Pharmaceuticals – Bulk Drugs & Formulations

advertisement

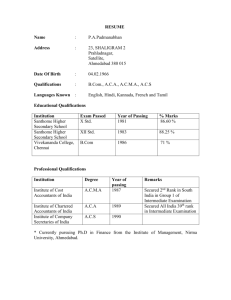

Initiating Coverage Cadila Healthcare Limited May 26, 2011 ACCUMULATE LOW RISK PRICE Rs. 866 TARGET Rs. 960 Pharmaceuticals – Bulk Drugs & Formulations STRENGTH: Focus on chronic therapies, Healthy Balance Sheet with best in class return ratios, Low net gearing and consistent cash generation. WEAKNESS: De-growth in Nycomed JV & subdued growth in Europe. OPPORTUNITIES: Foray into newer markets; Commencement of Abbott & Bayer deals. THREAT: Exchange rate volatility, Price control SHARE HOLDING (%) Domestic business to post a double-digit growth led by new product launches, focused approach on chronics & greater market penetration Promoters FII 74.8 5.5 FI / MF 13.3 Body Corporates 1.4 Public & Others 4.9 STOCK DATA Reuters Code Bloomberg Code BSE Code NSE Symbol Market Capitalization International Business – Regulated markets of US & Japan to drive growth whereas emerging markets will surge on robust sales in Brazil and Africa 532321 CADILAHC Cadila's US business is expected to witness increased traction on the back of new product launches (65 ANDA approvals) & with the commencement of filling of potential lowcompetition products (transdermal patches and respiratory products) whereas its presence in Japan, though not very significant now, holds immense revenue potential. With the strong growth prospects in the Brazilian market and plans to launch 8-10 products annually, we expect Cadila’s international revenues to grow at a CAGR of 23.3% over FY11-13E. 204.7 mn 52 Weeks (H/L) Rs. 941/582 Avg. Daily Volume (6m) 15,538 Shares Price Performance (%) 1M 3M 6M 2 13 15 200 Days EMA: Rs.749 Part of Cadila in recent years has strengthened its position in the chronic segment ( 57% of Domestic formulations) through the creation of the specialty divisions and steady ramp up in the field force (~4500). With an increasing focus on expanding its penetration in semi urban & rural areas and increasing its doctor coverage backed by its continous thrust on introducing new products (Launched 60 new products in FY11) coupled with the commencement of its JV with Bayer in Q4FY11, we expect Cadila’s domestic formulations to grow at 14.7% CAGR over the period of FY11-13E. CADI.BO CDH IN Rs. 177,305 mn US$ 3940 mn Shares Outstanding for the products covered under DPCO and Delay in regulatory approvals. Classic Consumer Business – Sustained growth Cadila’s Consumer business has been growing rapidly (FY07-11 – CAGR of 28.8%) due to a strong growth in their respective product categories and dominant market share in the segments. Owing to its flagship brands’ leadership position namely, Sugar Free, EverYuth and Nutralite; we expect Cadila’s consumer business to continue to grow at a CAGR of 22.5% over FY11-13E. Hospira JV to off take loss of business from Nycomed JV Q4FY11 marked Hospira JV’s entry into the US market with the launch of generic Taxotere. The JV is currently selling three products in the EU and one product in the US. While we believe, the Nycomed JV will be under strain, both in terms of volume and value owing to generic competition for Pantoprazole, the Hospira JV will drive growth as the six‐product supply arrangement (for US and EU) is likely to unfold over FY11-13E. OUTLOOK & VALUATION ANALYST Suneel Rao | +91 22 4093 5068 suneel.rao@sushilfinance.com SALES: Devang Shah | +91 22 4093 6060/62 devang.shah@sushilfinance.com Nishit Shah | +91 22 4093 5074 nishit.shah@sushilfinance.com Cadila achieved the $1bn milestone in revenue during FY11, a 24.6% CAGR growth during FY07-11. With a vision of the management of tripling its business in four years, we believe Cadila's future growth will be led by increased traction in its international businesses, a ramp-up in supplies to Hospira and sustained double-digit growth in the domestic formulations and consumer businesses. In view of strong revenue visibility in business coupled with a healthy balance sheet and best in class return ratios, we recommend an “ACCUMULATE” with a target price of Rs. 960 (20x FY13E EPS). It is currently trading at a P/E of 18.1x its FY13E EPS of Rs. 47.9. KEY FINANCIALS Y/E Mar. FY10 FY11 FY12E FY13E Please refer to important disclosures at the end of the report Sushil Financial Services Private Limited Office : 12, Homji Street, Fort, Mumbai 400 001. Revenue (Rs mn) 36868.0 46301.8 55068.8 65335.1 RPAT (Rs mn) 5051.0 7109.9 7968.6 9797.1 AEPS (Rs) 37.0 34.7* 38.9 47.9 AEPS (% Ch.) 66.6 -6.2 12.1 22.9 *1:2 bonus issue in FY11 P/E (x) 23.4 24.9 22.3 18.1 ROCE (%) 21.5 29.1 27.8 27.8 ROE (%) 37.0 38.7 33.3 31.6 P/BV (x) 7.3 8.2 6.3 4.9 For private Circulation Only. Member : BSEL, SEBI Regn.No. INB/F010982338 | NSEIL, SEBI Regn.No.INB/F230607435. Phone: +91 22 40936000 Fax: +91 22 22665758 Email : info@sushilfinance.com Cadila Healthcare Ltd. COMPANY OVERVIEW Zydus Cadila is a global healthcare provider founded by Late Mr. Ramanbhai B. Patel in 1952. After the split in 1995, the group restructured its operations and now it operates as Cadila Healthcare Ltd (Cadila). Cadila manufactures and markets a wide