Measuring Economic Capital

advertisement

Measuring Economic Capital: Value at Risk, Expected Tail

Loss and Copula Approach

by

Jeungbo Shim, Seung-Hwan Lee, and Richard MacMinn

August 19, 2009

Please address correspondence to: Jeungbo Shim

Department of Business Administration

Illinois Wesleyan University

P.O. Box 2900

Bloomington, IL 61702

Jeungbo Shim

Assistant Professor

Illinois Wesleyan University

Bloomington, IL 61702

Tel: 309-556-3308

jshim@iwu.edu

Seung-Hwan Lee

Assistant Professor

Illinois Wesleyan University

Bloomington, IL 61702

Tel: 309-556-3421

slee2@iwu.edu

Richard MacMinn

Professor

Illinois State University

Normal, IL 61790

Tel: 309-438-7993

rmacmin@ilstu.edu

Measuring Economic Capital: Value at Risk, Expected Tail

Loss and Copula Approach

Abstract

Investigating dependence structure between variables is important when modeling

multivariate data in the study of finance and insurance risks. In this paper, we explore

these practical applications for assessing the economic capital measured by Value at

Risk and Expected Tail Loss. The procedures are based on copula functions that

provide a flexible methodology for modeling multivariate dependence. Using copulas,

we examine the impact of dependence structure between market risk and underwriting

risk of insurance portfolio on the insurer’s economic capital, particularly for the

sample of the U.S. property liability insurance industry. Special attention is given to

the issue of choosing the copula that best fits our application data. We also assess

diversification benefit by comparing the difference between the diversified VaR and

the undiversified VaR. Numerical studies show that the insurer’s capital requirements

and the level of diversification benefit may vary depending on the choice of copulas.

The result suggests that t copula is preferred to Gaussian copula in estimating

economic capital for our given data.

Keywords: Copulas; Value at Risk; Dependence; Diversification; Property-liability insurers

1. Introduction

Economic capital is taking on growing importance along with the increasing

natural and man-made catastrophes within the insurance industry. One survey

revealed that 65% of all insurance respondents calculate a form of economic capital as

part of their business practice and an additional 19% are considering calculating

economic capital.1 Despite its increasing significance, there is currently no consensus

as to how to define and calculate economic capital. We present a model for assessing

the economic capital in an insurance context.

Capital is the financial cushion that insurance companies use to absorb adverse

consequences due to catastrophic claims costs or unfavorable asset returns. 2 The

meaning of capital varies depending on the viewpoint. Although not always precisely

defined, economic capital is distinct from regulatory capital in the sense that

1

The survey implemented by Tillinghast included responses from insurance executives in over 200

global companies, including 32 respondents from North American life insurers. See the details in the

2006 Tillinghast ERM survey at www.towersperrin.com

2

Capital is used interchangeably with policyholder surplus in the insurance industry.

2

Figure 1 VaR and Economic Capital

regulatory capital is the mandatory minimum capital required by the regulators while

economic capital serves to underpin all the actual risks borne by the insurer.

Conceptually, economic capital can be expressed as protection needed to secure

survival in a worst case scenario. More specifically, economic capital can be defined

as the difference between the expected loss and a worst tolerable loss at a selected

confidence level. Expected loss is the anticipated average loss over a defined period

of time and generally imputed as a cost of doing business. Expected loss does not

contribute to the capital charge since funds equivalent to the expected loss are held in

the insurer’s reserves. Because economic capital is the level of capital that the firm

should hold to maintain its probability of default below a certain threshold ( 1 − c %),

economic capital can be viewed as the Value at Risk (VaR) at a given confidence

level. Economic capital is based on a probabilistic assessment of potential future

losses and therefore itself random. The definition of VaR and economic capital is

presented graphically in Figure 1. Because asset-side risks and insurance underwriting

risks are aggregated to determine the insurer’s total economic capital, the distribution

is based on the aggregate return. Thus, VaR is at left tail where negative returns imply

the losses of the company portfolio value.

3

To estimate total economic capital for an insurance company, standalone

economic capital calculated separately for each risk type must be aggregated. The

conventional approach for aggregation is simply to add up standalone risk capital.

This simple additive approach may be easy to implement but overlooks potentially

important diversification effects. The risks of insurance company that should be

covered under the economic capital approach can be categorized into primary

components of asset risk, liability risk, and operational risk.3 Because these risks are

less than perfectly correlated, the potential for diversification suggests that the whole

risk will be less than the simple sum of standalone risk.

In modeling multivariate risks, the commonly used measure of dependence

structure is the linear correlation. Linear correlation is a natural scalar measure of

dependence under the assumption of elliptical distributions such as the multivariate

normal. However, the joint distributions of the real world in finance and insurance are

not always the case of the multivariate normal. Embrechts et al. (2002) point out that

the presence of non-linear derivative products and skewed heavy-tailed insurance

claims invalidates the assumption of multivariate normal distribution. Therefore, the

use of linear correlation under the assumptions of normality can mislead the level of

real dependence between different risks (Wirch, 1999). Furthermore, linear

correlation is unable to fully capture the degree of dependence in the tail of the

underlying distribution where extreme events are highly dependent. Thus, linear

correlation may not be an appropriate dependence measure for heavy-tailed

distributions (Embrechts et al., 2002).

3

Asset risk is generally decomposed of credit risk (e.g. when debt obligations are not met) and market

risk (e.g. a fall in the value of an insurer's investments). Liability risk refers to insurance underwriting

risk (e.g. the risk that arises from under-estimating the liabilities from business written or inadequate

pricing). Operational risk includes a risk of system failure or malpractice.

4

An alternative and theoretically more robust method to capture a wide of range

of dependence structure amongst different risks is to use copulas. Copulas formulate a

joint multivariate distribution by combining univariate marginal distributions in such

a way that various types of dependence can be represented. Because a copula

embodies all the information about the dependence between the components of

random vector, it has several advantages as a dependence measure. For example,

copulas identify both linear and non-linear dependence between random variables.

More importantly, copulas well capture the upper tail or the lower tail behavior. Thus,

copulas can be a useful technique to analyze dependence structure in an insurance

setting where extreme events appear to occur simultaneously and asset risks and

liability risks diversify against one another to some degree.

There are several studies that model dependence structure with copulas in the

insurance literature. Among them, Frees et al. (1996) examine the effects of

dependent mortality models on annuity valuation with data from a Canadian insurer.

They estimate the probability of joint survivorship of two annuitants using a bivariate

survivorship function called Frank copula. Their estimation results provide evidence

that strong positive dependence exists between joint lives and annuity values decrease

when dependent mortality models are used. Tang and Valdez (2006) examine the

differences of the insurer’s capital requirement under different copula assumptions.

They perform simulation using historical loss ratios of five lines of business for the

aggregated Australian industry to account for possible dependencies between

insurance risks. They find that the choice of copula has a significant impact on the

multi-line insurer’s capital requirement and diversification benefit. As they point out,

one limitation of their analysis is focusing merely on insurance underwriting risks, not

considering other sources of risks such as market risk. In reality, market risk is one of

5

dominant risks for property-liability insurers, accounting for 30% of the total

economic capital of a typical insurer, while insurance underwriting risk accounts for

50% of the capital requirement (Oliver, Wyman & Company, 2001).4

We contribute to the literature in two main aspects. First, we incorporate two

major categories of risks- market risk (asset-side risk) as well as insurance

underwriting risk (liability-side risk) in modeling the insurer’s total economic capital.

According to the new solvency requirements developing across the EU, insurers are

required to hold capital against market risk, credit risk and operational risk, which are

not covered by contemporary practice.5 The current EU regime concentrates mainly

on the insurance underwriting risks. Our study will provide practitioners and

regulators with important insights in determining total capital requirements where

both asset-side risks and liability-side risks and their interactions are considered.

Second, we attempt to identify which copula is the best one for the given application

data. The selection of the copula that best fits the data is critical since the estimates of

capital requirements can be significantly different according to the dependence

structure chosen. In addition, we quantify diversification benefit for each copula

model by comparing the difference between the diversified VaR and the undiversified

VaR on the aggregated portfolio returns.

