Yesterday’s truths,

today’s realities:

A new global mindset

for Brazilian business

Yesterday’s truths,

today’s realities:

A new global mindset

for Brazilian business

Brazil’s current crop of multinationals grew in an era of

relatively protected domestic markets and before the

acceleration in globalization and technology diffusion.

Today, Brazil’s next wave of internationalizers face a

dramatically different global landscape of opportunities

and challenges. Yet attitudes and behaviors have been

slow to change, resulting in the loss of important ground

to competitors abroad. We uncover four conventionallyaccepted truths as myths that must be dispelled to

facilitate improvements in the global competitiveness of

Brazil’s firms. At their core, the persistence of these

myths is due to an attachment to outdated mindsets that

must be fundamentally questioned and updated. We

show how some progressive Brazilian firms are

succeeding to achieve just that.

Authors: Felippe Oliveira, Armen Ovanessoff, Athena Peppes, Eduardo Plastino.

2

Brazil’s internationalization patterns:

new perspectives for a new breed of Brazilian companies

“Making it big” abroad can be a key step

toward “making it really big” at home.

Brazilians know this only too well. Witness

how Brazil’s most prolific football players

have earned their notoriety through playing

in European clubs. Or how Brazil’s legendary

Bossa Nova rhythms became a definitive

national treasure after the likes of Frank

Sinatra helped to popularize them around

the world. The most unique and special ideas

are often a blend of one’s own strengths

with ingredients from far away.

This is no less true in business. AB Inbev

brought together the powerhouses of

Interbrew from Europe and Anheuser-Busch

from the US, and blended them with Inbev’s

rigorous management model to create the

world’s largest brewing company. The

success and business logic of multinational

business models over the past two decades is

an outcome of companies realizing their

increasing ability to powerfully combine

resources, capabilities and ideas from around

the world.

But looking at the world as a banquet of

opportunities is not easy. “Blue-sky thinking”

is all very well, but Brazilian companies need

to deal with the immediate realities of

unwieldy bureaucracy, infrastructure

deficiencies and a lack of international

exposure and experience. Even those

companies that are confident about their

international growth plans feel unprepared

for the operational realities of running global

operations.1

An important obstacle to international

expansion, according to Brazilian executives

who responded to an Accenture survey, is the

absence from leadership teams and entire

workforces of the “global mindset” required

to manage successful international

operations.2 A body of academic research

reinforces the importance of the domesticfocused mindset of Brazilian companies in

inhibiting their international expansion.

As Brazil’s economy boomed through the

first decade of this century, it was easy for

Brazilian executives to point to the country’s

fast-growing domestic opportunities as a

further reason to put off international

expansion plans. But that hopeful reasoning

was flawed: measures of outward foreign

trade and investment over the same period

show Brazil’s position eroding relative to its

BRIC peers and other emerging economies.

Perceptions and realities

Assumptions about the strength of the

internal market are only one reason Brazil’s

executives have held back. In the course of

our research, we uncovered four perceptions

about international expansion that have

become outdated.

There is a lot of truth at the root of each of

these perceptions, and most are grounded in

the experience of Brazil’s multinationals. But

fresh thinking is required for the future.

The way in which companies are growing

and succeeding in today’s global economy is

dramatically different to the experience of

those that grew and succeeded in the past.

Brazil is no exception. To succeed in an era

of global, digitally enabled business, Brazil’s

executives must shed no-longer-valid

perceptions and adjust to the new realities

of competition.

1

The Accenture Institute for High Performance recently conducted an analysis of Brazil’s multinationals and aspiring multinationals, finding that while they are generally

confident about their international growth strategies, fewer than one in five of these firms are confident that they possess the full set of operational capabilities to execute their

expansion plans.

2

In a recent survey, Accenture asked executives in some 200 companies from Brazil, China, Germany, India, Russia, South Africa, the UK and the US about the international

mindsets of leaders in their businesses. In the Brazilian case, only 24 percent believe their companies’ leadership group has such a mindset. The figures are even lower when

considering the global mindsets of high-potential managers (7 percent) and employees whose roles span multiple countries (14 percent)—in all three cases, Brazil’s figures were

the lowest among the countries surveyed.

3

Domestic scale and

dominance are a prerequisite

to international success.

Increasingly, international

expansion will be needed

to achieve or maintain

domestic scale.

4

In the past, you started out “getting big” at

home. As one executive told us, “It’s all

about scale. Once you’re big enough, and

have the experience, you step outside; that’s

how it is for large countries like Brazil, India

and China.” Of course, he was right. Looking

at the “emerging market champions” that

have made global headlines, it’s clear that

they are, for the most part, giants that have

outgrown their domestic markets. Companies

like JBS Friboi, Camargo Corrêa, WEG and

Gerdau all grew to become dominant players

in their home market before venturing

abroad for new opportunities.

The benefits of having a large domestic

market have been evident. Brazil’s MNCs

have clearly benefited from their large

domestic market. In the course of

generating economies of scale from their

expansive domestic operations, they have

honed their expertise, accumulated

experience and built the confidence and

skillsets to enter new markets.

Business success at home also offers the

means to subsidize experimental ventures

abroad. Researchers have shown how large

domestic operations can offset losses

incurred as a firm learns how to do business

in a foreign market (Dunning, 2001; Wu &

Pangarkar, 2006).

All this means that Brazilian multinationals

tend to be big. Some 70 percent of the 47

MNCs included in the Fundação Dom Cabral

2013 ranking of the most internationalized

Brazilian companies currently have annual

revenues of over R$1 billion

(US$ 450 million).

That is more than three times the threshold

adopted by the country’s national

development bank, the BNDES, to identify a

“significantly large” company. Big is strong

and big is good, right? Well, it’s a positive

outcome, yes, and scale has certainly proven

to be important to Brazil’s current breed of

multinationals. But the modern global

economy also values and rewards strengths

such as agility, flexibility and nimbleness.

In other words, times have changed. Scale

should increasingly be seen as the outcome

of international success, rather than a

prerequisite to achieving it. Digital

technologies are reducing the importance of

scale as a barrier to market entry. Micromultinationals and companies that are

“born global” are symbols of this newest

phase of global business, where

interconnected networks of companies of all

sizes form the basis of the competitive

ecosystem. The ability to partner and

collaborate with companies of all sizes, and

from all countries, is becoming crucial for

high performance.

