Companyxx Statement of Commitment

advertisement

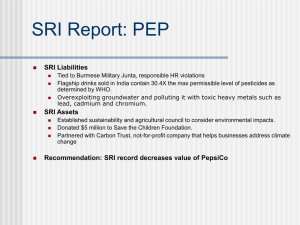

European SRI Transparency Code Statement of Commitment Sustainable and Responsible Investing (SRI) is an essential part of the strategic positioning and behaviour of Allianz Global Investors France S.A. (“AllianzGI France”). We have been involved in SRI since 2002 and welcome the European SRI Transparency Code. This is our second statement of commitment and covers the period 19/1/2012 to 18/1/2013. Our full response to the European SRI Transparency Code can be accessed below and is available in the annual report of the retail funds and on our web site. Compliance with the Transparency Code AllianzGI France is committed to transparency and we believe that we are as transparent as possible given the regulatory and competitive environments that exist in the countries in which we operate. AllianzGI France meets the full recommendations of the European SRI Transparency Code. Code Categories 1 Section 1. Basic Details Signatories should be clear about who they are and provide precise background information on the fund management company and the fund(s) The fund management company Provide the name of the fund management company managing the fund(s) to which this code apply. 1a Allianz Global Investors France S.A. 20, rue Le Peletier 75444 Paris Cedex 09 France Website: www.allianzgi.fr Contact: David Diamond, Head of Sustainable & Responsible Investment Describe, in a general way, the SRI philosophy of the fund management company and the way it is implemented concretely. 1b a / Philosophy AllianzGI France engagement in SRI originates in the long term character of its activity, as a fund management company within an insurance group. As such, our SRI convictions stem from our traditional expertise in insurance-based fund management which has led to the development within AllianzGI France of an active and fundamental investment management style aiming to capture strong long-term trends, coupled with stock-picking based wholly on intrinsic qualities. As one of the sustainable development segments within the investment industry, SRI forms a coherent part of the Allianz Group’s commitment to sustainable development. Allianz commitments: • Combating climate change - Partnership since 2005 with the WWF (World Wildlife Fund) assessing the consequences of climatic change and aiming to better integrate climatic risks into the insurance industry. • Aiming to reduce CO2 emissions by 20% by 2012 (target reached in 2011 : 27% reduction since 2006) - A 500m € investment target for life insurance premiums into wind farms by 2010 (target reached). - A 1bn € investment target for wind and solar projects before the end of 2012 (target reached: over €1bn invested since 2005). • Micro-insurance development: - Collaboration with non-governmental organisations, NGOs (CARE International), and technical assistance organisations (PNUD, PlanetFinance). - Development of micro-insurance products in India, Indonesia, Egypt, Senegal, Ivory Coast, Cameroon (over 4 million beneficiaries to date). • Improving employee practices and the company’s societal performance: - The “Allianz 4 Good” internal programme aims to develop employee conduct regarding sustainable development and social innovation. - Diversity: aiming to increase the proportion of women in management. AllianzGI France has also opted to include sustainable development at the heart of its corporate project, with backing from employees. The project was launched in April 2003 with the creation of a sustainable development committee. This committee currently comprises a dozen voluntary employees representing various departments. It role is to implement and follow up sustainable development actions on all fronts. Its main achievements include promoting every-day eco-friendly actions, such as putting into place selective waste collection, and increasing awareness regarding energy saving and paper use. In 2009, AllianzGI France decided to assess its carbon footprint. The corporate project includes the development of a range of SRI products. AllianzGI France’s SRI approach involves both financial and extra-financial research based on a best effort and best in class strategy. AllianzGI France’s equity investment process forms part of its long-term strategy. Position turnover rates are low and stringent risk control is permanently in place. AllianzGI France is confident that investment choices which take into account environmental, social and governance issues provide a fuller appreciation of issuers’ intrinsic medium-term value, whilst facilitating the detection of opportunities and reducing the inherent risks of investment management based solely on financial criteria. The characteristics and the scale of its SRI investment activity mean that AllianzGI France is a major player in the French market. Finally, the SRI funds in our company are central to our employee savings plan. Our profit-sharing agreement includes respect of environmental performance (energy, water, recycling ...) as a factor in its calculation. Today, our SRI approach is based on the Principles for Responsible Investment (PRI) initiative that we signed in 2007. Principles for Responsible Investment signatory Why did AllianzGI France become a signatory in March 2007? This initiative is in perfect harmony with our view of investment management based on fundamental analysis over a long-term investment horizon which enhances the detection of risks and opportunities. As such, this procedure conforms to Allianz group sustainable development commitments. Signing the PRI initiative illustrates AllianzGI France willingness to be present along the entire responsible investment value chain: • In the upstream segment, the fund management company aims to improve the business environment and market governance, by joining in with Collective Investors Initiatives, contributing to corporate sustainable development and social responsibility (principles 3, 4 and 5). • During the investment phase, AllianzGI France takes ESG criteria into account in its research and portfolio construction (principle 1). • In the downstream segment: the fund management company fully assumes its role as an active investor by voting at Annual General Meetings (AGMs) and promoting dialogue with companies (principles 2 and 6). Implementing PRI within AllianzGI France Principle n° 1: taking ESG issues into account in research processes and investment decision-taking: • An SRI department with investment management