Ice Cream and Frozen

Dessert Shops

Industry Overview

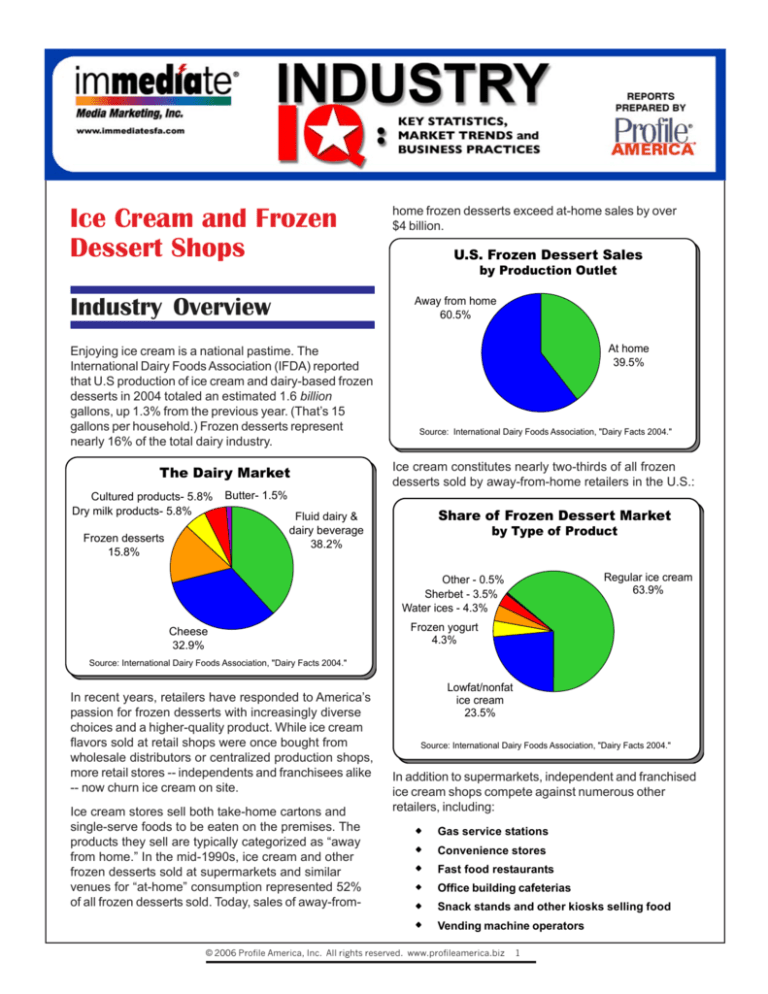

The Dairy Market

Frozen desserts

15.8%

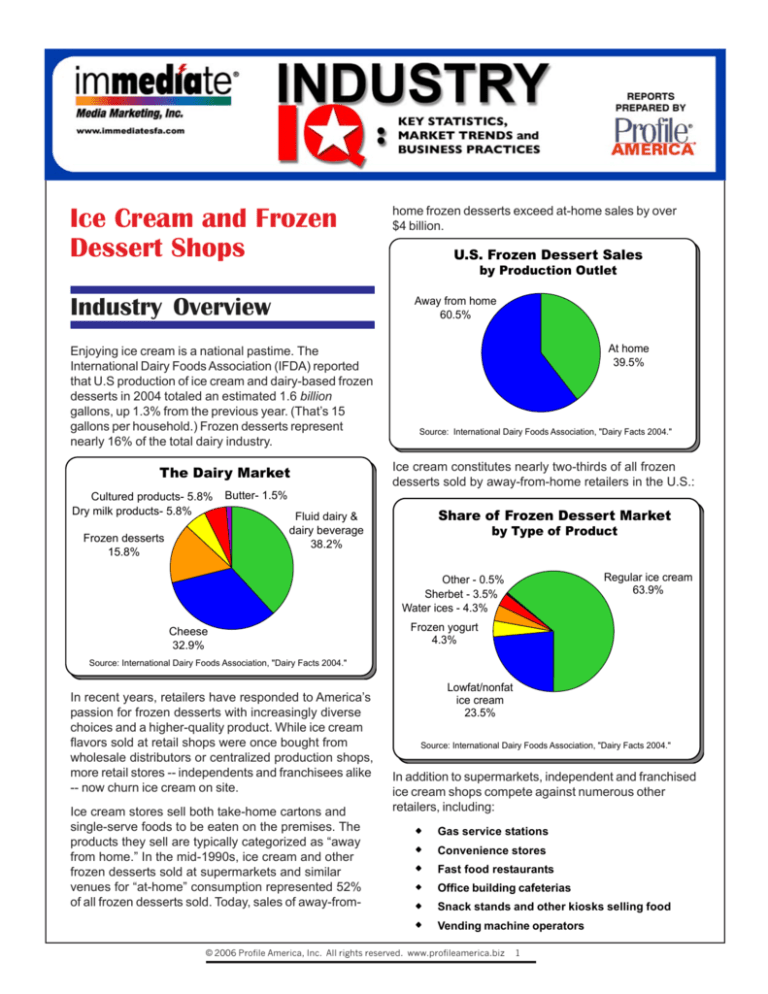

U.S. Frozen Dessert Sales

by Production Outlet

Away from home

60.5%

Enjoying ice cream is a national pastime. The

International Dairy Foods Association (IFDA) reported

that U.S production of ice cream and dairy-based frozen

desserts in 2004 totaled an estimated 1.6 billion

gallons, up 1.3% from the previous year. (That’s 15

gallons per household.) Frozen desserts represent

nearly 16% of the total dairy industry.

Cultured products- 5.8%

Dry milk products- 5.8%

home frozen desserts exceed at-home sales by over

$4 billion.

At home

39.5%

Source: International Dairy Foods Association, "Dairy Facts 2004."

Ice cream constitutes nearly two-thirds of all frozen

desserts sold by away-from-home retailers in the U.S.:

Butter- 1.5%

Share of Frozen Dessert Market

Fluid dairy &

dairy beverage

38.2%

by Type of Product

Regular ice cream

63.9%

Other - 0.5%

Sherbet - 3.5%

Water ices - 4.3%

Cheese

32.9%

Frozen yogurt

4.3%

Source: International Dairy Foods Association, "Dairy Facts 2004."

In recent years, retailers have responded to America’s

passion for frozen desserts with increasingly diverse

choices and a higher-quality product. While ice cream

flavors sold at retail shops were once bought from

wholesale distributors or centralized production shops,

more retail stores -- independents and franchisees alike

-- now churn ice cream on site.

Ice cream stores sell both take-home cartons and

single-serve foods to be eaten on the premises. The

products they sell are typically categorized as “away

from home.” In the mid-1990s, ice cream and other

frozen desserts sold at supermarkets and similar

venues for “at-home” consumption represented 52%

of all frozen desserts sold. Today, sales of away-from-