International growth as a domestic

competitiveness imperative

Competitiveness is key to understanding

Brazil’s internationalization imperative.

Unlike the decades during which today’s

crop of Brazilian MNCs built their

empires, today’s growing firms find

themselves in a far more open and

globally connected domestic market.

They are increasingly competing with

foreign companies both at home and

abroad. Their foreign competitors have

access to a broad range of strengths,

from low-cost business models to strong

global brands.

This requires Brazilian companies to

attain a greater degree of global

competitiveness at a much earlier stage

of their development than in the past.

Research by the Accenture Institute for

High Performance (2013) shows not only

increasing investment plans from foreign

firms into Brazil, but also a clear intent

from foreign companies, particularly from

Asia, to take on Brazilian companies

more directly. This is not about the

long-term future; this is about the

realities of business plans in the coming

one to three years. (See Figure 1, “Brazil

vs. Asia: Increasingly direct competition.”)

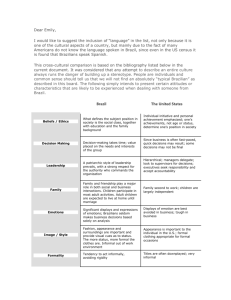

Figure 1: Brazil vs. Asia: Changing competitive dynamics

Asian firms have an intense focus on moving up to the higher-value areas that Brazilian companies today see as their

competitive strengths.

ASIA TODAY

BRAZIL TODAY

ASIA IN THREE YEARS

High-quality products

High-quality products

High-quality products

Low-cost operations

Skills and talent

High-value innovation

Low-cost innovation

Affordable capital

Skills and talent

High-value innovation

Strength of brand

Strength of brand

Skills and talent

High-value innovation

Intellectual property

Strength of brand

Intellectual property

Low-cost innovation

Intellectual property

Low-cost operations

Affordable capital

Affordable capital

Low-cost innovation

Low-cost operations

Cost-based strengths

Non-cost based strengths

Ranking is based on survey responses on the perceived globally

competitive strengths of 102 Brazilian MNCs and 250 Asian MNCs.

Source: Accenture analysis; Accenture Brazilian multinationals

survey 2012, and Accenture Asian multinationals survey, 2012

5

Access the world’s leading-edge

capabilities

Prioritize the role of SMEs as

business partners and growth drivers

SMEs – Brazil’s under-utilized

growth driver

As a first step, Brazilian companies need to

harness the opportunities that technology

and globalization offer them, in terms of

access to the world’s best skills and

resources. Brazil’s natural resource

companies figured out long ago that they

need to follow the global map of resources

in order to keep growing; now, increasing

numbers of industries are feeling the

imperative to reach beyond their borders.

Executives need to recognize that succeeding

in tomorrow’s Brazilian and global markets

will demand increased global awareness and

engagement from companies of all sizes.

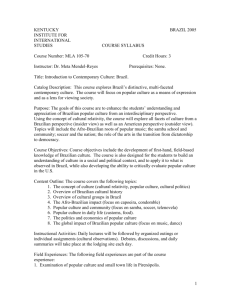

An analysis of Brazil’s exports by firm

size – a crude but telling measure

– shows that the contribution of small

and medium-sized enterprises (SMEs)

to the country’s total exports has

decreased in recent years, falling from 11

percent in 2004 to 4.1 percent in 2013.

If we exclude the export of services to

only look at goods, the decline is very

similar, from from 11.3 percent in 2004

to 4.2 percent in 2013. (See Figure 2,

“Out of balance.”)

Witness how Brazilian businesses at the

cutting edge of the digital economy are

quick to leverage these opportunities;

technology companies like Exceda, Movile

and Totvs have set up research and

development centers in Silicon Valley in the

United States, ensuring that they are

connected to the leading thinkers and

innovators in their fields. More companies

from a wider range of industries are realizing

that expansion abroad is not only about

gaining market share, but increasingly about

accessing talent, capital, technology and a

host of other factors that are essential to

remain competitive.

Build domestic brand value

through global presence

The Brazilian market places a premium

on external approbation: In a recent

study of Brazilian MNCs, Fundação Dom

Cabral (2012) asked executives what they

saw as the key benefits of

internationalization: “Increase in brand value

through international presence” was the

most popular response, and “differentiation

from domestic competitors” and

“improvement in the company’s domestic

image” came in joint-third place. Brazil’s

MNCs clearly see improved domestic

positioning as a key outcome of going global.

Firms looking to build their domestic

presence should be exploring how

international expansion can open or

accelerate opportunities to achieve this.

6

Just as SMEs are the engine for domestic

growth around the world, they are

increasingly becoming the engines of global

growth through their ability to network with

one another and large companies. Some

Brazilian companies have picked up on this:

Odebrecht recently collaborated with Sebrae

(the Brazilian Support Service for Micro and

Small Businesses) to jointly train 15 micro

and small businesses to produce shoes for

their construction sites overseas. Such

partnerships and opportunities can open

doors for future ventures abroad, but

Brazilian examples are few and far between.

Fortunately, multinationals from abroad are

also helping to build connections with

smaller Brazilian companies. This provides

the latter with important opportunities to

connect with global business opportunities.

Google, for example, is also collaborating

with Sebrae, supporting and promoting the

use of their own online tools such as Google

Maps (as a location tool), Google AdWords

(to support advertising), Google Analytics

(to measure and evaluate customer access),

YouTube (as an engagement channel) and

the use of AdSense (to generate new sources

of revenue).

Even accounting for the contribution of

Brazil’s large commodities players, these

figures compare poorly with rates seen in

some of the world’s most dynamic

emerging markets, and moreover they are

moving in the opposite direction. For

example, in India SMEs accounted for 43

percent of exports in fiscal year 20112012, and the government has

mentioned it expects their contribution

to rise to 50 percent by 2017. In five

high-growth ASEAN countries, this share

rose from 12 percent in the late 1990s to

23 percent in the late 2000s, reaching 35

percent in Thailand and 33 percent in the

Philippines (Wignaraja, 2011). Looking at

developed economies, SMEs accounted

for some 30 percent of US foreign

merchandise sales in the late 2000s

(United States International Trade

Commission, 2010).