teams specialised by asset class. • An independent SRI Advisory committee to help us take all sustainable development issues into consideration in our investments. • An SRI product range which is continually expanding. • ESG scores progressively being taken into account by all investment management teams, particularly equities. Principle n° 2: to be an active investor taking ESG issues into consideration in our shareholder policies and practices: • Voting right principles taking social and environmental criteria into account. • AllianzGI France is a founding shareholder and administrator of the shareholder-initiative open-ended investment fund Phitrust Active Investors (PAI). • No stock loan facility. Principle n° 3: request the entities into which we invest to publish information relating to ESG issues: • Participation in setting up international Corporate Social Responsibility (CSR) reporting standards through working groups led by the Global Reporting Initiative (GRI). Participation in the GRI food industry working group. • Member of the AFG (Association Française de Gestion Financière)Corporate Governance and SRI commissions. Principle n° 4: promote the acceptance and application of principles within industry and investment: • Founding member of the Enhanced Analytics Initiative (EAI). • Allocation of 5% of commissions to brokers publishing the best long-term ESG research. • Founding member and administrator of the “Sustainable Finance and Responsible Investment” rostrum in association with the Toulouse Institut d’Économie Industrielle and the École Polytechnique. • Member and administrator of the Responsible Investment Forum (Forum pour l’Investissement Responsable: FIR; website: http://www.frenchsif.org/fir.html ). Principle n° 5: collectively enhance our effectiveness in the application of principles: • Active participation in multiparty initiatives: administrator for the Extractive Industry Transparency Initiative (EITI). • FIR/PRI European sustainable development finance research prize sponsor. Principle n° 6: activity and progress reporting regarding the application of principles: • AFG/FIR transparency code signatory. • New SRI information letter entitled “Sustainable Values”. • Annual public voting report. b / Organisation & Management team AllianzGI France has a dedicated SRI investment management team: a transversal department, composed of a dozen employees, is in charge of SRI. This department includes SRI portfolio managers on the one hand and on the other, teams in charge of ESG research, AGM voting and shareholder dialogue. The head of SRI and the head of Corporate Governance both report directly to the Chief Investments Officer (CIO), who reports to Chief Executive Officer of the fund management company. The head of SRI participates actively in internal and external SRI promotion. The head of Corporate Governance is in charge of AllianzGI France sustainable development policy and voting rights at AGMs. The team is backed by: • Internal SRI Committee: internal monthly committee comprising the AllianzGI France CIO, SRI analysts and investment managers and marketing and sales department representatives. • SRI Advisory Committee: this committee is composed of external independent members, all of whom are renowned for their expertise in sustainable development. Its role is to support AllianzGI France to reinforce its expertise developed in the area of socially responsible investment (SRI) and to find answers to any related question. It brings an external view on the processes of SRI management in order to improve and deepen them. It also enhance environmental, social or governance issues related to financial analysis of an issuer or a sector. The SRI Advisory Committee does not make any portfolio management decision. c / History Since the first SRI fund was launched in 2002, AllianzGI France has progressively stepped up its involvement in social responsibility to become a committed contributor to sustainable development, a signatory of the Principles for Responsible Investment initiative and the United Nations World Pact. An integral part of AllianzGI France’s identity, this commitment finds expression in the development of a high-performance fundamental SRI investment management activity, the nature and scale of which make the group a market leader. Products launched 2002 SRI Equity Funds – launch of Allianz Valeurs Durables 2007 SRI Fixed-income Funds – launch of Allianz Euro Credit SRI 2007 Environmental Funds – launch of Allianz Euréco Equity 2008 SRI Money Market Funds – launch of Allianz Securicash SRI 2009 Social Funds – launch of Allianz Citizen Care SRI 2010 Allianz Euroland Equity SRI - UCITS 4 vehicle, mirror fund of Allianz Valeurs Durables Strategic choices 2006 Dedicated research team 2007 PRI signatory (Principles for Responsible Investment) d / Assets under management AllianzGI France is one of the SRI leaders in the French market in terms of assets under management: 11 billion Euros (end of December 2011, including advisory). At of end of December 2011, assets under management breakdown per asset class was as follows: -Equities: €2 bn -Diversified: €4.3 bn -Fixed Income: €2.8 bn -Money Market: €1.9 bn The SRI fund(s) Provide the name of the fund(s) to which this code apply, and its (their) main characteristics. Allianz Euroland Equity SRI A EUR (ISIN LU0542502157) Allianz Euroland Equity SRI N EUR (ISIN LU0542502660) Allianz Euroland Equity SRI, which was launched in October 2010, is the fund managed by AllianzGI France to which the code applies. The fund is a sub-fund of the Luxembourgregistered umbrella fund Allianz Global Investors Fund. Allianz Global Investors Fund was established under the laws of the Grand Duchy of Luxembourg as an open-ended investment company with variable share capital (Société d’Investissement à Capital Variable – SICAV). The fund’s legal standard is UCITS (Undertakings for Collective Investment in Transferable Securities) 4 Part 1. Allianz Euroland Equity SRI is managed as a mirror fund of the French mutual fund Allianz Valeurs Durables which was launched in 2002 and which applies the same investment process. With Assets under Management (AuM) of more than 834 million Euros (at end December 2011), Allianz Valeurs Durables is currently the largest SRI equity UCITS in Europe. 