Lowfat/nonfat

ice cream

23.5%

Source: International Dairy Foods Association, "Dairy Facts 2004."

In addition to supermarkets, independent and franchised

ice cream shops compete against numerous other

retailers, including:

Gas service stations

Convenience stores

Fast food restaurants

Office building cafeterias

Snack stands and other kiosks selling food

Vending machine operators

© 2006 Profile America, Inc. All rights reserved. www.profileamerica.biz

1

Issues and Trends

Despite American’s penchant for tasty treats, ice cream

sales have been stagnant for the last few years.

According to Dairy Field (June 2005), actual gallonage

sales were down 1% in 2004. This reality, however, has

not dampened the optimism of those in the industry. The

fact is that more than 90% of Americans are ice cream

buyers, and the current market for ice cream is

estimated to be about $20 billion (Dairy Field, January

2005).

Other positive trends include increased production in the

industry. Regular ice cream production reached a new

record high of just over 1 billion gallons in 2003. Furthermore, low-fat and non-fat ice cream’s production volume

grew almost 4%, to nearly 374 million gallons (IFDA,

“Dairy Facts 2004”).

The growth in production of low-fat and non-fat ice cream

marks a trend in the industry in response to consumer

demand. An estimated 60% of mature Americans are

either dieting or planning to diet, and ice cream shops

around the country have been forced to include new

products in order to cater to this large percentage of the

population (Dairy Field, June 2005).

Luckily, innovation and technology have advanced to the

point where most low-fat and non-fat products are as

tasty as (or almost) full-fat products (Dairy Field, January

2005). More and more ice cream shops have recognized

this trend and have moved to incorporate healthy options

into their existing product offerings.

