“CAPITALISM” AND “RISK”: NOTIONS CONCERNING FOUR

advertisement

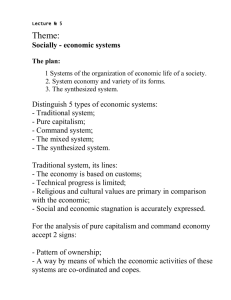

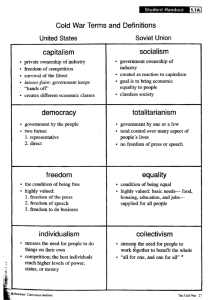

“CAPITALISM” AND “RISK”: NOTIONS CONCERNING FOUR QUESTIONS Edward A. Purcell, Jr. On a macro level, what risk does capitalism pose for societies? Extreme answers are familiar. Negative versions maintain that capitalism has a dynamic that creates concentrated wealth, massive inequalities, political oppression, and sharpened international rivalries. Ultimately it leads to fascism, imperialism, and war. Positive versions argue that capitalism brings freedom, economic growth, democratic government, and international cooperation but that its dynamic may spur irrational political interventions that can destroy it and all the good things it brings. For negative versions, the risk is that capitalism will not be checked, and the result will be political and economic oppression; for positive versions, the risk is that capitalism will be checked, and the result will be political and economic oppression. Understandably, most commentators locate themselves somewhere between those two extremes, while the tides of social and economic change periodically nudge them one way or the other. Historians can hope to better understand capitalism’s actual socio-political impact, and they can hope to better understand the way changing historical conditions influence popular and professional views about capitalism. To probe those issues, detailed historical analyses are essential, for at no time and place does capitalism exist in any “pure” form. Rather, it operates not simply according to economic “laws” but in line with particular historical contexts and conditions. One of the intriguing characteristics of the debate about the macro risks of capitalism is the extent to which analyses--including some positive ones--adopt the underlying trope of capitalism’s “contradictions.” Marx and Engels famously started the ball rolling when they declared that the bourgeoisie inevitably produces “its own gravediggers,” and subsequent analysts of varied stripes--from Thorstein Veblen and Max Weber to Daniel Bell and Irving Kristol--developed their own theories of such “contradictions.” Indeed, stanch defenders of capitalism often proudly cite Joseph Schumpeter’s declaration that “the essential fact about capitalism” is that it produces a “perennial gale of creative destruction.” Ironically, they seem to forget Schumpeter’s conclusion that capitalism’s “contradictions” undermine “the whole scheme of bourgeois values” and pave the way to socialism. Despite its frequent invocation, the trope of “contradiction” is highly misleading. While it lures capitalism’s enemies with the promise of ultimate triumph and arms capitalism’s defenders with notice of potential dangers, the trope embodies a rationalist fallacy that obscures rather than illuminates. Capitalist systems develop in an astonishing variety of forms, generating continuous and erratic changes and spurring countless and reconfiguring conflicts. Those changes and conflicts, however, are hardly “contradictions” in any logical and dialectical sense. Such changes and conflicts do not produce “necessary” social transformations, much less provide a sound basis for predicting future ones. The changes and conflicts that capitalist forms generate 1 are simply too diverse, numerous, and causally indeterminate to produce future developments that are “necessary” or, in most cases, even plausibly predictable. The trope of “contradiction” ultimately assumes some overarching unity, some “pure” form of capitalism with an essential and unchanging core, but capitalism has no such “pure” form and constitutes no such coherent unity. Hegel may have written about history, but he was no historian. Conceiving of capitalism in terms of “contradictions” that lead to new syntheses embraces the same fallacy that mars conceptions of “free markets” that automatically produce efficient equilibria. Both approaches harbor the false assumption that a theory--however compatible it might seem with some form of capitalism that happens to exist at a given time and place--truly captures the operational essence of “capitalism.” Stability and change, order and disruption, foreseeability and contingency all find their roles in human life, but all exceed the power of any unified theory to identify capitalism’s essence and calibrate its societal risks across time and space. Second, concerning definitions and interrelationships, what do we even mean by “capitalism” and “risk”? The former refers to a great variety of economic arrangements that have continuously changed over time. True, one can claim that such elements as “rationality,” private property, contractual freedom, wage labor, profit-seeking, invested surplus, and market behavior are “essentials” of capitalism, but all of those elements have changed substantially over time and place in form, scope, use, impact, and referent. Indeed, not all are necessary: Southern slavery was, at the very least, partly “capitalist.” Thus, “capitalism” exists in a multitude of forms as diverging cultural formations, institutional arrangements, and legal systems shape and guide it, and as its forms evolve through shifting and overlapping combinations of variously regionalized or globallized agricultural, commercial, extractive, industrial, financial, proprietary, corporate, state, and crony versions. Moreover, though capitalism is often equated with a “free market,” there is a huge difference between the two. Most fundamentally, capitalism actually exists. In contrast, the “free market” is merely a construct of certain economic theories. When incorporated into serious economic analyses, free market ideas can suggest useful insights and important relationships. When incorporated into political ideologies, as is so common, free market ideas obscure and mislead. Such ideologies exercise a partisan magic, shaping biased perceptions while conjuring away the social and political power that accompanies economic power. Indeed, when their conjuring falters, they also purport to show--like a good lawyer arguing in the alternative--that any such social and political power is insignificant because it is invariably checked by systemic economic “rationality” and countervailing market forces. The concept of “risk” is even more indeeterminate. On one level it is an essential element of capitalism in that it supposedly justifies the profits an entrepreneur makes. The higher the risk, the greater the reward. One problem with the justification is that “risk” correlates imperfectly, and sometimes not at all, with actual rewards. A second and more fundamental problem is that “risk” is a socially constructed concept. Consider the diverse understanding of 2 “risk” held by those who lived in different times and places, worshiped different gods, and relied on different material resources and