Instructions for Form 1116

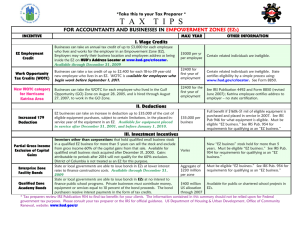

advertisement

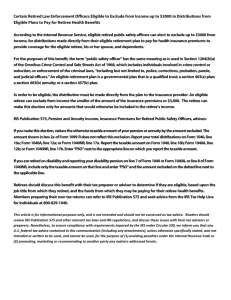

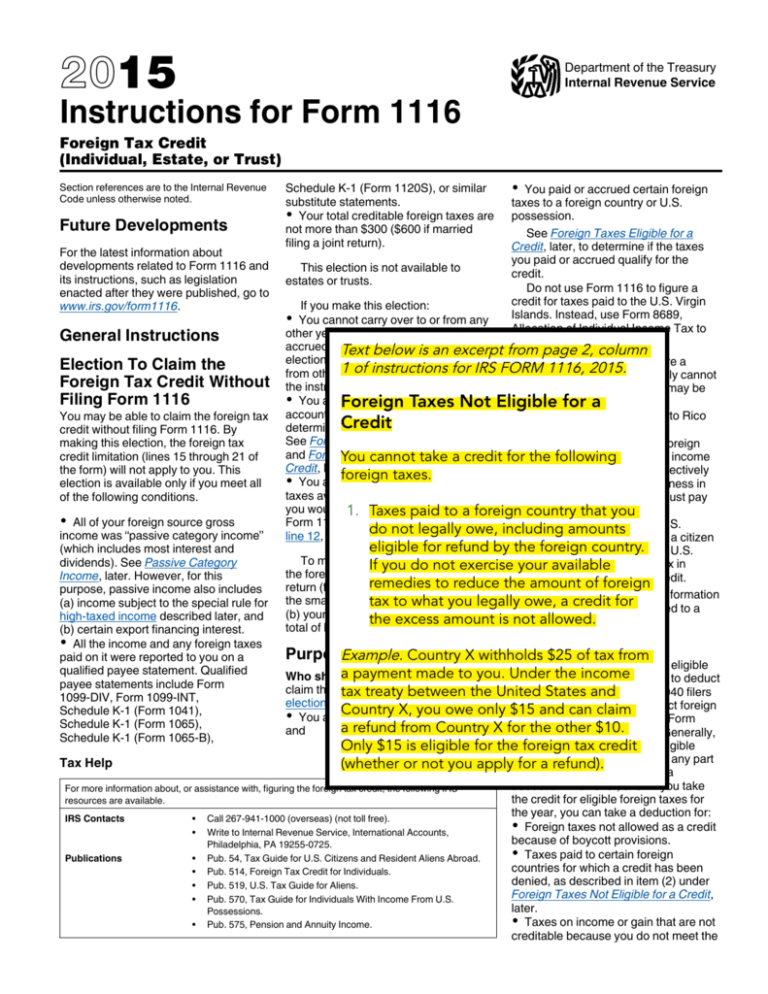

2015 Instructions for Form 1116 Department of the Treasury Internal Revenue Service Foreign Tax Credit (Individual, Estate, or Trust) Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. General Instructions Election To Claim the Foreign Tax Credit Without Filing Form 1116 You may be able to claim the foreign tax credit without filing Form 1116. By making this election, the foreign tax credit limitation (lines 15 through 21 of the form) will not apply to you. This election is available only if you meet all of the following conditions. All of your foreign source gross income was “passive category income” (which includes most interest and dividends). See Passive Category Income, later. However, for this purpose, passive income also includes (a) income subject to the special rule for high-taxed income described later, and (b) certain export financing interest. All the income and any foreign taxes paid on it were reported to you on a qualified payee statement. Qualified payee statements include Form 1099-DIV, Form 1099-INT, Schedule K-1 (Form 1041), Schedule K-1 (Form 1065), Schedule K-1 (Form 1065-B), Schedule K-1 (Form 1120S), or similar substitute statements. Your total creditable foreign taxes are not more than $300 ($600 if married filing a joint return). This election is not available to estates or trusts. You paid or accrued certain foreign taxes to a foreign country or U.S. possession. See Foreign Taxes Eligible for a Credit, later, to determine if the taxes you paid or accrued qualify for the credit. Do not use Form 1116 to figure a credit for taxes paid to the U.S. Virgin Islands. Instead, use Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands. If you make this election: You cannot carry over to or from any other year any foreign taxes paid or accrued in Text a tax year to which below is antheexcerpt from page 2, column election applies (but carryovers to and Nonresident aliens. If you are a of instructions IRS FORM 1116, 2015. from other 1 years are unaffected).for See nonresident alien, you generally cannot the instructions for line 10, later. take the credit. However, you may be You are Foreign still required to take into able to take thea credit if: Taxes Not Eligible for account the general rules for You were a resident of Puerto Rico Credit determining whether a tax is creditable. during your entire tax year, or See Foreign Taxes Eligible for a Credit You pay or accrue tax to a foreign and Foreign Taxes Not Eligible a country U.S. possession on income You cannot take for a credit for the or following Credit, later. from foreign sources that is effectively foreign taxes. You are still required to reduce the connected with a trade or business in taxes available for credit by any amount the United States. But if you must pay you would have enteredpaid on lineto 12aofforeign taxcountry to a foreign country 1. Taxes that youor U.S. Form 1116. See the instructions for possession on income do not legally owe, including amounts from U.S. line 12, later. sources only because you are a citizen eligible for refund by or the foreign a resident of country. that country or U.S. To make the election, justnot enterexercise on possession, do not use that tax in If you do your available the foreign tax credit line of your tax figuring the amount of your credit. remedies to reduce return (for example, Form 1040, line 48) the amount of foreign See section 906 for more information the smaller of (a)tax yourtototal foreign or what youtaxlegally owe, a credit for on the foreign tax credit allowed to a (b) your regular tax (for example, the the excess amount is nonresident not allowed. alien individual. total of lines 44 and 46 on Form 1040). Credit orofDeduction Purpose of Form Example . Country X withholds $25 tax from Instead of claiming a credit for eligible a payment made the income Who should file. File Form 1116to to you. Under foreign taxes, you can choose to deduct claim the foreign tax credit if the foreignStates income and taxes. Form 1040 filers tax treaty between the United election, earlier, does not apply and: choosing to do so would deduct foreign Country X, you owe only $15 and can claim You are an individual, estate, or trust; income taxes on Schedule A (Form a refund from Country X for theItemized other $10. and 1040), Deductions. Generally, take the credit for any eligible Only $15 is eligible for theif you foreign tax credit foreign taxes, you cannot take any part Tax Help (whether or not you apply for a refund). of that year's foreign taxes as a deduction. However, even if you take For more information about, or assistance with, figuring the foreign tax credit, the following IRS the credit for eligible foreign taxes for resources are available. the year, you can take a deduction for: IRS Contacts • Call 267-941-1000 (overseas) (not toll free). Foreign taxes not allowed as a credit • Write to Internal Revenue Service, International Accounts, because of boycott provisions. Philadelphia, PA 19255-0725. Taxes paid to certain foreign Publications • Pub. 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad. countries for which a credit has been • Pub. 514, Foreign Tax Credit for Individuals. denied, as described in item (2) under • Pub. 519, U.S. Tax Guide for Aliens. Foreign Taxes Not Eligible for a Credit, • Pub. 570, Tax Guide for Individuals With Income From U.S. later. Possessions. Taxes on income or gain that are not • Pub. 575, Pension and Annuity Income. creditable because you do not meet the Dec 29, 2015 Cat. No. 11441F