1 Bank-Borrower Relationships and Transition from Joint Liability to

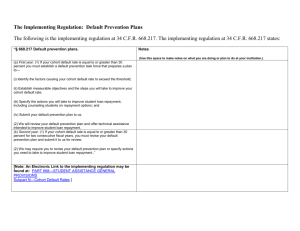

advertisement