range of products, including formulations, active pharmaceutical ingredients (API), intermediates, biologicals, animal healthcare products and consumer wellness products (Zydus Wellness). It has a strong presence in the cardiovascular, gastrointestinal, women’s healthcare segments, respiratory, pain management, CNS, anti-infectives, oncology, neurosciences, dermatology and nephrology segments with field force of 4,500 reaching out to super specialists, specialists, surgeons, physicians, and the rural markets. On the international front, Cadila operates in both the developed markets of the US, EU and Japan as well as the emerging markets (EMs) of Latin America, Asia-Pacific, Africa and the Middle East. It is one among the very few companies to have presence in the top three markets – US, Japan and Europe. It also has presence in high growth emerging markets. Cadila believes in quality and hence gives more thrust on R&D for its future expansion hence invests close to 5-6% of revenues annually in R&D. Cadila has entered into long-term strategic alliances with global players like Hospira, Nycomed, Abbott Laboratories and Bayer. While it struck JVs with Nycomed (1998) and Hospira (2009), recently it entered into an agreement with Abbott to out-license 24 branded generics to market in 15 key emerging markets from FY12 onwards. Cadila caters to consumer market also via its listed subsidiary - Zydus Wellness, in which it holds 72% share. Zydus wellness is the market leader in the segments present which was possible only due to its niche segment approach. Cadila’s revenue profile can be divided into two broad segments: Domestic Operations (comprising of branded and generic pharmaceutical formulations, API’s, Consumer Wellness business & Animal Healthcare business) International Operations (comprising sales outside of India of branded and unbranded generic pharmaceutical formulations, API’s & JVs with other Pharma companies), Cadila Healthcare Ltd (FY11) Domestic (49.4%) India Formulations (37.9%) API's (0.8%) Zydus Wellness (7.4%) Export (50.6%) Animal Healthcar e (3.3%) Bayer JV (0%) Formulations (37.7%) Formulation Joint Ventures (4.8%) API's (8.1%) - USA (21.4%) - Branded Generics - Europe (6.1%) - Generics Generics - Brazil (5.0%) Hospira JV (4.8%) Abbott JV (0%) BSV Pharma JV (0%) Nycomed JV (1.2%) - Japan (0.9%) - Emerging Markets (4.4%) May 26, 2011 2 Cadila Healthcare Ltd. While previously the India formulations accounted for the largest component of the revenue pie, it has, with time, reduced, and since FY09, the revenue from international operations has taken on greater prominence. Domestic Business India Formulations: Cadila operates both in branded generics as well as generics generics segment in the domestic market although major portion of revenues comes from branded generics portfolio i.e. 94% of domestic formulations revenues. The Company has expanded its portfolio by entering newer therapeutic areas organically or through acquisitions, aggressively launching new products with the first mover advantage in several products, gradually shifting its focus from acute segments to fast growing and sustainable chronic segments (57% of its FY10 domestic revenues) and enhancing market penetration through field force expansion. Cadila has retained its leadership position in cardiovascular, gastro intestinal, women’s healthcare and respiratory segments in the covered market. It is the fifth largest player in the Indian formulation market with ~3.7% market share, according to IMS ORG. As on FY11, 16 of its brands featured in the top 300 pharmaceutical brands in India. It has a strong field force of 4,500 people spread across 11 therapeutic focused divisions and doctor coverage of 125,000. A detailed breakup of the company’s domestic revenue is depicted in the chart below: Domestic Formulations Revenue Breakup 100% % of Domestic Formulations 90% 14 0 2 4 7 14 10 2 3 3 7 10 2 3 3 7 11 11 11 3 2 4 6 10 11 11 11 11 40% 10 10 11 11 30% 17 16 16 16 80% 70% 60% 50% Others Dermatology Diagnostics Neutraceuticals Neurologicals Biologicals Pain Management Anti Infectives 20% 10% Female Healthcare 21 21 21 21 Respiratory GI 0% FY07 FY08 FY09 FY10 CVS Rs. in Mn Domestic Business - Historical Play 18000 16000 14000 12000 10000 8000 6000 4000 2000 0 CAGR (07-11) of 13.4% CAGR (07-11) of 28.8% CAGR (07-11) of 31.3% CAGR (07-11) of 3.9% CAGR (07-11) of (1.8%) Branded Formulations Consumer & Others Animal Healthcare & Others Generic Formulations API's FY08 FY09 FY10 FY07 FY11 Source: Company May 26, 2011 3 Cadila Healthcare Ltd. The domestic business currently constitutes around 49% of FY11 gross sales with branded & generic formulations contributing 78% to its domestic business. Zydus Wellness: Cadila also has a consumer healthcare and wellness business under a separate listed company - Zydus Wellness in which it holds 72.5% stake. Established in 1994, Zydus Wellness Ltd (ZWL) manufactures, sells and markets consumer products in India. Its products include table margarine and spreads, cosmeceuticals and sweet meat. ZWL’s brands include Nutralite, which is table margarine; Sugar