Banking Handbook - North Carolina State Treasurer

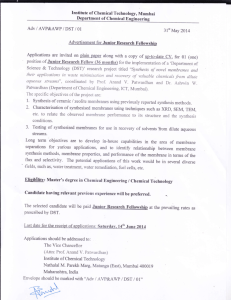

advertisement