Morning Cafe

sto.ctoxpui

ISSUE: 840

13 Sept 2013

MORNING STRATEGY

600

VN-Index

600

VN30-Index

550

550

500

500

450

450

400

400

350

350

300

S-12

N-12

J-13

M-13

M-13

J-13

S-13

70

HNX-Index Price Chart

65

60

55

50

S-12

N-12

J-13

M-13

M-13

J-13

S-13

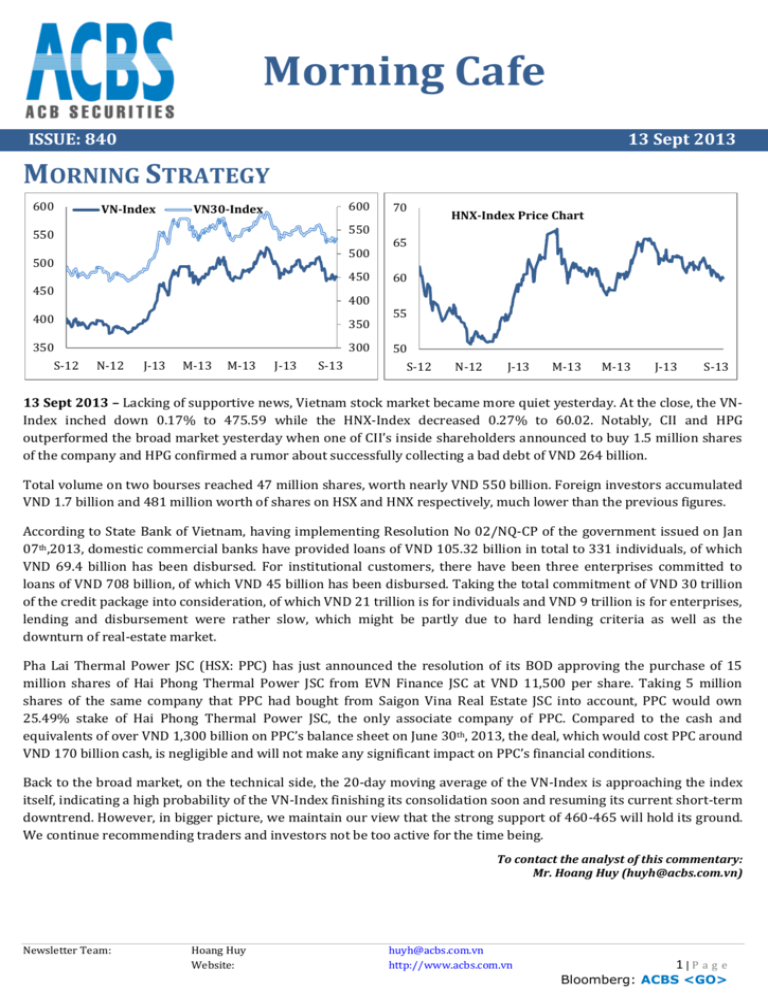

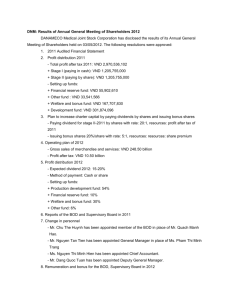

13 Sept 2013 – Lacking of supportive news, Vietnam stock market became more quiet yesterday. At the close, the VNIndex inched down 0.17% to 475.59 while the HNX-Index decreased 0.27% to 60.02. Notably, CII and HPG

outperformed the broad market yesterday when one of CII’s inside shareholders announced to buy 1.5 million shares

of the company and HPG confirmed a rumor about successfully collecting a bad debt of VND 264 billion.

Total volume on two bourses reached 47 million shares, worth nearly VND 550 billion. Foreign investors accumulated

VND 1.7 billion and 481 million worth of shares on HSX and HNX respectively, much lower than the previous figures.

According to State Bank of Vietnam, having implementing Resolution No 02/NQ-CP of the government issued on Jan

07th,2013, domestic commercial banks have provided loans of VND 105.32 billion in total to 331 individuals, of which

VND 69.4 billion has been disbursed. For institutional customers, there have been three enterprises committed to

loans of VND 708 billion, of which VND 45 billion has been disbursed. Taking the total commitment of VND 30 trillion

of the credit package into consideration, of which VND 21 trillion is for individuals and VND 9 trillion is for enterprises,

lending and disbursement were rather slow, which might be partly due to hard lending criteria as well as the

downturn of real-estate market.

