Comprehensive Guide to the ITR12 Return for Individuals

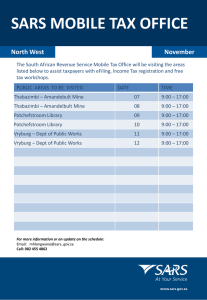

advertisement