Some of today’s Brazilian SMEs will

surely become the large Brazilian MNCs

of tomorrow, but waiting to achieve

domestic dominance before reaching out

abroad may prove to be a dangerous

game. Rather, Brazil’s ambitious business

leaders should look to engage more

deeply with the global economy as soon

as is strategically feasible.

Figure 2: Out of balance

The dominance of larger Brazilian companies among the country’s exporters has increased, accelerating after the global

downturn. By 2013, they accounted for some 96 percent of the country’s exports, up from 90 percent in 2002.

100%

90%

80%

Percentage of Brazilian exports

70%

60%

50%

40%

30%

20%

10%

0%

2002

Large

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

SMEs

Source: Ministry for Development, Industry and Foreign Trade (MDIC)

7

Domestic success leads to regional

success, and regional success is a

platform for global success.

High performers seek out

the best opportunities, not just

in their backyard but wherever

they may lie.

8

When expanding abroad, Brazilian firms tend

to look first to the country’s neighbors. For

example, a senior executive from Brazil’s

financial services sector told us of his firm’s

ambition to become a leading player across

Latin America, before reaching further afield.

This attitude is characteristic of a broader

tendency among Brazilian business leaders

who see a logical progression from domestic

growth to regional growth, and eventually to

global growth.

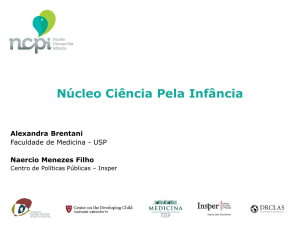

According to analysis by Fundação Dom

Cabral (2013), 56.5 percent of Brazilian

MNCs set up their first foreign subsidiary in

South America. North America follows as a

distant second with 32.6 percent. In fact,

researchers showed that a substantial share

of Brazil’s MNCs only seem to look beyond

the region once they have set up subsidiaries

in a number of other Latin American

countries. (See Figure 3, “Staying close to

home.”)

Our own research indicates that this trend

will continue. When we asked over 100

Brazilian MNCs and aspiring MNCs about

their investment plans for the next three to

five years, the Latin America and Caribbean

region emerged as the top priority for 61

percent. There was a significant gap before

the second priority, Middle East and Africa

(35 percent), closely followed by the US and

Canada (34 percent).

Figure 3: Staying close to home (Investigated companies`s entrance sequence by region)

Brazilian companies typically grow into a number of Latin American markets before considering expansion further afield.

First Market

6%

Second Market

3% 5%

9%

Third Market 1%

9%

Fourth Market 1%

Fifth Market

Oceania

21%

2%

18%

22%

4%

7%

22%

9%

Asia

7%

29%

Middle East

45%

22%

29%

4%

47%

2%

7%

7%

Africa

48%

Europe

20%

14%

34%

14%

USA and Canada

14%

18%

Latin America

Source: Cyrino, Barcellos & Tanure (2010)

9

The barrier of psychic distance

There is some logic to choosing

geographically close targets for expansion.

Cultural factors may make communication

and business simpler. There is a greater

chance that relationships already exist. And

in some industries, logistics and transport

systems can simply extend over borders. But

for many companies, the choice to grow

within the Latin American region is based on

a common, untested assumption that it is

just the sensible and easy way to begin.

Unfortunately, this is often untrue.

A major reason for this bias lies in the

concept of psychic distance (Johanson &

Vahlne, 1977). O’Grady and Lane (1996)

updated the definition as "the degree of a

company’s uncertainty in regard to an

international market, which results from

differences and other business-related

difficulties that create barriers for learning

about the market and for the establishment

of international operations".

Academic research confirms that Brazilian

multinationals tend to avoid psychically

distant markets (Cyrino, Barcellos, & Tanure,

2010). Reis & Fleury (2011) confirm that

Brazilian companies are, in general, sensitive

to psychic distance-related uncertainty and

risk, due to an emphasis on the domestic

market and local environment. The

researchers find this sensitivity measurably

hurts international performance through lost

opportunities. In short, Brazilian business

leaders have an instinctive preference to

grow within the region, rather than exploring

further afield.

The increasing riskiness

of a regional focus

By planning a growth trajectory that looks

exclusively at Latin America, many Brazilian

companies are not paying sufficient

attention to the dramatic degree to which

the global landscape of opportunities and

risks are being transformed.

Let’s look at the opportunities first. We

worked with Oxford Economics to create an

economic model that forecasts the growth in

the household incomes of 64 countries,

across 5 income bands, between 2010 and

2020. We use this as an indicator of broader

growth prospects. We observe a striking

increase in the higher-income populations of

most countries, with many developing

economies transforming their income

profiles over the decade.

10

As expected, Latin American economies are

likely to see a strong increase in the number

of households in the higher income bands,

raising their average incomes. But due to a

combination of demographic and economic

dynamics, many countries outside the region

are expected to see even larger increases in

household incomes over the period. And this

is not just true of macro growth rates, it is

also true of the increase in absolute income

levels, meaning that households literally will

have a greater amount of money available to

spend on goods and services. Countries as

diverse as Kazakhstan, Turkey and the Czech

Republic will likely enjoy dramatically

increased household income levels, and

associated business opportunities. (See

Figure 4, “Losing Ground?”).

The same degree of change is visible when

evaluating risks. Over the past decade,

increasing numbers of countries have

realized the importance of making their

economy attractive to foreign investment.

This has precipitated a wave of policy,

regulatory and institutional reforms, as

governments try to shrug off their

reputations as risky bets, and reinvent

themselves as attractive and welcoming

investment destinations. Companies that

focus their international expansion

exclusively on Latin America may be

overlooking countries further afield whose

risk/opportunity profile may surprise on the

upside.

Breaking the distance barrier

Here’s the good news: it has never been

easier to overcome the barriers of psychic

distance. Today’s globalized economy has

made it much easier to overcome the

obstacles of geographic reach and cultural

distance. Each successive advance in

information and communications technology

has eroded the cost and complexity that

distance used to represent.

Realizing that some sources of

competitiveness simply do not physically

exist in Latin America today, the Catarinense

Association of Technology Companies (Acate)

last year launched an internationalization

program to help its members “go global.” The

first step in this program was a visit from

businesspeople from Santa Catarina state to

accelerators, investment funds and

companies in the Silicon Valley and in

Miami, in the hope of establishing new

partnerships. Such global partnerships are

essential to build capabilities and

competitiveness, even if a firm’s demand is

focused on Latin America.

