ICAN 2012

Narjess Teyssier

Chief Economic Analysis and Policy Section

ICAO

Jeddah, December 8, 2012

8 December 2012

Page 1

ICAN 2012: A successful event

8 December 2012

Page 2

ICAN benefits for States

Venue

Year

Dubai

2008

UAE

Istanbul

2009

Turkey

Kingston

2010

Jamaica

Mumbai

2011

India

Number of

participating States

27

52

38

64

Number of bilateral

meetings held

100

200

200

340

Number of Bilateral

Agreements signed

at the meeting

20

60

60

120

In 2010 Estimated Cost savings to participating States: Several million USD

8 December 2012

Page 3

ICAO´s Policies and guidance material

Chicago Convention

basis for key policies

8 December 2012

A37-20

Page 4

4

Passenger traffic in 2011

+6.5%

+3.6%

30

Departures

million

Passenger-km

trillion

5.1

+5.6%

Passengers

8 December 2012

billion

2.7

(%): 2011/2010 growth

Page 5

Air Cargo in 2011

182

51

-0.1%

YoY

Air freight in the

international trade

By value

billion

Freight Tonnes-Kilometer performed

+1.4%

YoY

million

Freight Tonnes carried

Note: Scheduled services

8 December 2012

$5.3

billion

Page 6

6

Past decade traffic growth

Passenger traffic market share

By airline type

Non IATA

IATA members

airlines

79%

21%

Passenger traffic market share

By airline type

IATA members

93%

Non IATA

airlines

7%

4500

2000-2010

4000

+4.4 % p.a.

Passenger traffic

Billion RPKs

3500

3000

2500

2000

1500

1000

500

0

Source: ICAO, IATA

8 December 2012

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Page 7

Market Shares* Achieved in 2011

International traffic represents 62% of the total passenger

traffic

International passenger traffic**

North

America

15%

Latin

America

4%

Europe

39%

Asia and

Pacific

27%

Middle East

12%

Domestic passenger traffic**

Latin

America

7%

North

America

50%

Europe

8%

Africa

1%

Middle East

1%

Asia and

Pacific

33%

Africa

3%

* Market share of the scheduled traffic of the airlines domiciled in the region

**Expressed in Revenue Passenger Kilometer

8 December 2012

Page 8

Long-term passenger traffic forecast

Total World RPKs (billions)

AAGR for 20 years forecasts

14000

5.2 % p.a.

12000

10000

4.5%p.a

History

8000

1990-2010:

4.4 %p.a.

3.6% p.a.

6000

2030-2040:

4.3 %p.a.

4000

2000

1995

Source: ICAO

2000

2005

2010

Most Likely

2015

Low

2020

2025

2030

High

High GDP scenario = +0.3% for developed countries & +0.6 for the developing countries

Low GDP scenario= -0.5 for developed regions & -0.1 for the developing regions.

8 December 2012

Page 9

Air travellers represent 51% of

international tourist

Inbound travellers by mode of transport

Water

6%

Rail

2%

Aviation and Tourism: Key figures

Road

41%

Source: UNWTO

8 December 2012

Air

51%

Note: 2010 figures for international tourists

Page 10

10

Value chain of air transport

STATES

(Regulatory framework)

ANSPs

MROs

Airports

Airlines

Ground

Handling

Aircraft

manufacturers

Lessors

8 December 2012

Travel agents &

GDS

Fuel

suppliers

Seeks services from

Page 11

IATS: ICAO Air Transport Symposium

18 – 20 April 2012

TOWARD A SUSTAINABLE AIR TRANSPORT DEVELOPMENT

• Main Impediment: “Fragmentation” of

markets and regulation

• Strategy: “Seamlessness” while

– Striking a balance between security and facilitation

– Minimizing impact on environment

8 December 2012

Page 12

From ATConf/5….

to ATConf/6

Theme: “Challenges &

Opportunities for

Liberalization”

Role of ICAO:

“Facilitate, promote

and assist States in

the liberalization

Outcome / Results

process”

8 December 2012

Page 13

The nine Freedoms of air

APPENDIX C

Nine Freedoms of the Air

1. Overfly

A

B

Home State

2. Technical stop

B

A

Home State

3. Set down traffic

A

Home State

B

4. Pick up traffic

A

Home State

B

5. Carry traffic to/from

third State

B

A

Home State

6. Carry traffic via

Home State

A

B

Home State

7. Operate from second State

to/from third State

A

Home State

B

8. Carry traffic between two points

in a foreign State

A

Home State

9. Operate only in a foreign State

A

Home State

Figure 4.1-1.

