GOVT functions that promote greater competition

advertisement

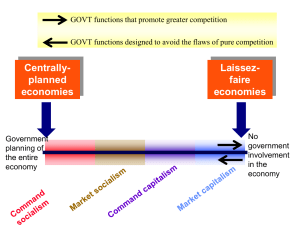

GOVT functions that promote greater competition GOVT functions designed to avoid the flaws of pure competition Centrallyplanned economies Government planning of the entire economy Laissezfaire economies No government involvement in the economy FOUR TYPES OF ECONOMIES Market capitalism - capital and natural resources are generally owned by private individuals who have the power to make decisions concerning their uses [i.e., USA, ROC, Japan, W. Europe] Command capitalism - capital and natural resources are generally privately-owned, but government has broad power to determine their uses [i.e., Middle East, Africa, Latin America] Command socialism - government owns most of the capital and natural resources and exercises broad power to determine how the economy’s resources will be allocated [i.e., Cuba, North Korea] Market socialism - government owns most of the capital and natural resources, but allows individuals who operate firms to make choices about the use of these factors [i.e., Russia, former Warsaw Pact countries] ECONOMIC FUNCTIONS OF GOVERNMENT [Based on McConnell & Brue, ECONOMICS, 13th ed., pp. 81-85] Government functions that strengthen/facilitate the operation of the market system • provide the legal foundation and social environment conducive to the effective operation of the market system - i.e., develop system of uniform weights and measures, “rules of the game,” [Pure Food and Drug Act of 1906, Fair Credit Reporting Act of 1968, etc.] • maintain competition by enforcing or simulating competition - i.e., anti-trust legislation, regulate “natural monopolies,” etc. Government functions that modify or supplement the operation of the market system • redistribution of wealth (1) transfer payments (2) market intervention (3) personal income tax • adjusting the allocation of resources to alter the composition of domestic output (1) positive and negative externalities (2) public goods/services (3) stabilizing the economy (a) fiscal policy (b) monetary policy KEYNESIAN ECONOMIC THEORY Business cycle fluctuations result from imbalances between aggregate demand and productive capacity • Aggregate demand is the total amount of money available in the economy to be spent on goods and services • Productive capacity is the total value of goods and services that can be produced by the economy when it works at full employment • Government can adjust imbalances by manipulating fiscal policies, monetary polices, or both FISCAL POLICY Inflation [too much demand] Taxes Spending Fiscal policy is the domain of the president and Congress. Fiscal policy has been criticized as being (1) too political (2) too slow recognition lag Recession [demand too weak] decision-making lag Taxes administrative lag operational lag Spending Ricardian Equivalence Theorem “Crowding-Out” Effect MONETARY POLICY Inflation Monetary policy is the domain of the Federal Reserve Board. Reserve requirements Discount rate Recession Reserve requirements Discount rate Many economists prefer monetary policy over fiscal policy because the Federal Reserve Board is thought to be insulated from politics and time lags are not as great.