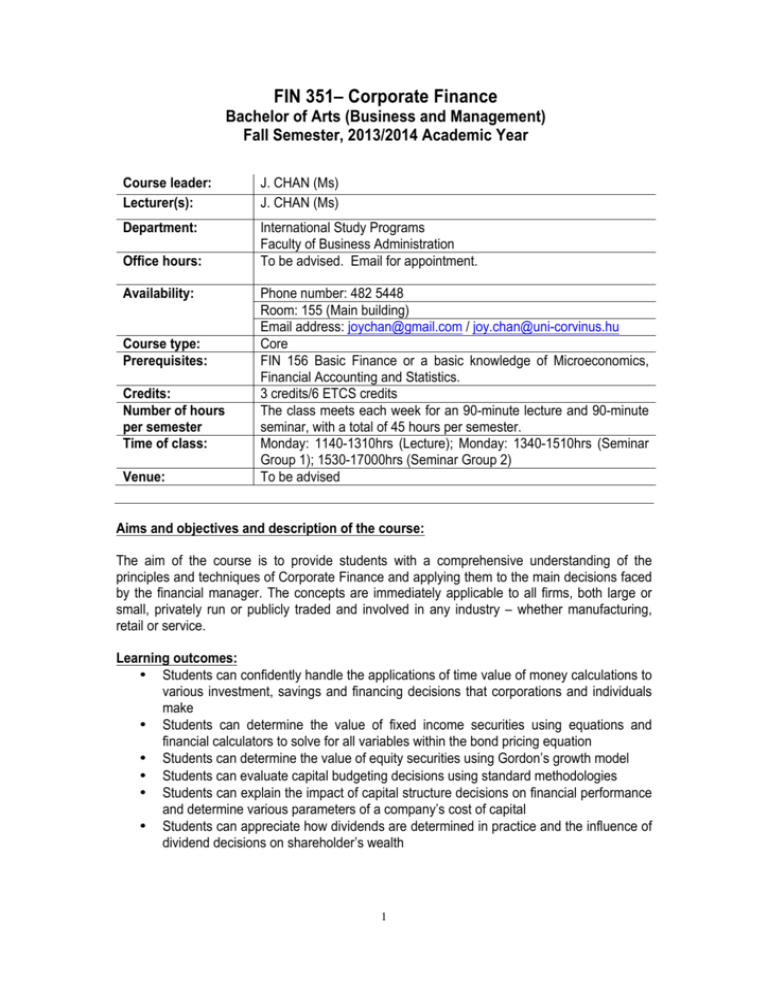

FIN 351– Corporate Finance

Bachelor of Arts (Business and Management)