Aside from an increasingly health-conscious population,

ice cream shops have had to face a number of other

challenges, some of them are listed below:

When the cost of ingredients increases, it

forces retailers to raise prices. Vanilla extract,

for example, went from $60 to $238 a gallon

because of shortages resulting from floods in

Madagascar, Indonesia and Mexico. That crisis

subsided (The Washington Post, May 4, 2005),

but then milk prices increased because fewer

cows are producing it. Even those shops that

do not make their own ice creams have been

forced to charge more to accommodate

increasing supplier prices.

Energy prices. The cost of energy has impacted many small businesses, including even

small retail shops. Higher operating costs are

just the beginning. Many customers that would

otherwise patronize shops are also paying

higher fuel bills, which will cut into their level of

spending on “treats.”

Most ice cream shops do the bulk of their

business in the summer months, with some

businesses reporting that 70% of their annual

sales come occur May and the end of September. Because of this ebb-and-flow situation, it

is difficult for shops to maintain a full staff

during slow times and then build a knowledgeable staff up again in busier times.

Shop owners repeatedly cite weather as a

challenge to their success. In an atypically

rainy or cold year, sales plummet.

Competition with in-store ice cream products.

Americans are tempted by the many cartons

of ice cream available at their local grocer. In

fact, some stores have more than 17 doors of

ice cream of all types and prices available to

the everyday consumer. With a couple of

quarts of the frozen treat at home, consumers

are less likely to stop at a specialty shop.

Sources: The National Dipper, March April 2005; Dairy Field, January

2005; The Business Journal, June 10, 2005.

A number of successful chains specialize in ice cream

and frozen desserts. Some (like Dairy Queen and

Baskin Robbins) have been recognizable brands for

decades; others are newcomers to the industry.

Top Franchises in the U.S.

Franchise

# of Locations 2005

Dairy Queen

5,741

Baskin Robbins

5,124

Cold Stone Creamery

1,203

Ben & Jerry's

616

Dippin Dots

618*

TCBY

1,360*

Maggie Moos

167

Marble Slab Creamery

312

Haagen Dazs

240*

Source: Entrepreneur Magazine, “Top 500 Franchises,” January 2006.

* Indicates number of stores in 2004.

Though most of these top franchises are successful,

with recognizable brands and advertising campaigns, the

industry is dominated by small local family-owned

chains or one-location independent shops -- many of

which are successful in their own right. Amy’s Ice

Creams, Inc., for example, which has 10 locations in

Texas, reported that its revenue reached around $4.5

million (Austin Business Journal, October 29, 2004). The

Blue Sky Creamery, in Minnesota, said it expects 2005

revenue from its single location to hit $500,000 (The

Business Journal, June 10, 2005).

© 2006 Profile America, Inc. All rights reserved. www.profileamerica.biz

2

In its “Industry Outlook,” The National Dipper interviewed

a number of independent store owners, all of whom

reported solid gains in 2004. While some saw greater

gains than others, all were pleased with the state of

affairs and expressed optimism about the near-term

outlook (March/April 2005).

Most small shops need to stand out from the crowd and

convince customers that theirs is a shop worth visiting.

Consumers typically visit ice cream and frozen treat

shops not only for the ice cream or frozen treat, but for

the experience. Small shops should look to make that

experience uniquely entertaining in order to promote

return visits (The National Dipper, March/April 2005).

One way stores have created a satisfying experience is

by providing a family-friendly atmosphere. The “oldfashioned, family-style” concept has proven successful

for a number of small shops (Orlando Business Journal,

January 7, 2005). Other shops have added a “wacky”

element to everything from their flavors’ names to their

employees’ attire (Austin Business Journal, October 24,

2004).

Ensuring that customers have a positive in-store

experience is an important element in the overall formula

for success, especially since happy customers tend to

become repeat customers. Attracting new customers is

also vitally important, so shops use a variety of

advertising vehicles to build awareness. In addition to a

growing tendency to create websites to tout their

products and educate or motivate consumers, the most

commonly used ad media, according to IFDA’s “Dairy

Facts 2004,” include the following:

Newspapers

Local magazines

Local television, including cable

Yellow Pages

Radio

Direct mail

Billboards and other signage

Ice creams made with premium ingredients, such as

seasonal fruits or high-quality chocolates, typically cost

around $4 for a single serving. Ice cream cakes (e.g.

those sold by Carvel, Baskin Robbins, and Cold Stone

Creamery), sell for $18 to $40, depending on the size

and the design work that goes into the cake.