In this paper, we focus on how different dependence structure between market

risk and underwriting risk has a substantial impact on the insurer’s total required

4

Credit risk and operational risk account for 5% and 15% of the total economic capital requirement of

a typical property liability insurer on average, a modest amount in comparison to the 55% and 25%,

respectively for a bank (Oliver, Wyman & Company, 2001).

5

The new Solvency II rules will introduce economic risk-based solvency requirements and be expected

to operate in 2012 across all EU Member States. The new regime would establish more risk-sensitive

and harmonized solvency requirements.

6

Figure 2 Process of Risk Aggregation and Economic Capital Calculation

Market Risk

Stock Marginal

•••

Rank Correlations

beteen Risks

Underwriting Risk

Mortgage Marginal

HO Marginal

Monte Carlo Simulation

(Random returns/loss)

•••

WC Marginal

Elliptical Copulas

(Gaussian, t, Cauchy)

VaR

economic capital using the sample of U.S. property-liability insurance industry.6 We

include six business lines to represent insurer’s underwriting risk and five categories

of assets are chosen as proxies for market risks. We first choose the best fitting

marginal distribution for each market risk class and business line based on historical

quarterly returns. Using estimated parameters from selected marginal distributions

and Spearman’s rank correlation coefficients as inputs in the simulation algorithm, we

then perform Monte Carlo simulation to generate random return series for each

market and underwriting risk under several different copulas. To estimate the

insurer’s economic capital, we calculate both the Value at Risk (VaR) and the

Expected Tail Loss (ETL) from the aggregated return distribution. Figure 2 illustrates

conceptually risk aggregation process that various marginal distributions of market

6

The recent report by the International Actuarial Association (IAA) and Solvency II rules generally

emphasize the importance of recognizing and modeling interdependencies of multiple risks. We do not

include credit risk and operational risk due to data limitations in this paper.

7

and underwriting risk components are combined to generate a single return

distribution- and economic capital- for the insurer.

This paper is organized as follows. Section 2 describes a brief introduction to

copula theory, and risk measures such as VaR and ETL are discussed in Section 3.

Section 4 illustrates how to measure the difference between diversified VaR and

undiversified VaR. Section 5 provides numerical examples and conclusions for the

assessment of economic capital are presented in Section 6.

2. Copula Functions as a Dependence Measure

The statistical properties and applications of copulas have been extensively

studied in the recent works (e.g.; Frees and Valdez, 1998; Breymann et al., 2003;

Demarta and McNeil, 2003; Trivedi and Zimmer, 2005). Copula functions are used to

fully capture real dependence amongst different risks. We first discuss several

approaches of dependence measures and then present basic properties of copulas, their

relationships to measures of dependence, and technical algorithms that generate

random vectors.

2.1 Dependence measures

The choice of the appropriate dependence measure is essential in determining

capital requirements. Consider an insurer with k classes of asset portfolios and

n − k lines of insurance business facing return random vector, ( X 1 ,..., X k ,..., X n ) .

T

The insurer’s total return is given by the weighted sum of X i ’s. We assume that X i

is a random return variable and has a marginal distribution, Fi ( x ) = P ( X i ≤ x ) . The

dependence between random variables, X 1 ,..., X n , is determined by their joint

distribution function

F ( x1 , ..., xn ) = P ( X 1 ≤ x1 , ..., X n ≤ xn ).

(1)

8

The traditional approach that measures the dependence is to use Pearson’s

linear correlation coefficient, assuming that random variables have jointly a

multivariate normal distribution. If ( X 1 ,..., X n )

T

has a multivariate normal

distribution and more generally an elliptical distribution, it is unproblematic to

employ the correlation matrix as a measurement of dependence structure. However,

most real world risks such as credit or operational risks are not likely to have an

elliptical distribution (Shaw, 1997). In addition, Pearson’s correlation coefficient is

influenced by extreme values, and not invariant under non-linear monotonic

increasing transformations of random variables, resulting in incomplete description of

dependence structure (Kumar and Shoukri, 2008). Thus, the use of linear correlation

in the jointly non-normal distributions may have serious deficiency in measuring real

dependency.

Two widespread concordance (global trend) measures are the Spearman’s rank

and Kendall’s rank correlations. They are non-parametric statistics used to measure

the strength of association between random variables in rank-ordered scale. It is wellknown that both Spearman’s and Kendall’s correlations are invariant under any

monotonic transformations. However, they are unlikely to fully capture extreme tail

dependence which is a major concern in quantifying capital charge. It is also very

complicated to estimate the multivariate joint probability distribution with these rank

correlations, especially when a large number of variables are involved.

An alternative to measure the dependence structure is copulas that overcome

the aforementioned limitations of the correlations. Copulas allow for any choice of a

marginal for each risk type and facilitate a more precise description of extreme

outcomes. Copulas provide a way of isolating the peculiar behavior of individual

risk’s marginal distribution from the description of dependence structure. Thus,

9

copula modeling fits well into an insurance framework, where each asset and liability

risk of the insurance company has a different distributional characteristic.

2.2 Copula Definition7

From a statistical point of view, a copula is a function that combines univariate

marginal distributions to construct a joint distribution with a specific dependence

structure. Thus it provides a way to create probability distributions to model

dependent multivariate components.

To elaborate, a copula is a function, C :[0,1]n → [0,1] , such that

1. For ui ∈ [0,1], i = 1,..., n, C (0,..., 0, ui , 0,..., 0) = 0 and C (1,...,1, ui ,1,...,1) = ui .

2. For

all

(u11 ,..., u1n ), (u21 ,..., u2 n ) ∈ [0,1]n ,

componentwise,

2

2

i1 =1

in =1

with

u1i ≤ u2i ,

i ∈ {1, ⋅⋅⋅, n},

∑ ⋅⋅⋅∑ (−1)i1+⋅⋅⋅+in C (u1i1 , ⋅⋅⋅unin ) ≥ 0.

The important aspect of copulas is summarized by Sklar’s theorem (1959), which

shows that the univariate marginal behavior and the multivariable dependence

structure can be separated from the joint multivariate distributions.

Theorem (Sklar, 1959) If F is a joint distribution function with marginal

distributions, F1 ,..., Fn , then there exists a copula C such that

F ( x1 ,..., xn ) = C ( F1 ( x1 ),..., Fn ( xn )).

Using the standard transformation method, it can be shown that Fi ( X i ),

(2)

i = 1,..., n,

has a uniform distribution defined on the interval[0,1] . Therefore, the copula can be

viewed as a multivariate function with standard uniform marginal distribution. If the

marginal distributions, F1 ,..., Fn , are continuous, then F has a unique copula. However,

if one or more marginals are not continuous, then copula for F is no longer unique.

7

The notion of copula and its ‘must-read’ literature are well discussed in Embrechts (2009).

10

Let ui be the observed value of Fi ( X i ) . Then for continuous univariate marginals, the

unique copula function is given by

C (u1 ,..., un ) = F ( F1−1 ( x1 ),..., Fn−1 ( xn )),

(3)

where F1−1 ,..., Fn−1 denote the quantile functions of the univariate marginals, F1 ,..., Fn .

From Sklar’s theorem, it is noted that any marginals can be used, since a copula links

marginals to their multivariate distribution, and it is independent of marginals as a

measure of dependence. Hence, such a copula is constructed under the assumption

that marginal distributions are known and can be consistently estimated from a given

data. A special category of copulas used in our numerical analysis are presented in the

following section.

2.3 Elliptical Copulas

The class of elliptical copulas such as Gaussian, Student-t, and Cauchy copula

is flexible since elliptical copulas allow for both positive and negative dependence.

Elliptical copulas are particularly suitable in modeling dependence structures with

multi-dimensions. Indeed, the introduction of a correlation matrix as a multidimensional parameter allows a great flexibility in terms of structure’s shape and

simulation procedures. However, a special class of copulas termed as Archimedean

copulas limits the complex nature of the dependence structure because they represent

dependence structure with a few parameters (Nelsen, 2006). Copulas of the

Archimedean family such as Gumbel and Clayton copulas cannot account for

negative dependence. 8 In this paper, we focus on elliptical copulas which are best

suited to our problem.

8

The class of Archimedean copulas is well discussed in Nelsen (2006). Gumbel is an appropriate

modeling choice when variables are strongly correlated in the upper tail of the joint distribution while

Clayton is suitable for strong lower tail dependence.

