ApAthy to Action - The Financial Services Council

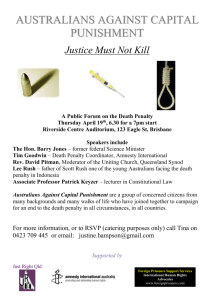

advertisement