Segware, a company from Santa Catarina

state, provides technology for the electronic

monitoring of alarms, with customers across

Latin America. The company increased its

foreign sales after 2012, when it looked

beyond the region and opened an office in

Miami, and began participating in

international fairs. Foreign operations

currently account for 10 percent of annual

revenue, but the firm hopes that overseas

activities will drive a doubling of total

earnings next year.

Luiz Matos Lima, the president of the

software company Lux Sistemas from

Fortaleza, says that the company chose the

United States as a destination not only

because of the size of the market, but also

for the visibility it gives to their products in

countries further afield. And in preparing for

export, the company has also improved its

products for the domestic market.

This is not just a story of connecting hi-tech

companies to the US. A hard-headed

approach to global opportunities is relevant

across sectors. Dudalina is a quality shirt

maker established in 1957 that has six

manufacturing units and over 70 stores in

Brazil. In a recent interview, CEO Sonia Hess

described their careful and thoughtful

approach to international expansion. She

acknowledged that internationalization has

been a learning journey for the company,

which only makes a new move abroad when

it is confident that it will represent a solid

step in the right direction.

Note the diversity of the destinations they

consider for expansion, in Latin America and

beyond. In October 2012, Dudalina opened

its first showroom in Milan – a global capital

of fashion where the firm also established its

first “shop-in-shop” abroad. In November

2013, Dudalina opened a new store in

Panama and the company also considers

Russia, Australia and a variety of Western

European countries as markets with

potential. More Brazilian companies could

benefit from a similar type of strategic

vision.

The innovator abroad

Brazil is also home to companies with truly

innovative businesses, which generate

products and services that have global

markets. It simply does not make sense to

restrict the reach of such companies to Latin

America. These companies should be

targeting the most strategically lucrative

markets in the world, whether in Latin

America or elsewhere. This is especially true

in a global economy where competitive

advantage lasts for shorter and shorter

periods.

P3D, which produces educational software

with 3D technology, decided to operate

abroad when it realized that its product was

unique and had global potential, says CEO

Mervyn Lowe. The company was created in

2003 in São Paulo, within the incubator of

Cietec (Center for Innovation,

Entrepreneurship and Technology). Now it

has a staff of 40, of which 10 are abroad. It

opened its first office overseas in 2006 in

Spain; and the second last year in China. In

2014 it expects to start operating in the

United States. The company has distributors

in 15 countries. It covers Europe from its

Spain office and Asia from China, and

expects the US office to cover operations in

North and Central America.

Figure 4: Losing ground?

On measures of risk and opportunity, some Latin American economies do not stack up well.

RISK

OPPORTUNITY

Weighted average of sovereign, trade, political and

regulatory risk indices

Additional households with annual income of US$30,000

and above, 2010-2020

Increase in the number

of households

% Increase in the number

of households

China

29.207.516

1743%

3,9

India

7.625.703

1276%

United States

9,8

Turkey

4.719.277

73%

18

South Korea

15,3

Mexico

3.295.373

36%

20

Chile

15,5

Indonesia

1.498.387

730%

28

Czech Republic

19,9

Poland

1.410.502

43%

35

Kuwait

28,5

Thailand

1.376.690

147%

Ranking

Economy

Index

1

Sweden

1,8

6

Singapore

16

Economy

41

Ireland

33,6

Malaysia

1.332.658

90%

43

Botswana

34,8

Saudi Arabia

1.150.497

30%

45

Saudi Arabia

35,5

Argentina

954.493

38%

48

Mexico

38,9

Nigeria

935.312

142%

49

South Africa

39,7

Czech Republic

843.329

73%

57

Turkey

43,1

Colombia

833.885

41%

60

Peru

44,9

South Africa

768.686

42%

61

Brazil

45,0

Kazakhstan

759.679

112%

101

Paraguay

67,7

Philippines

740.887

158%

127

Bosnia and Herzegovina

77,3

Chile

534.332

46%

131

Nigeria

79,3

Venezuela

215.722

29%

136

Argentina

81,8

Ecuador

175.273

72%

159

Iraq

95,5

Paraguay

60.193

63%

0 - 100 - The greater, the riskier

Source: Oxford Economics - November 14, 2013

Source: Accenture, Oxford Economics

11

Government support is a condition

for Brazil’s international success

Brazilian firms will increasingly

need to seek alternative sources

of funding

12

Brazil’s government has heavily supported corporate internationalization efforts. The

statistics tell the story: the BNDES, Brazil’s development bank, has offered lowinterest financing to or bought stakes in 21 of the country’s 25 most

internationalized businesses.

This is no bad thing. Targeted financing can stimulate the growth, innovation and

productivity of Brazil’s multinationals, and this kind of support can sometimes be the

only way to access sufficient capital investment to compete on an equal footing in

new markets. It is also an important way of building global competitiveness in

strategically critical industries. According to research by O Estado de São Paulo

(2013), BNDES invested at least R$18 billion (US$8.1 billion) over the six years to

2013 to support the creation of “national champions,” supporting the acquisitions

made by companies such as JBS (meatpacking), Oi (telecommunications) and Totvs

(software and technology services).

The strategic hand of the state

Tightening purse strings

Nadia Menezes’ research shows how Brazil’s

government support initially focused on

heavy industry and infrastructure, but has

more recently broadened to semiindustrialized goods and services. Most

recently, Luciano Coutinho, president of

BNDES, stated that the bank will refocus its

cheaper financing to infrastructure,

capital-intensive companies and projects

that spur technological innovation.

Brazil’s recent economic difficulties reflect

changes in both the domestic and the global

economy. The country’s domestic consumer

boom has run out of steam, and the

commodities boom has ended as China

rebalances its economy away from

investment and toward consumption. None

of this should come as a surprise, but the

impact on Brazil’s state finances is

significant.

There is not a nation in the world –

developed, emerging or developing – that

has not undertaken similar targeted

initiatives to help shape their development

journey. The Chinese government’s support

of state-owned enterprises and their

international expansion is well recorded, but

China’s prominent private-sector players also

receive state support. And smaller economies

have developed tools and mechanisms to

help their firms achieve scale and

competitiveness that would not be possible

domestically, such as Singapore’s Double Tax

Deduction Scheme for Internationalization

(DTD) or Spain’s Enterprise

Internationalization Fund (FIEM).