8 December 2012

The Nine Freedoms of the Air (Doc 9626, Chapter 4.1)

Page 14

Top 5 States involved in bilateral Open Skies

Agreements (OSAs)*

State

Number

United States

109

United Arab Emirates

77

Canada

43

Singapore

34

Bahrain

26

Source: Governmental Internet sites

*Considered as an OSA when there is no restriction on 5th Freedom and above

Status as of October 2012

8 December 2012

Page 15

States involved in bilateral OSAs

By October 2012, 145 States signed one or more bilateral OSAs

8 December 2012

Page 16

Toward more consolidation: Alliances,

Airlines’ mergers and acquisitions

8 December 2012

Page 17

2012: Alliances regional distribution

3 Major alliances grouping : more than 60% of the worldwide scheduled traffic

Star Alliance: 28%

Star Alliance: 28%

One world: 34%

One world: 29%

Skyteam: 32%

Skyteam: 28%

One world: 1%

Skyteam: 4%

Star Alliance: 31%

One world: 33%

Skyteam: 31%

Star Alliance: 8%

Star Alliance: 5%

One world: 2%

Skyteam: 1%

Skyteam: 2%

Most well-known Non Aligned airlines

8 December 2012

Page 18

Indicators: Air transport services conducted

under liberalized agreements or arrangements

As a % of international scheduled services

Frequencies

Number of frequencies

Number of country-pair routes

60%

Country pairs

50%

50%

40%

40%

30%

30%

20%

20%

10%

10%

0%

Source : ICAO

8 December 2012

0%

1995

1999

2004

2009

Page 19

Facilitating Liberalization

Template Air Services Agreement

TASA

TASA

TASA

8 December 2012

Page 20

World Air Services Agreements (WASA)

Web Database

• Original text of over 2500

bilateral agreements

• 90 distinct provisions covered

• Summary of the routes

exchanged

• A built-in search engine

8 December 2012

Page 21

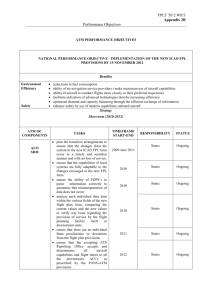

NEW ICAO STRATEGIC OBJECTIVE

Economic Development of Air Transport

To foster the development of a sound and

economically viable air transport system

New SO reflects the needs for ICAO’s leadership

in developing and harmonizing the global

regulatory framework

Helps focus ICAO’s work to meet the need of

Member States and aviation stakeholders

8 December 2012

Page 22

Sixth Worldwide Air Transport Conference

(ATConf/6)

Theme :

Objectives :

“Sustainability of Air Transport”

to develop guidelines and,

to develop an action plan for a global regulatory framework.

www.icao.int/meetings/atconf6/Pages/default.aspx

18-22 March 2013

ICAO Headquarters, Montreal

8 December 2012

Page 23

Pre-Conference Symposium

• One-day symposium: Montréal, 17 March 2013

– Better prepare participants

– Join forces with the major stakeholders organizations such

as IATA, ACI, CANSO, TIACA, UNWTO.

– Very high level speakers

– December 2012: Electronic bulletin for invitation including

the preliminary symposium agenda

8 December 2012

Page 24

Challenges and issues

• Market access

• Air carrier ownership and control

• Consumer protection

•

Fair competition and safeguards

• Funding and financing of the air transport system

• Taxation of international air transport

Main challenge:

Implementation of ICAO policies and guidance

8 December 2012

Page 25

SHUKRAN

Thank You,

Merci,

Spasiba,

Xie Xie,

Gracias

8 December 2012

Page 26

© ICAO All rights reserved.

This document and all information

contained herein is the sole property of

ICAO. No intellectual property rights are

granted by the delivery of this document or

the disclosure of its content. This

document shall not be reproduced or

disclosed to a third party without prior

permission of ICAO. This document and its

content shall not be used for any purpose

other than that for which it is supplied.

The statements made herein are based on

the mentioned assumptions and are

expressed in good faith. Where the

supporting grounds for these statements

are not shown, ICAO will be pleased to

explain the basis thereof.

8 December 2012

Page 27