11

Gaussian Copula

The Gaussian copula is derived from the multivariate Gaussian distribution.

The dependence structure among the margins is described by a copula function, C ,

such that

C RG (u1 ,..., un ) = G (Φ −1 (u1 ),..., Φ −1 (un )),

(4)

where G denotes the joint distribution function of the multivariate standard normal

distribution function with linear correlation matrix R , and Φ −1 is the inverse of the

univariate standard normal distribution function. In the case of bivariate distribution, a

bivariate copula function can be written as

CRG (u1 , u2 ) = ∫

Φ −1 ( u1 )

−∞

∫

Φ −1 ( u2 )

−∞

( s12 − 2 R12 s1s2 + s22 )

1

exp

−

ds1ds2 ,

2π (1 − R122 )1/ 2

2(1 − R122 )

(5)

where R12 is the linear correlation coefficient of the corresponding bivariate normal

distribution. Note that R = ( Rij ) with Rij =

∑

∑∑

for i, j = 1, ⋅⋅⋅, n , where

ij

ii

∑

ij

is

jj

the (i, j )th component of the covariance matrix ( ∑ ) of the distribution.

The most interesting property of the copula in our study is about tail

dependence. The Gaussian copula does not allow for extreme events to be dependent.

To illustrate the concept of tail dependence with bivariate variables, let X 1 and X 2 be

continuous random variables with marginal distribution functions F1 and F2 . The

coefficients of tail dependence are asymptotic measures of the dependence in the tails

of the bivariate distribution of X 1 and X 2 . The coefficients of lower and upper tail

dependences of X 1 and X 2 are defined as

λL = lim P ( X 2 < F2−1 (u ) | X 1 < F1−1 (u )),

u ↓0

(6)

12

λU = lim P( X 2 > F2−1 (u ) | X 1 > F1−1 (u )),

u ↑1

(7)

respectively, provided that the limit exists in the interval [0,1] . Hence the tail

dependence states the probabilities of having a high (low) extreme value of X 2 given

that a high (low) extreme value of X 1 occurs. The dependence structures are of a great

variety from one copula to another. If λU = 0 ( λL = 0 ), for example, random variables

X 1 and X 2 are said to be asymptotically independent in the upper (lower) tail, i.e., no

tail dependence, which is the case of the Gaussian copula. On the contrary, if

λU ∈ (0,1] ( λL ∈ (0,1] ), X 1 and X 2 are asymptotically dependent in the upper (lower)

tail.9

We now describe the algorithm that provides random vector generation from

the Gaussian copula C RG . Let ∑ be positive definite such that ∑ = AAT for some n × n

matrix A . If Z1 ,..., Z n denote a random sample from N (0,1) and µ + AZ is a normal

distribution with mean, µ and covariance, ∑ ,

where Z = ( Z1 , ⋅⋅⋅, Z n )T ,

Lower

triangular matrix A can be obtained using Cholesky decomposition method.

Construct the lower triangular matrix A so that the covariance matrix ∑ = AAT using

Cholesky decomposition. Then,

1. Simulate n independent standard normal random variates Z = ( Z1 ,..., Z n )T

from N (0,1).

2. Take the matrix product of A and Z , i.e., Y = AZ .

3. Set U i = Φ (Yi ) for i = 1,..., n., where Φ is the distribution function of the

standard normal.

4. Set X i = Fi −1 (U i ) for i = 1,..., n.

5. ( X 1 ,..., X n )T is the random vector with marginals, F1 ,..., Fn , and Gaussian

copula C RG .

9

See Embrechts, McNeil, and Straumann (1999) for a proof.

13

Student’s t-copula

Student’s t-copula (or simply t-copula) is implied by a multivariate Student’s t

distribution. The t-copula with v degrees of freedom can be written as

Cvt ,R (u1 ,..., un ) = tv, R (tv−1 (u1 ),..., tv−1 (un )),

(8)

where tv ,R denotes the multivariate t -distribution function, and tv is the marginal

distribution function of tv ,R (i.e. the usual univariate t-distribution function). For the

bivariate case, t-copula has the following form

C (u1 , u2 ) = ∫

t

v ,R

tv−1 ( u1 )

−∞

∫

tv−1 ( u2 )

−∞

( s12 − 2 R12 s1s2 + s22 )

1

1 +

2π (1 − R122 )1/ 2

v(1 − R122 )

− ( v + 2) / 2

ds1ds2 ,

(9)

where R12 is the linear correlation coefficient of the corresponding bivariate tv

distribution, if v > 2 .

Unlike the Gaussian copula, t-copula generates joint extreme movements

regardless of the marginal behavior of random variables. The t-copula has both lower

and upper tail dependence, expressing dependence between extreme events. In order

to quantify such dependences with various degrees of freedom and different

correlations, we calculate coefficients of upper tail dependence ( λU ) for the t-copula

based on the property of the equation (7). It is noted in Table1 that the coefficient of

Table 1 Coefficients of Tail Dependence ( λU ) for t-copulas

a

v \ R12 -1

-0.9

-0.8

-0.5

-0.2

0

0.2

0.5

0.8

1

0 0.1024 0.1474 0.2468 0.3333 0.3968 0.4544 0.5641 0.7196

2

0 0.0171 0.0351 0.0955 0.1679 0.2254 0.2929 0.4226 0.6220

3

0 0.0032 0.0093 0.0405 0.0917 0.1393 0.2010 0.3318 0.5527

10

0

0

0

0.0002 0.0023 0.0078 0.0220 0.0845 0.2948

30

0

0

0

0

0

0

0.0001 0.0031 0.0733

0

0

0

0

0

0

0

0

0

∞

a

R12 denotes the linear correlation coefficient and v is degrees of freedom

0.9

0.8003

0.7295

0.6776

0.4643

0.2113

0

1

1

1

1

1

1

1

14

tail dependence is increasing in R12 and decreasing in v (see Embrechts et al., 2002

for a proof). Thus, t-copula is more suitable than Gaussian copula to model the case

where extreme events occur simultaneously. Furthermore, the coefficient of upper tail

dependence tends to zero as degrees of freedom ( v ) tend to infinity for R12 < 1 ,

implying that a t-copula converges to a Gaussian copula as v tends to infinity.

To simulate random vector ( X 1 ,..., X n )T from the t-copula, Cvt , R , the following

algorithm can be used (Embrechts et al., 2001):

1. Construct the lower triangular matrix A so that the covariance matrix ∑ =

AAT using Cholesky decomposition.

2. Simulate n independent standard normal random variates Z = ( Z1 ,..., Z n )T

from N (0,1).

3. Simulate a chi-squared random variates S with v degrees of freedom,

independent of Z = ( Z1 ,..., Z n )T .

4. Take the matrix product of A and Z , i.e., Y = AZ .

v

Yi for i = 1,..., n.

S

6. Set U i = tv (Ti ) for i = 1,..., n.

5. Set Ti =

7. Set X i = Fi −1 (U i ) for i = 1,..., n.

6. ( X 1 ,..., X n )T is the random vector with marginals, F1 ,..., Fn , and t-copula, Cvt ,R .

Cauchy Copula

The Cauchy copula is a special case of the t-copula where the degrees of

freedom ( v ) is equal to one. The copula generated by a multivariate Cauchy

distribution is

C1,c R (u1 ,..., un ) = t1,R (t1−1 (u1 ),..., t1−1 (un )),

(10)

where t1,R is the joint distribution function of a standard Cauchy random vector.

Similar to t-copula, the bivariate Cauchy copula is

C (u1 , u2 ) = ∫

c

1, R

t1−1 ( u1 )

−∞

∫

t1−1 ( u2 )

−∞

( s12 − 2 R12 s1s2 + s22 )

1

1 +

2π (1 − R122 )1/ 2

(1 − R122 )

− (3/ 2)

ds1ds2 , (11)

15

t1−1 (⋅) is

where

the

inverse

of

a

standard

Cauchy

distribution

with

2

1 1

⋅

dw . The Cauchy copula also yields tail dependence because of

−∞ π 1 + w

t1 ( z ) = ∫

z

its relationship with the t-copulas. To simulate a random vector, ( X 1 ,..., X n )T from

the Cauchy copula, we follow the t-copula algorithm with v = 1 .