1c The objective of the fund is to invest over medium and long term in companies within the Euro zone taking extra-financial criteria into account (social policy, human rights, market conduct, governance and environmental policy). These criteria are taken into consideration in combination with traditional financial criteria, such as earnings growth or company value, with the aim of building a portfolio offering the best possible combination between societal and financial qualities. The open-ended fund adopts a long-term investment management approach based on low portfolio turnover over a 5-year investment horizon. Investment management convictions are based on sustainable corporate performance through a relatively concentrated portfolio comprising some 50-70 positions. Allianz Valeurs Durables, the fund on which Allianz Euroland Equity SRI is mirrored, is the largest open-ended SRI equity UCITS in France. The fund was awarded 4 stars in the Morningstar ratings (December 2011). Please also refer to the full portfolio holdings of the fund Allianz Euroland Equity SRI enclosed in the Appendix at the end of this document. Provide details on how to find further information regarding the funds. There is a dedicated SRI space on the AllianzGI France website in French language only http://www.allianzgi.fr/developpement-durable-et-SRI/ 1d Information regarding AllianzGI France’s involvement in SRI is available in this dedicated space in French language (section names): • a major SRI player in France • SRI value chain • PRI • Presentation of our SRI fund range • Our SRI investment management process • SRI and CSR (Corporate Social Responsibility) authorities • Corporate governance Also available on our website: • A letter “Valeurs” over SRI (English version available) is published three times a year: http://www.allianzgi.fr/fileadmin/contribution/pdf/ISR/let_trim_isr_DECEMBRE_2011.pdf (in French). This 4-page quarterly newsletter details our convictions, investment choices and group SRI news. Newsletter archive can be found under http://www.allianzgi.fr/presse/nospublications The newsletter in English language is available upon request to our communication department: amcomm@allianzgi.fr. • A product detail sheet (two-page presentation of the main product characteristics), a monthly report, a full prospectus and an investment management outline are available for each fund in our SRI product range (in French language): http://www.allianzgi.fr/isr/notreoffre-isr/ You will find further information on the fund on the following websites: www.allianzglobalinvestors.de (in German) Basic information, including fund prices and sales prospectus of the fund. Provide details of the content, frequency and means of communicating information to investors. 1e Fund prices, Performances, Net Asset Value (NAV) can be consulted on the following website in the products section http://www.allianzglobalinvestors.lu/products/products.html For further information in German on the fund Allianz Euroland Equity SRI please refer to www.allianzglobalinvestors.de 2 Section 2. ESG Investment Criteria in SRI fund Signatories should be clear about the fund(s) purpose and its (their) ESG investment criteria. How does the fund define SRI? AllianzGI France SRI investment management philosophy is based on a long-term conviction process. Allianz Global Investors SRI portfolio management aims to guarantee: Durability: ensuring a long-term financial performance to our clients Responsibility: adding environmental and societal value to the society Extra-financial environmental, social and governance criteria, and the respect of human rights provide a more exhaustive evaluation of issuers’ long term risk. 2a For this reason, extra-financial analysis is as important as fundamental analysis within the investment process. AllianzGI France combines a “Best in class” / “Best effort” approach for its 5 SRI funds together with Allianz Euroland Equity SRI which promotes, in any given sector, the application and improvement of good ESG and human rights practice. AllianzGI France SRI funds are therefore invested partly in securities considered Best in Class, i.e. with an ESG rating situated between 3 and 4 on an internal rating scale ranging from 0 to 4, and partly in securities considered Best Effort, rated between 2 and 3. What are the ESG investment criteria of the fund? 2b AllianzGI France does not adopt any sector or thematic exclusion policy in the context of its open-ended fund management, except for companies related to cluster bombs and antipersonnel mines, as defined by Oslo and Ottawa’s conventions. Corporate issuer analysis is undertaken for Allianz Euroland Equity SRI. Issuer analysis covers 5 SRI criteria: 1. Human rights: the sole exclusion criteria for AllianzGI France. The evaluation of corporate securities in the light of this criterion is based on the issuer’s respect of human rights in its business conduct (integration of Universal Declaration of Human Rights principles, respect of major International Labour Organisation conventions, Global Compact). For sovereign issuers, the signature of the 8 major International Labour Organisation conventions and the Universal Declaration of Human Rights is also taken into consideration in combination with an assessment of citizen political rights and civil liberties (including freedom of association) and freedom of the press. 2. Environment: providing an assessment of the company’s direct and indirect environmental impact and risks incurred. The analysis of sovereign issuers includes a global appraisal of government environmental policy: energy production mix and CO2 emission variations are examples of the criteria examined. The state’s willingness and capacity to commit to reducing its environmental impact is also scrutinised. 3. Social: the issuer’s direct social responsibility is taken into account. Appraisal of companies is based on the extent of dialogue with shareholders, workplace health and safety considerations and career management. General social policy is considered in the assessment of government states with a particular focus on topics such as the healthcare system, education; the role played by women in civil society and infrastructures providing citizens with access to basic needs. 4. Governance: includes an analysis of the issuer’s willingness and capacity to organise its internal structure to limit dysfunction risks. For corporate issuers, this criterion includes an evaluation of Management Board structure and independence, transparency of remuneration systems and the existence of independent remuneration, nomination and audit committees. For sovereign issuers, this criterion includes an evaluation of systems used in the prevention and fight against corruption, the stability of political structures and government capacity to introduce necessary reforms. 