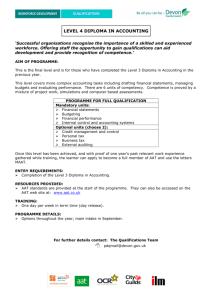

AAT level 3 diploma in Accounting leaflet

advertisement

AAT LEVEL 3 DIPLOMA AAT LEVEL 3 DIPLOMA IN ACCOUNTING Advice and Guidance Please come along and talk to us at the following enrolment sessions Tuesday 8th September 2015 4.30pm - 8.00pm Saturday 12th September 2015 10.00am - 2.00pm For further information please contact: Learner Services on 01952 642237 email: studserv@tcat.ac.uk website: www.tcat.ac.uk Telford College welcomes applicants from all sections of the community, including those who have any form of disability. The College employs a Learning Support Manager who is available on 01952 642391. Haybridge Road = Wellington = Telford = Shropshire = TF1 2NP What’s covered and is it for me? A range of accounting practices and techniques including, costing, accounts preparation, VAT, ethics and the use of spreadsheets. What will I learn? 1. Accounts Preparation Preparation of ledger accounts to trial balance stage according to current financial standards, including making any necessary adjustments. Accounting for the purchase and disposal of noncurrent assets. 2. Prepare final accounts for sole traders and partnerships Preparing final accounts for both sole traders and unlimited partnerships, including the appropriation of profits. Drafting final accounts and making necessary adjustments according to current financial standards. 3. Costs and Revenues Identifying why cost accounting is important to an organisation; being able to recognise and use different approaches; and make reasoned judgements to inform management on the most effective costing techniques to aid decision making. Able to gather, analyse and report information about income and expenditure to support decision-making, planning and control. 4. Indirect Tax Having the knowledge and skills to calculate VAT and submit the VAT return. It involves extracting the relevant information from the organisations accounting records; calculating the amount of tax payable or reclaimable and resolving errors or omissions. Able to submit completed documentation in a timely manner whilst maintaining an effective working relationship with the relevant tax authority. 5. Spreadsheet software How to use a spreadsheet to enter, edit and organise numerical and other data, select and use appropriate formulas and data analysis tools and techniques to present, format and publish information. 6. Professional ethics Recognising the importance of acting and working in an ethical manner. Able to work within the ethical code to ensure that the public has a level of confidence in accounting practices or functions, to protect their own and their organisation’s professional reputation and integrity and ensure they uphold principles of sustainability. For more details about the qualification please follow this link: http://www.aat.org.uk/qualifications/level-3-aat-accounting-qualification Should I start at Level 2 or 3? Most students start at AAT Level 2. However, in some cases you may feel that you have suitable experience or study skills to start at Level 3. As a guide, consolidated knowledge of manual book-keeping to trial balance is a requirement. A discussion with a tutor and completion of an initial assessment for suitability will be required before enrolment. For students moving from Level 2, again we would recommend a discussion with your current tutor for suitability for the demands of Level 3 studies. In addition to attending the classes below, all students will find it necessary to supplement their studies with home study, typically six hours per week when attending one day, to support the 305 guided learning hours recommended by the AAT. Course Costs An indication of course costs for you to consider: = Tuition Fees £1650.00 - 24+ Adult learning loan available (this includes exam fees for your first attempt) = Tuition Fees £830.00 - 24 and under (this includes exam fees for your first attempt) = Registration Fees approx £130.00 (paid by you to the AAT once your course starts) = Re-sit Exam Fees = Books (approx) £55.00 for each exam, regardless of method of funding £70.00 For assistance with course fees and general enquiries about fee remission please talk with an advisor in Learner Services on 01952 642237 For 24+ loan enquiries please contact Linda Willets on 01952 642295 September Start Course Delivery 2015/16 Options Attendance Start Date End Date Day release (34 weeks) Wednesday 9.30am - 4.30pm 16/09/2015 29/06/2016 Day release (34 weeks) Thursday 9.30am - 4.30pm 17/09/2015 30/06/2016 Evening (34 weeks) Tuesday and Thursday 6.00 - 9.00pm 15/09/2015 30/06/2016 Booklist - Please contact tutor for grouping before purchase Subject Publisher Accounts Preparation Kaplan Prepare final accounts for sole traders and partnerships Kaplan Spreadsheet software Osborne Indirect Tax - FA2015 Kaplan Costs and Revenues Kaplan Professional ethics Kaplan ISBN 978-1-78415-392-2 978-1-78415-393-9 978-1-90917-322-4 TBC 978-1-78415-394-6 978-1-78415-396-0 Ordering books from Kaplan = Books can be purchased from Kaplan at the College on 8th September 2-7pm = Books can be ordered directly from the Kaplan website (http://kaplan-publishing.kaplan.co.uk/aat-aq2013) using the preference code 3fp79js-s which will give 40% discount Ordering books from Osborne = Please order online from http://www.osbornebooks.co.uk/aat_accounting Exam Sessions Exam sessions will be held on a Saturday morning which will increase the tuition time. For more information on this course please contact: alex.brims@tcat.ac.uk sandra.ogden@tcat.ac.uk teresa.hughes@tcat.ac.uk Telephone: 01952 642412 or 01952 642532 or Head of School sue.burke@tcat.ac.uk 01952 642515 For enrolment at Telford College please contact: Learner Services on 01952 642237 Haybridge Road = Wellington = Telford = Shropshire = TF1 2NP