Roles, authority and involvement of the management

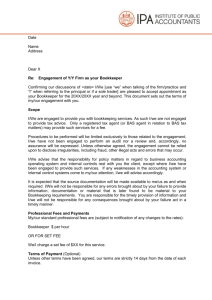

advertisement