COMPANY UPDATE ASIAN PAINTS

The growth palette

India Equity Research| Consumer Goods

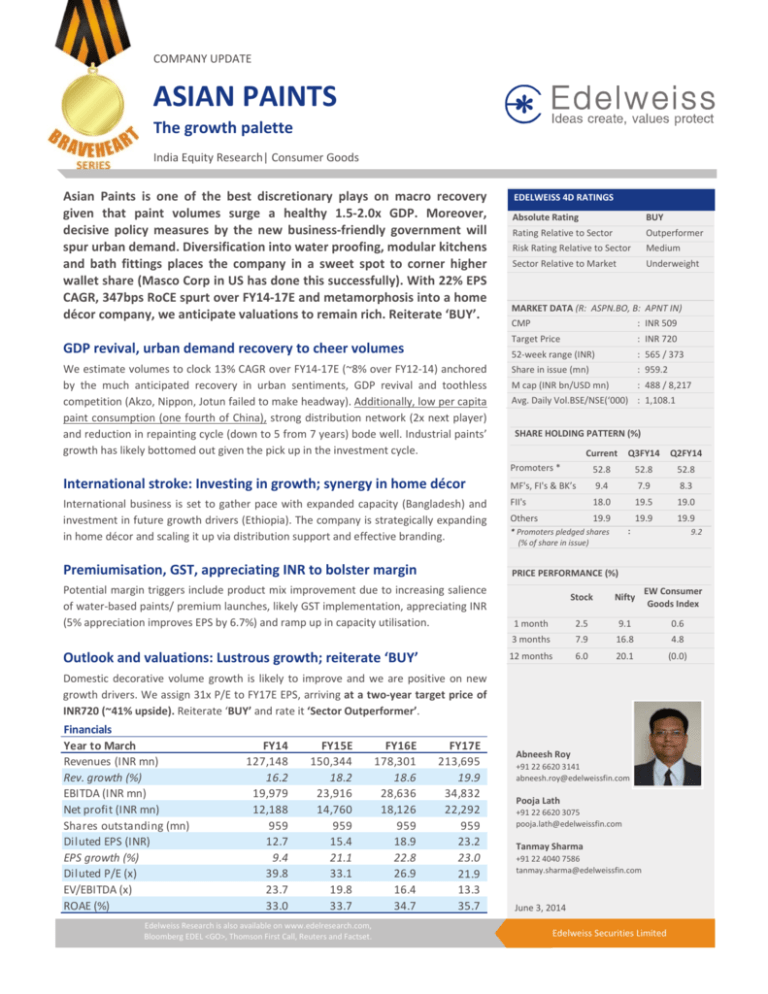

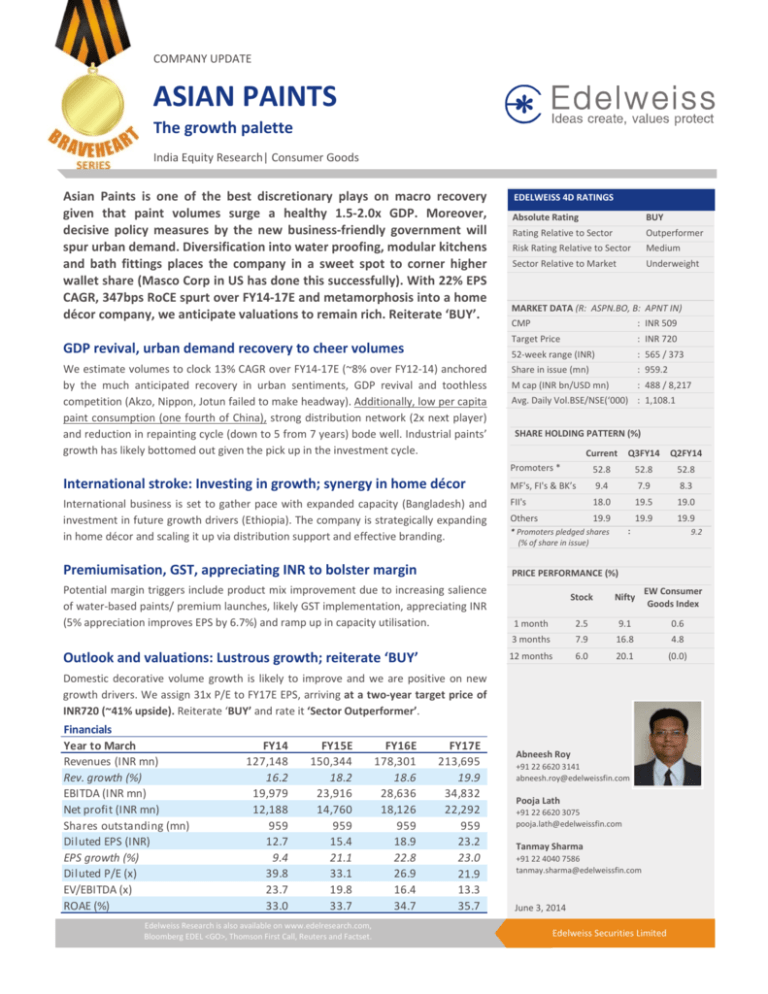

Asian Paints is one of the best discretionary plays on macro recovery given that paint volumes surge a healthy 1.5‐2.0x GDP. Moreover, decisive policy measures by the new business‐friendly government will spur urban demand. Diversification into water proofing, modular kitchens and bath fittings places the company in a sweet spot to corner higher wallet share (Masco Corp in US has done this successfully). With 22% EPS CAGR, 347bps RoCE spurt over FY14‐17E and metamorphosis into a home décor company, we anticipate valuations to remain rich. Reiterate ‘BUY’. GDP revival, urban demand recovery to cheer volumes We estimate volumes to clock 13% CAGR over FY14‐17E (~8% over FY12‐14) anchored by the much anticipated recovery in urban sentiments, GDP revival and toothless competition (Akzo, Nippon, Jotun failed to make headway). Additionally, low per capita paint consumption (one fourth of China), strong distribution network (2x next player) and reduction in repainting cycle (down to 5 from 7 years) bode well. Industrial paints’ growth has likely bottomed out given the pick up in the investment cycle. EDELWEISS 4D RATINGS Absolute Rating BUY

Rating Relative to Sector Outperformer

Risk Rating Relative to Sector Medium

Sector Relative to Market Underweight

MARKET DATA (R: ASPN.BO, B: APNT IN) CMP : INR 509 Target Price : INR 720 52‐week range (INR) : 565 / 373 Share in issue (mn) : 959.2 M cap (INR bn/USD mn) : 488 / 8,217 Avg. Daily Vol.BSE/NSE(‘000) : 1,108.1 SHARE HOLDING PATTERN (%)

Current

Q3FY14 Q2FY14

Promoters * 52.8

52.8 International stroke: Investing in growth; synergy in home décor MF's, FI's & BK’s

9.4

7.9 8.3 International business is set to gather pace with expanded capacity (Bangladesh) and investment in future growth drivers (Ethiopia). The company is strategically expanding in home décor and scaling it up via distribution support and effective branding. FII's

18.0

19.5 19.0 Others

19.9

19.9 19.9 Premiumisation, GST, appreciating INR to bolster margin 52.8 :

* Promoters pledged shares (% of share in issue) 9.2

PRICE PERFORMANCE (%)

Potential margin triggers include product mix improvement due to increasing salience of water‐based paints/ premium launches, likely GST implementation, appreciating INR (5% appreciation improves EPS by 6.7%) and ramp up in capacity utilisation. Outlook and valuations: Lustrous growth; reiterate ‘BUY’ Domestic decorative volume growth is likely to improve and we are positive on new growth drivers. We assign 31x P/E to FY17E EPS, arriving at a two‐year target price of INR720 (~41% upside). Reiterate ‘BUY’ and rate it ‘Sector Outperformer’. Year to March

Stock Nifty EW Consumer Goods Index 1 month 2.5 9.1 3 months 7.9 16.8 0.6 4.8 12 months 6.0 20.1 (0.0) Financials

Revenues (INR mn)

Rev. growth (%)

EBITDA (INR mn)

Net profit (INR mn)

Shares outstanding (mn)

Diluted EPS (INR)

EPS growth (%)

Diluted P/E (x)

EV/EBITDA (x)

ROAE (%)

FY14

127,148

16.2

19,979

12,188

959

12.7

9.4

39.8

23.7

33.0

FY15E

150,344

18.2

23,916

14,760

959

15.4

21.1

33.1

19.8

33.7

FY16E

178,301

18.6

28,636

18,126

959

18.9

22.8

26.9

16.4

34.7

Edelweiss Research is also available on www.edelresearch.com, Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset. FY17E

213,695

19.9

34,832

22,292

959

23.2

23.0

21.9

13.3

35.7

Abneesh Roy +91 22 6620 3141 abneesh.roy@edelweissfin.com Pooja Lath +91 22 6620 3075 pooja.lath@edelweissfin.com Tanmay Sharma +91 22 4040 7586 tanmay.sharma@edelweissfin.com June 3, 2014 Edelweiss Securities Limited Consumer Goods GDP Growth to Revive Fortunes of Paint Industry There is a high correlation between the paint industry’s growth and GDP growth rate (as per our calculations, the correlation between Asian Paints’ volume growth and India’s GDP growth rate is a strong 0.76x)—paint industry volumes grow 1.5‐2.0x India’s GDP. We anticipate GDP to surge to 7.5% (5.4%, 6.3% and 7.5% in FY15, FY16 and FY17) riding on a new stable and business‐friendly government in the saddle at the Center. Hence, we anticipate the paint industry to grow at a much faster pace. We estimate 11%, 13% and 15% YoY volume growth for Asian Paints in FY15, FY16 and FY17, respectively. Table 1: Positive correlation between paint industry and GDP Income Level

Increase in GDP will increase standard of living. With rise in income level, consumers will increase consumption which in turn will help the decorative segment.