5. Market conduct: analysis of the relationships between the issuer and other parties (client suppliers, local authorities...). For companies, this criterion also includes an evaluation of the impact the products or services have on society (mainly health and safety) as well as the respect of market regulations (absence of anticompetitive practices). Equity funds (such as Allianz Valeurs Durables/ Allianz Euroland Equity SRI) take into account the five criteria listed previously. For Allianz Valeurs Durable/ Allianz Euroland Equity SRI, 100% of the portfolio securities must display a human rights rating higher than 1.5 and an overall ESG rating higher or equal to 2. This ESG rating is a weighted average of the 4 listed criteria: environment, social, market behavior and governance. The use of derivatives financial instruments is limited to instruments with stable leverage and a use of hedge cover against certain market situations. The use of the derivatives is in conformity with SRI management of the funds: the derivatives whose subjacent are not eligible according to SRI process of the funds are limited to 10% of the funds in term of exposure. This rule does not apply to the swaps of currency and the swaps of rate insofar as ESG analysis and SRI approach of the funds cannot apply to their subjacent. How are the ESG criteria defined? Criteria were initially based on the three pillars of sustainable development: economy, social and environment. Based on these three pillars, AllianzGI France developed an analytical structure composed of five criteria: environment, social, governance, market conduct and human rights. 2c These five core criteria have not been modified since. Each of the criteria itself comprises sub-criteria which have not been revised, but have been enriched by the SRI analytical team internally. Any criteria modification would necessarily be carried out in collaboration with the investment management teams and after consultation with the internal SRI committee and the SRI Advisory Committee. AllianzGI France draws its main input for issuer SRI analysis from selected rating agencies. The SRI analytical team carries out complementary qualitative research which is used primarily to determine the weighting of sub-criteria and criteria on which the rating is based. How are criteria changes communicated to investors? 2d 3 The only changes to date concern the weighting of sub-criteria in each of the five analytical domains. As these were minor modifications, they were not communicated to investors. Any major changes to the structure of ESG analysis would feed through into the global research process accessible via the website (in French language only). http://www.allianzgi.fr/isr/processus-de-gestion/ Section 3. ESG Research Process Signatories should provide clear information on the ESG research process of their investments. Describe your ESG research methodology and process. The SRI research team draws on data from independent extra-financial rating agencies. Data provided by agencies is processed quantitatively and fed into an in-house database which ranks issuers on a scale of 0 to 4 in 5 categories for equities funds (social, environment, governance, human rights and market conduct) and 4 for fixed income funds (social, environment, governance and human rights). As an eliminatory criteria, the respect of human rights is taken into consideration upstream in the process whilst an average ESG rating is calculated using the other 4 criteria. 3a The average rating and the human rights filter determine whether it is possible or not to invest in the issuer. This selection principle is also reinforced by a “worst practice” alert rule. Issuers scoring the lowest corporate governance, environment or social rating are put on the “alert” list and the SRI analysts have to carry out further research before investing. The aim of this rule is to ensure that an issuer scoring below the minimum requirement in one criterion does not qualify as a result of a satisfactory global rating due to high scores in the other criteria. In addition to the quantitative processing of data from extra-financial ratings agencies, the SRI analysts undertake complementary qualitative research and can upgrade or downgrade average criteria or ESG ratings in the in-house ratings database. The SRI research team intervenes in the following situations: • Appraisal divergence between ratings agencies. Insufficient or out-of-date research • Criteria alert arising from the database (predetermined alert thresholds). • Controversies notified by the press or concerned parties (NGOs, unions...). • Unrated issuers by rating agencies. • Inclusion of complementary data from brokers, contact with company representatives, particularly sustainable development teams, CSR experts or concerned parties. Does the fund manager use an in-house ESG research team and/or does he delegate this research to one or several external specialised providers? 3b 3c In-house research is a core part of the research process into the ESG profile of an issuer. AllianzGI France has at its disposal a dedicated transversal SRI unit, comprising a head of department and 3 analysts covering all asset classes. In parallel, another team is in charge of exercising voting rights for all of AllianzGI France funds and the 5 fund managers are involved in the management of the SRI funds. The SRI analysts use data provided by the 3 extra-financial rating agencies (Vigeo (www.vigeo.com), EIRIS (www.eiris.org), and Oekom (www.oekom-research.com). The research team has regular contact with these specialist agencies in order to enrich the ESG data provided. Is there an external control or external verification process in place for the ESG research process? AllianzGI France is backed by the SRI Advisory committee in the implementation of SRI management. It is currently composed of 13 members including 10 independent externals members, all renowned for their expertise in one of the facets of sustainable development. The SRI Advisory Committee includes M. Grignard (deputy leader of the CFDT; one of the French national trade unions), M. Perrin (vice-president of Amnesty International France), Mrs. Aloisi de Larderel (ex-director of the technological, Industrial and economic division of the United Nations programme for the environment) and also M. Moingeon (deputy managing director of HEC; one of the foremost business schools in Europe). The aim of this committee is to help AllianzGI France take sustainable development into consideration along the entire SRI value chain. It also provides independent opinions regarding conflicts of interest with financial investment requirements, and advises the SRI research team in the event of any ESG dilemma pertaining to an issuer, a sector or theme. Does the ESG research process include stakeholder consultation? 