Slide Handout

advertisement

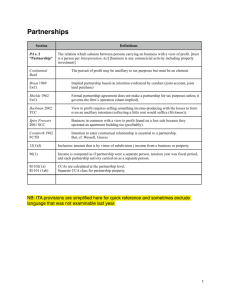

3/21/08 TX 2 Advanced Personal and Corporate Taxation Module 7 Partnerships 1 Module 7 Part 1: Topics 7.1 Definition, 7.2 Computation of Income, 7.3 Computation of ACB of Partnership Interest, 7.9 Information Return Part 2: Topic 7.4 Transfer of Property to Partnership and Admission of New Partner Part 3: Topics 7.5 Withdrawal of a Partner, 7.6 Dissolution of a Partnership Part 4: Topic 7.8 Transfer of Property by a Partnership to a Corporation Part 5: Topic 7.7 Limited Partnerships 2 What is a Partnership? Legal definition: a relationship that exists between persons carrying on business in common with a view to profit Partner may be an individual, corporation or another partnership 3 1 3/21/08 Computation of Income • • • • S. 96(1): partnership computes its income as if it were a person Requires computation of income at the partnership level – CCA Allocation to partners according to the partnership agreement Income or loss retains its source 4 Year-end s. 249.1(1)(b) a partnership with an individual or professional corporation as a member must have a December 31 year-end, unless alternate method elected Where no members are individuals or professional corporations: can have noncalendar year-end 5 Year-end Partners include in their income their share of the partnership income or loss earned during the fiscal period of the partnership ending in the fiscal period of the partner Can achieve tax deferral through selection of year-ends in non-individual/professional corporation situations 6 2 3/21/08 Tax Deferral Example corporate partnership year-end October 31 partner year-end September 30 October 31, 2005 partnership income included in partner’s taxable income for year-ended September 30, 2006 11 month tax deferral corporate 7 Partnership Returns Partners file tax returns and pay tax on partnership income – not partnership Partnerships of more than 5 partners must file information returns 8 Specified Partnership Income • Special rules in s. 125 limit the small business deduction available to corporations on their partnership income 9 3 3/21/08 Computation of the ACB of a Partnership Interest Partnership interest is a capital property for determining tax consequences of dissolution of a partnership, withdrawal of partner, disposition of a partnership interest, or death of a partner Important 10 Partnership Interest ACB Almost all the partner’s transactions with the partnership will involve ACB adjustments ACB adjustments: s. 53(1)(e) and 53(2)(c) 11 Partnership Interest ACB Add: Capital contributions Less: Capital withdrawals (draws) Add: Net income for tax purposes, i.e. after adjustments for book amortization / CCA, non-deductible expenses, plus 100% of capital gains and other adjustments under s. 53 Less: Net loss for tax purposes (s. 53 adj) Equals: Partnership Interest ACB 12 4 3/21/08 Negative ACB • • • Usually because partner’s draws have exceeded income allocation or allocation of partnership losses in excess of capital contributions Treated as a capital gain but usually only realized on disposition of the partnership interest, except: Limited partnerships – immediate capital gain recognized 13 Part 2 – Transfer of Property to the Partnership and Admission of New Partner • • • May be done on formation of partnership or at any time Rollover available – s. 97(2) Conditions for s. 97(2) rollover: Canadian partnership (all partners resident in Canada), transferor must be a partner of the partnership receiving the assets immediately after the transaction 14 s. 97(2) Rollover • • • Consideration taken back may include a partnership interest (doesn’t have to, unlike S. 85 which required at least 1 share must be taken back) If agreed amount > consideration received, excluding partnership interest, difference is added to the ACB of the partner’s interest Form T2059 (similar to T2057 for S. 85) 15 5 3/21/08 Superficial Loss s. 40(2)(g)(i) • • Partner and partnership are affiliated persons (s. 251.1(1)(f)) if partner holds majority interest When majority interest partner transfers property to partnership and incurs capital loss, stop loss added to ACB of property acquired by partnership 16 Admission of New Partner A partnership dissolves if there is any change in the partners, unless the partnership agreement provides for the continuation of the partnership New partner could enter partnership by acquiring partnership interest from one or more partners, contribute capital, or combination 17 Admission of New Partner • • If through acquisition of partnership interest, existing partners dispose of portion of interest with resulting capital gain or loss No deemed disposition of partnership