United Kingdom Defense Market Overview

advertisement

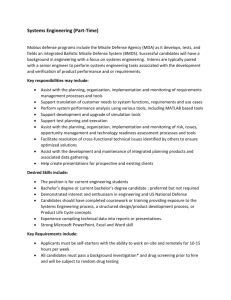

Pennsylvania’s Department of Community and Economic Development Office of International Business Development United Kingdom Defense Market Overview This study was prepared under contract with the Pennsylvania Department of Community and Economic Development, with financial support from the Office of Economic Adjustment, Department of Defense. The content reflects the views of the Pennsylvania Department of Community and Economic Development and does not necessarily reflect the views of the Office of Economic Adjustment. UNITED KINGDOM --- U.K. DEFENSE MARKET OVERVIEW Martin Lewis, Authorized Trade Representative—ATR Pennsylvania Trade Office for the UK, Ireland, and Scandinavia The Country & Its Economy in Brief : - U.K. (or Great Britain) comprises England, Scotland, Wales, & Northern Ireland. (Populations : 54m., 5m., 3m., and 2m., total : 64m.). Constitutional monarchy, Head of State—HM Queen Elizabeth (since 1952). Parliamentary democracy, New Government May 2015 (Term 5 years). Full member (since 1973) of European Union - EU, but outside Euro currency zone. Permanent Member of UN Security Council and all UN Agencies. Leading member of NATO, OECD, and WTO. Founder and Head of (British) Commonwealth—53 Member States worldwide. Economy is large (6th worldwide) open, dynamic, advanced, and progressive, totally dependent upon foreign trade and investment (FDI). Transatlantic (USA—UK) cumulative trade/FDI relation, largest worldwide. GDP = GB£1.94 tr. (US$2.85 tr.)*, current annual growth 2.6 %, comparable to USA, and 2% above other EU countries. Pennsylvania’s 3rd (or 4th depending on exchange rates) largest export market worldwide after Canada and Mexico, accounting for US$1000-1500m. per annum. Largest single (country) market in Europe for both Pennsylvania and US exports. Very favorable business environment for Pennsylvania companies: Common language and longstanding trading relationship, similar business practices and comparable legal/financial/regulatory systems, and excellent business services and communications (plus easy travel: (+) 5 hours time difference and 6-7 hours flight). ...................................................................................................................................................... *Note : Currency data in this Overview converted at the long-term average GB£1 = US$1.5. Backgound & Introduction: The (UK) defense market is extremely complex, competitive, and problematic for smaller-medium companies (SME’s) to penetrate and in which to succeed. Rather than presenting lengthy, detailed, and exhaustive descriptions of the UK defense establishment, the armed forces, and military programs— The aim, intention, and focus of this Report is to propose seven Key Elements of a UK defense market entry/supply chain strategy, which should provide a realisable and practicable agenda, applicable to all PA companies, especially those new-to-market, irrespective of their products and services, and based upon : - UK industry/trade associations, primarily A-D-S (www.adsgroup.com ), - UK trade shows, primarily: Farnborough International (www.farnborough.com) and DSEi (www.dsei.co.uk), and associated ‘Meet the Buyer’ events. And for homeland security: Counter Terror Expo (www.counterterrorexpo.com), InfoSecurity Europe (www.infosec.co.uk), and the Home Office Security & Policing event (www.securityandpolicing.co.uk). Note also the value of associated conferences, seminars, workshops, company presentations, etc. at these trade shows both as such, and for the identification of top company executives and management, which otherwise can be very elusive. -UK Ministry of Defence (www.mod.uk) – Defence Suppliers Service-DSS, Defence Equipment & SupportDE & S, and its associated business-oriented events and information sources. Available and specific named contacts are given where possible, as are Case Studies in which PA and/or US companies are involved, which can respectively assist and illustrate the defense market entry strategy. For more comprehensive coverage, status reports, analyses, etc. of the overall UK defense world, the reader is referred to the Sources & Resources section at the end of this Overview. The three Key Defense Related Sectors covered in this Overview are : -Aerospace - Defense* - Homeland Security All are of course closely linked, with many companies active in two or all, but their separate treatment here is predicated on the size and prominence of the UK aerospace industry and the differing and growing place of homeland security including