3d Our research process includes consultation with concerned parties (NGOs, unions, group committees...) through regular consultation of web resources linked to these bodies but also more directly in the event of specific ESG problems associated with an issuer (e.g. restructuring, doubt concerning supplier chain social standards...). Consultation also takes place with companies either in the context of sustainable development strategy presentations or more proactively if the research team requires complementary information on specific topics. Do companies/issuers have the opportunity to see their profile or analysis? 3e Companies and issuers do not have access to their profile but an appraisal of their activity may form a part of bilateral discussions. How frequently is the ESG research process reviewed? 3f Following a review in 2008, two major modifications were made to the ESG research process for SRI equity funds which had been in place since 2002. Firstly, data from a new extra-financial service provider was included in the SRI rating databases. Secondly, a sector weighting system was put in place, taking into consideration environmental, social, governance and market conduct criteria whereby global scoring is adjusted according to industrial sector. These changes have helped fine-tune ESG ratings and optimise investment management. The ESG fixed-income and Money Market research processes have been created more recently and are still being developed, principally in terms of convergence with the equity process. All changes are carried out through consultation with the investment management teams and the SRI Advisory Committee. What research findings are disclosed to the public? Various communication channels exist for SRI investors. Investors have at their disposal a dedicated SRI and sustainable development section on the AllianzGI France website: http://www.allianzgi.fr/isr/ (in French language only). 3g There is a subsection entitled “investment management processes” (http://www.allianzgi.fr/isr/processus-de-gestion/) (in French language only) which details, for each of the SRI funds, its SRI means and resources and investment philosophy and provides examples of eligible or disqualified securities. There is a contact link on the website (http://www.allianzgi.fr/menu-bottom/privacy-principles/ ) (in French language only) through which questions can be submitted by all web users. AllianzGI France also publishes an SRI newsletter “Valeurs” three times a year. The SRI newsletter includes an outline of ESG research themes, an interview with a well know figure from the world of sustainable development and presents an investment case. The letter is available on the website (http://www.allianzgi.fr/fileadmin/contribution/pdf/ISR/let_trim_isr_DECEMBRE_2011.pdf) and a hard copy is sent to clients. Finally, monthly SRI fund reports include the ESG profile of the fund (average score for each of the criteria) in comparison with benchmark ESG profile and the global score for the 10 largest positions can be fund here: http://www.allianzgi.fr/isr/notre-offre-isr/ (in French language only). Please refer to section “reporting” to obtain the fund reports. 4 Section 4. Evaluation and Implementation Signatories should provide information on how the ESG research is used to build and maintain their portfolio. How are the results of ESG research integrated into the investment process, including selection and approval of companies/issuers for investment? There is full overlap between the financial and extra-financial constituents of our issuer evaluation process. ESG criteria are included in our issuer evaluation methodology in the same way as traditional financial criteria, aiming to construct a portfolio with an optimum ESG quality / financial quality profile. An issuer will therefore be included in the portfolio if, and only if, the ESG profile and financial appraisal are both positive. 4a Financial and extra-financial analysis is carried out based on the core investment universe. The financial analysis opinion can be positive, neutral or negative whilst the extra-financial analysis determines an issuer score on a scale of 0 to 4. An issuer can enter the portfolio if the average ESG score is equal to or above 2 and if it is not excluded on human rights grounds or due to an insufficient score in one of the rating criteria. For Allianz Valeurs Durables/Allianz Euroland Equity SRI, 100% of the securities must be display a rating profile of at least 2. If the score of a security in the portfolio is downgraded and if the revised rating is confirmed by an internal analysis, there is a one-month delay for the portfolio manager to liquidate the position. In order to facilitate combined SRI and financial analysis, SRI analysts work closely with portfolio managers. SRI analysts therefore participate in equity, fixed-income and Money Market investment management meetings, as well as monthly internal SRI committee meetings attended by SRI teams and investment management teams for the different asset classes. What internal and/or external measures are in place to ensure portfolio holdings comply (or not comply) with ESG investment criteria? The SRI equity investment management process involves pre-trade and post-trade controls. The order transmission system alerts the SRI equity fund manager of any purchase of securities with an ESG score below 2. Post-trade monitoring is carried out by reporting teams which ensure the absence of low-scoring securities and rate the SRI fund’s ESG score against benchmark (MSCI EMU for Allianz Valeurs Durables/Allianz Euroland Equity SRI). 4b The SRI fixed-income investment management process does not include a pre-trade control to ensure that securities included in the portfolio comply with minimum rating. The fund manager, in collaboration with the ESG research team, ensures that the proposed investment can be made in compliance with the fund’s constraints. Post-trade monitoring is carried out via an internal system which gauges the proportion of the fund which is invested in high-scoring securities as well as the fund’s SRI rating compared to benchmark. What is the policy and procedure for divestments on ESG grounds? 