, 2015). The Financing Section increased from $(6.4) million in 2010 to $37.8 million in 2014. This was a result of a public offering of 2.3 million shares, which generated $40.9 million (KG, 2015). Cash Flow Analysis Operating Section 2010 4,718 2011 7,676 2012 7,352 2013 9,460 2014 14,744 Investing Section 1,808 (1,538) (1,776) (14,536) (21,858) Financing Section (6,375) (2,366) (3,914) 2,968 37,811 Figure 18 Kona Grill’s Cash Inflows are represented in Figure 19. Operating Activities were the highest material average as a percentage of total inflows over the last five fiscal years. In 2010 the most material inflow as a percentage of total inflows was Sale of investments. This was a result of selling $5.8 million in auction rate securities and $0.3 million in other investments. (KG, 2015). In 2014, Kona Grill sold 2.3 million shares for $40.9 million (KG, 2015). In 2013, Kona Grill borrowed $3.5 million from the Key Bank Credit Facility (KG, 2015). Cash Inflows (amounts in thousands) Operating Activities Proceeds from Issuance of Common Stock Net Sales of Investments Sale of Common Stock under employee purchase Net Borrowings on short-term borrowings Other Figure 19 62 2010 2011 2012 2013 2014 $4,718 $7,676 $7,352 $9,460 $14,744 - - - - $40,879 $6,108 - - - - $109 $561 $1,536 $310 $1,466 - - $500 $3,500 - - - - $87 - Caelin Campbell Cash Outflows was primarily affected by the purchase of property and equipment. See Figure 20. The purchase of property and equipment went from $4.3 million in 2010 to $14.4 million in 2013 and $21.8 million in 2014 as a result of costs associated with opening seven new restaurants (KG, 2015). In 2010, Kona Grill repaid $5.8 million under a line of credit with UBS (KG, 2012). As well, $0.7 million principle payments on equipment loans were made (KG, 2012). Kona Grill also repaid $3.8 million in 2014 to the KeyBank credit facility, included $0.2 million in fees for upsizing to $35 million for the credit facility to fund the increase in the number of stores (KG, 2015) (amounts in thousands) Purchase of Property & Equipment Purchase of Retirement of Common Stock Repayments borrowings of Line of Credit Other 2010 Cash Outflows 2011 2012 2013 2014 $4,318 $1,492 $1,794 $14,445 $21,855 - $2,423 $5,536 $203 - $5,800 - $262 $370 $3,500 $684 $504 $152 $447 $1,037 Figure 20 Recent Quarter Results The recent quarter results will be released one day before the analysis has to be completed. Quarter 1 of fiscal 2015, will be released May 5 at 5 p.m. Conclusion This conclusion will be presented in a SWOT structure. Kona Grill has many strengths including increasing Sales for the last five fiscal years. Since 2010, Sales increased by 44% to $119 million. Sales increased as a result of the improving economy. A measure of the economy is Personal Disposable Income, which increased from $11 billion in 2010 to over $13 billion in 2014 (The University of Michigan, 2015). The stock price went from selling at $3 per share in 2010 to $21 per share in 2014. The investors see long-term growth in Kona Grill, which has opened seven restaurants in the last two fiscal years and plans to open seven more in 2015 (KG, 2015). The investors also like Kona Grill because it does not have any long-term debt. The only debt associated with Kona Grill is Deferred Rent (KG, 2015). Kona Grill had a decrease in Return on Equity and a Return on Assets, which is the company’s biggest weaknesses. Kona Grill had a Return on Equity of 25% 63 in 2012 and in fiscal year 2014 it was less than 2%, as a result of decreasing Net Income. In 2014, Kona Grill had a stock offering that had net proceeds of $40.9 million, which affected Return on Assets and Return on Equity (KG, 2015). It affected Return on Assets by increasing Assets by 89% between fiscal year 2013 and 2014 and affected Return on Equity by increasing Additional-Paid-inCapital on the equity side. (KG, 2015). Return on Assets decreased as a result of Net Income decreasing and cash collected from the stock offering (KG, 2015). Kona Grill has an opportunity to expand the number of restaurant locations and to enter