Brazilian government debt, at nearly 60

percent of GDP, is higher than in most

comparable emerging markets. Public

finances have gradually deteriorated in

recent years, in part due to government

lending to BNDES. Credit rating agencies

have taken notice. Brazil has maintained the

“investment grade” status it proudly received

for its sovereign bonds in 2008, but earlier

this year, S&P downgraded its rating of these

bonds.

But times are changing in Brazil. Our

contention is that in the future, fewer

Brazilian companies will be able to rely on

financial backing from the government to

support their international expansion. The

reasons are simple: On one side of the

equation, government has less money to

give. On the other side, there will be more

companies going global, and thus there will

be increasing competition for scarcer funds.

Moreover, the government faces mounting

pressure to do a lot more with a lot less. For

example, Brazil needs to update the

country’s outdated infrastructure, as well as

to address underinvestment in public services

(notably education, healthcare and

transport). Protests in June of 2013

highlighted the groundswell of demand for

improved public services. With a tax burden

of some 36 percent of GDP (a level

characteristic of developed economies with

superior public services and a higher

percentage of older people in their

populations), further tax increases do not

seem to be a viable option.

13

This shift is about to take place. In April of

2013, the BNDES announced that it was

putting an end to its policy of supporting

national champions (a term not favored by

Coutinho). And more recently, the

government pledged to gradually reduce

subsidized loans to the BNDES, eventually

bringing them to an end.

The BNDES will continue to play a critical

role in supporting business and economic

development. In fact, the bank’s lending has

increased since its sharp drop in 2011, (see

Figure 5, “Limits to credit growth”), but its

president has already signaled that 2014 will

see an end to this trend, heralding a more

measured era of BNDES credit.

Figure 5: Limits to credit growth (BNDES lending, 2013 prices)

BNDES lending has seen a decade of strong growth, but this trend is expected to

lose steam or even reverse from 2014.

2013 R$ billion

In this context, it will be difficult for the

government to justify significant lending to

private businesses, let alone those that

target investments in foreign markets.

250

200

150

100

50

0

2004

SMEs

2005

2006

Medium-large

2007

Large companies

Source: Accenture analysis of BNDES data

14

2008

2009

2010

2011

2012

2013

The BNDES’s focus is clearly evolving as a

consequence of evolving economic and

political trends. And as increasing numbers

of Brazilian companies venture abroad, it is

unsustainable for the government to fund

private companies to the same degree,

particularly with so many competing

national priorities for those same scarcer

funds.

Business imperative: engage with

global capital flows

Regardless of the policies of the government

or the BNDES, Brazil’s aspiring multinationals

cannot afford to wait. If going global is

strategically the right thing to do, the

business case must be made and action

taken.

Waiting for or expecting financial support

will become increasingly untenable;

competitive pressures will not permit it.

Companies in Brazil’s fast-moving digital

economy are already realizing this. Witness

the innovative Brazilian start-ups trying to

build connections with Silicon Valley. They

are looking not only for skills and markets,

but also access to venture capital. BayBrazil

is a non-profit organization that has built a

network of some 3,000 entrepreneurs,

academics, professionals and critically,

investors, in the Silicon Valley and Brazil.

But international capital is not just reserved

for Silicon Valley-types. Netshoes has its

roots in São Paulo, but has grown since 2000

to become one of the nation’s highestprofile online retailers, receiving 20,000 to

30,000 orders every day for products as

varied as clothing to sporting equipment.

Netshoes did not wait for government

support to achieve this scale. The firm’s

leadership understood that a wide range of

capital sources are available for companies

with a strong business proposition, and that

some of the best sources may lie beyond the

country’s borders. Netshoes’ investors

include Tiger Global Management and Iconiq

Capital from the United States, Kaszek from

Argentina and Temasek Holdings from

Singapore. In May 2014 these were joined by

Singaporean sovereign wealth fund GIC,

which led a new investment round totaling

some US$ 170 million.

Businesses that have been born into these

globalized and Internet-enabled times can be

quicker to realize opportunities. Dafiti, an

online retailer, was established in 2011 and

has already established operations in five

other Latin American countries. The company

has so far raised US$255 million from

investors including the German incubator

Rocket Internet (which helped launch it),

New York’s Quadrant Capital Advisors,

Mexico’s Grupo León, JP Morgan Asset

Management and the Ontario Teachers’

Pension Plan.

Being a multinational in today’s global

economy requires leaders who will actively

tap international flows of talent, capital,

consumption, resources and innovation. Of

these, capital may be the least intuitive for

many companies to conceive of accessing

from abroad; there is a close attachment to

familiar, reliable funding sources. But

familiarity does not always equate with

suitability. It is in the interest of every

aspiring Brazilian multinational to actively

seek out the most appropriate sources of

capital to fuel their growth.

15

Growing and managing

international operations is

excessively complex and difficult

New-generation technologies

and operating models make

international operations more

manageable than ever

16

International expansion is not simple. Our research uncovers that even executives

confident in their international strategies lack confidence in their ability to

implement those strategies.

In fact, less than one in five of the Brazilian executives we investigated felt fully

confident that they have the operational capabilities required to execute their

international growth strategy. We questioned them more deeply and found that this

lack of confidence runs through all aspects of their international operating models;

their organizational structures, their processes, their information technology, their

leadership, people and culture.

Difficult but unavoidable choices

A new era of digital opportunity

The initial decisions and steps of building an

international growth strategy are hard

enough, but the realities of implementing

that strategy are intimidating. Then comes

the management of international operations,

which is a whole new kettle of fish: how do

we optimize operations across the global

organization? How do we stay relevant to a

global marketplace that is evolving in

different ways in different locations, and at

different speeds? And how do we achieve all

this in an efficient, cost-effective way?

Academics such as Bartlett and Ghoshal

(1987) and Boudrea, Loch, Robey and Straub

(1998) have emphasized the importance of

achieving efficiency, responsiveness and

learning in order to operate successfully

across borders. The latter scholars

highlighted the critical role that technology

plays in achieving this. Fifteen years on, the

acceleration in technology solutions has

dramatically enhanced the options for

organizations. The newest generation of

technology-enabled trends, such as cloud

computing, machine learning, mobility,

analytics, 3D printing and social media offer

improvements in both efficiency and

responsiveness simultaneously. Brazilian

firms have never had access to tools that

offer this degree of flexibility and benefits to

both the top and bottom lines. They have

never had the opportunity of being this

prepared for the complexities of running an

international business.