Pha Lai Thermal Power JSC (HSX: PPC) has just announced the resolution of its BOD approving the purchase of 15

million shares of Hai Phong Thermal Power JSC from EVN Finance JSC at VND 11,500 per share. Taking 5 million

shares of the same company that PPC had bought from Saigon Vina Real Estate JSC into account, PPC would own

25.49% stake of Hai Phong Thermal Power JSC, the only associate company of PPC. Compared to the cash and

equivalents of over VND 1,300 billion on PPC’s balance sheet on June 30th, 2013, the deal, which would cost PPC around

VND 170 billion cash, is negligible and will not make any significant impact on PPC’s financial conditions.

Back to the broad market, on the technical side, the 20-day moving average of the VN-Index is approaching the index

itself, indicating a high probability of the VN-Index finishing its consolidation soon and resuming its current short-term

downtrend. However, in bigger picture, we maintain our view that the strong support of 460-465 will hold its ground.

We continue recommending traders and investors not be too active for the time being.

To contact the analyst of this commentary:

Mr. Hoang Huy (huyh@acbs.com.vn)

Newsletter Team:

Hoang Huy

Website:

huyh@acbs.com.vn

http://www.acbs.com.vn

1|P a g e

Bloomberg: ACBS <GO>

MORNING CAFE

Date: 13 Sept 2013

TOP STORY

HPG: Brief company update

Yesterday, Hoa Phat Group JSC (HSX: HPG) declared to successfully collect VND 264 billion from Ha Noi ACB

Investment JSC, related to buying 20 million shares of a subsidiary, Hoa Phat Steel JSC. This has given a positive effect

on HPG’s market prices recently.

Last price (Sep 12 2013)

Average volume in 30 days

Average volume in 100

days

H1/2013

VND 33,100/share

423,881 shares

Charted capital (VND Billion)

Sales volume of construction

561,976 shares

steel (VND Billion)

Revenue (VND Billion)

EAT (VND Billion)

Sources: HSX, HPG, Bloomberg, ACBS Research Center (2013)

% fulfilled

targets

4,191

-

322,600

-

8,410

1,012

45.5%

84.4%

After collecting VND 264 billion worth of account receivables above, the company will be able to reverse VND 164

billion provision in Q3, which will push Hoa Phat’s profit adequately. As a result, in this update, we reduce the

company’s administrative expenses in our 2013 forecast from VND 554 billion to just VND 290 billion. Meanwhile, we

believe that Hoa Phat is able to garner a revenue of around VND3,500- 4,000 billion during Q3.

Outperform the industry

While total sales volume of VSA’s members advanced 3% y.o.y in 8M2013, Hoa Phat was continuously outperforming

the industry, attaining a real growth rate of 7.45% y.o.y to 431,600 tons during the period and holding about 14.3%

market share. Consumption of steel pipe remains stable around 12,000-13,000 tons per month, occupying 15.1%

market share.

80,000

Tons

HPG's monthly sales volume of steel in 2011 - 2012

70,000

60,000

50,000

40,000

30,000

20,000

10,000

Jan

Feb

Mar

Apr

May

2013

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2012

Source: HPG, ACBS Research Center (2013)

Launching Phase II - Hoa Phat Steel Complex

The Phase II of Coke and Thermal factory were fully operated since late August, lifting the company’s annual capacity

to 700,000 tons coke and 37 MW. With this, Hoa Phat can meet its total demand of coke and about 40% of electricity

demand for the whole Complex in the future.

Currently, the company is rushing to bring the Phase II - Hoa Phat Steel Complex into operation in Q4 as schedule.

Given that, Hoa Phat will attain annual capacity of 1.15 million tons billet and 1.15 million tons construction steel,

including two blast furnaces with total capacity of 900,000 tons/ year.

Newsletter Team:

Hoang Huy

Website:

huyh@acbs.com.vn

http://www.acbs.com.vn

2|P a g e

Bloomberg: ACBS <GO>

MORNING CAFE

Date: 13 Sept 2013

Thanks to that, Hoa Phat may achieve a real growth of 11% in terms of construction steel and 15% in terms of steel

pipe in 2013. The steel business is expected to stabilize around VND 13,000 billion in 2013FY. Revenues from most of

the other businesses are expected to grow around 3-7% while that related to exporting coke decreased by 40% due to

the plunge of prices.

The operation of the Phase II Hoa Phat Complex may create higher depreciation cost and interest expenses in

Q4/2013. Nevertheless, this is expected to promote the company’s steel gross margin, and product quality in longterm. With a large operation scale and its vertical investment into the construction steel value chain, Hoa Phat has a

great competitive advantage as compared to other domestic steel producers.