Independence Copula

The independence copula can be expressed as

C ind (u1 , ⋅⋅⋅, un ) = u1 ⋅ u2 ⋅⋅⋅ un .

(12)

From Sklar’s theorem, it is clear that the dependence structure of the continuous

random variables is given by the above (12) if and only if they are independent.

3. Risk Measures

The calculation of economic capital is a process that begins with the

quantification of the risks that any given company faces over a given time period.

Risk measures provide a magnitude of the severity of a potential loss in a portfolio

and present meaningful amounts to hold to support the risk. Thus, the capital required

for the company can be determined by the risk measure. Value-at-Risk (VaR) and

Expected Tail Loss (ETL), most prominent risk measures among regulators and

practitioners, are used to evaluate risks and to determine the capital requirements in

this paper.

3.1 Value-at-Risk

The Value-at-Risk (VaR) is a statistical-based risk measurement that

summarizes the expected maximum loss over a target horizon period, at a given level

of confidence. Consider a real-valued random variable X that represents the loss of

some risky portfolio in a specified time period, with the distribution,

F ( x) = P{ X ≤ x}, measuring the severity of the risk of holding portfolio. Then, the

16

maximum loss is simply infinity since F is unbounded in most models. Thus, the

maximum possible loss is given by inf{x : F ( x) = 1} on the real line, where ‘inf’

denotes a greatest lower bound. For each α , 0 < α < 1 , the VaR is given by the largest

number x such that the probability that the loss X does not exceed x is at least α .

Formally, the VaR with given level of α is defined as10

VaRα ( X ) = inf{x : F ( x) ≥ α }.

(13)

Assuming that the risk profile of the institution remains constant over the

horizon, VaR can be derived by reading the quantile off the actual empirical

distribution. The VaR is a commonly used risk measure in financial institutions to

assess the risk associated with any type of portfolio taking account of correlations

between risk factors.

11

VaR presents a probability statement about the potential

change in the value of a portfolio resulting from a change in market factors over a

given period of time (Crouhy et al., 2001). One of advantages of VaR is that it

aggregates all of the risks in a portfolio into a single number suitable for reporting to

regulators or disclosure in an annual report. Because VaR measures the worst amount

the firm is likely to lose, it can be very useful to determine capital requirements at the

level of the firm. Dhaene et al. (2008) find that when substituting the subadditivity

condition by the regulator’s condition, VaR is the most efficient capital requirement

in the sense that it reduces some reasonable cost function.

However, VaR has some limitations as a risk measure. For example, VaR does

not capture statistical properties of the significant loss beyond the quantile point of

interest. Thus, even if the severity of losses doubles beyond quantile point, the VaR

10

11

VaR can be expressed as VaRα ( X ) = inf{ x : S ( x ) ≤ 1 − α } with S ( x ) = 1 − F ( x ) . See

McNeil et al., (2005).

VaR information can be used to implement portfolio-wide hedging strategies that are otherwise

rarely impossible (Kuruc and Lee, 1998; Dowd, 1999). Properties of VaR have been discussed

extensively in the literature(e. g., Dowd and Blake, 2006).

17

figure may not be influenced and gives us no indication of how much (i.e., a loss in

excess of VaR) that might be.

3.2 Expected Tail Loss as a Coherent Risk Measure

Expected tail loss (ETL) is a coherent risk measure in the sense of Artzner et

al (1997, 1999).12 ETL is also known as the expected shortfall by Tasche (2001) and

Acerbi and Tasche (2002). 13 ETL calculates the conditional expected loss beyond

VaR. For a given α , ETL is defined by

ETLα ( X ) =

1

1−α

1

∫α VaR ( X )du.

u

(14)

ETLα ( X ) can be expressed as a linear combination of the corresponding quantile and

its expected shortfall (e.g., Denuit et al., 2005)

ETLα ( X ) = VaRα ( X ) +

P{ X > VaRα ( X )}

E{ X − VaRα ( X ) | X > VaRα ( X )}. (15)

1−α

ETL overcomes some drawbacks of VaR because ETL tells us what we can expect to

lose if a tail event occurs. Note that ETL is more conservative than VaR since it

averages VaR over all levels u ≥ α ,

looking further into the tail of the loss

distribution and ETLα > VaRα . Dhaene et al. (2008) showed that ETL is the optimal

capital requirement at a given confidence level when the regulator’s condition is

imposed to the class of concave distortion risk measures.

4. The Measure of Diversification Benefit

An important implication of diversification effect is to mitigate the riskiness of

the firm by pooling uncorrelated risks. The risk of the portfolio of businesses will be

less than the sum of the stand-alone risks of the businesses if the risks of business

lines are not perfectly correlated with one another (Merton and Perold, 1993). Myers

12

See e.g., Dowd and Blake (2006) and Dhaene et al., (2008) for more discussions about the properties

of coherent risk measure.

13

There is no consensus of terminology. Expected tail loss (ETL) is also called conditional VaR, tail

VaR and conditional tail expectation.

18

and Read (2001) show that if each line of business is assumed to be organized as a

stand-alone firm, total capital requirements for those lines increase because of loss of

diversification. Perold (2001) argues that diversification across business segments

diminish the firm’s deadweight cost of risk capital. If we do not consider the effect of

diversification when allocating capital, we may overestimate firm risk, leading to

overcharging capital requirements.

In general, the diversification benefits can be quantified by three key factors:

the number of risk positions (or assets), the concentration of risk factors, and the

cross-risk correlations. For the illustration purpose, we take only two assets (asset a

and asset b ). Then, the diversified portfolio variance can be expressed in terms of

covariance of weighted assets a and b as follows:

σ 2p = ( waσ a ) 2 + ( wbσ b )2 + 2wa wb ρabσ aσ b ,

(16)

where σ a and σ b represent standard deviation of asset a and asset b , respectively,

wa and wb are respective weights, such that wa + wb = 1, and ρ ab is correlation

coefficient between asset a and asset b . The equation (16) shows that portfolio

variance accounts for the risk of the individual asset ( σ a2 and σ b2 ) and correlation

( ρ ab ) between them.

If we assume the portfolio return is normally distributed, the portfolio variance

can be translated into a portfolio VaR measure in the delta-normal model. The

portfolio VaR is then

VaR p = ασ pW = α ( waσ a ) 2 + ( wbσ b ) 2 + 2wa wb ρ abσ aσ b W ,

(17)

where α is the confidence level and W represents the initial portfolio value. If the

correlation ( ρ ab ) between two assets is assumed to be zero, the portfolio VaR reduces

to

19

VaR p = (α waσ aW ) 2 + (α wbσ bW ) 2 = VaRa2 + VaRb2 .

(18)

The result shows that the portfolio risk is lower than the sum of individual stand alone

risk ( VaR p < VaRa + VaRb ).14 This reflects the fact that a portfolio of two assets will be

less risky than a portfolio consisting of either asset on its own if returns are

independent of each other. If the correlation reaches its maximum value of 1, and both

wa and wb are positive, equation (17) reduces to

VaR p = VaRa2 + VaRb2 + 2VaRaVaRb = VaRa + VaRb .

(19)

If two assets are perfectly correlated, the portfolio VaR is equal to the sum of

individual stand alone VaR. In other words, there is no benefit of risk diversification

when all correlations are unity. This is a special case because correlations are

generally not perfect. The results provide us with important insights that

diversification benefit can be measured by the difference between the diversified VaR

and the undiversified VaR. The undiversified VaR is defined as the sum of individual

VaR when all correlation are exactly unit and the diversified VaR is defined as the

portfolio VaR in all circumstances except for the special case where the correlation is

one (Jorion, 2007).15

5. Numerical Studies

We present numerical examples to explore the influence of dependence

structure on the insurer’s economic capital charge and the level of diversification

benefit under different copulas. We first discuss the process of aggregating risks

considered for this exercise. The correlation matrix and the marginal distributions

which are essential inputs for the specification of copulas are presented. We then

14

This shows that VaR is a coherent risk measure for normal and elliptical distributions in general

(Jorion, 2007)

15

We also assume that there is no short position in our portfolio.

20

discuss our simulation results. We also discuss the choice of the best copula for the

given data in this section.