counter-terror and cyber-defense. * Here defence in the classic sense, primarily the three national Armed Forces. All are much dependent upon Government policy and funding, and both driven by and resulting in scientific and technological advances. They are also characterized by international co-operation and competition at both the national and company levels—And most notably by the very long-standing links and joint programs in defense as such, and the intense trade and investment (Foreign Direct Investment-FDI) flows between the UK and the USA. All are leading, successful, and growing sectors in the UK economy (and its import/exports and FDI), technology-driven and largely recession-proof—And with significant opportunities throughout for Pennsylvania exporters. Those already supplying the US defense industry will of course have a ‘head-start’ and an excellent reference to build upon. Although the UK still commits approx.2% of GDP (US$60bn.) to defense, there is much pressure on this from other major and ‘untouchable’ national budgets (education, health, social security...) -- But the on-going uncertain global geo-political situation is rapidly pushing defense up the political agenda. Future Growth Areas : See: - Defence Equipment & Support (DE&S) : Corporate Plan FY 20152018 http://www.gov.uk/goverment/publications/defence-equipment-and-support-corporate-planfinancial-year-2025-to-2018 : DE&S (pdf). - The Defence Equipment Plan 2014 http://www.gov.uk/government/publications/the-defence-equipmentplan-2014 : MOD (pdf). - UK Defence & Security Report (includes 5-year forecast to 2018), Q1 2015: Business Monitor International (www.businessmonitor.com). (Available as a pdf from UK-ATR). These Reports and others summarize the major UK on-going and future Navy/Army/Air Force defense procurement programs and their prime contractors (all US$ data approximate) : - Type 26 Global Combat Ship (or frigate): BAE Systems (the main UK defense contractor www.baesystems.com) ), US$ 600m.per ship, first to enter service in 2022. - Three offshore patrol vessels: BAE Systems, currently under construction. - Two QE-Class aircraft carriers, Royal Navy flagships: Consortium of Babcock International (www.babcockinternational.com) / Thales (www.thalesgroup.com/en/united-kingdom) / BAE Systems, total US$9bn., currently under construction, and will be equipped with (US) F-35 Lighting aircraft (as below). - Scout armoured vehicles (590): General Dynamics UK (www.generaldynamics.uk.com), US$5.25bn., UK construction start 2017. - F-35-C Lighting-II multi-role/stealth aircraft: Lockheed-Martin (www.lockheedmartin.co.uk), US$100m each, first batch (14) delivery in 2016. - Paveway precision-guided missile/munitions: Raytheon (www.raytheon.co.uk), contract this year. Major Projects at longer-term include: Unmanned aircraft (ucav) future combat air system (current Taranis US$180m. demo project): BAE Systems and 250 UK sub-contractors. And: Vanguard submarine-- Trident nuclear missile Successor project: BAE Systems/ Babcock/RollsRoyce (www.rolls-royce.com), US$20bn., estimated delivery 2028. As noted below, UK-ATR can provide buying contacts at these (and other) major UK defense contractors. Other specific growth areas include: Stealth and/or unmanned aircraft (uav’s) and drones, other robotic and non-manned vehicles, counter terror, and cyber/ICT/infrastructure/transport security. Key Defense Sectors for Pennsylvania Companies in the U.K. : Aerospace : The UK has the largest aerospace industry (civil & military) outside the USA, employing around 110,000 (half of which is in defense/military), turning over approx. US$45bn. per year, and accounting for approx. 17% of the global market. The industry is characterised by both co-operation and competition between the UK, Europe, and the USA, and increasingly the emerging markets, at both Government and company levels, and by mergers and acquisitions to form powerful, integrated multinationals. On the international level, UK aerospace manufacturing exports 63% of total sales, and employs around 50,000 overseas generating an additional US$12bn. in sales. Both R&D investment (US$5bn. per annum) and the use of advanced manufacturing technologies and materials are very significant. Space and satellite technology provision and exploitation (including high-value services such as ground control/TV and space-craft insurance) are one of the most rapidly-expanding and added-value sectors, supporting around 70,000 skilled jobs and contributing US$10bn. per annum to the UK economy. Trade and investment links and co-operation with the US aerospace industry are very close and substantial, and all the leading companies in both the USA and the UK have manufacturing and/or service-support facilities in each country. Major UK players include: BAE, GKN Aerospace (www.gkn.com/aerospace), Marshall Aerospace (www.marshalladg.com), Patton Air (www.pattonair.com), and Rolls-Royce, and from the USA : Boeing, GE Aviation (www.ge.com/aviation), General Dynamics, and Lockheed-Martin. US exporters hold a 25% share of UK aerospace imports (approx. US$6bn. per annum), plus of course UK-based operations. The principal UK industry/trade association in the aerospace sector is: -A-D-S (www.adsgroup.com), also covering the defense and security industries, and with approx. 