E-view ******** 2 *********:***** Time

advertisement

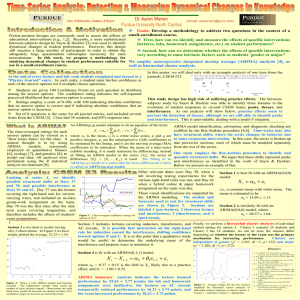

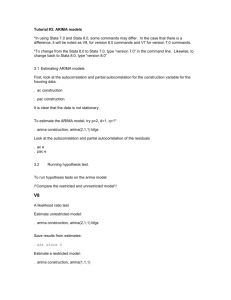

[1]. Graphical Analysis [2]. Autocorrelation Function (AFC) and Correlogram [3].The unit root test Using US_price.xls One simple test of stationary is based on the so-called autocorrelation function (AFC). The AFC at lag k, denoted by k Y Y Y 0 t n 2 Yt Y k k 0 n t k Y In the time series data a large proportion of correlation between Yt and Yt-k may be due to the correlations they have with the interventing lags Yt-1 Yt-2 Yt-3,…..Yt-k+1. The partial correlation removes the influence of these intervening variables. One way of accomplishing this is to consider the ACF and PACF and the associated correlograms of a selected number of ARMA processes, such as AR(1), AR(2), MA(1), MA(2), ARMA(1,1), ARMA (2,2), and so on. Type of model Typical pattern of ACF Typical pattern of PACF AR(p) Decays exponentially or with damped sine wave pattern or both Significant spikes through lags p MA(q) Significant spikes through lags q Declines exponentially ARMA(p,q) Exponential decay Exponential decay Yt Yt 1 t Yt Yt 1 t Yt T Yt 1 t H0: Unit root H1: no unit root Decision rule * If ADF critical value >> not reject null hypothesis, i.e. unit root exists. If * ADF critical value >> reject null hypothesis, i.e. unit root exists. This graph shows the series has a constant mean and constant variance which implies the first difference series of “CPI” achieves stationary Using hk_gdp.xls From the graph -deterministic upward -seasonal cycle Therefore, Non-stationary The ACFs are suffered from linear decline and there are two spikes of PACFs in 1 and 5 The firstdifference series perform with a nonconstant variance. The residuals are not white noise. Since there are seasonal cycles existing in the correlogram, we can try the fourperiod differences. There are two spikes of PACFs and three spikes of ACFs, thus we can have the idea to examine whether there is AR(2) and MA(3) of the series. ARIMA(2,1,3) To judge which is a best fit ARIMA model from different trials and errors, we have to base on some criteria, such as the smallest Schwartz criterion (BIC), Standard Error of Regression (SEE), the highest adjusted R2 and the invertiability condition and significant of AR and MA root, to determine the best fitted model. Also, the residuals of the selected BEST model must be white noise. Using the exchange Rate data The graph of correlogram suggests that ARIMA (p,d,q)? Since there is no significant spikes of ACFs and PACFs, it means that the residuals of this selected ARIMA model are white noise , so that there is no other significant patterns left in the time series, then we can stop at here . If the 6- month TB rate was higher than the 3 month TB rate more expected a priori in the last month, this month it will be reduced by 0.2 percentage points to restore the long-run relationship between the two interest rates. Using Problems 22.16 p. 866 Using the data on PCE and PDI given in table 21.1, develop a bivariate VAR model for the period 1970-I to 1990-IV. Use this model to forecast the value of these variables for the four quarter of 1991 and compare the forecast values with the actual values given in table 21.1 22.18 estimate the impulse response function for a period of up 8 lags for the VAR model that you developed in exercise 22.16 The IRF traces out the response of the dependence variable in the VAR system to shocks in the error term. Suppose the error term in equation 1 (PCE) increases by a value of one standard deviation. Such a shock or change will change PCE in the current as well as future periods. But since M1 appears in the PDI, the change in error term in equation 1 will also have the impact on PDI.