5.1 Aggregating Insurance Underwriting Risk and Market Risk

We measure insurance underwriting risk using quarterly industry-wide

underwriting returns by line of insurance business. Following the literature (e.g.,

Doherty and Kang, 1988; Gron, 1994; Doherty and Garven, 1995), the underwriting

return is defined as premiums written net of the present value of incurred losses for

each quarter divided by premiums written for the quarter. The quarterly data on losses

and premiums by line is provided by the National Association of Insurance

Commissioners (NAIC). We include six business lines –Homeowners (HO), Auto

Physical Damage (APD), Auto Liability (AL), Commercial Multiple Peril (CMP),

Workers Compensation (WC), and Other Liability (OL) that account for about 85% of

total underwriting risk in terms of premium written. Each business line has a different

risk characteristic depending on the payout patterns and product coverage. Long-tail

lines of business like AL, WC, and OL are considered to be more risky and complex

since losses of long-tail lines are not paid until long after the accident has occurred

due to several factors such as loss adjustment procedures and litigated claims.

Because the products of short-tail lines such as HO, APD, and CMP are more

standardized and their losses are fully developed or ultimately paid in one or two

years, short-tail lines are considered to be less risky.

Five categories of assets –Stocks, Government Bonds (GBond), Corporate

Bonds (CBond), Real Estate, and Mortgages are selected to represent the insurer’s

market risk (or asset-side risk). As proxies for market risks of asset portfolio, the

quarterly time series of returns are obtained from the standard rate of return series:

Stocks- the total return on the Standard & Poor’s 500 stock index; Government Bond

21

-the Lehman Brothers intermediate term total return; Corporate Bond -Moody’s

corporate bond total return; Real Estate-the National Association of Real Estate

Investment Trusts (NAREIT) total return; and Mortgages-the Merrill Lynch mortgage

backed securities total return.16

To produce a distribution of overall portfolio returns, we aggregate

underwriting return series of insurance business lines and market return series of asset

classes using their respective weights. The weight for each asset class is given by the

relative amounts invested in each asset class, while the weight for each business line

is specified according to the proportion of earned premium by line of business.

Weights are constructed to sum to unity by scaling the dollar amount in each asset

class and business line by the sum of all amounts of invested asset and earned

premium considered.

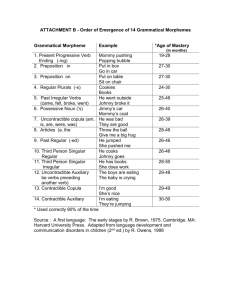

Table 2 lists descriptive statistics for the return series of asset classes and

insurance business lines used in the numerical analysis and presents their weights

used in aggregating portfolio returns. Several interesting patterns are observable. The

mean return ranges from 1.8% to 2.5% for asset classes while it varies from 26.5% to

37.2% for liability lines. Stocks among asset classes show the highest volatility, 7.9%,

consistent with common perception. Homeowners’ line is more volatile than other

business lines. One important pattern to notice is that minimum returns for all asset

classes are negative. Furthermore, the last column of Table 2 shows that assets

variables account for a considerable proportion of total weights. These results imply

that the aggregated portfolio return rate will be significantly influenced by the return

rate of asset classes.

16

Employing external indices as proxies for the behavior of particular risks is common among the

banking institutions. For example, CreditMetricsTM of J.P. Morgan opted equity returns as a proxy for

asset returns since internal asset returns are not directly observable (Basel Committee on Banking

Supervision, 2003; Morone, et al., 2007).

22

Table 2 Descriptive Statistics and Weights for Asset Classes and Liability Lines

Variables

Stock

GBond

CBond

RealEstate

Mortgage

HO

APD

AL

CMP

WC

OL

Mean

SD

Min

Max

Weight

0.0233

0.0792

-0.1897

0.1930

0.2222

0.0180

0.0186

-0.0187

0.0486

0.3856

0.0193

0.0341

-0.0659

0.0713

0.1539

0.0253

0.0607

-0.1155

0.1749

0.0095

0.0192

0.0172

-0.0233

0.0536

0.0039

0.2648

0.1255

-0.2169

0.4436

0.0294

0.3724

0.0460

0.2994

0.4659

0.0500

0.3040

0.0384

0.2401

0.3825

0.0757

0.3629

0.0694

0.1179

0.4810

0.0200

0.3026

0.0812

0.1105

0.4326

0.0313

0.3545

0.0713

0.1971

0.5286

0.0185

Variables: GBond (Government Bond), CBond (Corporate Bond), HO (Homeowners), APD

(Auto Physical Damage), AL (Auto Liability), CMP (Commercial Multiple Peril), WC

(Workers Compensation), and OL (Other Liability).

5.2 Correlations

The critical parameter that needs to be estimated for the simulation algorithm

using copulas is the correlation matrix between market risks and underwriting risks.

The industry-wide correlation matrix is estimated by the historical quarterly time

series of returns from each asset class and business line over the sample period 19912002. Table 3 provides the Spearman’s rank correlation coefficients for the return

series of five asset classes and six insurance lines. Rank correlation is invariant since

the simulated numbers replicate the same rank correlations that are used to generate

them. The returns of government bonds and mortgages are strongly positively related

each other, 93 percent correlations. Of the pair-wise correlations between insurance

underwriting risks, the pair of workers compensation (WC) and auto liability (AL)

shows the highest positive correlations with 85 percent. High correlations between

them may be justified since both WC and AL have similar long-term payout patterns.

The correlation between APD and WC is negative 40 percent. It can be argued that

23

Table 3 Correlation Matrix for Asset and Liability Return Series

Variable Stock GBond CBond RealEstate Mortgage HO APD AL CMP WC OL

Stock

1.000 -0.129 0.472 0.244

-0.027 0.177 -0.065 0.400 0.108 0.303 0.035

GBond -0.129 1.000 0.121 0.100

0.933 0.002 0.018 -0.190 0.306 -0.214 0.135

CBond

0.472 0.121 1.000 0.181

0.217 0.043 0.292 -0.100 0.440 -0.102 0.181

RealEstate 0.244 0.100 0.181 1.000

0.179 -0.262 -0.230 -0.202 0.106 -0.026 -0.126

Mortgage -0.027 0.933 0.217 0.179

1.000 0.070 0.001 -0.187 0.408 -0.201 0.122

HO

0.177 0.002 0.043 -0.262

0.070 1.000 -0.092 0.430 0.435 0.258 0.374

APD

-0.065 0.018 0.292 -0.230

0.001 -0.092 1.000 -0.299 0.264 -0.404 -0.137

AL

0.400 -0.190 -0.100 -0.202

-0.187 0.430 -0.299 1.000 -0.078 0.854 0.170

CMP

0.108 0.306 0.440 0.106

0.408 0.435 0.264 -0.078 1.000 0.006 0.176

WC

0.303 -0.214 -0.102 -0.026

-0.201 0.258 -0.404 0.854 0.006 1.000 -0.008

OL

0.035 0.135 0.181 -0.126

0.122 0.374 -0.137 0.170 0.176 -0.008 1.000

Variables: GBond (Government Bond), CBond (Corporate Bond), HO (Homeowners), APD

(Auto Physical Damage), AL (Auto Liability), CMP (Commercial Multiple Peril), WC

(Workers Compensation), and OL (Other Liability).

APD line that covers damage to auto physical is less likely to be correlated with WC

line that provides coverage for bodily injuries due to job-related accidents. The

returns of government bonds, corporate bonds, real estate and mortgages are

negatively correlated with those of several business lines of insurance, suggesting that

insurer’s investment in these types of assets provides effective hedges against some

losses in insurance liability lines. This view is consistent with the findings of recent

empirical studies that the insurer’s asset returns are correlated with liability risks to

some degree (e.g., Cummins et al., 2006; Ren, et al., 2008).

5.3. Fitting Marginal distributions

Determining the appropriate marginal distributions with a given data set is

important along with the choice of copula because capital requirement measured by

VaR and ETL is largely dependent on the tail behavior of distribution of each risk.

Various techniques including graphical or numerical method can be used to model

marginal distribution. The choice of distributions for each asset class and liability line

is detailed.