interest for existing partners if capital contribution and no ACB adjustment 18 6 3/21/08 Part 3: Withdrawal of Partner Many different ways for partner to withdraw: sale of partnership interest, buy-back of interest by partnership (redemption), retention of residual or income interest, or combination 19 Consequences to Partnership: S. 98(6): full rollover if a Canadian partnership ceases to exist and all of its property is transferred to another Canadian partnership whose partners were all partners in the old partnership The new partnership is deemed to be a continuation of the old partnership Applies only if all of the property of the old partnership is transferred to the new partnership 20 Consequences to Withdrawing Partner: • • Sale of interest- capital gain/loss on disposition Buy-back of Interest by partnership - Where the partner withdraws but retains for a period of time a right to receive property of the partnership in satisfaction of his interest (residual interest) 21 7 3/21/08 Buy-back S. 98.1(1)(a) the withdrawing partner is deemed not to have disposed of his interest in the partnership Withdrawing partner may recover amounts taxfree up to his partnership interest ACB Further recoveries are capital gain as negative ACB taxed as capital gain in year it goes negative (not deferred until interest paid-out in full) 22 Income Interest in Partnership: • • Common in professional partnerships. Arrangement to allocate future partner income to retired or deceased partner pursuant to partnership agreement (retirement income) 23 Income Interest in Partnership: S. 96(1.1) provides that this type of payment is to be treated as a distribution of partnership profits Retired partner deemed to continue to be member of partnership Income retains its source, i.e. business income Certain conditions must be met 24 8 3/21/08 Dissolution of Partnership: S. 98(2) - property transferred to partner deemed disposed of by partnership at fmv Tax implications: recapture of CCA, capital gains on the disposition of partnership assets to the partners, ACB adjustments S. 98(3) Rollover: election to permit a tax-free rollover of partnership property to the partners in certain circumstances 25 s. 98(3) Roll-up • • • • Conditions: Canadian partnership ceased to exist, all property distributed to partners, each person has undivided interest in each property Joint election - form T2060 Partnership property deemed disposed of at cost amount – no gain or loss on dissolution Partner deemed to dispose of partnership interest at greater of ACB of partnership interest or cash and % cost amount of property distributed. Usually no gain or loss. 26 Business Continued by One Partner: S. 98(5): tax-free rollover of assets from a discontinued partnership to a proprietorship Applies where, within three months of the termination of a Canadian partnership, one of the former partners commences to carry on the business of the previous partnership as a sole proprietor Partnership property is received as POD of partnership interest 27 9 3/21/08 Business Continued by One Partner: Deems the member of the partnership who becomes the proprietor to have acquired partnership interests and not to have acquired partnership property S. 98(5) - not an elective provision - operates automatically when conditions are met 28 Part 4: Transfer of Property by Partnership to a Corporation Rollover for incorporation of partnership – s. 85(2) and s. 85(3) Election form - T2058 2 step process: s. 85(2) rollover of partnership property followed by s. 85(3) rollover of shares to partners Partnership must be wound up within 60 days of the s. 85(2) transfer 29 Incorporation of Partnership Partnership may receive cash and shares from the corporation as consideration for the s. 85(2) asset transfer S. 85(3) - rollover treatment for the transfer of the consideration received from the corporation to the partners on the winding-up of the partnership 30 10 3/21/08 Part 5: Limited Partnerships (LP) Common in real estate, tax shelter investments used to limit legal liability and limit risk to amount invested (capital contribution), i.e. not jointly and severally liable for partnership’s acts, nor are they liable to compensate for losses incurred by LP Limited Partner – S. 96(2.4) definition Usually 31 At-risk Rules S. 96(2.1) to 96(2.7) limit the amount of losses which can be deducted by a limited partner for tax purposes Write-off limited to the “at-risk” amount S. 96(2.2) - calculation of the at-risk amount Running total of capital contributions (ACB of initial investment) less write-offs allocated 32 Negative ACB of LP Partner realizes capital gain at end of fiscal period of partnership in which ACB went negative 33 11