Free, which is a low calorie sweetener and EverYuth, which includes skincare products. Nutralite is a table margarine which has less cholesterol and does not contain hydrogenated fats. Under sugar free alternatives and substitutes it offers Sugar Free Gold, Sugar Free Natura, Sugar Free D'Lite ready to drink and powder drink names. Animal Healthcare: Cadila is also present in the animal health market in India through its 100% subsidiary Zydus Animal Health Ltd., (ZAHL), offering several products meant for the livestock and poultry segments. We expect this segment to post a 14.5% CAGR over the next two years and report Rs. 1930 mn revenues in FY13E. International Business Cadila operates in both the developed markets of the US, EU and Japan as well as the emerging markets (EMs) of Latin America, Asia-Pacific, Africa and the Middle East. The company’s foray into the international markets has primarily been through the inorganic route providing it access to brands and distribution channels. Of the territories that the company caters to, the US territory is the most productive from a top line perspective, followed by Europe and then Brazil. A detailed geographical breakup of the company’s export business is given below: Export Formulations Breakup 100% 24% 80% 60% 0% 5% 34% 15% 1% 19% 18% 2% 17% 25% 22% 38% 40% 41% FY07 FY08 FY09 12% 2% 14% 12% 2% 13% 21% 16% 51% 57% FY10 FY11 40% 20% 0% US Europe Brazil Japan Emerging Markets Source: Company May 26, 2011 4 Cadila Healthcare Ltd. 12000 International Revenue Breakup 10000 Rs. in Mn 8000 6000 4000 2000 0 FY07 US Emerging Markets FY08 Europe Hospira JV FY09 Brazil Nycomed JV FY10 FY11 Japan API's Source: Company Joint Ventures (JV’s) Cadila has adopted a unique model to grow its business. It has formed JV’s with strategic partners to have long term relationship which helped the company in having higher revenue visibility and to gain from the experience of its partners. Till now it has formed three such JV’s in the formulations space and one JV in the API space. API JV with Nycomed: Cadila formed a JV with Swiss Pharma major, Nycomed in 1999 to manufacture active ingredients for API Pantoprazole, which is an antiulcerants sold under the brand name Protonix by Pfizer. Its revenue contributions, however, have fallen in Q4FY11 as the Pantoprazole drug lost its patent in Feb 2011 in the US. With the scope of the JV expanded to supply intermediates for 14 additional APIs (including Pantoprazole) for both generic and patented drugs and eventual shifting of its entire API production to India, we expect the sales to pick up slowly. Formulation JV’s: Hospira JV: The JV mainly focuses on Injectibles and for that it has set up a manufacturing facility in SEZ Ahmedabad. FY10 was the first year of commercial operations for the JV with three products for European region. With supply of generic Taxotere formulation from India JV plant in Q4FY11, the Zydus-Hospira JV has reported 156% sales growth in FY11. Out of the six products that the JV plans to supply to US and Europe, the JV has already begun supply of 3 products to Hospira to be marketed in the EU and 1 product to be marketed in the US. The management has indicated plans to launch the remaining products in FY12E. Abbott JV: Cadila entered into a strategic alliance with Abbott Laboratories to license 24 branded generics in 15 key emerging markets in Q1FY11. Abbott has the option to increase the scope of the agreement to 40 drugs. As part of the agreement, Cadila has already received a licensing fee of Rs. 470 mn from Abbott. Bayer JV: Cadila and Germany’s Bayer Healthcare have signed an agreement to set up a 50:50 joint venture (JV) company Bayer Zydus Pharma to market pharmaceutical products in India with focus in areas such as women’s healthcare, metabolic disorders, diagnostic imaging, cardiovascular disease, anti-diabetic treatments and oncology. May 26, 2011 5 Cadila Healthcare Ltd. INVESTMENT ARGUMENTS Domestic business to post a double-digit growth led by new product launches, focused approach on chronics & greater market penetration Cadila is one of the oldest players in the Indian formulations market for several years. With a continuous thrust on improving market presence and market share, it has expanded its portfolio by entering newer therapeutic areas organically or through acquisitions, aggressively launching new products with the first mover advantage in several products, gradually shifting its focus from acute segments to chronic segments and enhanced market penetration through field force expansion. These strategic initiatives have helped the Company become one of the dominant players in the Indian formulations market with theleadership position in several therapeutic categories. Increased focus on Chronic segments….. In recent years, Cadila has strengthened its position in this segment through the creation of the specialty divisions and ramp up in the field force. Cadila derives 57% of its domestic formulations segment from lifestyle related therapy segments (Chronic) with leadership position in cardiovascular, gastro intestinal, women’s healthcare and