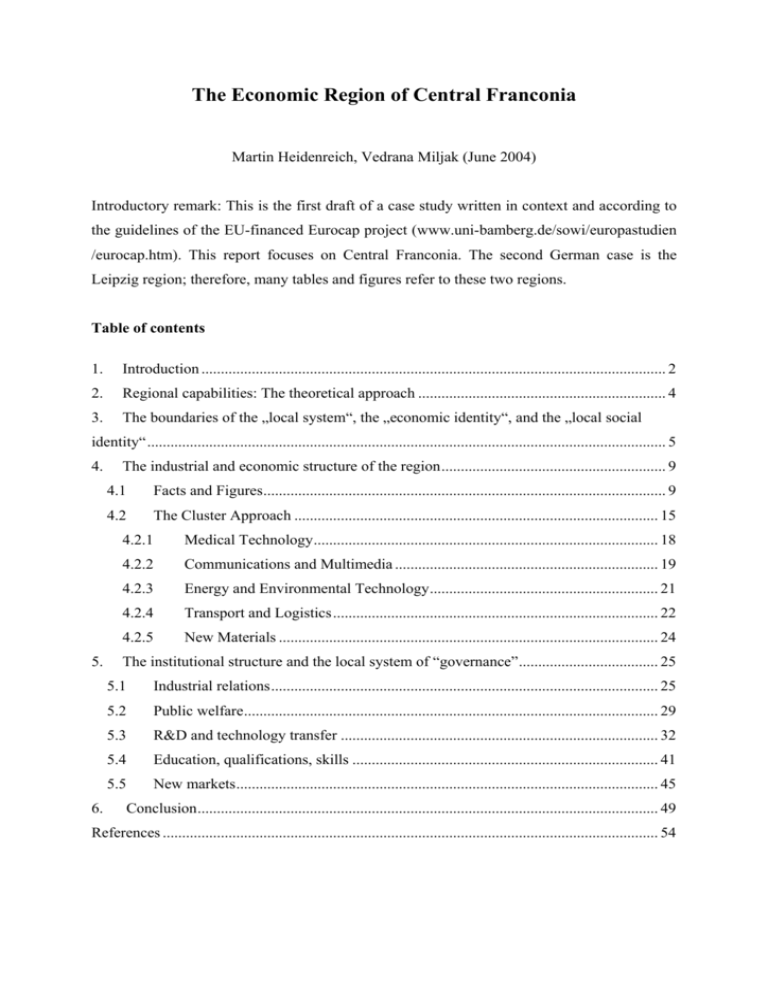

The Economic Region of Central Franconia

advertisement