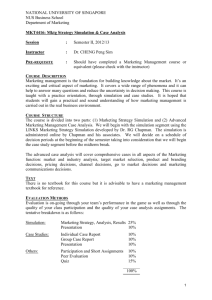

Sustainability Business Simulation

advertisement