24

Let F ( x) be the fitted distribution function of a random variable X and then

the empirical distribution function for X 1 ,..., X n is defined as

1 K

Fˆi ( x) = ∑ I ( X ji ≤ x),

K j =1

(20)

where i = 1, ⋅⋅⋅, n, and K is the number of observations for the i th random variable.

The fit of the marginal distributions can be assessed with a graphical comparison of

the specified theoretical distribution function against its empirical version, as

demonstrated in Figure 3. For an illustration, we present here the fit of the univariate

marginals using lognormal distribution for Auto Liability line. Figure 3 (left) shows

that the plot of the empirical distribution function, Fˆ ( x), is fairly close to the smooth

curve of the theoretical distribution, F ( x) . Hence we can conclude that the lognormal

distribution seems a suitable model for AL line.

Figure 3 Graphical Method to Model Marginal Distribution

An alternative method is to use the probability-probability plot (P-P plot) that

helps to determine how well a specified distribution fits a given data set. Figure 3

(right) illustrates P-P plot method using the sample data of AL line. The adoption of

lognormal distribution for AL appears reasonable since there is no significant

discrepancy between the dotted curve of empirical distribution function and the

diagonal reference line.

25

As numerical measures, Skewness and kurtosis can be used to derive a fitting

distribution. Skewness is a measure of the asymmetry of the probability distribution

where positive (negative) skewness indicates a long right (left) tail, while zero

skewness reveals symmetry around the mean. Kurtosis is a measure of whether the

data are peaked or flat relative to a normal distribution. That is, data sets with high

Kurtosis portray a distinct peak near the mean and tend to have heavy tails, whereas

data sets with low Kurtosis show a flat top with skinny tails.

Using the identical historical quarterly returns used in the estimation of

correlations and following all procedures discussed above, we present the best fitting

distributions for asset classes and business lines in Table 4.17

Table 4 Best Fitting Distributions and Parameter Estimates

Distribution

Skewness

Kurtosis

Parameter1c

Parameter2d

Gumbel(Min)a

-0.7187

0.9260

0.0589

0.0617

Normal

0.1107

-1.1021

0.0179

0.0186

Logistic

-0.5902

-0.0760

0.0193

0.0188

Logistic

0.0477

0.6335

0.0252

0.0335

Gumbel(Max)b

0.0090

-0.2239

0.0114

0.0134

-1.9608

5.2755

0.3212

0.0978

Gumbel(Min)a

Gamma

0.3427

-0.8930

65.499

0.0057

Lognormal

0.4637

-0.7658

-1.1983

0.1231

Normal

-1.4028

3.1125

0.3629

0.0694

Lognormal

-0.4540

-0.5081

-1.2381

0.3087

Gamma

-0.0537

-0.1524

24.761

0.0143

Variables: GBond (Government Bond), CBond (Corporate Bond), HO (Homeowners), APD

(Auto Physical Damage), AL (Auto Liability), CMP (Commercial Multiple Peril), WC

(Workers Compensation), and OL (Other Liability).

a

Gumbel(Min) denotes Gumbel minimum that highlights the left tail.

b

Gumbel(Max) denotes Gumbel maximum highlights the right tail.

cd

Parameter1 and Parameter 2 indicate the estimates of the parameters in the probability

density function

Variables

Stock

GBond

CBond

RealEstate

Mortgage

HO

APD

AL

CMP

WC

OL

The variables for Stock, Mortgage, and Homeowners (HO) display the extreme value

distributions where Gumbel minimum highlights the left tail (i.e., thin right tail and

thick left tail) while Gumbel maximum highlights the right tail (i.e., thin left tail and

17

We also employed the commonly used goodness-of-fit tests such as Anderson-Darling test,

Kolmogorov-Smirnov test and Chi-Square test.

26

thick right tail). Both Auto Liability (AL) and Workers Compensation (WC) best fit

the Log-normal distribution which exhibits a relatively heavier tail than Gamma

distributions of Auto Physical Damage (APD) and Other Liability (OL) lines. We

estimate the parameters for each of the selected distributions using the maximum

likelihood method that often leads to the unbiased estimates with minimum variance.

The results are provided in Table 4.

5.4 Simulation Results

We perform Monte Carlo simulation to generate random return series for each

asset class and business line by applying the procedure described in the previous

section. The scatter plots between return series and economic capital measured by

VaR and ETL are presented for each copula model. We also discuss the results of

diversification benefit in this section.

5.4.1 Scatter Plot of Simulated Return Series

We present scatter plots of the return series to observe graphically the

dependence level between asset classes and insurance business lines for the following

copulas: Gaussian copula, t-copula with degrees of freedom v =10 and v =2, Cauchy

copula and Independence copula. We simulate 5000 random values of each asset class

and business line for each of copula models considered using correlations and

parameter estimates of the marginal distributions in Table 3 and Table 4. The scatter

plots of five selected classes -Stock, GBond, HO, AL and WC are presented to

conserve the space. Each dot stands for a joint observation for each pair.

The scatter plots show that different copulas impose distinctive tail behaviors,

leading to different level of risk measures. Even with the identical rank correlations,

the level of dependence structure can be differentiated by copula types. In general, we

observe that the Gaussian copula (Figure 4) demonstrates a modest linear relationship

27

across returns in each asset and liability class and observations tend to cluster around

the center of the distribution. It is important to realize that dependencies may be

different according to the correlation parameters initially determined by historical data.

For example, the scatter plot between AL and WC shows a relatively strong linear

relationship, compared to that of other pairs. This positively sloping linear pattern is

consistent with high rank correlation (85%) between AL and WC as shown in Table 3.

However, neither upper nor lower tail dependence is detected across all pairs in the

Gaussian copula. This is justifiable because the degree of tail dependence for the

Gaussian copula is zero if the correlation of any pair is less than unity. Little evidence

of tail dependence implies that extreme events appear to occur independently under

Gaussian copula model regardless of how high a correlation we choose between asset

and liability classes.

In contrast, t-copula differs from Gaussian copula, even when their

components have the same correlation coefficients. The scatter plots of t-copula with

v =10 (Figure 5) shows that observations are more scattered toward upper or lower

tail distribution than those of Gaussian copula. This is reasonable given that t-copula

permits symmetric tail dependence. The joint observations in Figure 5, however,

appear somewhat similar to the case of Gaussian copula even if simulated from tcopula. As we noted in Section 2, this phenomenon results from the asymptotic

characteristic of the t-copula that the tail behavior of t-copula resembles that of

Gaussian copula as the degrees of freedom increase. Although 10 degrees of freedom

may not be sufficient enough for asymptotic behavior, we still observe some

similitude with the Gaussian case.

As expected for these forms of copulas, the t-copula with v =2 in Figure 6 and

Cauchy copula in Figure 7 display more pronounced non-linear dependence between

28

Figure 4 Scatter Plots of 5000 Simulated Return Series under Gaussian Copula

Figure 5 Scatter Plots of 5000 Simulated Return Series under t ( v =10) Copula

Figure 6 Scatter Plots of 5000 Simulated Return Series under t ( v =2) Copula

29

Figure 7 Scatter Plots of 5000 Simulated Return Series under Cauchy Copula

Figure 8 Scatter Plots of 5000 Simulated Return Series under Independence

Copula

asset and underwriting returns than the other types of copulas. We also observe strong

tail dependence particularly in the lower tail of the distribution, compared to the

Gaussian copula case. This suggests that extreme negative returns have a tendency to

occur together. See for example, the pair-wise plots for Stock and WC where large

losses from stock market collapse tend to be closely associated with large losses in

workers compensation from the insurer’s perspective. Such dependence is stronger as

the degrees of freedom are decreasing. The scatter plots of all pairs in Cauchy copula

are more extended to the top right corner and the bottom left corner than those of

other forms of copula. Thus, Cauchy copula generates more simultaneously extreme

30

value observations than other types of copulas. Notably, Cauchy copula that allows

for stronger non-linear dependence constructs a cross form and thus captures both

positive and negative dependence concurrently.

Independence copula in Figure 8 provides no distinctive patterns since returns

of asset and liability classes are assumed to be independent each other. The result of

scatter plot is consistent with the assumption of Independence copula.