1000 UK members including all significant companies in the three related sectors. ADS membership and/or liaison is proposed as Key Element 1) of the UK defense market entry strategy, with this leading UK association offering a vast range of important member benefits, much focussed on SME’s, including around 170 events per year and 30 Special Interest Groups. Contact : Ian.Clapp@adsgroup.org.uk Tel : +44-(0) 345-872-3231. Annual membership is US$1270 for companies with annual turn-over up to US$750,000 in the relevant industry sectors, then on a sliding scale upwards. Note 1): UK-ATR is also negotiating membership, and can act as a ‘bridge’ for PA companies. 2) Many potential UK business partners for PA companies are likely to be found among ADS members. By far the most important event, owned, organized and managed by ADS is: -Farnborough International (www.farnborough.com ), the world-class aerospace trade show held every other year (alternating with the Paris Air Show) and the largest aerospace event in Europe (approx. 1500 exhibitors and 150,000 trade visitors), with very large US participation, the majority in the US Pavilions (www.kallman.com/shows/farnborough). Note, however, that this trade show covers both civilian and defense/military aerospace. The next event will be held 11—17 July 2016 : Key Element 2) of the UK defense market entry strategy is : Visit (and eventually exhibit) at Farnborough International, when UK-ATR can organize a business meeting program in and around the Show, and will provide practical travel, transport, logistics, access/entry formality, etc. support (essential for 1st time visitors). Any visit should also include participation (cost approx. US$500) in the unique : ‘Meet-the-Buyer’ program (www.be-group.co.uk), requiring early registration and payment, providing an invaluable opportunity for one-on-one meetings with selected company buyers from Prime Contractors, Tier 1 suppliers, and others. UK-ATR has participated in past such events, and: Key Element 3) of the UK defense market entry strategy is: Participate in the ‘Meet-the-Buyer’ program at Farnborough 2016. Based on these and other relevant events, UK-ATR maintains a database of Company Buyer contact details (with specific purchasing requirements where available), comprising input from approx. 30 leading UK and UK-based/US aerospace/defense companies. This will be up-dated at Farnborough 2016, but meanwhile UK-ATR is glad to provide any specific company buyer details on request. Other (smaller, specialized) UK aerospace trade shows, with a defense element are: - The Helicopter Show (www.heliukexpo.com). Next: 29—31 May 2015, Sywell-Northants. -Unmanned Aircraft Systems (www.uas-event.com ): Only second-time event in this increasingly important sector (UK-ATR will visit), 7—8 July 2015, Twickenham, near South-West London. Contact: Doug Schlam, Sales Manager-North America doug.schlam@clarionevents.com Tel : +1-203-275-8014 -Aero Engineering (www.advancedengineeringuk.com/aeroengineering-show/). Next: 4—5 Nov.2015, NEC-Birmingham. This trade show is of particular interest to the many PA companies involved in metals/alloys/composites production, working, forming, and component manufacture, and is also co-located with four other advanced engineering shows. Another UK aerospace industry association of interest in the defense/security sector is the : - Unmanned Aerial Vehicle Systems Association-UAVS (www.uavs.org). Defense : The UK is home to one of the world’s largest, and most effective/efficient, defense and military forces, with an annual budget of around US$60bn. However, a reduction of 30,000 personnel is expected across the UK regular Armed Forces up to 2020, and there is constant speculation in the media regarding budget cuts : See, for example : FlightGlobal Analysis, Dec.2014 (www.flightglobal.com/news), ‘Military face ‘perfect storm’ of budget vs. need’. The two main umbrella websites : UK Government (www.gov.uk), and the Ministry of