respiratory segments in the covered market. With a growing shift towards the chronic segment, we believe Cadila will continue to benefit from the growth opportunity in the domestic chronic therapy segments given its established player status and relevant portfolio of products. Ramp up in field force for greater penetration….. With an incresing focus on chronic segments, Cadila is also focusing on expanding its penetration, especially in semi-urban and rural areas and increasing its doctor coverage to 2,00,000 doctors from the current coverage of 1,25,000. In FY11 It expanded its field force in the cardiology by 300 and respiratory by 100 agents, while in FY10, it had formed Zydus Cardiva, with a specific focus on urban markets with a range of anti-hypertensive and aspirin combinations. With a physician focus, these initiatives are expected to start yielding desired results from next year. No. of Products Increase in new product introductions….. Cadila continued its thrust on Domestic new product launches 70 new product introductions to 60 drive growth and launched 60 new products (including 50 line extensions) in the 40 domestic market in FY11. Out 30 60* of this, 24 products were 20 35 30 30 launched for the first time in 25 25 30 10 NA India, the prominent launch 0 being that of indigenously FY08 FY09 FY10 FY11 developed H1N1 vaccine VaxilFlu-S. Going ahead, New product Launches Line Extensions Cadila plans to launch 35-40 Source: Company, Sushil Finance, 60* includes line new products (excluding line extensions extensions) every year. Also only 12% of domestic revenues come from products under Drug Price Control Order (DPCO) that is one of the lowest in the pharmaceutical industry. May 26, 2011 6 Cadila Healthcare Ltd. Introduction of Zydus-Bayer JV in Q4FY11….. Q4FY11 domestic sales witnessed introduction of proceeds from the Zydus-Bayer JV for the domestic markets. As per the terms of the JV, Bayer will supply products and Cadila is expected to use its marketing network to sell the products in the local markets. However, we have not factored in any numbers from the JV in our projections due to inadequate information on the same. Any positive development on the same will act as an upside risk. Domestic Formulations gaining traction 25000 1124 1041 20000 Rs. In Mn 946 15000 833 10000 16200 13625 18792 21423 5000 0 FY10 FY11 Branded Formulations FY12E FY13E Generic Formulations Source: Company, Sushil Finance Domestic formulations gaining traction….. During FY07-10, the company’s domestic formulations revenue reported a CAGR of 10.9%, however, in FY11 it witnessed a growth of 19% which we believe is on the back of various initiatives taken by the company. We expect Cadila’s domestic growth rate to continue to pick up from lower growth rates in FY07-10 as a result of product launches, in-licensing arrangements, and a special focus on rural markets. We thus expect Cadila’s domestic formulations to grow at 14.7% CAGR over the period of FY11-13E. Zydus Wellness – Sustained growth across products Rs. in Mn Zydus Wellness, a 72.5% subsidiary of Cadila, operates in niche health and skincare segments. Among Consumer Business - Sustained growth across products other products, its 6000 portfolio includes low 5000 calorie sugar and low cholesterol alternative 4000 for butter. All these categories are growing 3000 5035 at a CAGR of ~29% for 4127 2000 the period FY07-11. 3355 2675 The strong growth can 1000 1947 1539 be attributed to the 0 sustained robust sales FY08 FY09 FY10 FY11 FY12E FY13E volume growth in its pillar brands: Sugar Source: Company, Sushil Finance Free, EverYuth and Nutralite. The business has been growing rapidly due to a strong growth in their respective product categories and dominant market share in the segments. May 26, 2011 7 Cadila Healthcare Ltd. To cater to the growing demand of Sugar Free and EverYuth, which are outsourced at present, the Company is setting up a manufacturing facility in Sikkim, which is expected to be commissioned in Q1FY12E. This state-of the- art facility will be sufficient to meet the supply requirements for the next five to seven years. Zydus Wellness has launched various products during the year namely: ActivLife (a nutritional supplement). Supplements under the “Sugar free” umbrella Sugar Free tea-lite, Flavoured sachets of sugar free, sugar free mint and Sugar Free Natura Sweet Drops. In the future we expect the business to post robust growth of 22.5% CAGR over FY11FY13E. International markets – US gaining traction and Europe expected to be subdued Cadila has spread its presence in US, Europe, Japan, Latin America, Asia Pacific, Africa and Middle East during the last couple of years by launching products in the therapeutic areas like CVS, GI, pain management, etc. The company’s foray into the international markets has primarily been through the inorganic route providing it access to brands and distribution channels. It also has in-licensing arrangements with international players like Bayer, Nycomed, Hospira etc. On the back of robust performance in international markets mainly US (CAGR 07-11: 61%) and Brazil (CAGR 07-11: 89%), the share of international formulations in the company’s total revenues has increased to 50.6% in FY11 from 32.3% in FY07. Cadila’s international revenues have grown at a CAGR of 46% over the period of FY07-11. US to continue to remain key international market for Cadila….. Accounting for nearly 42% (FY11) of its international revenues, US remains a key international market for Cadila. With a portfolio of 41 products focused, Cadila’s sales have grown at a CAGR of 61.3% in FY07-11 period. Currently, it is among the top 20 generic companies in the US. Strong Pipeline of products 250 41 200 29 150 25 16 100 50 39 65 54 42 130 78 92 106 FY08 FY09 FY10 0 ANDA's Filed ANDA's Approved FY11 Products Launched Source: Company, Sushil Finance Cadila has filed 130 cumulative ANDAs till date and out of that received 65 approvals. It launched 12 new products including four Day-1 in US in FY11. It has filed total 24 ANDAs May 26, 2011 8 Cadila Healthcare Ltd. and seven DMFs during FY11. In Q4FY11, the company saw some new order flows on the back of supply issues for other generic players. To further strengthen its position in the most competitive market, Cadila has initiated the process of launching products in other dosage forms like pulmonary, nasal and Injectibles. It has already filed 7 ANDAs for Nasal and 14 for Parenterals. These products are “difficult to make” ensuring higher growth and better margins. Going forward, the company’s target will be 12-15 ANDA filings and 7 to 8 product launches every year in the US. On the belief that it would be difficult for the company to maintain its historical yearly growth rate on a high base, we expect the growth rate to taper and factor in a 27.5% CAGR over FY11-13E. Japan – though not very significant now, holds immense revenue potential…… Cadila entered the Japanese market through the inorganic route with the acquisition of Nippon Universal Pharma Ltd in FY07. It also has a manufacturing facility approved by the Japanese regulatory authority. With a size of nearly US$80bn, Japan is the second-largest Pharma market globally. However with the generic penetration still low it is the most difficult market to make inroads. Cadila is following a strategy of in-licensing of products and acquisition of brands for better understanding of the market. It launched generic Amlodipine in Japan in FY11, a first for the company as the product was developed and manufactured in India. With 27 inlicensed products and 2 in-house products already launched in Japan and initiation of the process of filling from India, we believe Cadila has created a strong base in Japan. We project sales in the Japanese market to grow at a CAGR of 30% over FY11-13E on a small base. Europe market – subdued growth going forward….. Cadila has a presence in Europe through the inorganic route that it took to enter France (Alpharma SAS, 2003) and Spain (Laboratorios Combix, 2008). Cadila’s European operations have grown at a CAGR of 21.4% between FY07-11. However, it posted flat revenues in FY11 on the back of price cuts that the government takes every two years in France and a challenging Spain market which the company entered in 2009. US & Europe expected to grow at a CAGR of 27.5% & 4.0% over FY11-13E 18000 16000 14000 713 2980 549 2865 12552 2755 422 2000 316 4000 6715 6000 9655 8000 15689 10000 2740 Rs. in Mn 12000 0 FY10 FY11 US FY12E Europe FY13E Japan Source: Company, Sushil Finance May 26, 2011 9 Cadila Healthcare Ltd. Till date in Europe, Cadila has filed 116 new product dossiers and received approval for 67 products. In France, 20 products were launched in FY11, including 4 day‐1 launches. Growth in the market is likely to be a challenge, given the price cuts the country has introduced. Spain, on the other hand, is likely to grow in FY12E. Going forward, the company’s growth in Europe would be driven by new product launches and an improvement in margins by product transfer to Indian facilities. The company has site transferred 46 products for the French market whereas 3 site transfers were done for Spain to protect profitability. However, we expect the Europe market to remain subdued and grow at a CAGR of 4% over FY11-13E. Emerging markets – Brazil to remain the mainstay with focus on increasing its presence elsewhere Cadila, as part of its international strategy, has made significant investments to establish presence in the emerging markets and should benefit as operations in these markets scale up. Brazil market – Garnered significant strength….. In Brazil, Cadila operates in both branded (through the acquisition of Nikkho in FY08) and generic segments (through its subsidiary Zydus Healthcare Brasil Ltda). Cadila’s branded business grew by 15% in FY11 whereas the generic business reported a 25% growth. The launches of four new products have achieved healthy growth in branded generics and pure generic business in Brazil. Cadila has 64 cumulative filings in place; 23 products have been approved, of which 16 products have been launched. Cadila’s sales from this market have grown at a CAGR of 22.3% in FY08-11 period on the back of a strong