5.4.2 Calculation of Economic Capital and Diversification Benefit

Economic capital presented in terms of portfolio return rates is calculated

using both Value-at-Risk (VaR) and Expected Tail Loss (ETL). The risk measuresVaR and ETL represent the economic capital that the insurer should hold to keep its

probability of default below a certain threshold because they measure the worst

expected loss at a given confidence level if events develop in an adverse or

unexpected way. It is noted that the VaR measure does not state how much actual loss

will exceed the VaR figure; it simply presents the information about how likely the

worst expected loss will be exceeded. Thus, we include Expected Tail Loss (ETL) to

accommodate statistical characteristics of return distribution beyond the VaR.

We initially simulate 500,000 random returns for each asset class and business

line under different copulas. The simulated returns are then aggregated using the

weights discussed in Section 5.1 to construct a distribution of the portfolio rate of

return. Figure 9 presents the histograms of the aggregated returns. 18 There is a

substantial difference in dispersion across the types of copulas. Cauchy copula and tcopula with v =2 are more widely dispersed than other forms of copulas. In particular,

Cauchy copula and t-copula with v =2 lead to negatively skewed distribution that

extends a larger range of values in the negative return direction, compared to other

18

For illustration, 5000 simulated returns are presented. We also conducted the analysis using 500,000

simulated returns to check robustness. The same results are observed.

31

copulas. This observation is consistent with the theoretical view that under heavy tail

dependence, extreme events tend to occur simultaneously, resulting in more extreme

aggregate losses in general. Thus, we expect that the heavier tail behavior of Cauchy

and t-copula ( v =2) eventually leads to larger capital requirements.

Figure 9 Distributions of Aggregated Portfolio Return Series

Given the distribution of forward portfolio return series, VaR is readily

estimated by cutting the point on the ranked portfolio return distribution that

corresponds to the selected confidence level. ETL is simply the expected value (or

mean) of the portfolio rate of return in excess of VaR of the same ranked distribution.

For comparison purpose, we choose three confidence levels- 99%, 99.5%, and 99.9%

over a one-year time horizon.19 Especially, 99.5% confidence level is consistent with

a solvency capital requirement under the new EU solvency II regulation framework.

19

The confidence level can be viewed as the risk of insolvency during a defined time period at which

management has chosen to operate. The higher the confidence level selected, the lower the probability

of insolvency.

32

Value at Risk at 99.9% rating target is the risk measure required by the Basel

Committee on Banking Supervision.

When describing the insurer’s aggregated portfolio returns and determining

capital requirements, we are more concerned about lower tail dependence which

results in negative returns in our sample.20 Table 5 presents the undiversified VaR and

ETL which is considered a base scenario to assess the diversification benefit. There is

no significant difference in the estimates of VaR and ETL among different copulas.

This is reasonable because coefficients of tail dependence are equivalent across all

types of copulas when all correlations of asset classes and business lines are assumed

to be unity (See the Table 1).

The diversified VaR and ETL for each copula model are presented in Table 6.

As expected, we observe that there is a different impact of choice of copula on the

total capital requirements. The level of capital requirements measured by VaR and

ETL is inversely related to the number of degrees of freedom. The Cauchy copula

produces the highest risk measures in terms of the aggregate portfolio returns,

followed by the t-copulas with v =2 and v =10, and Gaussian copula in all cases. This

implies that extreme losses are likely to occur simultaneously under heavy tail

dependence structure, giving rise to the most conservative economic capital number

for the aggregated risks. The Independence copula results in the lowest VaR and ETL.

This observation is expected because Independence copula is assumed to have zero

correlations between risks. On average, the risk measures range from -5% to -7%

across all copulas.

20

Negative return rates imply the loss of portfolio value. This negative returns result from large

weights in asset classes (see Table2).

33

Table 5 Undiversified VaR and ETL

Copula

VaR(99%) ETL(99%) VaR(99.5%) ETL(99.5%) VaR(99.9%) ETL(99.9%) Average

Cauchy

-0.0713 -0.0975

-0.0896

-0.1155

-0.1323

-0.1511

-0.1096

t( v = 2 )

-0.0717 -0.0968

-0.0891

-0.1144

-0.1292

-0.1557

-0.1095

t( v = 10 )

-0.0716 -0.0963

-0.0890

-0.1133

-0.1279

-0.1522

-0.1084

Gaussian

-0.0711 -0.0956

-0.0883

-0.1124

-0.1271

-0.1500

-0.1074

-0.0891

-0.1140

-0.1275

-0.1536

-0.1087

Independence -0.0715 -0.0966

Table 6 Diversified VaR and ETL

Copula

VaR(99%) ETL(99%) VaR(99.5%) ETL(99.5%) VaR(99.9%) ETL(99.9%) Average

Cauchy

-0.0380 -0.0597

-0.0529

-0.0749

-0.0888

-0.1092

-0.0706

t( v = 2 )

-0.0362 -0.0577

-0.0512

-0.0726

-0.0855

-0.1085

-0.0686

t( v = 10 )

-0.0342 -0.0532

-0.0476

-0.0663

-0.0783

-0.0966

-0.0627

Gaussian

-0.0330 -0.0510

-0.0458

-0.0633

-0.0734

-0.0915

-0.0597

Independence -0.0258 -0.0421

-0.0372

-0.0533

-0.0634

-0.0788

-0.0501

Table 7 Diversification Benefits

Copula

VaR(99%) ETL(99%) VaR(99.5%) ETL(99.5%) VaR(99.9%) ETL(99.9%) Average

Cauchy

0.3477

0.3798

0.3712

0.3934

0.4016

0.4195

0.3918

t( v = 2 )

0.3355

0.3735

0.3649

0.3882

0.3982

0.4107

0.3853

t( v = 10 )

0.3233

0.3559

0.3485

0.3692

0.3797

0.3883

0.3665

Gaussian

0.3170

0.3479

0.3415

0.3603

0.3661

0.3789

0.3571

Independence 0.2652

0.3035

0.2945

0.3186

0.3321

0.3391

0.3155

We assess diversification benefit that insurers may pursue by constituting

various asset portfolios or by operating multiple-lines of businesses. Note that

diversification benefit is defined as the relative difference between risk measure of the

unit correlation and risk measure of the non-unit correlation. We measure the extent to

which diversification reduces overall risk by the ratio of diversified VaR to

undiversified plus diversified VaR. In Table 7, the magnitude of diversification

advantage is calculated under each copula and risk measure. We observe that there

exists a positive diversification benefit across all copulas and risk measures. The

result is consistent with the theoretical view that diversification enables firms to

reduce their overall portfolio risk and firms, then, would be required to hold less

capital to support uncertain events (Merton and Perold, 1993; Myers and Read, 2001).

34

Similar to the result of capital requirements, the use of different types of copulas has a

different effect on the level of diversification benefit. Selecting tail dependence model

with Cauchy copula offers the highest level of diversification gains (34%-42%

depending on the risk measure) while applying Independence and Gaussian gives rise

to the lowest diversification advantage (26%-33% and 31%-37%, respectively). It is

interesting to note that there exists a positive relationship between the absolute level

of risk measures and the resulting diversification benefit. We observe Copulas that

result in high risk measures are likely to be associated with high diversification gains

(see Tables 6 and 7).

Overall, we find that the choice of copula has a significant impact on the

resulting capital requirements and diversification benefits. The large variation is

primarily driven by the level of tail dependency that the copula allows for between

returns of asset classes and liability lines. The observed discrepancy of the risk

measures and diversification benefits among copulas demonstrates the importance of

choosing appropriate dependence structure to model the insurer’s aggregated risks.

5.4.3 Which Copula is the Best?

The question is now to choose the type of copula that fits best the given data.

The selection of the best copula model is an important issue especially to practitioners.

The methods of fitting a copula to the bivariate data case are well described in Frees

and Valdez (1998). Frees and Valdez illustrate how to identify an appropriate copula

with the joint distribution of insurance company losses and claims adjustment

expenses following the procedure developed by Genest and Rivest (1993). The basic

idea behind their procedure is to compare the degree of closeness of copula

distribution and its non-parametric estimate. Specifically, for the data ( xi , y i ) ,

i = 1,..., n , let the pseudo random variable Ti ={number of ( xi , y i ) such that x j < xi

35

and

y j < yi }/( n − 1). With this random variable, define the distribution of

copula, K (t ) = P(Ti ≤ t ) for t in [0,1] , and its nonparametric estimate

∧

K (t ) =

1 n

∑ I (Ti ≤ t ),

n i =1

(21)

where I is the indicator function. Then, the copula that best fits the data would be the

∧

one that yields zero distance between K (t ) and K (t ) . In their studies (Genest and

Rivest, 1993; Frees and Valdez, 1998), the best copula is chosen by minimizing the

square of the distance such as

1

∧

∧

D( K , K ) = ∫ {K (t ) − K (t )}2 d K (t ).