conditions. More to the point, capitalism transforms the concept of “risk” from one referring simply to the perils of life to something far more complex. It gives those perils monetary “value” and then creates multiplying ranges of new risk-based commodities defined in terms of the economic interests and legal rights of human beings. For capitalism, “risk” is a conceptual “calculating device” developed by people who have learned how to “consume the future.” Odysseus faced many perils sailing the wine-dark sea, but in a capitalist sense his voyage posed no “risk” absent a credit obligation or a contract for marine or life insurance. Thus, “capitalism” and “risk” function together, the former inspiring ways to create the latter by identifying perils that can be commodified and given both economic value and legal protection. Death was an inevitability that rested in the hands of God until a combination of social forces--law, religion, industrialism, actuarial science, and institutionalized promotionalism--transformed it into a “risk” that could be valued and thereby used to encourage the exchange of small regular payments for large future payments. Capitalism expands by creating ever more such “risks” and thereby creating ever more economic value and thus ever greater wealth. Indeed, it commodifies an ever-expanding variety of perils that differ radically in nature, scope, and impact on society, thus conferring value on a staggering range of diverse and sometimes potentially disastrous perils. As those commodified risks multiply and their values swell, capitalism layers and pyramids them to create ever more value while, in the process, creating ever more perils that can, in turn, be identified and transformed into ever more “risks” and hence ever more commodities and ever more value. Thus capitalism and risk combine to create a dynamic for both economic growth and economic crisis. Third, on a micro level, how do individuals make use of capitalism and risk? Because both terms are imprecise and manipulable it is essential to understand who exactly is using them, how they are used, and the likely social consequences of their uses. Commentators address issues of capitalism and risk from a variety of perspectives, some obviously serving identifiable practical goals and others seeking more open-mindedly to understand economic systems. Recognizing and understanding the varying perspectives and commitments of commentators is pivotal in evaluating the relative merits of their analyses and proposals. Further, regardless of the commentator’s perspective, their merits are often questionable because they frequently rely excessively on abstractions and generalizations. As A. O. Hirschman repeatedly warned, general concepts are essential but must always be evaluated through detailed examinations of specific events, contexts, and relationships. A well-known example of the social construction of “risk” is the law and ideology that define the “risks” people “assume.” Many perils threaten, but only legal rules, technological developments, and social and economic pressures determine the identity of those “risks” and the extent to which people “assume” them. Those changing social constructions, moreover, bring diverse implications. As worker compensation laws appeared and valued industrial risks, they 3 offered injured individuals more likely compensation but also conceptualized their injuries as “acceptable” costs of production, giving them the aura of the natural and unavoidable. A similar process encompasses literally everyone through the law’s definition of the “risks” that consumers “assume,” thereby painting selected consumer injuries as equally natural and unavoidable. While “capitalism” has long been a central focus of inquiry, “risk” came into new prominence in the 1970s and inspired massive scholarly outpourings. Numerous factors contributed, including growing awareness of catastrophic risks involving nuclear power, environmental degradation, and consequent mass demographic movements. One additional factor was growing recognition of the extent to which powerful institutions were learning to use contract to shift more kinds of risks onto ordinary Americans. Releases and “independent contractor” agreements continued to serve that purpose, while the late twentieth century witnessed far-reaching new techniques. Contract was increasingly used to disadvantage aggrieved individuals and deprive them of their right to seek judicial redress for the harms they suffered. Of broader systemic importance, powerful institutions increasingly used contract to create financial instruments and arrangements that shifted accompanying risks onto outsiders who understood little or nothing of those risks. “Risk,” in other words, became a more widely used weapon of the powerful for financial manipulation, aggrandizement, and exploitation. Revealingly, that use mocks one of capitalism’s premises, that there is a fair relationship between risk and reward. The power of the weapon, after all, lies in its ability to reward the powerful while placing accompanying risks on the weak and vulnerable. Finally, what risk does capitalism pose for the United States today? Speculating broadly, two developments point to a tentative answer. First, national politics exploits “cultural” issues that fragment the economic interests of Americans while promoting “free market” ideologies that advance the interests of an elite investor-donor-manager stratum. Second, globalization unifies certain corporate interests across the world and brings unprecedented liquidity and mobility to capital. From mercantile theory in the seventeenth-century to free trade ideas in the nineteenth and twentieth centuries, forms of capitalism thrived on promises of expanding “the wealth of nations.” Today, globalized capitalism and market ideologies threaten different results. The macro risk of capitalism today is that it will produce steadily growing wealth, not for nations or their citizens generally, but for that globalized, elite investor-donor-manager stratum. And contrary to the pretensions of market ideologies, that elite stratum will exercise increasingly compelling social, political, and economic power. That power will enable the elite stratum to shape the contours of political debate, filter out unacceptable economic ideas and their advocates, control the range of public policies deemed “acceptable,” and steadily entrench its own selfserving norms and interests in American culture and political practice. Pointing to that contemporary risk is not an attempt to predict the future. The historical developments that created the risk were contingent, as are future developments that might exacerbate, moderate, or minimize it. We are, after all, not dealing with any necessary and essential developments, any more than in considering capitalism and risk we are dealing with necessary and essential forms. 4