product portfolio of 25 branded and 16 generics products. Brazilian Business Performance 4000 3500 Rs. In Mn 3000 2500 2000 3459 1500 2813 1000 500 1230 1629 1818 FY09 FY10 2250 0 FY08 FY11 FY12E FY13E Source: Company, Sushil Finance With the strong growth prospects in the Brazilian market and plans to launch 8-10 products annually we believe the company is set for strong growth. We expect the company to register a CAGR of 24.0% over FY11-13E. Emerging markets – Growth momentum to gather pace….. Cadila has presence in more than 20 smaller emerging Pharma markets such as Sri Lanka, Myanmar, Uganda, Taiwan, Philippines and South Africa. As a leading player in some of these markets, Cadila has grown at a CAGR of 22% over FY07-11 with revenues accounting for 4.4% of the total sales (FY11). Cadila made Simayla Pharmaceuticals a wholly-owned subsidiary in FY10 with a view to increase its presence in the SA market. Cadila is May 26, 2011 10 Cadila Healthcare Ltd. developing a strong product pipeline from India to capture the demand for generic drugs in South Africa. Emerging Markets 3000 2500 Rs. In Mn 2000 1500 2780 2376 1000 500 1980 1750 1590 FY09 FY10 971 0 FY08 FY11 FY12E FY13E Source: Company, Sushil Finance Cadila also plans to foray into newer markets and has identified Thailand with market size of $2 bn. It is the second largest pharmaceutical market in South East Asia, growing at 16% CAGR. We thereby expect sales from emerging markets to grow at a CAGR of 18.5% in FY11-13E. Hospira JV to offset for loss of business from Nycomed JV with ramp up in Abbott to start from FY13E. Hospira JV flourishing on the back of Taxotere supply….. Hospira received a USFDA approval for generic Docetaxel (Taxotere) to be sold in the regulated markets. The medication is a generic version of Sanofi-Aventis's Taxotere. Hospira with its JV with Cadila introduced the drug in 4QFY11 resulting in a spurt in sales during Q4FY11. The JV is also sole supplier of Gemcitabine to Hospira which is expected to be launched post Teva’s 180 days exclusivity in July 2011. With this Cadila is supplying 3 products to EU and 1 product to US out of the contract signed for supplying six products in each market. Going forward, we expect sales for the Hospira JV to be maintained at such elevated levels as more products await approvals and the contribution to the Zydus-Hospira JV is expected to rise significantly. We expect the ramp up in this business to happen in FY12E through timely launch of key products. We thereby expect it to register a CAGR of 37.5% over FY1113E. Nycomed JV witnessing de-growth on the back of erosion in the revenues from the generic Pantoprazole….. After the patent expiry of Pantoprazole, the scope of the JV has been expanded to supply intermediates for 14 additional APIs for both patented and generic products. Cadila Nycomed venture has commissioned the newly expanded API manufacturing facility at Navi Mumbai, marking transition of JV from an intermediate manufacturer to a full-fledged API manufacturer. We expect Nycomed JV sales to de-grow at a CAGR of ~13% over FY1113E. Abbott Deal to ramp up from FY13E….. Cadila has entered into a 24 product agreement with Abbott for 15 emerging markets, expandable up to 40 products. The company has already started dossier registrations for the products. Though the product launches would start from FY2012, we believe the ramp May 26, 2011 11 Cadila Healthcare Ltd. up in the revenues will start from FY13E and we have factored in Rs. 500 mn from the same in FY13E. Mixed growth in JV's FY13E 423 FY12E 445 4067 3013 556 FY11 2152 758 839 FY10 0 1000 2000 3000 4000 5000 Rs. in Mn Nycomed JV Hospira JV Source: Company, Sushil Finance Consistent past performance and improving margins Cadila, backed by its steady growth in the domestic market, consistent play in its consumer business and exponential growth in its international business, has delivered excellent numbers in the past. The company’s revenue has grown at a CAGR of 25.7% from FY07-11, while the EBITDA and PAT have grown at a CAGR of 28.6% and 32.1% respectively. This is on the back of the company’s improving margins over the years. 70000 65335 Net Sales (Rs. In Mn) 60000 55069 46302 50000 36868 40000 29275 30000 23229 18547 20000 10000 0 FY07 FY08 FY09 FY10 FY11 FY12E FY13E Source: Annual Report, Sushil Finance EBIDTA (Rs. In Mn) 0 FY07 FY08 FY09 FY10 EBIDTA (Rs. In Mn) FY11 FY12E 13.7% 12.6% 11.1% 8000 14.5% FY07 FY08 FY09 7969 9797 10% 8% 6% 4% 2% 0 EBIDTA Margin 16% 12% 4000 FY13E 18% 14% 6000 2000 15.0% 10.4% 7110 6058 2000 3780 4000 8086 6000 14537 19.7% 12005 8000 10343 20.4% 4582 Rs. in Mn 10000 20.7% 10000 5051 12000 15.4% 3031 22.3% 21.8% 21.9% RPAT (Rs. In Mn) 12000 2576 14000 23% 23% 22% 22% 21% 21% 20% 20% 19% 19% 18% 2338 22.3% Rs. in Mn 16000 0% FY10 RPAT (Rs. In Mn) FY11 FY12E FY13E RPAT Margin Source: Annual Report, Sushil Finance May 26, 2011 12 Cadila Healthcare Ltd. Cadila’s EBIDTA margins saw a marginal increase in FY11 on the back of increased contribution from the Hospira JV (Docetaxel sales in Q4FY11). With the contribution from Docetaxel to decline as competitors