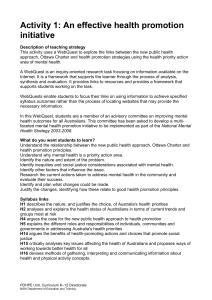

ApAthy to Action - The Financial Services Council

advertisement