4c If the ESG criteria rating of a security or an issuer is modified so that it no longer meets the required conditions for the fund in question, or if it is subject to any ESG controversy, the SRI research team studies the issues, enters into discussion with the parties concerned (companies, NGOs, experts...), possibly submits the case to the SRI Advisory committee and draws a conclusion. If the judgment is negative, the fund manager must have liquidated the position within one month. What divestments occurred in the past year related to the SRI fund criteria? 4d Divestment resulting from ESG criteria occurs regularly. This is the case when SRI analysts form a negative opinion regarding securities or issuers with a deteriorating ESG performance. Some issuers which are subject to negative publicity regarding ESG issues are held in portfolio if the facts do not justify a divestment to be made, or if the issuer has put in place appropriate measures to remedy any dysfunctions observed and to avoid further incidents. In controversial cases, the SRI analysts contact the issuer concerned to assess the reactivity and explanations given and to enter into discussion with any relevant parties (NGOs, unions...). Subsequently, the research team can opt not to exclude the issuer from SRI portfolios. In the specific case of fixed-income investment management, the lack of market liquidity may mean that an issuer subject to negative publicity remains in the portfolio. It will be sold as soon the market makes it possible. Are investors informed about divestments on ESG grounds? 4e For the time being, investors are not informed of divestments on ESG grounds. Does the fund manager inform companies/issuers of portfolio movements due to non-compliance with its ESG policy and criteria? 4f For the time being, issuers are not informed of portfolio movements due to non-compliance with ESG principles. To what extent do any results of engagement activities feed into companies/issuers selection? 4g 5 Following contact and dialogue, SRI analysts can modify an issuer’s ESG score in the database. Section 5. Engagement Approach Signatories should explain their approach to engagement if the fund has such a policy. What are the aims of the engagement policy? 5a 5b Engagement has several aims: • To contribute to the improvement of the ESG practices of companies and governments represented in our portfolio or within our investment universe. • To reduce material ESG risks incurred by investments in non-SRI portfolios. • To preserve or even broaden the SRI universe through engagement with issuers which are on negative-watch regarding their ESG rating. • To promote the inclusion of sustainable development in the business of companies. How does the fund prioritise which companies/issuers it will engage with? The SRI and Corporate Governance teams engage with issuers based on identified ESG issues and upcoming annual general meetings, including any sensitive items on the agenda. Priorities are identified based on the level of risk associated with the ESG issue and also according to the size of investment in our portfolios. Who undertakes engagement on behalf of the fund? 5c Both the SRI and Corporate Governance Team are responsible for engaging with issuers. Members of both teams also participate in collective investors or multi-stakeholder initiatives, which regularly dialogue with issuers, including the Extractive Industries Transparency Initiative, the Global Reporting Initiative and others linked to the PRI Engagement platform. What methods of engagement are employed? AllianzGI France engages through several channels: • Exercise of voting rights and filing external resolutions: For further information please refer to Section 6: Voting Policy. • Dialogue with companies and concerned parties. The ESG team contacts companies directly, mainly the sustainable development representatives, to discuss socially responsible investment. Face to face meetings are organised providing the opportunity to discuss company CSR policy and highlight any channels for improvement. The ESG team also contacts companies in the event of specific ESG problems or controversies. The company is questioned in order to evaluate its reactivity and to understand its arguments as well as any remedial actions envisaged. These contacts by email, by post, telephone or through meetings are frequently backed up by discussion with NGOs, company or branch unions and any other parties which can have an input to the situation. 5d • Participation in Collective Investors Initiatives at national or international level. AllianzGI France participates in Collective Investors Initiatives promoting SRI and serving to improve issuer ESG practices. AllianzGI France is a member of the FIR http://www.frenchsif.org/membres.html), Responsible Investment Forum and is active more specifically within CorDial, a dedicated discussion platform involving issuers created by the FIR. AllianzGI France pilots one of the CorDial working groups on governance, which aims to study changes to governance practices, especially at AGM. 26 French companies have been selected for the study. 22 of them have been interviewed by a member of the working group: a questionnaire has been drawn up involving four themes: remuneration, inclusion of social and environmental issues at AGMs, improved shareholder mobilisation and AGM functioning, and finally, the role of the leading independent director. AllianzGI France is also a founding member and administrator of the open-ended fund Phitrust Active Investors group which aims to improve CAC40 company governance practices; is a founding member of the Sustainable Finance and Responsible Investment rostrum with the Toulouse IDEI-R (Industrial Research institute) and the Polytechnique business school and board member of the ITIE (Extractives Industries Transparency Initiative). Through our engagement within ITIE, we encourage companies and governments involved in extraction to be more transparent, which contributes to an improvement in issuer profile and reduces risk for portfolios invested in these issuers. How is the effectiveness of engagement activity monitored/addressed? 