enter in the market and increased spend by the company on marketing on account of deeper penetration in domestic market and venturing into newer emerging markets; we believe the EBIDTA margins will decline in FY12E thereby factoring in EBIDTA margin of 21.8% for FY12E. With expanding reach in the domestic business, strong traction from exports triggered by a growing presence in developed and emerging markets coupled with new product launched from the Hospira JV, we expect revenues to grow at a CAGR of 19.5% for FY11-FY13E. Its EBITDA is likely to grow at CAGR of 18.6% and PAT to grow at a CAGR of 17.4% in the same period. Strong balance sheet and Healthy return ratios Debt to Equity 14000 1.2 12000 1.0 1.0 10000 0.8 8000 0.8 4000 0.6 0.7 6000 0.5 0.4 0.5 0.4 0.3 2000 0 0.2 0.0 FY07 FY08 FY09 Debt FY10 FY11E FY12E FY13E D:E Ratio 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 Healthy ROE & ROCE 38.7 33.3 37.0 27.2 26.4 18.2 18.5 FY08 FY09 31.7 29.1 27.8 27.8 FY11E FY12E FY13E 21.5 FY10 ROCE (%) ROE (%) Source: Annual Report, Sushil Finance Cadila did a capex of Rs. 4.6 bn in FY11 and has plans for Rs. 5 bn for FY12 and FY13. The planned expenditure is aimed at developing larger infrastructure and expanding network in vaccine, and domestic formulation business. However, the D: E ratio of the company has decreased from 1.0x in FY09 to 0.5x in FY11. With the company generating sufficient cash flows to fund its future capex requirement, we believe the company’s D:E ratio is likely to decline to 0.3x by FY13E, thus strengthening the balance sheet further. Cadila has healthy return ratios with ROE & ROCE pegged at 33.3% and 27.8% respectively for FY12E. May 26, 2011 13 Cadila Healthcare Ltd. RISK & CONCERNS Price control for the products covered under DPCO While the domestic formulations business enjoys high margins, the industry however remains vulnerable to changes in Government policies related to price control. Approximately 12% of the company's domestic revenues were subject to price control under the DPCO. In the event of expansion of list under price control, the company's revenues and margins might get impacted. Unfavourable currency movements: Cadila derives around 51% of its revenues from its export business to countries like US, Europe, Brazil, and emerging markets etc. Thus any appreciation in the INR against respective currencies will result in the erosion of margins. However, as a conscious effort to mitigate this risk partly, Cadila has taken forward cover to the extent of $93mn for FY12E export revenues. Delay in Regulatory Approvals: A significant portion of Cadila’s topline is expected to be driven by new product launches in the domestic as well international markets. Any unanticipated delays in receiving necessary approvals from the local authorities could hamper our future revenue estimates. Also any negative news flow on the regulatory front in any of the markets that’s the company caters to could impact our earnings estimates. OUTLOOK & VALUATION Cadila with a focused approach towards its domestic business is now looking to improve its presence in the under-penetrated semi-urban and rural areas. We believe new product introductions & increased geographical exposure through field force expansion will help the domestic segment to register a CAGR of 14.7% over FY11-13E. On the export front, Cadila’s strong product pipeline in the US market coupled with the commencement of filling of potential low-competition products (transdermal patches and respiratory products) envisages huge opportunities in the US market. In emerging markets, Cadila is aggressively targeting Brazil and the CIS region. We expect Cadila’s export business to grow at a CAGR of 23.3% over FY11-13E. Cadila achieved the $1bn milestone in revenue during FY11, a 24.6% CAGR growth during FY07-11. With a vision of the management of tripling its business in four years, we believe Cadila's future growth will be led by increased traction in its international businesses, a ramp-up in supplies to Hospira and sustained double-digit growth in the domestic formulations and consumer businesses. In view of strong revenue visibility in business coupled with a healthy balance sheet and best in class return ratios, we recommend an “ACCUMULATE” with a target price of Rs. 960 (20x FY13E EPS). It is currently trading at a P/E of 18.1x its FY13E EPS of Rs. 47.9. May 26, 2011 14 Cadila Healthcare Ltd. PROFIT & LOSS STATEMENT Y/E March Net Sales Raw material (Rs.mn) FY10 FY11 FY12E FY13E 36868.0 46301.8 55068.8 65335.1 BALANCE SHEET STATEMENT As on 31st March Share Capital FY10 (Rs.mn) FY11 FY12E FY13E 682.0 1023.7 1023.7 1023.7 Reserves & Surplus 15603.0 20691.1 27072.4 35272.7 Net Worth 16285.0 21714.8 28096.1 36296.4 11784.0 14753.8 17622.0 20907.2 Manufacturing 1660.0 2502.0 3028.8 3560.8 Secured Loans 9782.0 9850.4 10235.9 10401.5 Staff Cost 3930.0 6089.2 6332.9 7186.9 Unsecured Loans 1123.0 1123.0 1123.0 1123.0 28478.0 36040.0 43063.8 50798.1 Total Loan funds Total Expenditure PBIDT Interest Depreciation Other Income PBT incl OI Tax 11358.9 11524.5 1126.6 1126.6 1126.6 Capital Employed 