Defence-MoD (www.mod.uk) are useful starting points for research, the latter a mine of information on all policy, programs, topics, and queries of relevance, and combines and links the three main Armed Services : Royal Navy (www.royalnavy.mod.uk), British Army (www.army.mod.uk), and Royal Air Force (www.raf.mod.uk), with links to numerous other Government, defense, military, and commercial/business interests. Over the past 15 years, the UK Government and the MoD have made considerable, on-going, and generally successful efforts to ‘privatise’, open up and facilitate their complex procurement programs , also to increasingly bring (mainly but not only UK) SME’s into the picture, with the aims of enhanced procurement economy/efficiency and spreading the financial support for such suppliers. This is embodied in the establishment in April 2014 of the Defence Equipment & Support-DE&S agency within but operationally separate from the MoD, a ‘refreshed bespoke trading entity’, with an annual budget of US$20bn. (See Corporate Plan, 2015—2018, above). As a whole, the MoD currently spends over US$27bn.per year on a very wide range of defence equipment, products, and services, and has committed to spend US$240bn. over the next 10 years for new equipment, data/IT systems, and equipment support and service. The Principal access portal for potential PA suppliers to the MoD is : www.contracts.mod.uk/sell-to-mod issued by the Defence Suppliers Service-DSS (and published by www.bipsolutions.com). Both defense suppliers/sub-contractors and companies seeking to source products and services can register free in order to initiate contact and negotiations. The website also gives comprehensive information on MoD procurement policies, budgets, procedures, and opportunities-And the (hard-copy for convenience) Defence Suppliers Service Yearbook 2015 (90 pages, US$115 plus postage, from BiP Solutions Ltd.), with detailed and valuable content, including contact listings for MoD teams, groups, organizations, operating centres, and project teams, prime contractors, and industry (UK-ATR holds a copy and can advise). Key Element 4) in the UK defense market entry strategy: Register with and use www.contracts.mod.uk as above. An additional on-line subscription service for defense contracts up-dated alerts and related information is : - Defence Contracts Bulletin—Official UK MoD contract and award notices, annual subscription US$450 (www.dcicontracts.com), also with a wider global version, Defence Contracts International. Direct personal contacts at DSS are : - Philip Margerison, Head/Manager-DSS Tel : +44-30-679-32832 dessrt-dss@mod.uk and : - Dawn King, Directorate of Supplier Relations-DSS, Tel :+44-117-913-2843 dss1@mod.uk Mr. Margerison is very experienced and very amenable to assist Pennsylvania companies as their first point of contact with the UK MoD, and can introduce them to the DE&S agency. Key Element 5) in the UK defense market entry strategy: Make personal contact with Philip Margerison and his Office. Advice, consultancy, and information on procedures, regulations, related UK seminars, etc. for UK/EU public procurement in general is available (on payment/subscription) from: PASS-Procurement Advice & Support Service (www.passprocurement.com). UK—USA Defense Relations & Co-operation : The UK defense sector has notably a very long-standing and close relationship with the USA on both the Government/military forces and industrial/commercial/business levels, and this facilitates PA companies approach to the market. Defense relations between the Governments and Military are channelled through their respective defense delegations : - Defense Attache Office, US Embassy, London(http://london.usembassy.gov/dao/index.html) DAOLondon@state.gov Tel : +44-207-894-0726 - British Defence Attache/Staff, British Embassy, Washington, DC http://ukinusa.fco.gov/en/aboutus/working-with-usa/security/defence The US Commercial Service (US-CS) at the US Embassy, London (www.export.gov/unitedkingdom) assists US exporters, also worldwide, and with PA local offices in Pittsburgh and Philadelphia. Contacts in London : PJ Menner - Commercial Specialist, Defense/Security PJ.Menner@trade.gov Tel : +44-207-7894-0470 Mobile : +44-7525714938 (Who can provide contacts as needed with the Military/Airforce/Naval Attaches in London), and : Richard Stanbridge - Head Tech. Ind. Team richard.stanbridge@trade.gov Tel : As above. Contacts in Philadelphia: robert.elsas@trade.gov Tel: 215-597-6110 and samuel.cerrato@trade.gov : 215-597-6120 and in Pittsburgh : steven.murray@trade.gov Tel : 412-644-2819 Tel UK Defense Trade Shows: The principal event here is : Defence & Security Equipment International-DSEi (www.dsei.co.uk), held every two years at the ExCel Centre in London-Docklands, and alternating with Eurosatory in Paris. is the UK’s ‘other’ world-class trade show, ‘the worlds largest fully integrated international defence and security exhibition’, being in the same league as Farnborough International for aerospace. It Data for the most recent event (2013) are: 1490 exhibitors from 50 countries (including 40 national pavilions) and 32,000 trade/business visitors. There is a very substantial and significant US presence, being the most numerous after the UK, many in the US Pavilion, organized in 2013 by AUSA (www.ausa.org). DSEi 2015 will be held 15—18 September again at ExCel, London-Docklands, and Pennsylvania companies are urged to make a visit this year to this very important trade show (next 2017), with its associated keynote briefings, seminars and strategic conferences, live demonstrations (including naval), and high-level visiting national and international delegations, plus of course the exhibitors and 40 national pavilions. As before, the UK and US exhibitors are by far the most numerous, followed by Germany, France, South Korea, and Australia. DSEi is truly international in scope and coverage--And in addition to the opportunities in the UK defense sector, reflects the position of the UK as an ideal and receptive base for PA defense suppliers to expand their export sales to both Europe, the Middle East and further afield. This year, the event is focusing increasingly on global and national security, and associated equipment, products, systems, and technology. Key Element 6) in the UK defense market entry strategy therefore: Visit DSEI 2015 (www.dsei.co.uk/registration ) for the maximum stay possible. UK-ATR will be glad to both arrange (in advance) business meetings programs in and around the Show and to provide practical UK/London/local advice and support: Please contact your local REN well in advance. Overall event and US Pavilion information: Contact: Doug Schlam, Sales Manager-North America, doug.schlam@clarionevents.com Tel : +1-203-275-8014 Homeland Security: The UK Home Office (www.homeoffice.gov.uk), the counterpart to the US Department of Homeland Security, is the UK Government Department with overall responsibility for national security, counterterrorism, cyber/ICT/transport/infrastructure security, border control, and customs & immigration. The Home Office –Office for Security & Counter Terrorism-OSCT is its principal agency of interest here , Its Feb.2012 policy document : ‘ National Security through Technology—Technology, Equipment, & Support for UK Defence & Security’ is available as a pdf : www.gov.uk/goverment/uploads/system/uploads/attachment_data/file/27390/cm827 8.pdf Among other recommendations made are more ‘off-the-shelf’ solutions and procurement, more open procurement, and more opportunities for SME’s, all of which is positive news for Pennsylvania exporters, especially since US security technology and solutions are held in very high regard. All aspects of homeland security are experiencing and will see rapid future growth, especially counter-terror and cyber-security. UK imports of security equipment are running at US$5bn.per annum, of which around one-third from the USA. And the annual UK market as a whole for security equipment, products, and services totals around US$20bn., expanding very rapidly at 10% per annum. The UK security industry has particular strengths in surveillance & detection, CBRN defence, forensics, CCTV, and transport security. There are a number of world-class companies, such as G4S (www.g4s.com), Smiths Detection (www.smithsdetection.com), and Chemring (www.chemring.co.uk), all with a substantial US presence, but the industry is dominated by SME’s, many among the security membership of A-D-S (www.adsgroup.org.uk). Most of the global defense prime contractors, such as BAE Systems, EADS (www.airbusgroup.com), Lockheed-Martin, Thales, and others, are increasingly moving into the homeland security market. In addition to A-D-S, the other main UK security industry/trade association is the : - British Security Industry Association--BSIA (www.bsia.co.uk), and its news-site/newsletter www.securitynewsdesk.com is of interest, as is the : - Information Systems Security Association, UK Chapter (www.issa.uk.org). A UK security market entry (supply chain) strategy, as with aerospace and defense, is best initiated and pursued with personal visits to the UK, again optimally timed for UK security trade shows, of which the principal and rapidly growing events are : - Counter Terror Expo (www.counterterrorexpo.com), annual at London-Olympia, just held: 21-22 April 2015, next: 19-20 April 2016. With around 300 suppliers exhibiting, of which 13 from the USA (plus others through UK subsidiaries), the trade show included ‘Interactive Feature Zones’ (Cyber Threat Intelligence, Policing & Special Ops., Transport Security Live, and Advanced Technologies), industry/company seminars, and four high-level conferences with 150 international speakers : Cyber Threat Intelligence, Transport Security, National Infrastructure, and World Counter Terrorism Congress. The 2015 Show Guide & Catalogue (110pp) is available on request from the UK-ATR. - InfoSecurity Europe (www.infosecurityeurope.com), annual at London-Olympia. Next: 2-4 June 2015. A very well-established (20 years) trade show and conference with around 300 exhibitors, focusing on cyber/ICT security. The US Pavilion, organized by the US Commercial Service (US-CS) in London (www.export.gov/unitedkingdom) is a regular feature. - Transport Security (www.transec.com), annual at London-Olympia. Next: 2-3 Dec.2015. 13 years- established, covering aviation, maritime, rail/road, and border security. A broader more-traditional (40 years est.) security trade show is: - IFSEC (www.ifsec.co.uk), annual at London-ExCel. Next: 16-18 June 2015. A unique very high-level, Home Office (www.homeoffice.gov.uk ) event, participation by invitation only, is: - Security & Policing (www.securityandpolicing.co.uk), Five-Farnborough, next: 8-10 March 2016. Organized by A-D-S and the UK Trade & Industry (UKTI) Defence & Security Organization (www.gov.uk/government/organisations/uk-trade-and-investment-defence-and-security-organisation )*. *Note that the UKTI – D&SO will advise and assist any PA companies looking at setting up or investing in the UK : Contacts in the UK: Howard Gibbs, howard.gibbs@ukti.gsi.gov.uk Tel : +44-207-215-8204 and +44-7776-457936 and in the USA : Cormac.Bailey@ukti.gsi.gov.uk UK Trade & Industry-UKTI (www.ukti.gov.uk) is the UK counterpart to the PA-DCED and the US Commercial Service, and has offices worldwide and nine in the USA including (for Pennsylvania) in NYC and Washington-DC. This very secure-environment annual event is aimed at and attended by top-level police, military, law enforcement and security professionals and their homeland security suppliers from the UK, USA, and Europe. And as such, we would suggest this as the ‘go-to’ event for Pennsylvania companies targeting the homeland security market and industry. Therefore Key Element 7) in the UK defense market entry strategy: Visit and eventually exhibit at Security & Policing 2016. The ‘Government Zone’ at this event includes in addition to the Home Office and UKTI-D&SO : Border Force*, College of Policing (www.college.police.uk), Defence Science & Technology Laboratory *, Ministry of Justice*, National Crime Agency (www.nationalcrimeagency.gov.uk), and National Counter Terrorism Security Office* (* Details under : www.gov.uk/government/organisations/) . The around 150 exhibitors constitute a ‘who’s-who’ of companies and organizations (and potential UK business partners) in the homeland security industry, and from the USA, the following have exhibited : American Science & Engineering, Brijot Imaging Systems, Digital Ally, Envision CmosXray, General Dynamics(UK), JSI Telecom, KeyW, Logos Imaging, Northrop Grumman(UK), Pacific Scientific Energetic Materials, QSA Global, Raytheon(UK), ReconRobotics, RS Decon, Salient Stills, Tactical Electronics, ThinkLogical, and VayTek. Best prospects for Pennsylvania exporters in the UK homeland security market (systems/software/programs, equipment, products, services) are throughout the industry, in particular: - Cyber security (UK market projection : US$1600m. in 2016), e.g. Company/ employee education, training, awareness, testing and simulation, User access/authentication/vendor controls, E-commerce (websites, payment) data protection, Home/shared-working risks management, Incident/disaster recovery, resilience, counter-measures, and planning. - Surveillance, detection, screening, imaging, analysis, and scanners. - Bio-profiling & forensics (See also www.forensicseuropeexpo.com), London, April 2016). - Transport and infrastructure (energy, banks, communications, data centres) in general. - Robotics, and (advanced materials) components. Common Business and Commercial Considerations : Some of the business and commercial topics common to the above three market/industry sectors (aerospace, defense, and homeland security), which Pennsylvania companies approaching or entering the UK,will need to consider and address can be found in the following