5e Engagement activity is considered a success if dialogue has been established with the issuer and if the elements provided by the issuer enable the SRI team to take a decision whether to maintain or not the issuer in the socially responsible investment universe: • Maintained within the investment universe if the problem is correctly addressed and remedied by the issuer or if the issuer undertakes to do so. • Otherwise, the issuer exits the investment universe. What further steps, if any, are taken if engagement is considered unsuccessful? 5f If engagement is unsuccessful (no dialogue or unsatisfactory elements), the issuer is excluded from the socially responsible investment universe. If our mainstream portfolios are invested in the issuer, we continue engagement dialogue. How, and how frequently, are engagement activities communicated to investors and other stakeholders? 5g In accordance with the Financial Security laws, our 2010 votes, together with the reasons for voting against or abstaining on some resolutions, are disclosed on our website at the following address: http://www.allianzgi.fr/developpement-durable-et-isr/ (French language) on a regular basis. Hard copies are available upon request to our headquarters. The ESG team’s direct dialogue with companies which can take place through face-toface meetings, phone, email or mail, is not disclosed on our website. However, as a member of the FIR http://www.frenchsif.org/membres.html), AllianzGI France is active more specifically within CorDial, a dedicated discussion platform involving issuers created by the FIR. Information on activities of the working group can be found under http://www.frenchsif.org/cordial.html. What engagement activity has been carried out on behalf of the fund during the past year? 5h For example, AllianzGI France participated in the PRI working group on the issue of cluster bombs and antipersonnel mines. Section 6. Voting Policy 6 Signatories should make clear their policies on voting. Does the fund have a voting policy? For AllianzGI France, the exercise of voting rights is an investment management deed in its own right. AllianzGI France voting policy applies to all of our portfolios, whether the portfolios are SRI or not. Voting perimeter therefore includes all SBF120 index and Eurostoxx 324 companies as well as those in which we hold more than 0.50% of the capital across all portfolios managed by AllianzGI France. To fully undertake this commitment, AllianzGI France follows a precise voting policy but takes care to study the resolutions of each AGM on a case by case basis. http://www.allianzgi.fr/fileadmin/contribution/pdf/ISR/PrincipeDeDroitDeVote2012_VA.pdf (in English & French language). 6a Voting policy is updated each year by the Corporate Government Committee in order to take into account any changes in corporate government. In the context of AllianzGI France PRI engagement, we include environmental, social and governance criteria in our voting policy. This is consistent with our fundamental medium and long-term investment management, and helps to understand risk and provide a global appreciation of investment opportunities. Our engagement is expressed through participation in the AFG corporate government commission and in addition this year, through heading the working group created at the end of 2009 by the FIR Responsible Investment Forum on corporate governance within listed companies (http://www.frenchsif.org/etudes-et-dossiers ). Finally, AllianzGI France is engaged through company contact before and after AGM. Does the fund disclose its voting practices and reasoning for decisions? In accordance with the Financial Security laws and with the AMF general regulations, we have disclosed our voting statistics since 2006, accessible on our website or available at the company registered offices. 6b Please find hereafter the latest voting right exercise report for 2010 (French version): http://www.allianzgi.fr/fileadmin/contribution/pdf/ISR/Rapport%20AMF%20DROITS%20DE %20VOTE%202010.pdf. To this effect, we keep a database detailing our votes and reasons for voting against or abstaining for each AGM. This database provides an internal statistical monitoring and justification of our votes. Does the fund sponsor/co-sponsor shareholder resolutions? The funds have promoted shareholder resolutions and will continue to do so, in the context of AllianzGI France voting right policy. 6c AllianzGI France is a founding shareholder and administrator of the open-ended fund Phitrust Active Investors, an open-ended shareholder initiative fund. In 2010, AllianzGI France co-sponsored a resolution aiming to amend Société Générale's articles of association to include the dissociation of President and Managing Director functions. In 2010, AllianzGI France supported external resolutions filed by shareholders at the BP and Shell AGMs requesting more transparency and information regarding the exploitation of oil-baring sands in Canada. What voting actions occurred that were related to the SRI fund ESG criteria? During the fiscal year 2010, we have voted in 262 AGMs (vs. 282 in 2009). Out of them, 147 related to French companies (166 in 2009) and 115 top the Euro zone excluding France (116 in 2009). 2009). Nb of meetings Nb of meetings with votes Proportion of meetings with votes France 147 147 100% Euro zone excluding France 116 115 99% Total 263 262 99% Zone Votes breakdown: 6d Zone Number of voted resolutions Vote “For” France 2600 1889 Vote “against” and abstention 711 Euro zone excluding France 1179 955 224 19.0% Total 3779 2844 935 24.7% Percentage of negative votes 27.3% For more details, you will find the report on the exercise of voting rights in 2010 on the website of AllianzGI France via the link below: http://www.allianzgi.fr/fileadmin/contribution/pdf/ISR/Rapport%20AMF%20DROITS%20DE %20VOTE%202010.pdf. As mentioned in point 6.c, in 2010, AllianzGI France supported external resolutions filed by shareholders outside AGMs of BP and Shell requesting more transparency and information regarding the exploitation of oil-baring sands in Canada. Appendix Portfolio Holdings Allianz Euroland Equity SRI as at 30/09/2011: Security Name Identifier ABENGOA ES0105200416 AIR LIQUIDE PRIME FIDELITE FR0000053951 AKZO NOBEL NV NL0000009132 ALLIANZ DE0008404005 ALLIANZ CITIZEN CARE SRI I FR0010727792 ALLIANZ CITIZEN CARE SRI R FR0010716837 ALLIANZ SECURICASH SRI I FR0010017731 ALSTOM FR0010220475 AXA FR0000120628 BAYER DE000BAY0017 BIOMERIEUX FR0010096479 BNP PARIBAS FR0000131104 BUREAU VERITAS FR0006174348 CARREFOUR FR0000120172 CGG VERITAS FR0000120164 DANONE FR0000120644 DEUTSCHE BANK DE0005140008 DEUTSCHE TELEKOM DE0005557508 DIA ES0126775032 ENI IT0003132476 ESSILOR INTERNATIONAL FR0000121667 GDF