28723 34484 41624 50450 10343.0 12005.0 14537.1 821.0 780.4 795.1 806.7 Net Block 16844.0 20154.4 23572.3 26684.9 1339.0 1269.2 1582.1 1887.4 Cap. WIP 2111.0 2111.0 2111.0 2111.0 207.0 206.9 206.9 206.9 Sundry Debtors 4668.0 7652.4 7694.5 9129.0 Cash & Bank Bal 2507.0 2952.0 4746.8 8360.0 Loans & Advances 3070.0 4106.3 4224.5 5012.0 Inventory 7504.0 8118.5 10138.7 12143.4 Curr Liab & Prov 8661.0 11188.5 11441.3 13568.7 Net Current Assets 9088.0 11640.7 15363.2 21075.7 Total Assets 28723 34484 41624 50450 159.0 131.1 137.7 163.3 6039.0 8424.5 9765.5 12006.3 741.0 1063.6 1464.8 1800.9 5298.0 7360.9 8300.6 10205.3 Extraordinary Exp./ (Income) -247.0 -251.0 -332.0 -408.2 RPAT after MI 5051.0 7109.9 7968.6 9797.1 FINANCIAL RATIO STATEMENT Growth (%) Net Sales EBITDA Adjusted Net Profit Profitability (%) EBIDTA Margin (%) Net Profit Margin (%) ROCE (%) ROE (%) Per Share Data (Rs.) EPS (Rs.) CEPS (Rs.) BVPS (Rs) Valuation PER (x) PEG (x) P/BV (x) EV/EBITDA (x) EV/Net Sales (x) Turnover Debtor Days Creditor Days Gearing Ratio D/E 10973.4 1141.0 8086.0 RPAT Y/E March 10905.0 Deferred Tax Investments CASH FLOW STATEMENT FY10 FY11 FY12E FY13E 25.9 33.5 74.7 25.6 27.9 38.9 18.9 16.1 12.8 18.6 21.1 22.9 21.9 13.7 21.5 37.0 22.3 15.4 29.1 38.7 21.8 14.5 27.8 33.3 22.3 15.0 27.8 31.6 37.0 45.5 119.4 34.7 40.9 106.1 38.9 46.6 137.4 47.9 57.1 177.7 23.4 0.4 7.3 15.6 3.4 24.9 8.2 17.9 4.0 22.3 1.8 6.3 15.3 3.3 18.1 0.8 4.9 12.4 2.8 46 177 48.6 186.8 51.0 173.0 51.0 173.0 0.7 0.5 0.4 0.3 (Rs.mn) FY10 FY11 FY12E FY13E 6039.0 8424.5 9765.5 12006.3 1339.0 1269.2 1582.1 1887.4 Chg. in Working Capital -403.0 -2107.7 -1927.7 -2099.4 Cash Flow from Operating 6059.0 6508.0 7955.1 9993.4 -2708.0 -4579.6 -5000.0 -5000.0 42.0 0.1 0.0 0.0 -593.0 0.0 0.0 0.0 Cash Flow from Investing -3183.0 -4451.3 -5000.0 -5000.0 (Decr)/Incr in Debt -1768.0 68.4 385.5 165.6 0.0 341.7 0.0 0.0 -1237.0 -1545.8 -1545.8 -1545.8 -2886.0 -1611.7 -1160.3 -1380.2 2507.0 2952.0 4746.8 8360.0 Y/E March Profit before tax & Extraordinary Items Depreciation & Amortization (Incr)/ Decr in Gross PP&E (Incr)/Decr In Intangibles (Incr)/Decr In WIP (Decr)/Incr in Share Capital Dividend Cash Flow from Financing Cash at the End of the Year Source: Company, Sushil Finance Research Estimates May 26, 2011 15 Cadila Healthcare Ltd. Rating Scale This is a guide to the rating system used by our Equity Research Team. Our rating system comprises of six rating categories, with a corresponding risk rating. Risk Rating Risk Description Predictability of Earnings / Dividends; Price Volatility Low Risk High predictability / Low volatility Medium Risk Moderate predictability / volatility High Risk Low predictability / High volatility Total Expected Return Matrix Rating Buy Accumulate Hold Sell Neutral Not Rated Low Risk Over 15 % 10 % to 15 % 0% to 10 % Negative Not Applicable Returns Not Applicable Medium Risk Over 20% 15% to 20% 0% to 15% Negative Not Applicable Returns Not Applicable High Risk Over 25% 20% to 25% 0% to 20% Negative Not Applicable Returns Not Applicable Please Note Recommendations with “Neutral” Rating imply reversal of our earlier opinion (i.e. Book Profits / Losses). Indicates that the stock is illiquid With a view to combat the higher acquisition cost for illiquid stocks, we have enhanced our return criteria for such stocks by five percentage points. Additional information with respect to any securities referred to herein will be available upon request. This report is prepared for the exclusive use of Sushil Group clients only and should not be reproduced, recirculated, published in any media, website or otherwise, in any form or manner, in part or as a whole, without the express consent in writing of Sushil Financial Services Private Limited. Any unauthorized use, disclosure or public dissemination of information contained herein is prohibited. This report is to be used only by the original recipient to whom it is sent. This is for private circulation only and the said document does not constitute an offer to buy or sell any securities mentioned herein. While utmost care has been taken in preparing the above, we claim no responsibility for its accuracy. We shall not be liable for any direct or indirect losses arising from the use thereof and the investors are requested to use the information contained herein at their own risk. This report has been prepared for information purposes only and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. The information, on which the report is based, has been obtained from sources, which we believe to be reliable, but we have not independently verified such information and we do not guarantee that it is accurate or complete. All expressions of opinion are subject to change without notice. Sushil Financial Services Private Limited and its connected companies, and their respective directors, officers and employees (to be collectively known as SFSPL), may, from time to time, have a long or short position in the securities mentioned and may sell or buy such securities. SFSPL may act upon or make use of information contained herein prior to the publication thereof. May 26, 2011 16