Housing Sector

Growth in housing sector will increase urbanisation, provide cheaper loans and shift from semi – permanent to permanent housing structures will increase spending in the decorative segment.

Industrial Segment

The industrial segment can be further broken down into protective, general industrial, automotive powder and marine coatings. This segment accounts for 25% of the paint industry's revenue. Infrastructure Investment

New projects in roads and ports will increase revenues of paint industry and drive the industrial segment.

Fig. 1: Revival in GDP growth positive for paint industry Boom in Housing Sector

Increased Income Level

Expansion of Industrial Segment

Increased Infrastructure Investment

Growth in Paint Industry

Chart 1: Asian Paints’ volume grows 1.5‐2.0x GDP growth rate 20.0

16.0

12.0

(%)

8.0

4.0

GDP

Forecasted Volume Growth

FY17E

FY16E

FY15E

FY14

FY13

FY12

FY11

FY10

FY09

FY08

FY07

FY06

FY05

0.0

FY04

Increase in GDP

Actual Volume Growth

Source: Edelweiss research 2 Edelweiss Securities Limited Asian Paints

Urban Recovery to Spur Growth Urban demand revival to boost paint demand Rural growth, that had consistently outstripped urban growth for the past many years, is now gradually losing steam; this is amply evident from the Q4FY14 results of a few consumer companies. As a result, players who were focusing on enhancing their presence in rural areas and introducing products catering to the rural population are shifting focus to urban areas and are now introducing more urban‐centric products (premium products which are also margin accretive). The central government, bolstered by a historic mandate, is likely to herald policies boosting urban demand; BJP is focused on infrastructure development, faster execution of policies, development of 100 new smart cities and asset creation under NREGA. This urban revival will potentially benefit companies like Asian Paints, which have a higher urban salience in terms of sales. Urban demand on the mend As per consumer sentiment tracker BluFin, consumer confidence in India improved for fourth consecutive month in February; the Consumer Confidence Index (CCI) shot up 0.5 points to 42.6 (highest since August 2012). The rising score could be an early sign of recovery. Persistent inflation, slower economic growth and high interest rates had led to a flattish inflation index, indicating cautious consumer stance. However, with CAD under control and CPI & WPI easing a tad, inflation is now taming. Though urban consumers have gradually adapted to food inflation, these early signs of tapering inflation are encouraging. Consumer spending is likely to pick pace as the new government sheds policy paralysis and kick starts growth. Also, as per latest findings by Nielsen, consumer confidence in urban India increased by six points in Q1CY14 to 121—the highest level of optimism since Q4CY12. India retained its position as the second‐most‐optimistic country in Nielsen’s survey. Chart 2: Consumer confidence index—On an uptrend 44.0 41.8 39.6 37.4 35.2 Feb‐14

Jan‐14

Dec‐13

Nov‐13

Oct‐13

Sep‐13

Aug‐13

Jul‐13

Jun‐13

May‐13

Apr‐13

Mar‐13

Feb‐13

Jan‐13

Dec‐12

Nov‐12

Oct‐12

Sep‐12

Aug‐12

33.0 Source: BluFin, Edelweiss research 3 Edelweiss Securities Limited Consumer Goods New Business‐Friendly Government to Spur Growth BJP manifesto cheers paint companies BJP, in its manifesto, has emphasized on the need to build infrastructure and has promised to build 100 new smart cities—a clear positive for paint companies. Also, it has stated that it will look at urbanisation as an opportunity, building upon areas like housing. Urban development will be based on integrated habitat development and on concepts like Twin Cities and Satellite Towns. Real estate and infrastructure development will in a proportionate manner increase paint demand, benefitting paint companies, especially the leader—Asian Paints—as it commands the preferred status owing to high brand recall. New government to spur job market The job market in India is set to revive with a stable government coming into power at the Centre. As per media articles, only 3mn jobs were created during the UPA tenure from FY05‐

10. Sentiments have turned positive as the new government assumes power and as per ABC Consultants’ (placement firm) survey, ~84% employers indicated that the total headcount in their firms will rise in FY15. Revival in the job market will be a significant driver of economic growth as it will spur per capita consumption, which in turn will boost GDP. “The job market will grow at least by 30% and with Modi in power, the number of vacancies expected are about 15mn, far better compared to the previous numbers.” ‐ Udit Mittal, MD,

Unison International

Chart 3: Higher salary growth rate bodes well for paint companys’ margins 14.0 11.2 (%)

8.4 5.6 2.8 0.0 FY10

FY11

Salary growth

FY12

FY13

FY14E

GDP growth

Source: Aon Hewitt, Edelweiss research NDA regime to boost urban trade As per a FICCI survey, almost 93% of the 76 CEOs said they foresee a substantial improvement in the near‐term economic situation, while the balance 7% participants expected marginal improvement in the situation In Edelweiss report, BLIND SPOT ‐ The big switch: Bharat Nirman to India Shining?, dated April 02, 2014, our strategy team has analysed evolution of the Indian economy under the two alliances that governed India in the past 15 years—NDA (1998‐2004) and UPA (2004‐

2014). The study throws up an interesting fact—under UPA (especially starting 2006), there has been a remarkable shift in terms of trade from urban to rural India, with price increase for agri‐goods far outpacing that of manufactured goods. This, we believe, has been triggered by massive increase in minimum support prices (MSPs), procurement of food grains by government, pick up in government spending in irrigation/agriculture sector, rise in agri credit and expansion in social sector schemes under UPA compared to NDA. The rising rural 4 Edelweiss Securities Limited Asian Paints

prosperity is evidenced in capital deepening, income trends of farm workers and rural consumption patterns more generally. Thus, in the past 10 years, tractor sales have catapulted, use of fertilisers & pesticides has increased, productivity gains have been large across crops, rural wages have seen unprecedented rise (outpacing GDP growth in recent years) and discretionary spending saw sustained uptrend. In our view, with NDA back in the saddle, the terms of trade will reverse in favour of urban India (as was the case during 1998‐

2004, which saw little productivity gains in crops, minimal MSP hikes etc). (Index re‐based to 100)

Chart 4: Trade shifted from urban to rural areas under UPA; could revive under NDA 140 130 120 110 100 Jan 14

Jan 13

Jan 12

Jan 11

Jan 10

Jan 09

Jan 08

Jan 07

Jan 06

Jan 05

Jan 04

Jan 03

Jan 02

Jan 01

Jan 00

Jan 99

Jan 98

90 WPI food articles relative to non‐food articles

Source: CMIE Chart 6: …accompanied by high procurement 40.0 34.0 240 28.0 Rice buffer stocks

FY13

Rice buffer requirement norms

Source: Food Corporation of India, CMIE 5 FY12

FY11

FY10

FY09

FY08

FY07

10.0 FY06

90 FY02

16.0 FY05

22.0 140 Rice minimum support price (INR)

UPA

FY04

190 NDA

FY03

(MT)

290 FY99

FY00

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY14

(Re‐based to 100)

Chart 5: High MSPs in rice under UPA… 340 Edelweiss Securities Limited Consumer Goods Chart 7: Similar trend in wheat as well Chart 8: …accompanied by high procurement 50 265 (MT)

20 10 Chart 9: Sharp increase in agri and irrigation spending… 17.5 FY13

FY12

FY11

FY10

FY09

FY08

FY07

FY06

FY05

FY04

FY99

FY00

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY14

Wheat minimum support price (INR)

FY03

125 FY02

Wheat buffer stocks

Wheat Buffer requirement norms

Source: Food Corporation of India, CMIE Chart 10: …also agri credit 40.0 33.0 12.5 26.0 (%)

15.0 10.0 19.0 7.5 12.0 5.0 Budget expenditure on agri and irrigation

FY12

Agri credit outstanding as a % of Nominal agri GDP

Source: Union Budgets, Government of Indi, RBI, CMIE 6 FY10

FY08

FY06

FY04

FY02

FY00

FY98

FY96

5.0 UPA

(FY04‐FY14)

FY94

NDA (FY98‐FY04)

FY90

FY90‐FY98

FY92

(Re‐based to 100)

160 0 (CAGR, %)

UPA

30 195 90 NDA

40 230 Edelweiss Securities Limited Asian Paints

Chart 11: Sharp growth in tractor sales under UPA… 15.0 Chart 12: …also fertiliser consumption 6.0 4.6 (CAGR, %)

(CAGR, %)

10.0 5.0 0.0 3.2 1.8 (5.0)

0.4 (10.0)

(1.0)

FY90‐98

NDA (FY98‐FY04)

UPA (FY04‐FY14)

FY91‐FY98

Tractor sales

NDA (FY98‐FY04)

UPA (FY04‐FY13)