Mandarin project

Mandarin has still received customer interests thanks to Hoa Phat’s good reputation for its rapid construction progress

and timely delivery of 257 Giai Phong projects. The company has sold about 700 of 1,000 Mandarin’s apartments and

collected about VND 2,185 billion from customers (as of the end of June 2013). As such, we believe that Hoa Phat is

able to gain a revenue of about VND 2,500 billion from the project in 2013.

Valuation

Given the recovery of steel business and sales of Mandarin project, Hoa Phat may fulfill 99% its revenue target (VND

18,400 billion) and 164% its EAT target (VND 1,967 billion) in 2013.

In terms of valuation, using DCF method and Multiples method gives the fair price at VND 37,054 per share; up VND

553 per share against our previous update (July 2013). Given the HPG current market price, we preserve our Buy

recommendation on the stock.

Technical view: bearish signals from indicators

HPG has just breached its medium-term high of 32,100 and is aiming to its all-time one of 37,600. However, taking

HPG’s more-than-2-fold rally in the past year and RSI(14)’s bearish divergence into consideration, we do not expect

HPG to keep rising much further. A drop back below the just-broken resistance of 32,000, if any, will signal a significant

reversal. *Note: HPG’s prices are adjusted according to dividend, stock split, etc.

To contact the analyst of this commentary:

Ms. Tran Thi Hai Yen (yen.tran@acbs.com.vn)

Newsletter Team:

Hoang Huy

Website:

huyh@acbs.com.vn

http://www.acbs.com.vn

3|P a g e

Bloomberg: ACBS <GO>

MORNING CAFE

Date: 13 Sept 2013

LOCAL NEWS

Vietnam’s aviation likely to rise 12-15% this year

Vietnam’s aviation is expected to growth from 12% to 15% this year in term of passenger transport, Vnexpress.net

reported, citing information of the Civil Aviation Authority of Vietnam.

If the forecast comes true, this year’s increase will be really impressed versus last year’s figure of 6.8% growth, Luu

Thanh Binh- Deputy Head of the Civil Aviation Authority said, commenting that amid aviation industry in the world has

been facing a number of difficulties, airlines in Asia in general and in Vietnam in particular still posted optimistic

growth and there are positive signals that Vietnam’s airlines will have strong recovery. It is expected that Vietnam’s

aviation to grow by 12-15% this year and the growth will maintain at 2 digit figures in 2014 and 2015.

In 2013, Vietnam’s airlines are expected to serve total of 29 million passengers. The market is very potential with

population of more than 80 million.

Currently Vietnam has 4 airlines, including the Flag courier Vietnam Airlines, Jetstar Pacific, Vietjet Air and Vasco. In

which, Vietnam airlines serves both as passenger delivery and political duty. Vietjet Air is a private and low cost

aviation. Vietjet Air is a young aviation in Vietnam but it has begun to demonstrate compliance with the conditions of

Vietnamese, having diversified serving policies with many options for passengers.

Source: StoxPlus

BIDV delays fixing time for international bond issuance

The Bank for Investment and Development of Viet Nam (BIDV) has not set a specific time for issuing international

bonds, said the bank's spokesperson, Quach Hung Hiep.

The statement follows approval given by the State Bank of Viet Nam (SBV) last Wednesday for BIDV to issue up to

US$500 million worth of international bonds this year.

"We've intended to issue these bonds for a long time and the confirmation from SBV is a positive step for BIDV to

capitalise on opportunities. This doesn't mean we have fixed a time for the issuance," said Hiep. BIDV planned to issue

international bonds from 2011.

Source: VNS

Vietnam Treasury sells VND180Bln G-Bond sale on Sept 11; yields up

The State Treasury of Vietnam only sold VND180 billion worth of government bonds in an auction on Sept 11 at the

yields of 8.3-9.1% per annum, according to the Hanoi Stock Exchange (HNX).

In the auction, the State Treasury planned to sell VND2 trillion worth of government bonds, distributed equally for 2-y,

3-y, 5-y and 10-y maturities.

The bid-to-cover ratios were 1.86 and 0.16, respectively for 3- and 5-y tenors. In details, there were 4 bidders

registering for VND930 billion 3-y bonds, seeking for yields of 8.3-9.5% while only 2 investors bid for VND80 billion 5y notes, asking for yield of 9.1%.

Of the total, the State Treasury sold VND100 billion 3-y bonds at fixing of 8.3%, up 0.6% from the earlier auction on

Aug 29. It also mobilized another VND80 billion from 5-y bond sale at 9.1%, up 0.6% from the previous auction on Sept

5. No 2-y and 10-y debts were sold in the auction.

The sales help to raise total funds mobilized from bonds by the State Treasury via the Hanoi exchange to

VND102,793.57 billion year to date.

