ANNUAL REPORT 2014

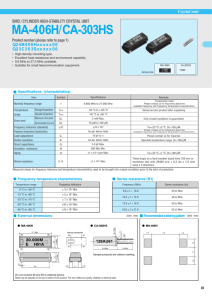

advertisement