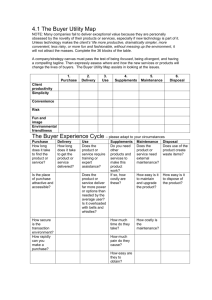

Bensaou's buyer-supplier relationships

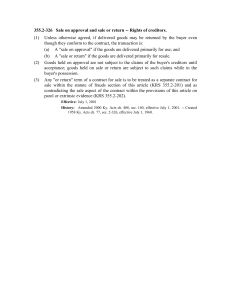

advertisement