Source: StoxPlus

Newsletter Team:

Hoang Huy

Website:

huyh@acbs.com.vn

http://www.acbs.com.vn

4|P a g e

Bloomberg: ACBS <GO>

MORNING CAFE

TODAY’S EVENTS

Ticker

GDT

HTL

SSC

Date: 13 Sept 2013

Event

The ex-rights date of 1st dividend payment of VND 1,000/share for 2013

The ex-rights date of dividend payment of VND 500/share for 2013

The ex-rights date of 2nd dividend payment of VND 1,000/share for 2012

UPCOMING EVENTS

Ticker

HDG

HPB

CIC

TAS

S55

VNN

CII

D2D

DAE

HAG

KBC

SFN

TH1

TNA

VNL

FIT

ITQ

PSD

VHL

XMC

HHS

KSA

SJE

Ex-rights Date

09/16/2013

09/16/2013

09/18/2013

09/18/2013

09/18/2013

09/18/2013

09/18/2013

09/18/2013

09/18/2013

09/18/2013

09/18/2013

09/19/2013

09/19/2013

09/19/2013

09/19/2013

09/19/2013

09/20/2013

09/20/2013

09/26/2013

Execution Date

09/16/2013

09/16/2013

09/23/2013

09/23/2013

09/30/2013

09/25/2013

10/30/2013

10/04/2013

10/09/2013

09/26/2013

10/09/2013

10/31/2013

10/15/2013

10/04/2013

10/26/2013

10/10/2013

10/11/2013

10/11/2013

10/30/2013

Event

Listing of 5,062,477 additional shares

Delisting of 3,880,000 shares

Delisting of 4,635,062 shares

Delisting of 13,900,000 shares

Dividend payment of VND 2,000/share for 2012

Collecting shareholders' opinions in documents

2nd Dividend payment of VND 400/share for 2012

1st Dividend payment of VND 1,000/share for 2013

1st Dividend payment of VND 900/share for 2013

Collecting shareholders' opinions in documents

Collecting shareholders' opinions in documents

Dividend payment of VND 900/share for 2012-2013

Dividend payment of VND 600/share for 2012

1st Dividend payment of VND 1,000/share for 2013

1st Dividend payment of VND 700/share for 2013

Stock dividend payment of 5% for 2012

Annual Shareholder Meeting 2013

Annual Shareholder Meeting 2013

1st Dividend payment of VND 1,000/share for 2013

Extraordinary Shareholder Meeting

Extraordinary Shareholder Meeting

1 for 1.2 rights issue at 10,000 VND/share

Dividend payment of VND 1,500/share for 2012

FUTURE TRADES

Ticker

EID

BGM

CII

VFMVF1

BGM

FPT

HAI

HVG

SZL

VRC

SGD

TPH

Start date

09/12/2013

09/13/2013

09/13/2013

09/13/2013

09/16/2013

09/16/2013

09/16/2013

09/16/2013

09/16/2013

09/16/2013

09/19/2013

09/19/2013

Newsletter Team:

End date

10/11/2013

10/11/2013

10/11/2013

10/12/2013

10/16/2013

10/15/2013

10/15/2013

10/15/2013

10/15/2013

10/15/2013

09/30/2013

10/08/2013

Hoang Huy

Website:

