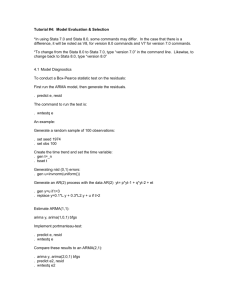

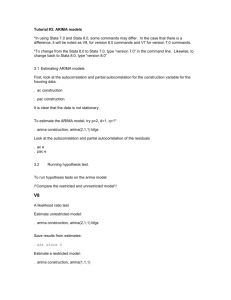

The ARIMA Procedure

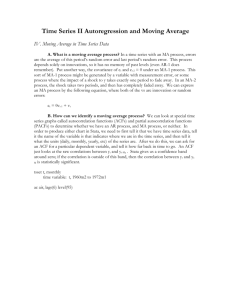

advertisement