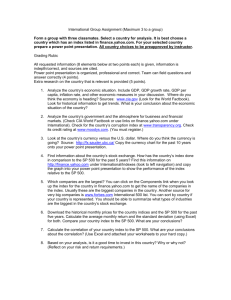

ExChAnGE RATE pOlICY, GROWTh, AnD fOREIGn

advertisement