Fertilizer sales volume

Source: Crisil, Fertiliser Association of India Chart 13: Improvement in productivity of all crops under UPA 2,500 1,200 1,120 960 Cereals yield (3Y moving average)

FY13

FY11

FY09

Oilseeds yield (3Y moving average)

Chart 14: Rapid rise in rural wages… 20.0 15.0 (%, yoy)

NDA

UPA

10.0 5.0 Rural wages of unskilled labourers

FY14td

FY13

FY12

FY11

FY10

FY09

FY08

FY07

FY05

FY04

FY03

FY02

(5.0)

FY01

0.0 FY00

FY07

800 FY05

1,750 FY03

880 FY97

1,900 NDA

FY01

NDA

FY06

2,050 1,040 FY99

(Kg/Hectare)

2,200 FY97

FY98

FY99

FY00

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

(Kg/Hectare)

2,350 GDP at market prices

7 Source: RBI, CMIE, Ministry of Agriculture Edelweiss Securities Limited Consumer Goods Increasing migration to propel urban growth Urbanisation has been growing at a fast pace as: (i) the aspirational value is increasing; and (ii) urban areas provide lucrative opportunities leading to increased migration. As per 2011 census, urban population share to total residents has increased to 31.16% from 28.53% in 2001 and as per UN State of the World Population report, 40.76% of India's population is expected to reside in urban areas by 2030. This increasing trend of urbanisation coupled with revival in urban demand bodes well for companies that have higher urban salience. Real estate demand will grow proportionately, thus boosting paint demand. Also, the repainting cycle is shorter in urban areas (a factor of higher per capita income) compared to rural areas. Chart 15: Urban population in India—On the rise Source: McKinsey Global Institute, Edelweiss research Chart 16: Rate of urbanisation on an uptrend 48.0 42.4 (%)

36.8 31.2 25.6 20.0 1990

1991

2001

2005

2008

2011

2025E

Urbanisation Rate

2030E

Source: McKinsey Global Institute, Edelweiss research 8 Edelweiss Securities Limited Asian Paints

Shorter Repainting Cycle Bodes Well As per industry sources, ~70% of the total decorative paints’ demand in India comes from repainting (higher for Asian Paints at ~85‐90%) and balance from fresh construction. Fresh construction is a function of improvement in real estate and infrastructure development, which in turn is linked to GDP growth. Repainting, on the other hand, is influenced by factors like increase in income levels, number of festive & marriage days and lifestyle of people. Repainting cycle in India has reduced significantly from 7 years about a decade ago to 5 years now; the trend is expected to continue as income levels rise and lifestyle improvement induces consumers to change the look and feel of their homes more often. Repainting also depends on occasions like marriage, etc. Such occasions coupled with increase in per capita incomes are leading to higher consumption of paints and shorter repainting cycle. Change in the mindset of people is another reason for the shorter repainting cycle. Earlier, people painted their walls only when they started to peel off, but now paint is perceived as décor and customers are open to investing more in beautification of homes. Asian Paints derives 85‐90% of demand from repainting, which is higher than the industry average. We expect this to put the company in an advantageous spot compared to peers, who rely on fresh painting demand. Upgrading in paint quality is a key characteristic of repainting which bodes well for Asian Paints’ premiumisation strategy. Chart 17: Urban income share to improve as percentage of total income 100.0

80.0

(%)

60.0

40.0

20.0

0.0

1990

2001

Urbal Income

2008

2030

Rural Income

Source: McKinsey Global Institute, Edelweiss research 9 Edelweiss Securities Limited Consumer Goods Asian Paints: Market Leader in an Oligopoly Market An oligopolistic market is characterised by a few sellers producing and selling either homogeneous or close substitutes of products. The domestic paint industry is thus oligopolistic in nature, with more than 90% of the organised decorative paints market dominated by the top four players—Asian Paints, Berger Paints, Kansai Nerolac and Akzo Nobel. Asian Paints has the lion’s share of this market with ~54% market share. Some of the essential characteristics of any oligopolistic market are pricing power, entry barriers, product differentiation and advertisement & selling costs. Asian Paints, the market leader, exhibits all these characteristics and is poised to gain from any surge in the paint industry. “There’s been a massive transformation in the Indian consumer. Earlier, people used to paint when walls were peeling. Now, it’s about décor. We perceived this before most of our competition.” ‐

Fig. 2: Decorative business in India is an oligopolistic market Entry Barriers

Pricing power

Oligoplistic market

K.B.S. Anand, MD &CEO,

Asian Paints

Product Differentiation

Advertisement & selling cost

Source: Edelweiss research Robust pricing power One of the most important features of an oligopolistic market is that firms are price setters rather than price takers. Asian Paints, by virtue of being the market leader, enjoys strong pricing power, while the industry exhibits pricing discipline and follows the leader in pricing action. Asian Paints tries to maintain and operate within a range of gross margin. Raw material prices largely determine the company’s pricing strategy. The primary raw materials, titanium dioxide (TiO2) and monomers, being crude linked are impacted by crude inflation and also currency fluctuation. Though global Tio2 prices have remained flattish in the past one year, currency depreciation has had an adverse impact, compelling paint companies to hike prices—Asian Paints effected total price increase of 6.1% in FY14, followed by other competitors. Despite this price increase, Asian Paints delivered consistent double digit volume growth even amongst tough macro environment. Recently, the company took two price hikes effective from May 1, 2014, and from June 1, 2014, of 1.0% and 1.2%, respectively, to offset the increased monomer prices. 10 Edelweiss Securities Limited Asian Paints

Table 2: Price hike taken by Asian Paints over the years Date

Price hike (%)

Jun‐14

1.2

May‐14

1.0

Feb‐14

2.1

Sep‐13

1.8

Aug‐13

1.0

May‐13

1.2

Jan‐13

(0.2)

May‐12

3.2

Mar‐12

2.1

Mar‐12

1.4

Dec‐11

2.2

Jul‐11

1.3

Jun‐11

2.5

May‐11

4.4

Q4FY11

1.0

Dec‐10

3.0

Aug‐10

1.2

Jul‐10

2.6

May‐10

4.2 Source: Company, Edelweiss research Robust volume growth strong despite slowdown, price hikes Despite having taken 6.1% price increase in FY14, Asian Paints clocked ~11% volume growth. Paint demand thus remains resilient in spite of pricing action. We expect the company to continue to deliver strong volume growth riding robust urban recovery. Compared to other companies in the consumer goods space—Emami, Nestle and HUL—Asian Paints’ volumes have remained resilient despite discretionary slowdown. We expect its volume growth to be much faster as economic growth picks pace. Chart 18: Volumes resilient despite slowdown 22.0 18.2 (%)

14.4 10.6 Asian Paints Volume Growth

FY17E

FY16E

FY15E

FY14

FY13

FY12

FY11

FY10

FY09

FY08

FY07

FY06

FY05

3.0 FY04

6.8 Source: Company, Edelweiss research 11 Edelweiss Securities Limited Consumer Goods Volume growth is not only a function of price, but also other factors including per capita consumption, market share gain, innovation, repainting demand, marriage days, festive seasons etc. As per Nielsen, the per capital consumption of paints in India was 2.6kg in FY12 (2.2kg in FY08), one of the lowest compared to many other countries (one fourth that of China). It is expected to increase to 4kg by FY16E. The low consumption indicates that there is ample opportunity for growth in paints, with Asian Paints likely to benefit the most due to its strong brand equity. Chart 19: Low per capita consumption of paints in India 5.0 4.0 (kg)

3.0 2.0 1.0 0.0 2007

2008

2012

2016E

Per Capita Consumption

Source: AC Nielsen, Edelweiss research Market share gains to continue In 1967, Asian Paints became the leader in the decorative paint industry and since then has maintained its pole position. The company’s market share in the decorative paints segment surged from ~44% in FY05 to ~54% in FY13 among the top 5 players due to its strong dealer network, brand equity, easy availability, customer centricity, advertisements and superior quality. The domestic paint industry has ~12 paint players in the organised sector and more than 2,000 in the unorganised space. Despite the presence of a large number of players in the organised sector, the market is dominated by Asian Paints. Other players are not able to match the scale and brand power of Asian Paints which being a dominant player gains market share riding on these abilities. Also, the unorganised sector, ~35% of the total paint market, provides enough opportunity for gaining and expanding the market share further as more people are shifting from unorganised players to the more reliable organised ones. The rising middle class population and increase in per capita incomes helps shift to branded paints as house painting is a high investment warranting superior quality. Asian Paints becomes the preferred pick due to its strong dealer network and brand recall. Going forward, we expect Asian Paints to not only maintain its leadership in the decorative paints market, but also gain incremental share. Also, players having a higher revenue contribution from industrial segment stand to lose out in the decorative space. These players are not able to back their brands in the decorative space with sustained investments as investments are also made in the low‐margin technologically intensive industrial segment. Drag in the industrial segment resulting in lower cash flows paves way for players 12 Edelweiss Securities Limited Asian Paints

like Asian Paints to capture market share from such players as well. If we take the universe of the top 5 organised players in the decorative paints segment, Asian Paints has constantly gained market share—from 44% in FY05 to 53.7% in FY13. Kansai Nerolac, Akzo Nobel and Shalimar Paints, on the other hand, have lost market shares over the same period; Berger’s market share has remained constant over the past four‐five years. Chart 20: Market share of paint companies in decorative paints segment 100.0 80.0 (%)