Critical Success Factors

CSFs for Frozen Dessert Shop

Owners and Operators

Self promote. Often the best way to promote a

small ice cream shop is to let other people

know directly how great the product is (e.g.,

providing samples and coupons to passers-by

and neighboring merchants).

Allow passion to show in the product. Offer

high-quality ice cream and other treats with

original, fun flavors.

Promote value over price. Often the value of

the product will outweigh the price; a product

can be so good that customers do not mind the

price.

Get customers’ contact information. Keeping

in touch with customers is a good way to

encourage them to return.

Make customer service the priority. Greet

customers as soon as possible. Gladly provide

sample tastes. Give away the occasional cone

at no cost to help engender loyalty.

Change things up in the store. Create new

flavors and/or product offerings. People are

more likely to make unplanned stops if they

know the store’s offerings are likely to change.

Sources: The National Dipper, May 2004, May/June 2005; Orlando

Business Journal, January 7, 2005, Baltimore Business Journal, March

18, 2005.

Industry Resources

Value of Products and

Services in the Industry

Average household spending on away-from-home ice

cream is around $114 ($12.5 billion divided by 122

million households).

According to an article in The Boston Globe (May 23,

2004), the average price of an ice cream cone rose 35 to

45 cents, due ingredient cost increases. Most ice cream

cones cost between $1.50 (for a small) and $3.25 (for a

large, or double scoop).

International Dairy Foods Association

International Ice Cream Association

1250 H Street N.W., Suite 900

Washington, D.C., 20005

202-737-4332

www.idfa.org

The National Dipper

1841 Hicks Road, Suite C

Rolling Meadows, IL 60008

847-202-4770

www.nationaldipper.com

Ice Cream Reporter

7 Hilton Terrace

Willsboro, NY 12996

518-963-4333

© 2006 Profile America, Inc. All rights reserved. www.profileamerica.biz

3

Background

Values and Benefits

Media Marketing, Inc., creators of imMEDIAte®

software, has been in the forefront of sales

presentation systems since 1987. The imMEDIAte

suite, a state-of-the-art consultative system, is

used by hundreds of media reps every day to

create compelling presentations and expert

media proposals. Built on Microsoft Office®

technology, the imMEDIAte system provides a

complete solution to your media sales needs.

Media Marketing is an authorized distributor of

Profile America’s IndustryIQ reports. Sales and

marketing teams embrace these industryknowledge reports because of their concise,

easy-to-read style and rich store of information.

Regular use of IndustryIQ reports creates a

relationship-building, consultative environment.

Sales reps want to be smart about advertisers’

industries, but face the realities of limited time

and resources. They need to track dozens of

different industries, and value these concise,

easy-to-use sales tools that they can leave

behind with their advertisers.

Likewise, managers want reps to be confident,

professional and informed. They want their

reps viewed as partners, not vendors -- and

they appreciate the IndustryIQ method of

collecting, analyzing and presenting

information.

Independent, third-party IndustryIQ reports

leave marketing and sales professionals free

to practice their core competencies:

developing successful advertising strategies

for their clients.

Since 1986, Profile America has provided

profiles of industries, markets and trends to

business-to-business marketers, facilitating an

understanding of the industries into which they

sell their products and services.

Program Objectives

IndustryIQ reports are used by managers as

sales training, planning and business

development tools. Sales reps use IndustryIQ

reports to prepare for sales calls and as a

valuable leave-behind.

Armed with independent, third-party

assessment of industry dynamics, media reps

can “walk the walk and talk the talk” of their

advertisers’ industries, allowing reps to better

assist advertisers in creating compelling,

effective messages for their target audiences.

Delivery

IndustryIQ reports incorporate a customerguided approach to gathering information and

creating industry-knowledge products. We

value your content recommendations as we

strive to create the most useful, fact-filled

industry reports available.

IndustryIQ reports are available in PDF format

from Media Marketing’s web site,

www.immediatesfa.com.

IndustryIQ is distributed by Media Marketing, Inc. in association with Profile America, Inc. for use by advertising sales representatives.

Although the information in this report has been obtained from sources that Profile America, Inc. believes to be reliable,

no guarantees are made as to the accuracy of the information presented, and any information presented may be incomplete or condensed.

© 2006 Profile America, Inc. All rights reserved. www.profileamerica.biz

4