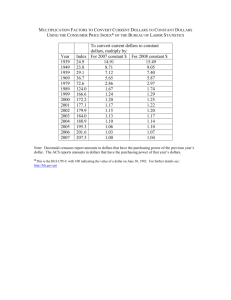

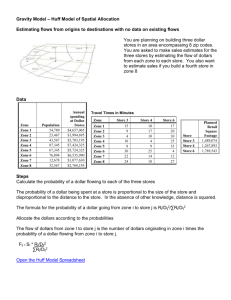

A straightforward explanation of the present financial

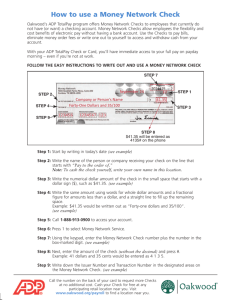

advertisement