60.0 40.0 20.0 0.0 FY05

FY06

Asian Paints

FY07

FY08

Berger

FY09

Kansai

FY10

FY11

FY12

Akzo

FY13

Shalimar

Source: Edelweiss research Chart 21: Share of organised and unorganised cos in total decorative paints market 100.0 80.0 (%)

60.0 40.0 20.0 0.0 FY05

FY06

FY07

Organised share

FY08

FY09

FY10

FY11

FY12

Unorganised share

FY13

Source: Edelweiss research High entry barriers Oligopolistic markets present a huge entry barrier, thereby securing market share of existing players from outside threat. Since the domestic paint market is dominated by a few large players, it makes entry difficult owing to their strong distribution network, pricing power, robust capacity and brand strength. Asian Paints, being the largest player, is the leader on all fronts as far as barriers to entry are concerned. 13 Edelweiss Securities Limited Consumer Goods Unmatched distribution strength Asian Paints’ strong dealer network creates a huge entry barrier for new players and makes it difficult for existing players to make inroads into the decorative market. The company has strong distribution in terms of dealer network (in urban and rural areas) and tinting machines, which makes it difficult for other players to compete. Asian Paints leverages upon its strong brand strength, efficient inventory management, a vibrant product variety and a large dealer network while negotiating with dealers. Distribution is thus the key parameter differentiating Asian Paints from other paint companies. The company invests heavily in dealers and IT services to improve the supply chain management. It has a total dealer network of 35,000 and it is planning to add 1,500‐

2,000 dealers to its network every year. Though other players are also increasing their dealer network, they have a long way to go (Berger Paints’ dealer network is half of Asian Paints). Tinting machines, which are colour dispensing machines, is another crucial factor that bolsters a company’s distribution strength. Asian Paints has been adding ~1,000 tinting machines per year with a total of 27,000 currently. Large number of tinting machines helps retain dealers as these machines result in low inventory at the dealer level. It also helps provide a wider variety of colours to customers. Tinting machines entail an investment of INR0.30‐0.35mn and they are becoming an integral part of the business for dealers as they help meet rising demand. Asian Paints maintains strong relationships with dealers, helping the company retain dealers and also enhance brand push through them. Dealer relationship indirectly results in a good relationship with customers. The company’s top management meets dealers personally. Asian Paints also organises events (‘Asian Paints Rangmanch' for dealers in Mumbai) for its dealers which gives them a sense of belonging to the company. The company built a solid connect with consumers by providing different services which helps them choose the right paint for their homes, calculate total amount of painting cost, understand different types of paints available for selection etc. Asian Paints has a detailed website from where a consumer can get live consultancy on paints online via Colour Consultancy Online from where a consumer can chat online with a colour consultant and get his/her queries solved. A consumer can also schedule a meeting with a colour consultant of Asian Paints at his home to solve his queries through the consultancy@home tab on the website. The company, apart from Colour Consultancy Online, also has an online chat app, Ask Aparna, where queries can be solved online via chat by consumers. Apart from this, Asian Paints also offers tools like paint selector, budget calculators, dealer locator etc., which provide consumers the ease of resolving all the queries and needs related to their painting needs. Tinting machine: Painting growth story Table 3: Dealer network, tinting machines and depots of paint companies Tinting Machines

Depots

Dealers

Asian Paints

27,000 110 35,000

Berger Paint

12,000 125 16,500

Kansai Nerolac

7,500 75 15,000

Akzo Nobel

5,500

NA 8,500 Source: Company, Edelweiss research 14 Edelweiss Securities Limited Asian Paints

Table 4: Asian Paints—Colour World dealers (2.7x in 6 years) FY08

FY09

FY10

FY11

FY12

FY13

FY14

Color World Dealers

10,000

12,000

14,600

18,000

21,100

24,000

27,000 Source: Company, Edelweiss research Formidable brand strength Each company in the paint industry has created its own brand—Asian Paints has Royale, Aspira, Tractor; Berger has Silk, Easy Clean etc. Purchases are heavily influenced by brand recall, which is directly proportional to the advertising frequency and its impact on consumers. Asian Paints has been able to create strong brand equity with dealers, painters and customers, making it difficult for a new player to compete. A strong brand helps build a strong emotional connect with customers. This, coupled with superior quality of products, helps create strong brand loyalty, making Asian Paints the preferred paint company for repainting. Asian Paints has travelled a long way in its brand building exercise right from 1954 when ‘Gattu', a cartoon kid created by R.K. Laxman, was its mascot, which was changed to a logo in red and golden yellow in 2002. After a decade, the logo was re‐launched to make it look more fresh and contemporary. The new logo reflects a more meaningful and personalised engagement with the customer. The flowing ribbon that creates the ‘AP’ design highlights easy flow, smoothness and dynamism that the company provides. Asian Paints was a part of the nine Indian companies that were included in the Forbes 'World's 100 most innovative growth companies’ Fig. 3: Asian Paints—Changing with times Source: Company 15 Edelweiss Securities Limited Consumer Goods Product differentiation Each player in an oligopolistic market attempts to differentiate its products to attract consumers. Investments in innovation also help earn better margins as it commands a premium over other plain vanilla offerings. Asian Paints has been at the forefront of differentiation and innovation. It was the first company to allow consumers to choose a particular pattern and colour for their walls. In 2004, it launched a premium range of paint Royale Play. Recently, it launched ultra luxury paint Royal Aspira with differentiated features like five years’ warranty, teflon surface protector, anti‐microbial formula, crack bridging property etc. Differentiation can also be via services. In 2009, the company introduced dealer‐owned Colour Idea stores, which is a retail format where a customer can get free in‐store colour consultancy by trained professionals along with an option to visualise the colour choice on a Colour Visualiser. Asian Paints launched 70 new Colour Idea stores in FY14 taking the total count to around 170 stores. It has also launched Ezycolour Store and Ezycolour Beautiful Home Guide which lets customers try different colours and textures, select the right colour and finish for each room, to find a paint that best fits their budget etc. All these differentiations and innovations keep brands alive and helps develop strong customer loyalty. Table 5: Asian Paints—Different brands across segments Interior Paints

Value for Money

Tractor Acrylic Distemper

Tractor Emulsion

Tractor Sythetic Distemper

Premium

Apcolite Premium Emulsion

Apcolite Advanced Emulsion

Luxury

Royale Glitter

Royale Lustre

Royale Luxury Emulsion

Royale Shyne

Super Luxury

Royale Aspira

Exterior Paints

Ace Emulsion

Apex Exterior Emulsion

Metal Finishes

Utsav Enamel

Apex Ultima

Apcolite Premium Gloss Enamel

Apcolite Premium Satin Enamel

Premium Semi‐Gloss

Apex Duracast Finetex

Apex Duracast RoughTex

Apex Duracast CrossTex

Apex Duracast PebbleTex

Apex Duracast SwirlTex

Apex Ultima Protek

Source: Company, Edelweiss research Effective advertising Advertising and sales promotion (A&P) activities play an important role in an oligopolistic market, enabling players capture higher mind share by harping on the superiority of their products. Asian Paints has maintained high level of A&P spends as a percentage of sales over the years. A&P spends include differentiated advertisements on TV and other media like newspapers etc., and target based promotional offers to dealers etc. The company spends heavily on A&P across product categories (mass to premium) to outpace competitors in specific segments. Saif Ali Khan is the brand ambassador for certain offerings (Asian Paints Royale, Royal Aspira) for interior walls. The company launched an ad campaign for its high‐end emulsion for interiors Royal Aspira with Saif Ali Khan and Soha Ali Khan. For exterior paints like Apex Ultima it relies more on conceptual eye‐catching ads than on brand ambassadors (similar to Pidilite’s strategy). Asian Paints hired Rahul Dravid to re‐

launch the Apcolite brand. It recently launched an interesting ad for its exterior paint Apex 16 Edelweiss Securities Limited Asian Paints

Ultima Protek highlighting its superior anti‐ageing quality. The company, as part of product promotion, also sponsored a television show Har Ghar Kuch Kehta Hai on Colors channel. It was a 10‐part series featuring celebrities talking about their childhood memories and the house where they spent their childhood. Table 6: Ad spends as percentage of sales of paint companies % of Revenue

FY07

FY08

FY09

FY10

FY11

Asian Paints

3.9 4.8 4.6 4.8 4.5

Berger India

3.9 4.0 4.2 4.6 4.9

Akzo Nobel

5.6 6.6 7.3 9.2 9.2

Kansai Nerolac

3.1 3.2 3.4 4.0 3.8

FY12

4.1

5.1

5.3

3.8

FY13

4.6

5.6

5.0

3.6 Source: Edelweiss research Fig. 4: Rahul Dravid in a recent Asian Paints Apcolite advertisement Source: Company

17 Edelweiss Securities Limited Consumer Goods Margin Set to Paint Cheery Picture Asian Paints enjoys higher EBITDA margin compared to other organised players like Berger, Kansai and Akzo Nobel as its products command a premium and has higher operating leverage due to its larger scale. Also, strong brand strength, efficient inventory management, wide product variety and a large dealer network help negotiate better terms with dealers. Operating leverage also kicks in owing to a large scale. However, the company’s margin fluctuates depending upon raw material prices (in turn depends on INR movement). The other concern on margin is increase in power and diesel prices. In H2FY14, Asian Paints’ other expenses shot up due to higher transportation cost on account of strike at the Sriperumbudur plant. Margin is likely to improve in FY15 given that transportation cost will normalise (will not need to transport paints from other factories to areas catered by the Sriperumbudur plant as the issue has been resolved; strike was called off in April 2014 ). We expect margin to improve due to: (i) stabilising INR; (ii) operating leverage due to pick up in demand and enhanced capacity utilisation; and (iii) premiumisation. Table 7: EBITDA margin profile of paint companies (%)