SUEZ FR0010208488 GDF SUEZ STRIP VVPR BE0005628020 GEMALTO NL0000400653 GROUPE EUROTUNNEL REGROUPT FR0010533075 HEINEKEN NV NL0000009165 HENKEL VZ DE0006048432 IMERYS FR0000120859 INFINEON TECHNOLOGIES N DE0006231004 ING GROEP CVA NL0000303600 K+S AG NOM. DE000KSAG888 KON.PHILIPS ELECTRONICS NL0000009538 LAFARGE FR0000120537 LAFARGE PRIME FIDELITE FR0000066946 METRO DE0007257503 MICHELIN FR0000121261 NEXANS FR0000044448 NOKIA FI0009000681 NOVARTIS N CH0012005267 REED ELSEVIER NV NL0006144495 REPSOL YPF ES0173516115 ROYAL DUTCH SHELL A SHARES AGF000765105 SAFRAN FR0000073272 SAFT GROUPE FR0010208165 SAINT-GOBAIN FR0000125007 SANOFI FR0000120578 SAP DE0007164600 SCHNEIDER ELECTRIC FR0000121972 SUEZ ENVIRONNEMENT FR0010613471 TATE & LYLE PLC GB0008754136 TELEFON AB LM ERICSSON B SE0000108656 THALES FR0000121329 TOTAL FR0000120271 UMICORE BE0003884047 UNICREDIT IT0000064854 VALLOUREC FR0000120354 VEOLIA ENVIRONNEMENT FR0000124141 VINCI FR0000125486 VIVENDI Source: Allianz Global Investors, as at 30/09/2011 FR0000127771 Definitions of key terms used in the Code Term AGM Divestments ESG Engagement Exclusion Fund manager Fund(s) Fund Purpose Holdings Portfolio Signatories SRI Voting Policy Definition General Assembly Meeting Companies that are sold from the fund portfolio. Environment, Social and Governance A long-term process of dialogue with companies by investors which seeks to positively influence company behaviour in relation to their social, ethical, governance and environmental practices. This includes vote at AGM, filing or co-filing shareholder proposals, asking questions at AGM, collaborative engagement initiatives, individual company contact and dialogue with policy makers and industry organisations. The exclusion of sectors or companies from a fund if involved in certain activities based on specific ESG criteria. The entity responsible for overall management of the fund. A legal entity, the purpose of which is solely the acquisition of portfolio investments. This also includes compartments and sub-funds. The spirit and overall focus of the fund, but not the investment criteria employed. Equities and/or bonds of companies that collectively comprise the fund portfolio. A collection of investments managed by the fund manager. Fund(s) and/or fund manager that commits to disclose SRI information in line with the Code. SRI, a generic term covering sustainable, responsible, ethical, environmental, social investments and any other investment process that integrates financial analysis with the influence of environmental, social and governance (ESG) issues. It includes an explicit written policy to make use of ESG criteria. Policy of a fund to exercise its voting rights as investors to influence company behaviour. About Eurosif EUROSIF, the European Sustainable Investment Forum, is the pan-European network whose mission is to address sustainability through the financial markets. Eurosif works as a partnership of the national Sustainable Investment Forums (SIFs) within the EU and with the support and involvement of Member Affiliates. Recognised as the premier European forum for sustainable investment, Eurosif’s Member Affiliates are drawn from leading pension funds, asset managers, NGO’s, trade unions, academic institutes and research providers, together representing assets totalling over €1 trillion. Eurosif's work includes a focus across asset classes - equity and fixed income markets, microfinance, renewable energy, property, private equity and hedge funds - all centred around the industry trends and future legislation affecting this space. The key benefits that Eurosif affiliate members receive include EU interfacing, SRI information and European wide initiatives that integrate Environmental, Social and Governance (ESG) issues into the financial services sector. For the full list of Eurosif Member Affiliates, please see www.eurosif.org. National social/sustainable investment forum to date include: Belsif, Belgium Dansif, Denmark FNG – The German, Austrian and Swiss Sustainable Investment Forum Forum per la Finanza Sostenible, Italy Forum pour l'Investissement Responsable, France Norsif, Norway Spainsif, Spain Swesif, Sweden UKSIF, UK VBDO (Vereniging van Beleggers voor Duurzame Ontwikkeling), The Netherlands For further information contact Eurosif at +33 1 40 20 43 38 or by email at contact@eurosif.org. Additionally, feel free to see the most updated information on the Transparency Code at www.eurosif.org. Eurosif La Ruche – 84 quai de Jemmapes, 75010 Paris, France Tel: +33 1 40 20 43 38 www.eurosif.org Disclaimer Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors may not get back the full amount invested. The volatility of fund unit prices may be increased or even strongly increased. Past performance is not a reliable indicator of future results. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for information only and not to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities. The products or securities described herein may not be available for sale in all jurisdictions or to certain categories of investors. This is for distribution only as permitted by applicable law and in particular not available to residents and/or nationals of the USA. The investment opportunities described herein do not take into account the specific investment objectives, financial situation, knowledge, experience or particular needs of any particular person and are not guaranteed. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer and/or its affiliated companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable, but it has not been independently verified; its accuracy or completeness is not guaranteed and no liability is assumed for any direct or consequential losses arising from its use, unless caused by gross negligence or willful misconduct. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. Contact the issuer electronically or via mail at the address indicated below for a free copy of the sales prospectus, the incorporation documents, the latest annual and semi-annual financial reports and the key investor information document in English. Please read these documents - which are solely binding - carefully before investing. This is a marketing communication. Issued by Allianz Global Investors Europe GmbH, www.allianzglobalinvestors.eu, a limited liability company, incorporated in Germany, with its registered office at Mainzer Landstrasse 11-13, D-60329 Frankfurt/Main, authorized by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted.