CSR Report (NYK Report) 2013

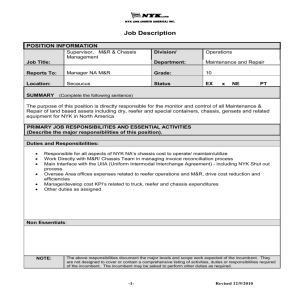

advertisement