FY07

FY08

FY09

Asian Paints

15.1 16.4 13.2

Berger Paints

9.9 10.1 8.4

Kansai Nobel

14.0 14.1 11.5

Akzo Nobel

11.1 10.4 11.6

FY10

19.8

10.5

15.5

12.4

FY11

18.3

10.6

13.6

12.0

FY12

16.2

10.4

13.0

8.7

FY13

16.5

11.1

11.8

8.4 Source: Edelweiss research Stabilising INR to curb raw material prices INR movement affects gross margins of paint companies as key raw materials—TiO2 and monomers—are indirectly crude linked. With a stable government in power we expect INR to strengthen as economic growth revives. The currency has already appreciated from INR68/USD in August 2014 to INR59 now with CAD under control. Asian Paints directly imports ~30% of total raw material (largely TiO2). If we take into account crude‐linked raw materials, ~50% of total COGS get impacted by INR movement. Many other raw materials are also linked to crude oil prices. Crude oil prices are currently steady at USD108 per barrel. Assuming crude to be at these levels, it is only currency fluctuation that will affect raw material costs. On a conservative basis, if we assume that ~40% of total raw material is affected by currency movement (both directly and indirectly) keeping all other variables constant, then 5% INR movement leads to 6.7% impact on standalone EPS. When INR appreciates, gross margin benefit flows for two to three quarters as price cut is taken with a lag. Thus, any INR appreciation will pave way for margin expansion in FY15. 18 Edelweiss Securities Limited Asian Paints

Table 8: Effect of appreciation and depreciation of INR on margins INR mn

FY14

Rupee depreciates by 5%

Revenues

104,188 104,188

Cost of goods sold

Raw material consumed

57,587 58,739

Indigenous @60%

34,552 34,552

Imported @40%

23,035 24,187

Purchase of stock in trade

2,566 2,566

Changes in inventory

(753) (753)

Total COGS

59,400 60,551

Gross profits

44,788 43,637

Staff expenses

4,824 4,824

Other expenses

22,191 22,191

Total expenses (Excluding COGS)

27,016 27,016

EBITDA

17,773 16,621

Depreciation

2,123 2,123

EBIT

15,650 14,498

Other income

1,737 1,737

Finance cost

261 261

PBT

17,125 15,974

Tax

5,335 4,976

Core PAT

11,790 10,997

EPS

12.3 11.5

% change in EPS (6.7)

% of sales

43.0 41.9

Gross margins (%)

EBITDA margins (%)

17.1 16.0

EBITDA margin (decline)/expansion (bps)

(111)

Rupee appreciates by 5%

104,188

56,435

34,552

21,883

2,566

(753)

58,248

45,940

4,824

22,191

27,016

18,924

2,123

16,801

1,737

261

18,277

5,694

12,583

13.1

6.7

44.1

18.2

111 Source: Edelweiss research Chart 22: INR appreciating against USD 70.0

(INR per USD)

64.0

58.0

52.0

46.0

May‐14

Feb‐14

Nov‐13

Aug‐13

May‐13

Feb‐13

Nov‐12

Aug‐12

May‐12

Feb‐12

Nov‐11

Aug‐11

May‐11

40.0

Source: Edelweiss research 19 Edelweiss Securities Limited Consumer Goods Operating leverage on robust volumes, enhanced capacity utilisation Operating leverage is a function of improvement in sales and effective fixed cost rationalisation. Asian Paints has been able to sustain strong volume growth of ~11% YoY in FY14 despite economic slowdown. We expect it to gain from urban recovery as it has commissioned a manufacturing facility in Khandala (in February 2014 with installed capacity of 300,000KL per annum) and enhanced capacity at Rohtak plant (from 150,000KL per annum to 200,000KL per annum in Q1FY14). With such huge capacity in place and likely volume growth boost from recovery in urban demand and revival in GDP growth, optimal capacity utilisation will kick in operating leverage. The company’s other expenditure as a percentage to sales has surged over the past five quarters because of issues like strike at the Sriperumbudur plant (leading to higher transportation costs) and power & diesel cost inflation (Khandala plant was initially running on DG sets further heightening power costs). These issues have been resolved—strike at Sriperumbudur plant has been called off and power issue at the Khandala plant has been solved. We expect other expenditure to remain high but will remain constant as a percentage of sales. Freight costs may see some inflation owing to diesel prices moving North, but rapid volume surge will lead to scale benefit and thereby spur margin. Chart 23: Other expenditure as percentage of sale 26.0 (% of sales)

24.0 22.0 20.0 18.0 Q1FY04

Q3FY04

Q1FY05

Q3FY05

Q1FY06

Q3FY06

Q1FY07

Q3FY07

Q1FY08

Q3FY08

Q1FY09

Q3FY09

Q1FY10

Q3FY10

Q1FY11

Q3FY11

Q1FY12

Q3FY12

Q1FY13

Q3FY13

Q1FY14

Q3FY14

16.0 Source: Company, Edelweiss research Table 9: Asian Paints—Capacity expansion Area

Feb‐14

Khandala Industrial Area, Maharashtra

Apr‐12

Rohtak, Haryana Feb‐12

Rohtak, Haryana Apr‐10

Rohtak, Haryana Feb‐07

Taloja, Maharashtra

Apr‐06

Baddi, Himachal Pradesh

Capacity

3,00,000 KL pa

50000 KL pa; extended and started

150000 KL pa; shutdown

1,50,000 KL pa

14000 KL pa

1800 KL pa; shutdown

Source: Company, Edelweiss research 20 Edelweiss Securities Limited Asian Paints

Margin to get premiumisation boost With increasing per capita income and improvement in aspirational levels, consumers are looking for better quality and are more willing to uptrade. Most consumer companies are tapping this opportunity and focusing on premiumising their portfolios. This trend has been apparent in the paint industry as well with consumers upgrading from distempers, putties etc., to more premium emulsions. Asian Paints has also benefitted from pick up in this trend backed by higher saliency of premium products, wider variety of technologically advanced and differentiated premium products, strong dealer network to be able to cater to demand and its strong brand equity. As per an AC Nielsen report, the paint industry is witnessing premiumisation as contribution of exterior emulsions has increased to 20.3% in 2012 from 13.5% in 2008 and that of interior emulsions increased to 16.8% in from 12.3% over the same period. The share of lower‐end distempers declined to 11.5% in 2012 from 12.9% in 2008. We expect premiumisation trend to increase at a faster pace, particularly in urban areas, with urban growth revival on the cards and the new government’s emphasis on building 100 new cities. Improvement in per capita income of urban population will also boost premiumisation. Asian Paints has a strong premium portfolio with Royale, Apcolite, Protek, etc., in its stable. Recently, the company launched a super premium offering Royale Aspira (INR600 per litre) and re‐launched Apcolite as Apcolite Advanced as a more premium offering. With strong marketing campaigns and brand ambassadors like Saif Ali Khan and Rahul Dravid for its premium offerings, Asian Paints has been aggressive in marketing its premium end of portfolio. We expect it to benefit from improvement in mix and see improvement in margin. “We expect that with a new government coming in, things would improve in terms of investment climate and subsequently, the protective coating business, in which we are ranked first, will naturally begin growing at a fast pace.” – Abhijit Roy, MD,

Berger Paints

Water‐based paints to boost margin There has been a steady shift towards the use of water‐based paints from oil‐based paints not only because of the environmental advantages, but also because of ease of application. Consumers prefer water‐based paints as they dry quickly, emit less odour and are easier to clean (with water). Solvent‐based paints, on the other hand, contain high levels of Volatile Organic Compound (VOC), take longer to dry and emit strong odour. This has led to strong consumer inclination towards water‐based paints/emulsions as evident from their increased contribution to overall paint demand. From a paint manufacturer’s perspective, water‐

based paints carry 5‐7% higher margin than oil‐based paints. This is the reason behind higher focus of paint companies on water‐based paints. As per industry reports, the share of water‐based paints in the decorative paints market is ~52%, while balance 48% is solvent based. Companies offer water‐based enamels that give look and feel of oil‐based enamels. Asian Paints has the highest revenue contribution from water‐based emulsion and distempers (more than 50%). Also, the company is increasingly introducing more products in this category. In line with global paint companies, Asian Paints has been emphasizing on paints with reduced VOC. Vast opportunity to further increase contribution from water‐

based paints bodes well for margin improvement. Another trigger for margin improvement is uptrading of consumers from distempers to emulsions. 21 Edelweiss Securities Limited Consumer Goods Apart from many water‐based emulsions like Royale, Apex Ultima, Apex Weather Proof emulsions etc., Asian Paints also has water‐based enamels under the Asian Paints Premium Semi Gloss Enamel brand. It also has water based wood finishes. We expect revenue contribution of water‐based paints to improve riding higher focus led by innovations and aggressive marketing. Chart 24: Share of emulsions increasing over the years for the industry 39.0 31.6 (%)

24.2 16.8 2012

Primers, Thinners

Putty

Wood Fin

Cement Paint

2008

Distemper

Ext Emulsion

Int Emulsion

2.0 Enamel

9.4 Source: AC Nielsen, Edelweiss research

22 Edelweiss Securities Limited Asian Paints

Anticipated Industrial Paint Segment Revival a Boon Industrial paints contribute ~7% to Asian Paints’ total revenue and the segment continues to remain affected by slowdown in automotive and industrial paints sectors. The company is present in the automotive coating segment via JV with PPG (PPG AP) and is the second largest supplier to the auto segment in India (behind Kansai Nerolac). It is the largest player in auto refinish segment. In the non‐auto industrial segment, Asian Paints participates through a JV (AP PPG) that covers protective coatings, floor coatings, road marking paints and powder coatings segments. With the business‐friendly BJP government coming into power, growth in the industrial segment is likely to pick up phenomenally, particularly in the infrastructure sector. This will drive performance of the industrial coatings sector as there will be an increase in the public and private investments due to the new government coming in. “The demand for industrial paint is going to be driven by the pick‐up in the automobile industry and growth in infrastructure. Infrastructure is at the lowest level in the country today, hence we see a sustained growth in the industrial paints business." ‐ H M Bharuka, MD,

Kansai Nerolac

Real estate revival to spur industrial paint volumes While repainting contributes 85‐90% to Asian Paints’ overall demand, 10‐15% is dependent on new real estate development. Since the past six‐eight months, real estate prices in a few metros and tier‐I cities have been under pressure. However, owing to improved sentiments due to a stable government at the Centre, property prices are expected to stabilise and volumes are set to improve. This was highlighted in a latest research report by the Edelweiss real estate team, ‘Real Estate‐Rising on a strong foundation’, dated May 16, 2014. Any improvement in inflation, high GDP growth as well as reduction in interest rates will drive consumer demand, which should benefit the real estate sector. The real estate sector has been gearing up in anticipation of a recovery by strengthening its operations and improving balance sheets. New launches by real estate developers have picked up speed over the past few years. Because of the expected recovery in the entire real estate sector, completion of these projects is expected to accelerate. When this pent up supply hits markets, it should drive volumes of paint companies like Asian Paints. Also, many real estate developers have lined up attractive project launch pipelines. 23 Edelweiss Securities Limited Consumer Goods Table 10: Key launches by major real estate developers launch area (msf) key Immediate launches

DLF

DLF Camelias ‐ 3.55msf total project size

1.4

DLF Crest ‐ 2.66msf total project size

0.8

DLF Ultima ‐ 2.2msf project

0.8

Oberoi Realty

Oasis Worli

0.6

Oberoi Exotica, Mulund

3.2

Oberoi Exquisite III

2.2

Borivali land

4.5

Sobha Developers

Sobha Silicon Oasis

1.5

Sobha Valley View

0.7

Kanakapura road

0.7

Godrej Properties

Panvel township ‐ 3.5msf total project size 1.2

Chembur redevelopment

1.0

Ghatkopar redevelopment

0.2

Gurgaon, Sector 79

0.8

Gurgaon, Sector 88A

0.5

Mahindra Lifespace

Sector 59, Gurgaon

0.4

0.4

Andheri project

Bannerghatta, Bengaluru

0.5

Kolte‐Patil Developers

Wakad, Pune

2.0

Kondhwa

0.4

Mirabilis, Bangalore

0.6

Hosur Road, Bangalore

0.6

Brigade Enterprises

Brigade Northridge, Yelahanka Junction

0.4

Brigade Panorama, Mysore Road ‐ Highway 0.9

Meadows Phase 2 , Bangalore

0.9

Exotica ‐ Tower 2

0.7

INR psf

Total Value

26,000

16,000

9,000

36,400

12,800

7,200

45,000

12,000

16,500

15,000

25,650

38,400

36,300

67,500

5,500

6,000

5,000

8,250

4,200

3,500

5,250

17,500

15,000

5,500

6,250

6,458

16,625

2,850

4,510

2,875

10,000

13,500

6,500

4,400

4,995

3,185

5,500

5,000

5,000

4,500

11,000

2,200

3,000

2,610

4,850

5,200

3,500

4,750

1,940

4,792

3,080

3,420 Source: Edelweiss research Revival in auto sector to spur industrial paints With ~24% market share, PPG AP is the second largest player in the automotive OEM paint segment after Kansai Nerolac. The company’s revenue clocked 10.3% CAGR over FY09‐13 and it has been profit‐making since inception. However, performance of the automotive segment was dented in FY13 and FY14 owing to slowdown in the automobile industry. Total vehicle production fell by 0.3% YoY in FY13 and 7.4% in FY14. As a result of the economic slowdown, many first‐time buyers have delayed their car purchases. For example, first time buyers fell to 37% for Maruti Suzuki compared to ~50% a couple of years back. 24 Edelweiss Securities Limited Asian Paints

Table 11: Auto production data suggests demand has been low since past two years FY11

FY12

FY13

FY14

Passenger cars

2,442,820 2,536,625 2,426,509 2,310,336

% growth

3.8 (4.3) (4.8)

Utility vehicles

314,307 371,492 565,417 558,787

% growth

18.2 52.2 (1.2)

Total vans

216,533 237,954 239,434 196,693

% growth

9.9 0.6 (17.9)

Total passenger vehicles

2,973,660 3,146,071 3,231,360 3,065,816

% growth

5.8 2.7 (5.1)

Heavy Commercial Vehicles

345,597 384,801 279,626 221,564

% growth

11.3 (27.3) (20.8)

413,973 544,335 552,335 476,983

Light Commercial Vehicles

% growth

31.5 1.5 (13.6)

Total commercial vehicles

759,570 929,136 831,961 698,547

% growth

22.3 (10.5) (16.0)

Total vehicle production

3,733,230 4,075,207 4,063,321 3,764,363

% growth

9.2 (0.3) (7.4) Source: SIAM, Edelweiss research While urban auto demand has been soft, rural auto demand has been strong since the past few years. Lackluster economic growth had impacted job creation, while wages had been increasing in line with inflation. Thus, discretionary purchasing power, especially in urban areas, had taken a hit. Chart 25: Rural wages growing faster than national income 25.0 (%, yoy)

19.2 13.4 7.6 1.8 Rural wages

National Income

FY14

FY13

FY12

FY11

FY10

FY09

FY08

FY07

FY06

FY05

FY04

FY03

FY02

FY01

FY00

(4.0)

Source: CMIE, Edelweiss research 25 Edelweiss Securities Limited Consumer Goods Management commentary on automotive segment in FY14 Q1FY14: Industrial and automotive segments remained under pressure due to tough business conditions. These segments’ margins dipped QoQ. Q2FY14: Industrial and automotive segments continued to remain under pressure. Q3FY14: Demand continued to be weak in industrial segment. In the industrial space, non‐

automotive segment continued to face slowdown pressure. However, growth in the automotive segment was decent in the refinishing space (OEMs continued to face sluggish demand). Asian Paints raised prices in this portfolio to protect margin. Q4FY14: Slow demand in automotive segment resulted in a challenging environment for paint companies. However, margins improved due to lower inflation in material cost and better operational efficiencies. Historical analysis suggests that auto sector recovery is likely Analysis of auto sector demand shows that in the past three recovery cycles of FY99, FY03 and FY09, when GDP growth recovered by ~200bps, auto demand surged by more than 20% CAGR over two years post trough year. The primary demand drivers for the auto sector are improvement in GDP, high liquidity and improvement in purchasing power. We expect GDP growth to improve to 5.4%, 6.3% and 7.5% in FY15E, FY16E and FY17E, respectively, from ~4.5% in Q4FY14. Also, improved consumer sentiment due to a stable government should drive job creation and wage hikes. Analysis by the Edelweiss auto sector research team in the report ‘Automobiles ‐ Get Set, Go!!’ dated May 19, 2014 indicates current underlying conditions are similar to earlier cycles, thereby infusing confidence of recovery in auto demand along with GDP recovery. FY98 ‐ 00

280 GDP (bps over trough period)

340 34

28

FY98 GDP 4.8%

220 22

160 16

100 2W

FY03 GDP 6.8%

34

280 28

220 22

160 16

10

GDP (LHS)

M&HCV

340 40

100 10

PV

FY03 ‐ 05

400 40

Vol. CAGR (% YoY)

GDP (bps over trough period)

400 Chart 27: Auto volume trend vs GDP recovery from FY03‐05 Vol. CAGR (% YoY)

Chart 26: Auto volume trend vs GDP recovery from FY98‐00 PV

2W

M&HCV

Source: Bloomberg, SIAM, Edelweiss research 26 Edelweiss Securities Limited Asian Paints

Chart 28: Auto volume trend vs GDP recovery from FY09‐11 FY09 ‐ 11

40.0 340 34.0 280 28.0 220 22.0 FY09

GDP 6.7%

160 Vol. CAGR (% YoY)

GDP (bps over trough period)

400 16.0 100 10.0 GDP (LHS)