At the heart of these questions sit a series of

difficult choices and trade-offs. The most

fundamental of these are around governance

and decision making. To what degree should

decisions be centralized or decentralized

across business units, geographies and

functions? To what degree should processes

be standardized or left to be governed

distinctly? Ultimately, these questions are

about choosing between two eminently

desirable outcomes: on one hand, efficiency

across the global organization, and on the

other hand, responsiveness to diverse and

evolving market dynamics. To complicate

matters further, consider that the relative

importance of these imperatives may

fluctuate over time. And also that the

pressures to centralize or standardize may

move in different directions when

considering different parts of the business

value chain.

In this context, it is no wonder that Brazilian

executives feel daunted by the prospect of

going global. But the degree of complexity is

no reason to delay what the company sees

as the right strategy. If international

expansion makes strategic sense, then time

and resources should be invested to build the

appropriate operational capabilities to

realize that strategy.

Audi, the automotive manufacturer, provides

a good example of how these technologies

can accelerate both efficiency and

responsiveness. The firm’s designengineering process connects data from a

wide array of sources to generate products

at speed and to accurately-tailored

specifications. Audi’s Virtual Lab, for

example, is an online network that draws on

crowd-sourced input from customers to drive

the design of a software-based infotainment

system. Intelligent machines perform rapid,

iterative data analysis to systematically

refine customer input which is used to

simulate prototypes. The company also used

customer input to help design their R18

Ultra Chair. Thermal-imaging data was

collected from 1,500 people who tested out

the chair at a Milan furniture show in 2012,

which was then fed into a proprietary

algorithm and which informed further

iterative designs of the chair. Among other

awards, Audi secured prizes in the Connected

Car of the Year awards organized by the

Connected World Magazine in 2012 and

2013.

17

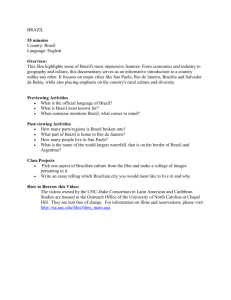

Figure 6: Key components of an international operating model

An international operating model is the vehicle through which a company executes

its business model and international growth strategy.

Macroeconomic and Industry Landscape

Business Strategy

Operating Model

Value Chain

Corporate support

Continual Adaptation

Design, Sell and Market

Buy, Make and Distribute

Transact, Service and Collect

Operating Model Levers

Organizational

Structure

Leadership

People

Corporate Culture

Process and IT

Source: Accenture Institute for High Performance, 2013

Value versus cost

Reading an example like Audi’s may worry

executives with tight budgets. But our

experience with clients suggests that

successful investments in this kind of

technology arise when the initiative is not

viewed as a cost but rather as a generator of

new value. That value can be multiplied if

the same technology investments are able to

serve a variety of markets; bringing

efficiencies to many locations and insights

into customer groups. In this way,

technology can help simplify complex

international operations.

Even the most cash-rich corporations cannot

afford to implement these technologies

immediately and at scale. Prioritization is

critical. It is important, therefore, to assess

where these technology investments will

make the greatest impact. This must be done

in the context of the firm’s specific strategic

objectives and priorities.

18

Increasing Brazil’s decisions

“at the edge”

Numerous scholars have characterized the

traditional Brazilian management model as

hierarchical, with a high degree of control

sitting at the top of the organization. These

academics have identified the presence of

rigid hierarchical structures as one of the key

components of the traditional Brazilian

management model (Caldas, 2006). Yet this

model, as Fleury & Fleury (2012) noted, is

“compatible with a domestic market [that is]

protected and dependent on government

actions.” In order to succeed in the globally

integrated economy, the most successful

Brazilian multinationals have realized the

importance of relaxing hierarchical

tendencies and adopted a more flexible and

adaptable management style. (See Figure 7,

“Decentralizing the core.”)

This suggests that many firms could generate

significant value by implementing

technologies that effectively empower units

distant from headquarters. The aim might be

to increase the value and accuracy of

decisions that are taken “at the edge” of the

business. Combinations of mobility, machine

sensors and analytics solutions are being

used by companies to do precisely that.

GE Transportation, for example, is designing

technology that enables train operators to

continuously monitor equipment, determine

schedules and plan for locomotive servicing

thanks to sensors that track about 250

variables. In this way, train operators are

empowered to implement quick decisions

that are responsive to the latest events and

can save time and costs.

The international convenience grocer

7-Eleven has similarly shifted decision

making responsibilities to the edge of the

company, rather than the center. Point-ofsale terminals transmit data to a data

repository in real time, allowing a

transformation in inventory management

processes, with store managers in thousands

of locations taking responsibility for stock

management decisions that used to lie with

corporate senior executives.

Figure 7: Decentralizing the core

Brazilian companies are increasingly focused on decentralizing decision making in core business functions, such as manufacturing and sales.

Please think about the location of decision-making authority across your international organization. What changes, if any, do you think are

necessary over the next 3 years across the following processes? (% of respondents who answered “centralize more” or “decentralize more”)

Core business functions

Support functions

Manufacturing

Treasury and risk

management

Sourcing

Talent management

Operations planning

and forecasting

Research and innovation

Marketing and sales

activities

Tax management

Distribution and logistics

Operations performance

management

Centralize more

Decentralize more

Source: Accenture Brazilian Multinationals survey

Leading with confidence

The last decade has seen profound

changes in the structure of Brazil’s

economy and society; and the rest of the

world has also evolved dramatically.

Multinationals have refreshed their

strategies, rearranged their priorities and

begun to accept that new thinking is

required to succeed in tomorrow’s

interconnected global markets. Some

Brazilian companies are among this

group. But many remain stuck in old

patterns, unaware or unwilling to accept

how new technologies and new business

models are reshaping the future

competitive landscape as well as their

relationships with stakeholders around

the globe.