into international territories. Kona Grill went from twentythree stores in 2012 to thirty stores at the end fiscal year 2014. The company has also signed leases for seven more restaurants in 2015. Kona Grill has had talks about opening locations in the Middle East and Latin America (Doerfler, 2015). Kona Grill recently created a new position, vice president of international development (Doerfler, 2015). The company hired Carlos Leon, who has over 20 years of experience in international restaurant franchise expansion (Doerfler, 2015). Restaurants are largely tied to the economy, which is a threat to Kona Grill. The economy was in a recession in 2009 and as a result Kona Grill’s Net Income was $(21.6) million (KG, 2012). If the economy goes into another recession, then the average Personal Disposable Income in the United States will decrease resulting in less Sales for Kona Grill. Another threat to Kona Grill is rising food costs, which decreases restaurant profitability by raising Cost of Goods Sold. As of February of 2014, a pound of ground beef cost $3.55, which is a record high even after accounting for inflation (CNN, 2014). Rising food costs is something Kona Grill has little control over, but it might be in a better position than other restaurants because the company has a diverse menu. 64 Caelin Campbell Resources BizMiner. (2015). Industry Report: Full-Service Restaurants. Retrieved From http://reports.bizminer.com/temp/pdf/2108246964.pdf Cheesecake Factory, Inc. (2015, March 2). 2014 Annual Report of The Cheesecake Factory Retrieved From http://www.sec.gov/Archives/ed gar/data/887596/000110465915015350/a14-26871_110k.htm CNN Money. (2014, April 21). Beef prices hit record high. CNN Retrieved from http://money.cnn.com/2014/04/14/news/economy/beef-prices/ index.html Doerfler, S. (2015, March 10). Kona Grill Looking to expand overseas. The Republic. Retrieved From http://www.azcentral.com/story/money/ business/2015/03/09/kona-grill-looking-expand-overseas/24512703/ Kona Grill, Inc. (2015, March 3). 2014 Annual Report of Kona Grill. Retrieved Fromhttp://www.sec.gov/Archives/edgarda ta/1265572/000143774915004920/kona20141231_10k.htm Kona Grill, Inc. (2012, March 14). 2011 Annual Report of Kona Grill. Retrieved From http://www.sec.gov/Archives/edgar/ data/1265572/000143774912002311/kona_10k-123111.htm Kona Grill, Inc. (2015). Investor Relations. Retrieved From http://phx.corporate-ir.net/phoenix.zhtml?c=191864&p=irol-faq Kona Grill. (2015, March). Kona Grill Investor Relations. Raymond James Financial. Retrieved From file:///C:/Users/Jerri/Downloads/Raymond%20James%20 Investor%20Conference%20Presentation.pdf NASDAQ. (2015) Kona Grill Stock Graph. Retrieved From http://www.nasdaq.com/symbol/kona/guru-analysis/valideamomentum NASDAQ. (2015). Kona Grill Stock Graph. Retrieved From http://www.nasdaq.com/symbol/cake/guru-analysis/fool National Restaurant Association (NRA). (2014, January 12). Restaurants enter 5th year of real sales growth. NRA. Retrieved From http://www.restaurant. org/News-Research/News/Restaurant-industry-enters-fifth-year-ofreal-sale National Restaurant Association (NRA). (2015). Research Fast Facts. NRA. Retrieved From http://www.restaurant.org/News-Research/Research/ Facts-at-a-Glance Savilonis, K. (2014). The Impact of rising commodity prices on franchise restaurants. Restaurant Business Chronicles. Retrieved From http://www.restaurantbusinessonline.com/controlling-costs/food-cost-outlook/articles/ impact-rising-commodity-prices-franchise-restaurants Simple Studies. (2013, March 30). Lease accounting for escalating rent payments or rent Holidays. Retrieved From http://simplestudies.com/ lease-accounting-for-escalating-rent-payments-or-rentholidays.html 65 The University of Michigan. (2015, April 15). United States Consumer Sentiment. Trading Economics. Retrieved from http://www.trading economics.com/united-states/consumer-confidence The University of Michigan. (2015, April 15). United States Disposable Personal Income. Trading Economics. Retrieved from http://www.trading economics.com/united-states/disposable-personal-income 66