PV

2W

M&HCV

Source: Bloomberg, Companies, Edelweiss research Chart 29: Edelweiss estimate of ~280bps of recovery in GDP over FY14‐17E 10.5 GDP (% YoY)

9.0 7.5 6.0 4.5 FY95

FY96

FY97

FY98

FY99

FY00

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15E

FY16E

FY17E

3.0 Source: Edelweiss research 27 Edelweiss Securities Limited Consumer Goods International Stroke: Betting Big on Africa International operations contribute ~13% to Asian Paints’ overall consolidated sales. The company’s international business is divided into four regions—Caribbean (Barbados, Jamaica, Trinidad and Tobago), Middle East (Egypt, Oman, Bahrain and UAE), Asia (Bangladesh, Nepal, Sri Lanka and Singapore) and South Pacific (Fiji, Solomon Islands, Samoa, Tonga and Vanuatu). The largest contribution comes from Middle East, which contributes 51%, followed by Asia with 27%, Caribbean with 14% and South Pacific with 8%. Though international business contributes only 13% to overall revenue, it presents a huge growth opportunity as the company is among the top three players in all international markets (except in Singapore) in decorative paints. In FY14, growth was commendable in the international business led by Bangladesh and Nepal in Asia and UAE in the Middle East. Bangladesh presents a big FMCG opportunity with many consumer companies trying to capture market share. Asian Paints is a distant No.2 player in Bangladesh with 14% market share and operates at low margin compared to the leader, Berger Paints. The company’s capacity expansion in the region to 24,000KL per annum will further help drive margin through operating leverage benefit. Middle East grew only 14.5% YoY in FY14 as it has been bearing the brunt of political turmoil in Egypt and Bahrain. We believe this slowdown is temporary and growth will return, particularly in Egypt (most populous and second largest country in Arab world). Asian Paints is present in Egypt through SCIB Paints. FY14 international business PBT grew 4.6% YoY. Excluding Egypt, PBT growth would have been 16.2% YoY, indicating improvement in international business once the political situation in Egypt improves. Chart 30: International sales contribution by different geographies 100.0 80.0 (%)

60.0 40.0 20.0 0.0 FY08

FY09

Caribbean FY10

Middle East

FY11

Asia

FY12

FY13

South Pacific

Source: Company, Edelweiss research 28 Edelweiss Securities Limited Asian Paints

Table 12: International geographies—Sales growth (% YoY) FY08

FY09

FY10

FY11

Caribbean (1.4)

8.7

2.0

(3.0)

Middle East

22.6

45.8

15.0

(4.0)

Asia

‐

‐

‐

20.0

South Asia

33.4

38.5

28.0

‐

South East Asia

5.2

19.3

‐

‐

South Pacific

(7.2)

13.2

7.0

4.0

FY12

9.5

12.1

31.0

FY13

15.0

26.0

21.0

‐

‐

20.9

FY14

7.9

14.5

21.0

‐

‐

25.0

‐

‐

16.3 Source: Company, Edelweiss research Asian Paints is following the footsteps of other consumer companies like Godrej Consumers and Marico and has marked its entry in Africa by acquiring 51% equity in Kadisco Chemical Industry, Ethiopia. This acquisition will help the company enter other markets of Africa. Africa is an immense opportunity for Asian Paints and with its scale and size, the company can exploit this untapped market, which is growing at a fast pace (especially Nigeria). Africa’s GDP is growing at more than 5% and it can be compared to the situation that existed in India 10 years ago. Africa is well poised for growth with six of the 10 regions with fastest growing GDP globally. Growth is stable in the region with sustained and gradual reduction of debt and inflation. As paints volume growth has high correlation with GDP growth, the paint sector is likely to post robust growth. Though North Africa is facing some issues, sub Saharan Africa is growing well. Nigeria, which is growing at more than 7% (set to become the largest economy in Africa), stands second to South Africa. Table 13: Africa—Paint industry size Region North Africa

South Africa

East Africa

West Africa

Paints and coating market size (USD mn)

910

603

111

258 Source: Frost & Sullivan, Edelweiss research Most consumer companies, having realised Africa’s potential well in advance, have built presence in the region. Table 14: Africa’s contribution to consumer companies Company

Contribution from African region (%)

GCPL

12.0

Dabur

7.0

Marico (in South Africa)

9.0

Emami

1.0 Source: Company, Edelweiss research Africa has a large population which is young, has good GDP growth potential and has a large portion of unorganised market, making it a lucrative play for consumer companies. 29 Edelweiss Securities Limited Consumer Goods Chart 31: Africa—Paint market in different geographies 420,000 (tonnes)

336,000 252,000 168,000 2011

2016E

Zambia

Tunisia

Senegal

Nambia

Morocco

Egypt

Algeria

0 South Africa

84,000 Source: IRL, Edelweiss research Chart 32: Africa—Volume share of different geographies in paints Zambia

Tunisia

1%

Senegal 10%

South Africa

3%

23%

Nambia

1%

Morocco

16%

Algeria

21%

Egypt

25%

Source: IRL, Edelweiss research 30 Edelweiss Securities Limited Asian Paints

Home Improvement: The New Frontier Asian Paints ventured into the home improvement segment by the acquisition of Sleek, a modular kitchen brand. It recently entered into a binding agreement with Ess Ess Bathroom Products (Ess Ess) to acquire its entire front‐end sales business including brands, network and sales infrastructure. ~10% of Asian Paints dealers are already selling bathroom fittings and this synergy effect will help them to increase the sales of Ess Ess products. Asian Paints will benefit by its entry into these aligned business as it will get the synergy of its vast dealer network which can also be used for the home improvement segment. Globally, Masco Corp in US has successfully accomplished similar diversification into a home décor company from a plumbing products company (details in Annexure I). In the near future, in our view, the company may acquire tiles and sanitary ware companies as these portfolios are necessary for it to be a market leader in the décor business and these businesses can also get synergies from the its vast dealer network. With presence in paints, water proofing, modular kitchens and bath fittings, Asian Paints aims to gain higher wallet share of existing customers. With aspirations of being a complete home décor company, Asian Paints may enter home furnishing and sanitary ware segments. As per PWC’s India Home Furnishing Market Forecast and Opportunities, 2018, report the home furnishing market is expected to post 8% CAGR over 2013‐18 riding higher per capita incomes and increase in the number of working women. “Home improvement is an aligned business. The basic customer is the same–the homeowner. This is a large potential market that’s growing. Eventually, we want to be in all areas of home improvement–

from furnishings to bathrooms.” ‐ K.B.S. Anand, MD and CEO,

Asian Paints

Modular kitchen (Sleek) In 2012, household consumption in India grew at 12%, leading to growth in the modular kitchen market. The domestic modular kitchen market is at a nascent at INR21bn (in 2012) with the potential to grow up to INR60bn by 2016. The market segment is largely unorganised (70‐75%) and is mostly cornered by local and small players. Unorganised players include carpenters who design kitchens based on requirements of customers. Generally, end users in this segment are urban middle class and affluent households. Due to increase in urbanisation, rise in working women, increase in disposable incomes and aesthetics of modular kitchens over traditional kitchens, this segment has been gaining consumer traction. Thus, modular kitchen has become an attractive space. Key players in this segment include Godrej Interio, Sleek, Hafele, Gilma, Haecker and Veneta Cucine. In November 2013, Asian Paints entered this segment with the acquisition of 51% stake in Sleek Group (for eight month in FY14 sales stood at INR793mn, 3.9% PBIT margin), a leading player in modular kitchen segment with seven years of experience. The company has 30 showrooms and a network of 250 dealers. The acquisition was a strategic fit for Asian Paints as the company will derive distribution synergies by selling spare parts of Sleek through Asian Paints’ dealer network. Sleek: It commenced operations as a wire basket manufacturer in 1993 and went on to become a complete kitchen solutions provider. The company has tied up with the world’s best modular kitchen companies like Grass (Austria), Lamp (Japan) Scilm (America), Sige, Technoinoc and Airforce (Italy). 31 Edelweiss Securities Limited Consumer Goods Chart 33: Modular kitchens—Organised and unorganised players’ share Organized Sector

30%

Unorganized Sector

70%

Source: PWC, Edelweiss research Chart 34: Modular kitchens—Market size 72.0 (INR bn)

60.8 49.6 38.4 27.2 16.0 2012

2016

Source: PWC, Edelweiss research Wall papers (Nilaya) Wall papers can be used to decorate interiors and ceilings of homes and offices. Wall papers come in various styles and designs and can be easily applied (approximately 8 hours) without any dampness and leakages and are easy to maintain. People use walls as a canvass to express their imagination, thus making wall papers an attractive segment for the paint industry. Digital printed wall coverings are the latest innovation in the industry. Wall papers attract customers looking for convenience and time saving (fixing takes eight hours compared to 10‐12 days for painting). People with breathing problems, skin problems or odour allergies also prefer wall papers over painting. Asian Paints has entered this space with Nilaya (launched in February 2014 at Taj Palace). However, a key issue with wall papers is that they are not suitable for walls with leakage problems. 32 Edelweiss Securities Limited Asian Paints