Many commentators have talked of

Brazil’s “underdog complex.” Perhaps we

are fundamentally talking about the

need to build confidence. Confidence

about the strength required to go global,

confidence to interact with unfamiliar

markets, confidence to seek new and

alternative partners, and confidence to

take on the unavoidable complexities of

international operations.

Much is to be gained by questioning

conventionally held assumptions.

Brazil’s business leaders who free their

thinking and understand the dynamics

of the new global economy will be well

positioned to develop a global

mindset—a necessary first step toward

creating business strategies that combine

the best of Brazil with the best of what

the rest of the world has to offer.

19

Bibliography

7-Eleven. (2012). Retail Information Systems - Backgrounder Corporate Communications .

Accenture Institute for High Performance. (2013). Brazil Unleashed:

Lessons in building world-class international operations.

Accenture Institute for High Performance. (2013). Naturally Global:

Brazil’s global growth imperative. The challenge of

internationalization.

Agarwal, S., & Ramaswami, S. N. (1992). Choice of Foreign Market

Entry Mode: Impact of Ownership, Location and

Internalization Factors. Journal of International Business

Studies, 23, 1-27.

Associação Catarinense de Empresas de Tecnologia. (2013,

September). ACATE lança programa de internacionalização

de empresas de tecnologia catarinenses. Retrieved from

http://www.acate.com.br/noticia/acate-lanca-programa-deinternacionalizacao-de-empresas-de-tecnologiacatarinenses

Banco Nacional de Desenvolvimento Econômico e Social (BNDES).

(n.d.). Porte de empresa. Retrieved from BNDES: http://www.

bndes.gov.br/SiteBNDES/bndes/bndes_pt/Institucional/

Apoio_Financeiro/porte.html

Bartlett, C. A., & Ghoshal, S. (summer 1987). Managing Across

Borders: New Strategic Requirements. MIT Sloan

Management Review, 28, no. 4, 7-17.

BayBrazil. (2013, October). About Us. About Us. Retrieved from http://

www.baybrazil.org/

Boudreau, M. C., Loch, K. D., Robey, D., & Straud, D. (1998). Going

global: Using information technology to advance the

competitiveness of the virtual transnational organization.

The Academy of Management Executive 12(4), 120-128.

Brasil Econômico. (2013, July 23). Presidente da Dudalina planeja

internacionalização. Retrieved from http://brasileconomico.

ig.com.br/noticias/presidente-da-dudalina-planejainternacionalizacao_134190.html

Business Standard. (2013, June 3). MSME share in exports was 43%

in 2011-12. Retrieved 2013, from http://www.businessstandard.com/article/sme/msme-share-in-exports-was-43in-2011-12-113060300986_1.html

Caldas, M. P. (2006). Conceptualizing Brazilian Multiple and Fluid

Cultural Profiles. Management Research, 4(3), 169-180.

Carvalho, C. E., & Sennes, R. (2009, December). Integração financeira

e internacionalização de empresas brasileiras na América do

Sul. Nueva Sociedad especial em português. Retrieved from

http://www.nuso.org/upload/portugues/2009/2.Carvalho.pdf

Cyrino, A. B., Barcellos, E. P., & Tanure, B. (2010). International

trajectories of Brazilian companies: Empirical contribution to

the debate on the importance of distance. International

journal of emerging markets, 5(3/4), 358-376.

20

Dimitratos, P., Johnson, J., Slow, J., & Young, S. (2003).

Micromultinationals: New Types of Firms for the Global

Competitive Landscape. European Management Journal,

21(2), 164-174.

Dunning, J. H. (2001). The eclectic (OLI) paradigm of international

production: past, present and future. International journal of

the economics of business, 8(2), 173-190.

E-Commerce News. (2013, October 10). Google e Sebrae lançam série

de vídeos para ajudar pequenos e-commerces. Retrieved

November 22, 2013, from E-Commerce News: http://

ecommercenews.com.br/noticias/lancamentos/google-esebrae-lancam-serie-de-videos-para-fomentar-pequenosecommerces

Evans, P. C., & Annunziata, M. (2012, November 26). Industrial

Internet: Pushing the Boundaries of Minds and Machines.

General Electric.

Exame. (2013, July 19). Agora são os brasileiros que invadem o Vale

do Silício. Retrieved from http://exame.abril.com.br/

revista-exame/edicoes/1045/noticias/agora-os-invasoressao-eles?page=1

Fleury, A., & Fleury, M. L. (2012). Multinacionais brasileiras.

Competências para a internacionalização. Rio de Janeiro:

FGV Editora.

Fundação Dom Cabral (FDC). (2013). Ranking das Multinacionais

Brasileiras 2013 - Os impactos da política externa na

internacionalização das empresas brasileiras. Fundação Dom

Cabral.

Fundação Dom Cabral. (2012). Ranking das Multinacionais Brasileiras

2012 - Os benefícios da internacionalização. Fundação Dom

Cabral.

GIC. (2014, May 7). Netshoes receives new round of capital

investment led by GIC. Singapore. Retrieved from http://

www.gic.com.sg/en/newsroom/news-speeches/2132014/472-netshoes-receives-new-round-of-capitalinvestment-led-by-gic

Instituto Brasileiro de Planejamento e Tributação. (2013). Evolução

da carga tributária brasileira e previsão para 2013. Retrieved

from https://www.ibpt.org.br/img/uploads/novelty/

Johanson, J., & Vahlne, J.-E. (1977). The Internationalization Process

of the Firm-A Model of Knowledge Development and

Increasing Foreign Market Commitments. Journal of

International Business Studies, 8(1), 23-32.

Laghzaoui, S. (2009). Internationalisation des PME : apports d’une

analyse en termes de ressources et compétences.

Management & Avenir, 22(2), 52-69. Retrieved from http://

www.cairn.info/revue-management-et-avenir-2009-2page-52.htm

Little, M. (2013, May 31). GE Research and Development. In-person

interview. (R. J. Thomas, Interviewer) Schenectady, NY, United

States.

Menezes, N. B. (2012, June). A Política Governamental Brasileira de

Incentivo à Internacionalização de Empresas (1997-2005). In

S. S. brasileiro de estudos estrag[egicos internacionais (Ed.),

Integração Regional e Cooperação Sul-Sul no Século XXI.