section. Regulatory Issues: For the highly-sensitive industries discussed above, regulations need to be considered on an individual company basis, but general starting points are: - US Export Controls (www.state.gov/strategictrade/overview). - And UK counterpart, UK Strategic Export Control lists (www.gov.uk/uk-strategic-export-control-lists/ - UK Import Controls (www.gov.uk/import-controls ), and: - HM Customs & Revenue (www.hmrc.gov.uk). U.K.Business Partners: In order to successfully pursue export opportunities in the complex and demanding industry and technology environments discussed here, Pennsylvania companies will generally need some presence ‘on-the-ground’, in practice a business arrangement/agreement with a UK-based company with defense, etc. experience, track-record, and contacts. Options here are a commercial/commission agent (manufacturers’ rep.) and/or distributor, and for specific or time-limited projects or contracts: Joint venture (JV) or strategic alliance partner companies. Other longer-term options are a reciprocal (UK-US) marketing arrangement, manufacture-under-licence (MUL), the acquisition of a complementary (or even competitive) UK/EU company, setting-up of own sales/marketing and/or service operations, and eventually own manufacturing/processing facility. In all cases, legal advice and written agreements/contracts are essential; as is ‘getting it right the first time’. For a smaller-medium PA company, the most usual and realistic initial arrangement is with a commission agent and/or distributor, each with particular advantages and possible potential problems and challenges (as no doubt already experienced in the domestic market). Commercial agents (manufacturers reps) is aself-employed sales persons who receive from their ‘principals’ (PA companies) a percentage commission (typically 5—10%) on the sales they make. These individuals are both difficult to identify and to qualifypartly because they are a one-person or small operations themselves. Competent, interested and available agents with suitable complementary products areespecially difficult to find. There are two UK agent finding services, each charging around US$500 for a search : The Manufacturers’ Agents Association-MAA (www.themaa.co.uk) is the UK counterpart to MANA in the USA and a member of the International Union-IUCAB (www.iucab.com), mainly EU based. The MAA gives a short-form contract free-of-charge to any advertising principal and also supplies the International Chamber of Commerce-ICC (www.iccwbo.org) model contract for around US$100. (Note the ICC is also the source for ‘ATA Carnets’ for tax/duty-free temporary export/import). On the negative side, the MAA is owned by its members, who are rather limited in numbers (around 500), focused more on consumer rather than industrial/technology products, and tends to favor the interest of its members rather than those of the principals. AgentBase (www.agentbase.co.uk) is a well-established (1993) and well-organized commercial ‘matchmaking’ service for both principals and agents, reaching around 10,000 UK agents. Finding fees vary widely between US$500 and 5000 depending on size, position, and period of the advert/announcement. For US companies, see: www.agentbase.co.uk/pa_usacompanies.php Most UK commercial agents have only regional or limited geographical sales coverage, and are now protected (essentially like employees) by EU legislation, particularly with respect to termination and any resulting compensation. This latter factor has led many US and other overseas exporters to the EU not to take the commercial agent (manufacturer’s representative) option. Distributors buy and import products on their own account (‘take title to them’), in addition to selling them on to their established customer base.Their customer base is typically wider than those of agents. They generally simplify both the import/ logistics and financial (e.g. buying in US$) sides; can often provide commissioning, installation, and after-sales services; and are a single point of contact in the market. Against these advantages, the distributor can decide or fix pricing (typically +30% on the principals’), effectively maintaining control of the business flow and standing between the principal and their end-customers, and frequently want exclusivity for a given product and sales coverage. Identification of potential business partners for the UK aerospace/defense/homeland security industries can be through: Referrals and recommendations from compatible/complementary PA/US companies; exhibitors, visitors, and presenters at UK and US trade shows, conferences, and other business networking events (e.g. Farnborough International, DSEi, Counter Terror); trade associations (e.g. A-D-S) ; advertising in trade publications and own website ; industry directories on-line and websites (e.g. www.azuradec.com) www.applegate.co.uk, www.kompass.com) ; using consultants and ‘multipliers’, e.g. chambers of commerce, banks, law firms, etc. with matchmaking services; and national (US-CS : www.export.gov ) and state (www.newPA.com/trade) export promotion agencies, respectively fee-paying and free-of-charge. UK-ATR (and counterpart ATR’s in the PA network) will also be glad to provide (also free-of-charge) background (financial/credit) and other checks on potential candidates as needed. Of importance in this and more general business/commercial connections are two prestigious business organizations, of which Pennsylvania companies could well consider membership, the first when investigating the UK market, and the second when more established with a UK facility or base : - British American Business (www.babinc.org): The largest bi-lateral chamber of commerce worldwide, with chapters (British-American Business Councils-BABC) throughout the USA, including Philadelphia (www.babcgp.com). Contact: Jane Rosenberg-Executive Director jrosenberg@greaterphilachamber.org In the UK contact: Nick Royle-Director of Membership NRoyle@babinc.org Tel: +44-207-290-9880 - Institute of Directors-IOD (www.iod.com): The leading UK members’ association for business policy, lobbying, support, promotion, networking, events, and information/advice. The impressive central London ‘club-house’ and 15 regional centers throughout the UK are available for business meetings, events, and conferences. UK-ATR is a member and can advise and connect Pennsylvania business visitors. Business Etiquette & Culture : North-East USA and North-West Europe have much in common today, also historically, as do Pennsylvania and the U.K., and visitors to either from the other, whether for business or pleasure, will feel very much welcome and ‘at home’. Any notable cultural differences between Pennsylvania and the UK have been largely ironed-out by the long-standing and continuous two-way exchange of TV programs, cinema, music, theatre, sport, etc., not to mention the internet and social media. The similarities outnumber the differences, but the latter are still numerous enough to ensure stimulating conversation and exchanges of views and opinions. In the early stages of a business relationship, better to avoid the contentious topics of politics, religion, and the various -isms. The UK is comparatively, relative to other European countries, relatively homogenous. However visitors will encounter marked differences in pace and style of life between London and the larger cities, and the countryside, and also between the four constituent countries, England-Scotland-Wales-Northern Ireland, which politically are becoming less united. The country is also relatively small in size, but US visitors often underestimate in-country travel—England alone is the same size as Pennsylvania, and Scotland larger. Road traffic is very heavy and drives on the left (Look both ways when crossing on foot!) -- And the days of the patient and polite British driver are long gone. As in the USA, business relations, meetings, behavior, and dress-code, for both men and women, are more formal for larger companies and for the established services (banking/finance, law, and Government/ diplomacy/ military), and far more casual in the newer, technology, media, etc. industries, in which ‘first-name’ terms are immediately or rapidly adopted. Pennsylvania business visitors can almost invariably expect their UK counterparts or partners to make time for meetings and also socializing--British business people enjoy entertaining, initially at pubs, cafes, and restaurants, and eventually also at home. Sources and Resources (for further reading and reference) : - Selling to the MoD : Defence Suppliers Service-DSS, 21st Edition (2014) : Available as a pdf from UK-ATR. - Defence Contracts International-DCI (www.dcicontracts.com) : ‘Industry Insights – Aerospace, and - Cyber Security’. - MarketLine (www.marketline.com) : Aerospace & Defence in the UK 2014 : Available as a pdf from UK-ATR. - PWC - Aerospace, Defence, & Security : (www.pwc.co.uk/aerospace-defence/publications/index.jhtml ). - KPMG - Aerospace and Defence : (www.kpmg.com/UK/en/industry/AerospaceandDefence/Pages ) - Keynote (www.keynote.co.uk) : Security Industry 2015, Aerospace Industry 2015, Defence Equipment 2014, IT Security 2014 : Benchmarking reports US$600 and Market Reports US$860 : Executive Summaries & Contents free on-line.