Wall proofing (SmartCare) Wall proofing is another solution provided by the paint industry. Dampness affects exterior as well as interior walls and this problem is exacerbated during monsoon. Consumers expect painting companies to provide a dampness solution along with painting. Initially, Asian Paints directed consumers to unorganised players or other companies like Pidilite, which provided water proofing solutions. However, recently it entered the construction chemicals space under which it offers water proofing solutions—SmartCare products like damp block (interior waterproofing solutions), damp proof (exterior waterproof coating) and crack seal (crack filing compound). Bathroom fittings (Ess Ess) The Indian bathroom fittings market is approximately ~INR45bn, of which 15% belongs to the premium segment. Indian brands like CERA, Jaguar and Hindustan Sanitaryware are dominant players in the market. Rapid urbanisation is leading to higher standards of living, which results in higher demand for super‐premium or luxury bathroom products. Asian Paints has entered into a binding agreement with Ess Ess to acquire its entire front‐

end sales business including brands, network and sales infrastructure. Ess Ess is an established player in the bath and wash business segments in India. It has more than 1,500 dealers in India and eight branch offices (Mumbai, Delhi, Ahmedabad, Bengaluru, Chennai, Kerala, Kolkata and Secunderabad) and a factory Himachal Pradesh. It exports to the UK, Far East and Middle East. This move by Asian Paints is in line with its strategy to be a one‐stop solution in the home décor space. Ess Ess is a profitable entity. We expect Asian Paints to utilise its paints distribution network to drive Ess Ess sales. We also expect it to drive marketing of Ess Ess (currently low brand equity) and take it to the next level. This has been the case with Sleek, which saw marked increase in advertising post acquisition. 33 Edelweiss Securities Limited Consumer Goods GST Implementation: A Key Trigger GST, which was to be implemented in April 2010, has not seen the light of the day as yet. However, with a strong government in the saddle at the Centre, chances of its implementation are bright. GST aims to replace the multiple acts contained in indirect taxation like central excise, additional excise, value‐added tax, octroi and service tax that are levied by the Centre and state governments and replace them by a uniform tax. Asian Paints too will reap benefits of GST as it will gain from the lower tax rate planned under the regime, which will be executed by increasing the tax base and minimising exemptions. Under the current regime, there is taxation at different points like on the finished product when it is moved out of the factory and also during retail sales. GST will abolish this cascading tax as under it tax will be levied at one point i.e., point of sale. Thus, lower incidence of tax will lead to reduction in manufacturing cost, which will result in low cost of production. It may also lead to lower prices, which will boost consumption. Lower prices will also help Asian Paints wrest market share from unorganised players as consumers of latter could shift towards organised players because of lower prices. ~35% of the paint industry is unorganised and as it too will come under GST ambit, it will be a level playing field with organised players like Asian Paints which have got high economies of scale. Under the current regime, CST is levied on inter‐state sale of goods, but stock transfer between factory and C&F agent/depot of the same entity is not liable for CST. To reduce the CST liability many companies currently operate depots/C&F agents in all major states to avoid CST. The result is increased number of depots and warehouses, which leads to cost equal to 1‐2% of revenue towards maintenance of these facilities. With the introduction of GST, CST will be phased out and companies need not bear these additional infrastructure costs. A company can then have only four or five big warehouses from where it can supply the goods to dealers without having to pay taxes for inter‐state sale of goods. Asian Paints, which has around 110 depots, will have to evaluate whether the tax savings from reduction of depots is higher than the increase in transportation cost because of this. 34 Edelweiss Securities Limited Asian Paints

Robust Growth Momentum; Reiterate ‘BUY’ Urban growth in India is set to revive with a stronger/ stable government coming to power, which had, in its election manifesto, outlined a strong focus on urban growth recovery, infrastructure development, faster execution, development of 100 new cities, among other initiatives. We believe Asian Paints is well poised to reap benefits of this impending urban recovery riding its strong market share, pricing power, brand strength and wide spread dealer network (2x next player). We expect Asian Paints to be one of the best plays on the much anticipated recovery in macros given that paint volumes surge a healthy 1.5‐2.0x GDP. We expect the company’s volumes to clock 13% CAGR over FY14‐17E (~8% over FY12‐14) anchored by the recovery in urban sentiments, GDP revival and toothless competition (global behemoths Akzo, Nippon, Jotun failed to make headway in India). Additionally, low per capita paint consumption in India (one fourth China’s) and reduction in repainting cycle (5 years now from 7 years a decade ago) render the company the best play on paints. Industrial segment growth, which has languished over the past few quarters, is likely to pick up, especially in the automotive space (forms large part of non‐decorative segment), led by likely improvement in discretionary spends and higher investments by the new government. We expect distribution synergies between home décor segments and the existing paint distribution network. Also, investments in home décor brands (Sleek, Ess Ess) will help these businesses gain scale riding Asian Paints’ well entrenched brand equity. Though Asian Paints is trading at close to its all time high valuations and despite the fact that consumer companies have gone out of flavour in the current bull run, we remain positive on the stock because it is a quality play in the consumer discretionary segment. With 22% EPS CAGR, 347bps RoCE spurt over FY14‐17E and metamorphosis into a home décor company, we expect valuations to remain rich. On account of strong performance coupled with investment in new growth drivers (construction chemicals, wall paper, Sleek, Ess Ess), we assign 31x to FY17E earnings (against 3 year average 1‐year forward PE of ~31x) with two‐year target price of INR720. We maintain ‘BUY/Sector Outperformer’ rating. EPS likely to post 22% CAGR over FY14‐17E Chart. 35: One year forward P/E band 650

35x

(INR)

530

30x

25x

410

20x

290

15x

10x

170

May-14

Nov-13

May-13

Nov-12

May-12

Nov-11

May-11

Nov-10

May-10

50

Source: Company, Edelweiss research 35 Edelweiss Securities Limited Consumer Goods Annexure I Global companies venturing into home improvement Masco Corporation Masco Corporation was founded in 1929 when Alex Manoogian started the first commercially successful Masco screw product factory in the US. Though it began as a screw manufacturing factory, today it is the world’s leading manufacturer of home improvement and décor business. The enterprise focused on innovation and quality and years later, Masco Corporation is still dedicated to these priorities. In 1954, it started production of single handled faucet, revolutionising the plumbing industry. Continuing its diversification strategy, Masco Corporation entered the cabinet manufacturing business in 1985. Moving ahead, it diversified into architectural coating business and windows business. The achievements of past decades clearly show that its strategy lead to success as operating margin did well for decorative business compared to the plumbing business. Chart 1: Masco: Contribution from different businesses 100.0 (%)

80.0 60.0 40.0 Plumbing Products Revenues

Installation and Other Services

Other Specialty Products

CY 2013

CY 2012

CY 2011

CY 2010

CY 2009

CY 2008

CY 2007

CY 2006

CY 2005

CY 2004

CY 2003

CY 2002

CY 2001

0.0 CY 2000

20.0 Decorative Products Revenues

Cabinets and Related Products

Source: Company, Edelweiss research Asian Paints is following in its footsteps. It started as a paint company and is now trying to diversify into different businesses, but having synergies in distribution network. Its aims is to be a market leader in home improvement and décor space and to make this dream come true, it has acquired Sleek, a modular kitchen company, and Ess Ess, a bathroom fittings company. Though it is a long journey for Asian Paints to achieve its dream, we believe that the innovative path taken by it is an excellent strategic move. In the near future, in our view, Asian Paints may acquire companies in segment like tiles and sanitary ware as these portfolios are necessary for it to be a market leader in the décor business. 36 Edelweiss Securities Limited Asian Paints

Fig. 1: Asian Paints’ planned entry in home décor space Sleek, Modular Kitchen Business

ESS ESS, Bathroom Fitting Business

Furnishing Company (likely)

Asian Paints

Sanitary ware Company (likely)

Glass Company (?)

Tiles Company (likely)

Source: Company, Edelweiss research PPG Industries The journey for Pittsburgh Plate Glass Company (PPG) started way back in 1883 when Capt. John Ford and John Pitcam decided to establish a plate glass factory in Creighton, United States. The company has rapidly expanded, serving clients throughout the world. Though it started as a plate glass factory, it vertically integrated its portfolio with the construction of an alkali plant in Barberton, Ohio, in 1899 which provided raw material for glass making. For the first time in 1900s, PPG diversified its product range by moving into coatings business with the acquisition of Wisconsin‐based Patton Paint Company. Though being a globally famous glass company which focused continuously on product innovation and quality, today it is also a leading global coating company. PPG’s excellent strategic plan to diversify into different businesses, but via the same distribution channel, proved to be a good strategic fit for the company. Fig. 2: PPG Industries—Entry in diverse businesses Founded plate glass factory

Introduced DesignaColor system, custom‐tinting consumer paints

Entered optical business

Diversifie

d into coating business

Started its fibres glass business

Acquired architectural coatings business of AkzoNobel

Acquired SigmaKalon Group, a worldwide coatings producer

Source: Company, Edelweiss research 37 Edelweiss Securities Limited Consumer Goods Annexure II El Nino and its impact on monsoon 1883

1990

Monsoon plays an important role in deciding the number of paint days available for any household as exterior painting is not possible during monsoon. Q2FY14 witnessed a strong and prolonged monsoon, which did impact paint companies as it resulted in loss of painting days. We believe, if the reverse happens, the same will be beneficial for paint companies from a near term perspective. 1940 1970

2013

1952

2000