Porto Alegre/RS. Retrieved from http://www.ufrgs.br/

sebreei/2012/wp-content/uploads/2013/01/Nadia-BMenezes.pdf

Menezes, N. B., & dos Santos, L. T. (2012). A Política Governamental

Brasileira de Incentivo à Internacionalização de Empresas

(1997-2005). O Atlântico Sul como Eixo da Inserção

Internacional do Brasil. SEBREEI Seminário brasileiro de

estudos estratégicos internacionais. Porto Alegre (Brazil).

Retrieved from http://www.ufrgs.br/sebreei/2012/wpcontent/uploads/2013/01/Nadia-B-Menezes.pdf

O Estado de São Paulo. (2013, March 10). 'Campeãs nacionais' do

BNDES patinam. O Estado de São Paulo. Retrieved from

http://www.estadao.com.br/noticias/impresso,campeasnacionais-do-bndes-patinam-,1006808,0.htm

O Estado de São Paulo. (2013, November 25). Dudalina vai vender

camisas na América Central.

O'Grady, S., & Lane, H. W. (1996). The psychic distance paradox.

Journal of International Business Studies, 309-333.

Reis, G. G., & Fleury, M. T. (2011). Global Mindset, Psychic Distance

and the Achievements of Brazilian Multinationals´

Subsidiaries. A Multilevel Analysis. V Encontro de Estratégias.

Porto Alegre: ANPAD.

Reuters. (2013, January 15). 2013 Audi S7 Wins 'Connected Car of

the Year' Award by Connected World Magazine. Retrieved

from http://www.reuters.com/article/2013/01/15/

idUSnMKW74637a+1c0+MKW20130115

The Economist. (2013, April 27). Perverse advantage: A new book lays

out the scale of China’s industrial subsidies. Retrieved from

http://www.economist.com/news/finance-andeconomics/21576680-new-book-lays-out-scale-chinasindustrial-subsidies-perverse-advantage

The Washington Post. (2012, March 1). Audi A8 named 2012

‘Connected Car of the Year’. Retrieved from http://www.

washingtontimes.com/news/2012/mar/1/audi-a8-named2012-connected-car-of-the-year/

United States International Trade Commission. (2010). Small and

Medium-Sized Enterprizes: Overview of Participation in U.S.

Exports. Washington, D.C.

Valor Econômico. (2013, October 23). BNDES vai dar prioridade a

setores de infraestrutura. Valor Econômico.

Valor Econômico. (2013, September 30). Feiras encurtam as

distâncias culturais.

Valor Econômico. (2013, February 27). Lições para evitar erros no

exterior. Retrieved from http://www.valor.com.br/

empresas/3023476/licoes-para-evitar-erros-no-exterior

Valor Econômico. (2013, September 17). Maior fundo de pensão do

Canadá é novo sócio da Dafiti.

Valor Econômico. (2013, September 20). Organização aproxima laços

entre Califórnia e Brasil.

Valor Econômico. (2013, September 30). Trajetória global.

Valor Econômico. (2014, May 13). Coutinho diz que redução do

BNDES pode ficar aquém do esperado.

Reuters. (2013, Abril 16). Netshoes se prepara para ser global,

considera IPO. Retrieved from http://www1.folha.uol.com.br/

mercado/2013/04/1263840-netshoes-se-prepara-para-serglobal-e-estuda-abrir-capital-diz-vice-presidente.shtml

Wignaraja, G. (2011). Engaging Small and Medium Enterprises in

Production Networks: Firm-level Analysis of Five ASEAN

Economies. ADBI-Graduate Institute-WTO Conference.

Geneva. Retrieved from http://www.wto.org/english/res_e/

reser_e/wts_future2013_e/wignaraja.pdf

Ruh, B. (2013, May 28). Global Software VP for GE Analytics.

In-person interview. (R. J. Thomas, & A. Kass, Interviewers)

San Ramon, CA, United States.

Wu, J., & Pangarkar, N. (2006). Rising to the global challenge:

Strategies for firms in emerging markets. Long Range

Planning, 39(3), 295-313.

Sousa, A. T. (2013, April). Passando em revista: políticas públicas para

a internacionalização das empresas brasileiras. Encontro

Internacional Participação, Democracia e Política Públicas:

aproximando agendas e agentes.

The Economic Times. (2013, May 23). MSMEs share in India's exports

may rise up to 50% by 2017. Retrieved 2013, from http://

articles.economictimes.indiatimes.com/2013-05-23/

news/39475613_1_msme-sector-guarantee-cover-exports

The Economist. (2012). State capitalism - This house believes that

state capitalism is a viable alternative to liberal capitalism.

Retrieved 2013, from The Economist: http://www.economist.

com/debate/days/view/802/CommentKey:1226921

21

About the Authors

Armen Ovanessoff (armen.ovanessoff@accenture.com)

is a senior research fellow in the Accenture Institute

for High Performance and leads the Institute’s research

on emerging markets

Athena Peppes (athena.peppes@accenture.com)

is an economist and a research fellow

in the Accenture Institute for High Performance

Eduardo Plastino (e.plastino@accenture.com)

is a research fellow in the Accenture Institute

for High Performance

Felippe Oliveira (f.demedeirosoliveira@accenture.com)

is a research specialist in the Accenture Institute

for High Performance

Senior executive sponsor

Vasco Simões

We would like to thank the following individuals

for their contributions to the study:

Daniella Alves, Fabio Mittestaedt, Carolin Puppel and Andréa Santini.

22

23

About Accenture

Accenture is a global management

consulting, technology services and

outsourcing company, with approximately

293,000 people serving clients in more

than 120 countries. Combining

unparalleled experience, comprehensive

capabilities across all industries and

business functions, and extensive

research on the world's most successful

companies, Accenture collaborates with

clients to help them become highperformance businesses and governments.

The company generated net revenues of

US$28.6 billion for the fiscal year ended

Aug. 31, 2013. Its home page is

www.accenture.com.

About the Accenture Institute

for High Performance

The Accenture Institute for High

Performance develops and publishes

practical insights into critical

management issues and global economic

trends. Its worldwide team of researchers

connects with Accenture’s consulting,

technology and outsourcing leaders to

demonstrate how organizations become

and remain high performers through

original, rigorous research and analysis.

Copyright © 2014 Accenture

All rights reserved.

Accenture, its logo, and

High Performance Delivered

are trademarks of Accenture.

Proprietary and confidential