Conducting Entity

Affiliated shareholder

Inside shareholder

Inside shareholder

Affiliated shareholder

Inside shareholder

Inside shareholder

Affiliated shareholder

Inside shareholder

Affiliated shareholder

Affiliated shareholder

Treasury

Treasury

huyh@acbs.com.vn

http://www.acbs.com.vn

Buy volume

500,000

1,500,000

200,000

200,000

100,000

201,598

Sell volume

100,000

675,000

1,157,117

8,693,880

1,065,600

500,000

-

5|P a g e

Bloomberg: ACBS <GO>

MORNING CAFE

CURRENT TRADES

Date: 13 Sept 2013

Ticker

APG

ASM

BMP

BRC

COM

DHC

DNC

Start date

08/22/2013

09/10/2013

08/31/2013

08/23/2013

08/28/2013

08/29/2013

08/22/2013

End date

09/20/2013

10/09/2013

09/29/2013

09/21/2013

09/26/2013

09/27/2013

09/17/2013

Conducting Entity

Inside shareholder

Affiliated shareholder

Affiliated shareholder

Affiliated shareholder

Affiliated shareholder

Inside shareholder

Affiliated shareholder

DPR

09/09/2013

10/08/2013

Treasury

DQC

DTL

EIB

HDO

HPG

HVX

ITD

KDH

KHA

KSD

L18

MAFPF1

MHC

NIS

NIS

NTP

NVB

PAN

POM

PV2

SCR

SEC

SFI

STB

TTF

TTF

TTF

TTF

VNM

VRC

09/06/2013

09/11/2013

08/28/2013

08/28/2013

08/23/2013

09/10/2013

09/03/2013

08/14/2013

09/04/2013

08/26/2013

08/20/2013

09/09/2013

09/06/2013

09/04/2013

09/05/2013

08/27/2013

09/11/2013

08/13/2013

08/21/2013

09/10/2013

08/20/2013

08/14/2013

09/05/2013

08/28/2013

08/30/2013

08/30/2013

09/05/2013

09/05/2013

09/05/2013

08/26/2013

10/05/2013

10/10/2013

09/26/2013

09/26/2013

09/20/2013

10/10/2013

10/02/2013

09/12/2013

10/03/2013

09/24/2013

09/18/2013

10/08/2013

10/04/2013

10/03/2013

10/04/2013

09/25/2013

10/09/2013

09/11/2013

09/19/2013

10/09/2013

09/18/2013

09/12/2013

10/04/2013

09/26/2013

09/28/2013

09/28/2013

10/04/2013

10/04/2013

10/04/2013

09/24/2013

Affiliated shareholder

Inside shareholder

Affiliated shareholder

Inside shareholder

Affiliated shareholder

Inside shareholder

Affiliated shareholder

Treasury

Affiliated shareholder

Inside shareholder

Affiliated shareholder

Affiliated shareholder

Inside shareholder

Affiliated shareholder

Inside shareholder

Affiliated shareholder

Major shareholder

Affiliated shareholder

Affiliated shareholder

Inside shareholder

Affiliated shareholder

Affiliated shareholder

Affiliated shareholder

Inside shareholder

Inside shareholder

Inside shareholder

Inside shareholder

Inside shareholder

Affiliated shareholder

Affiliated shareholder

Newsletter Team:

Hoang Huy

Website:

huyh@acbs.com.vn

http://www.acbs.com.vn

Buy volume

2,000,000

2,000,000

119,360

200,000

141,000

200,000 1,000,000

350,000

1,000,000

600,000

500,000

107,000

200,000

2,400,000

500,000

500,000

500,000

210,000

1,000,000

100,000

6,062,772

1,900,000

500,000

500,000

180,000

400,000

1,000,000

300,000

Sell volume

264,960

800,000

1,000,000

400,200

448,560

180,000

16,000,000

337,000

100,000

886,544

237,627

-

6|P a g e

Bloomberg: ACBS <GO>

MORNING CAFE

Date: 13 Sept 2013

Analyst certification

The analysts named on the previous pages of this report, who are primarily responsible for the preparation of this

report, certify that the opinion(s) in the report and any other views or forecasts expressed herein accurately reflect

their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the

specific recommendation(s) or view(s) contained in this report.

Report Distribution

This report is restricted to and intended only for the clients of ACBS in Vietnam. If a client receives and/or uses this

report outside Vietnam, it is the client’s sole responsibility to ensure that it is legally permitted in the client’s

jurisdiction. Otherwise, the client should disregard this report in its entirety and let ACBS know that the client no

longer wishes to receive such reports.

Disclaimer

This report is published solely for information purposes, it does not constitute an advertisement and is not to be

construed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction.

The information in this report is obtained from sources believed by ACBS to be reliable. However ACBS makes no

representation or warranty, either expressed or implied, as to their accuracy or completeness. THE REPORT IS

SUBJECT TO CHANGE WITHOUT PRIOR NOTICE.

The client shall be liable for any risk or loss (if any) as if the client makes the investment decision based on this report.

ACBS accepts no liability and will not be liable for any loss or damage arising directly or indirectly from the client’s use

of this report, including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection,

fault, mistake or inaccuracy in its contents.

Some parts of the report reflect the assumptions, views and analytical methods of the analysts who prepared them, and

ACBS is not responsible for any error of their works and assumptions. ACBS may have issued, and may in the future,

issue other reports that are inconsistent with and reach different conclusions from the information presented in this

report.

© Copyright. ACB Securities Company Limited 2013, ALL RIGHTS RESERVED. No part of this report may be

reproduced or transmitted, in any form or by any means, electronically, mechanical, photocopying, recording, or

otherwise, without the prior written permission of ACB Securities Company Limited.

Newsletter Team:

Hoang Huy

Website:

huyh@acbs.com.vn

http://www.acbs.com.vn

7|P a g e

Bloomberg: ACBS <GO>