0

(22)

Genest and Rivest’s procedure is somewhat limited to the family of Archimedean

copulas, because K (t ) is presented only by the functional form of the generator that

defines Archimedean copulas. In contrast to Genest and Rivest, Durreleman et al.

(2000) and Palaro and Hotta (2006) suggest a different approach that utilizes

comparison of parametric and nonparametric values of a copula, which is not limited

to the Archimedean copulas. Because nonparametric (empirical) copulas have no

fixed structure and depend upon all the data points to produce an estimate, the

nonparametric copula should be getting closer to the copula being considered as the

amount of information in the sample increases. Similar to the method of the choice of

the marginal distributions discussed earlier, the best copula can be chosen in a way

that the distance of the theoretical and empirical copulas is minimized. We extend this

method with high dimensions for the elliptical copulas as described below.

Let x1, j ,...xn , j , j = 1,..., K , be a random sample from a multivariate distribution.

Then the empirical copula function is defined by

36

Table 8 Values of the Distances

Copula

Cauchy

t( v = 2 )

t( v = 10 )

Gaussian

∧

C(

|| Cˆ − C ||L2 / K

0.0239

0.0271

0.0196

0.0275

j1

j

1 K

,..., n ) = ∑ I ( x1, j ≤ x1, ( j1 ),..., xn, j ≤ xn, ( j n ) ),

K

K

K j =1

(23)

where I is the indicator function, K is the number of observations of a variable, and

xi , ( ji ) , i = 1,...n, j = 1,..., K , denote the ji th order statistics of the i th variable. Note that

K

∑ I (⋅) in (23) implies the number of elements in the sample that satisfy the argument

j =1

of the indicator function.

In order to investigate how “close” two functions are, we need a notion of

“size” for functions. To this end, we consider the L2 (Euclidean) norm as a numerical

measure. Specifically, following Durrleman et al. (2000), the best copula is captured

by looking for the minimum distance between the (assumed) parametric copula ( C )

and the empirical copula ( Ĉ ). Using the L2 norm criteria for jk = 0,1, ⋅⋅⋅, n, the

distance is

K

K

j

j

j

j

ˆ

|| C − C ||L2 = ( ∑ ⋅⋅⋅ ∑ | C ( 1 , ⋅⋅⋅, n ) − Cˆ ( 1 , ⋅⋅⋅, n ) |2 )1/ 2 .

K

K

K

K

j1 =0

jn = 0

(24)

Note that unlike the empirical copula, the theoretical copula C is parameterized by θ

which will be replaced by its estimate in practice. We estimate the distances for each

copula using the equation (24). Table 8 shows that t copula with 10 d.f. among others

is the best fit for our given data, which minimizes the distance between the parametric

copula and the empirical copula. Given that the objective of finding the best copula is

37

to estimate the economic capital necessary to cover the simultaneous occurrence of

extreme events, we clearly see that t copula with 10 d.f. is preferable to the Gaussian

copula.

6. Concluding Remarks

Economic capital refers to the amount of risk capital that financial service

firms require to secure solvency in a worst case scenario over a certain time period at

a pre-specified confidence level. Thus, economic capital is typically calculated using

VaR. The primary value of economic capital is its application to management’s

decision making as well as to risk management. Specifically, economic capital has

become a useful tool in evaluating capital adequacy in relation to risk. To assess

capital adequacy, examiners focus on a comparison of an insurer’s available capital

with its capital needs based on the insurer’s overall risk profile. Rating agency and

shareholder considerations are also cited as principal drivers for calculating economic

capital. Moreover, it is increasingly used in management’s strategic decisions about

whether to enter or exit certain market segments by reviewing economic capital

requirements.

It is vital to reflect real dependency between risk factors in modeling

economic capital. One method of measuring dependencies that overcomes the

limitations of traditional linear correlation and that has become very popular recently

among practitioners is using copula functions. A copula is an effective statistical tool

to model dependent interrelationships between the components of distinct risks

without losing information on some important characteristics of the tail dependency.

We estimated economic capital by incorporating both market risk and

underwriting risk. The market risk is associated with a fall in the value of an insurer’s

investments while underwriting risk arises when premiums are not sufficient to cover

38

future incurred losses. Because insurers’ profits and losses primarily depend on the

performance of both investment and underwriting activity, it is important to take both

market risk and underwriting risk and their interaction into account in the economic

capital modeling.

Based on the sample of the U.S. property liability insurance industry, we

examined the impact of dependence structure between the insurer’s market and

underwriting risks on the insurer’s total required economic capital under different

copulas. The diversification benefit for each copula model is also measured by

comparing the difference between the diversified VaR and the undiversified VaR. We

simulated quarterly return rate for the selected asset classes and business lines using

copula functions and then estimated VaR and ETL from the aggregated portfolio

return distribution. As a result, we found that there is a significantly different impact

of choice of copula on the insurer’s total capital requirements measured by VaR and

ETL. Copulas that allow for greater tail dependence result in greater VaR and ETL

compared to those with smaller dependence. Specifically, the Cauchy copula produces

the highest risk measures in terms of the aggregate portfolio returns, followed by t

( v =2), t ( v =10), Gaussian and Independence copulas in all cases. The result indicates

the importance of selecting appropriate copulas and risk measures to model the capital

requirements. For example, in the case of market crash where all portfolio values fall

down simultaneously, economic capital model under Gaussian copula may not

capture the riskiness of such contingency effectively because Gaussian copula

underestimates both the thickness of the tails of marginal distribution and their

dependence structure. Thus, we attempted to identify the type of copula that fits best

the empirical data. The parametric copula that is most close to its empirical copula is

defined as the best appropriate one. We found that the distance between parametric

39

and empirical copulas becomes smallest when the dependence structure is simulated

by the t copula with 10 degrees of freedom. The result suggests that t copula is

preferred to Gaussian copula not to underestimate the economic capital for our given

data.

Not surprisingly, diversification is major rationale for insurers to engage in

investment portfolio mix and operation in multi-line businesses. Insurers can realize

capital savings by reducing portfolio risks through geographic or product line

diversification. In general, the diversification benefit increases with the number of

assets or business lines and decreases with higher correlation between risk factors. We

found a positive diversification benefit -overall benefit in terms of reduction in total

capital requirements. The potential for diversification benefit stems from the fact that

some of insurers’ asset returns are negatively correlated with insurance underwriting

returns as evidenced from a correlation matrix and thus certain risks can be offsetting.

The result is consistent with Myers and Read (2001)’ proposition that low

covariability of losses with losses on the other lines of insurance in the portfolio or

high covariability of losses with returns on the portfolio of assets results in lower

capital requirements.

40

References:

Artzner, P., F. Delbaen, J. M. Eber, and D. Heath, 1997, Thinking Coherently,

Risk, 10: 68-71.

Artzner, P., F. Delbaen, J. M. Eber, and D. Heath, 1999, Coherent Measures of

Risk, Mathematical Finance, 9: 203-228.

Basel Committee on Banking Supervision, 2003, The Joint Forum: Trend in Risk

Integration and Aggregation.

Breymann, W., A. Dias, and P. Embrechts, 2003, Dependence Structures for

Multivariate High-Frequency Data in Finance, Quantitative Finance, 3: 1-16.

Campbell, J.Y., A. W. Lo, and A. Mackinlay, 1997, The Econometrics of Financial

Markets, Princeton University Press, Princeton

Crouhy, M., D. Galai, and R. Mark, 2001, Risk Management, McGraw-Hill

Publication

Cummins, J.D., Y. Lin, and R. D. Phillips, 2006, Capital Allocation and the Pricing of

Financially Intermediated Risks: An Empirical Investigation, Working paper.

Demarta, S., and A. McNeil, 2003, The T Copula and Related Copulas,

International Statistical Review, 73: 111-129.