Fall Semester, 2013/2014 Academic Year

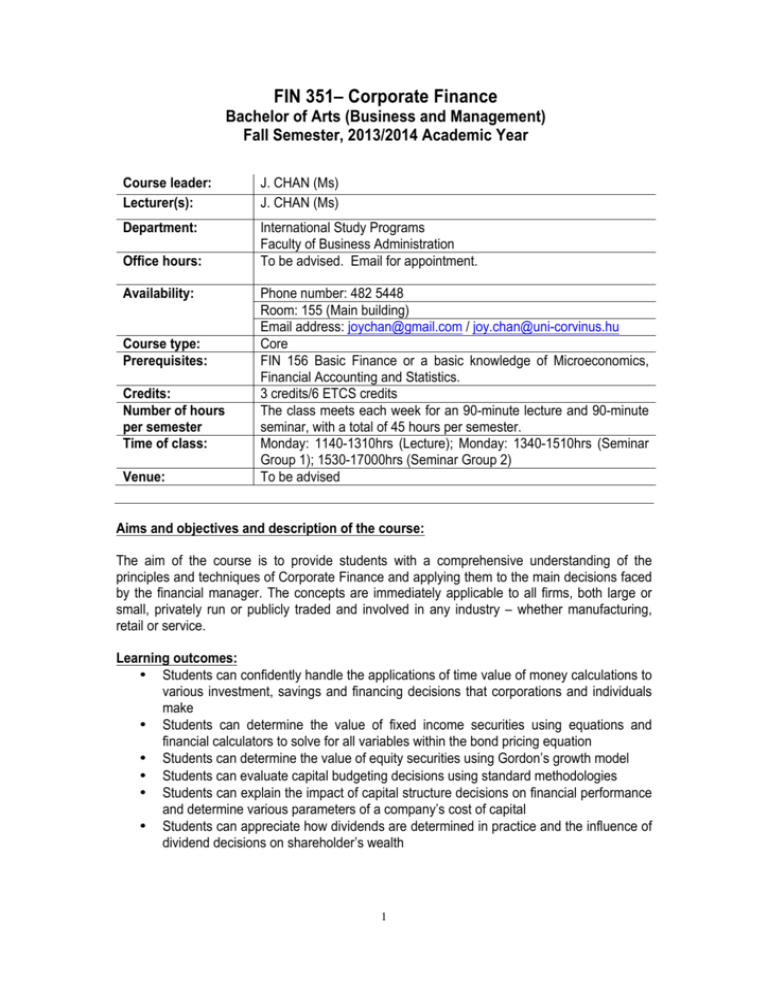

Course leader:

Lecturer(s):

J. CHAN (Ms)

J. CHAN (Ms)

Department:

International Study Programs

Faculty of Business Administration

To be advised. Email for appointment.

Office hours:

Availability:

Course type:

Prerequisites:

Credits:

Number of hours

per semester

Time of class:

Venue:

Phone number: 482 5448

Room: 155 (Main building)

Email address: joychan@gmail.com / joy.chan@uni-corvinus.hu

Core

FIN 156 Basic Finance or a basic knowledge of Microeconomics,

Financial Accounting and Statistics.

3 credits/6 ETCS credits

The class meets each week for an 90-minute lecture and 90-minute

seminar, with a total of 45 hours per semester.

Monday: 1140-1310hrs (Lecture); Monday: 1340-1510hrs (Seminar

Group 1); 1530-17000hrs (Seminar Group 2)

To be advised

Aims and objectives and description of the course:

The aim of the course is to provide students with a comprehensive understanding of the

principles and techniques of Corporate Finance and applying them to the main decisions faced

by the financial manager. The concepts are immediately applicable to all firms, both large or

small, privately run or publicly traded and involved in any industry – whether manufacturing,

retail or service.

Learning outcomes:

• Students can confidently handle the applications of time value of money calculations to

various investment, savings and financing decisions that corporations and individuals

make

• Students can determine the value of fixed income securities using equations and

financial calculators to solve for all variables within the bond pricing equation

• Students can determine the value of equity securities using Gordon’s growth model

• Students can evaluate capital budgeting decisions using standard methodologies

• Students can explain the impact of capital structure decisions on financial performance

and determine various parameters of a company’s cost of capital

• Students can appreciate how dividends are determined in practice and the influence of

dividend decisions on shareholder’s wealth

1

Course description

The course is divided into 3 main sections, beginning with the concept of valuation where

topics covering time value of money and the valuation of income streams, share and bond

valuations will be discussed. The course will thereafter extend these principles in the second

section to provide an in-depth discussion and critical analysis of the various techniques used in

investment appraisal decisions: Net Present Value, Internal Rate of Return, Payback Period.

These techniques will be applied to more complex investment proposals, including choices

between alternative projects, investment timing decisions and decisions on whether to invest.

The final section explores the relationship between risk and return, diversifiable and nondiversifiable risks, and beta through the use of the Capital Asset Pricing Model (CAPM) to

determine the Weighted Average Cost of Capital that financial managers use as a hurdle rate

for project evaluation in order to achieve the ultimate aim of maximizing the value of the firm.

Methodology to be used:

All students should make an effort to read the required material before class as this would

enable you to make the most out of the lecture. All students are responsible for the material

covered in class, as well as the material in the handouts and required readings for each class,

regardless of whether they were able to attend the class.

Attendance is COMPULSORY for seminars and lectures. Missing 25% of the classes will

mean that you have failed the course (see ISP rules on class attendance).

There are 2 seminar groups for this course, and once students are assigned to the

respective seminar groups (by the ISP office), they are not allowed to switch between

the groups.

A problem set or case study will be assigned for home preparation each week. Students are

expected to read the assigned material, relevant sections of the textbook and prepare the

home assignment for discussion during the seminars (note that homework is graded).

Students are encouraged to participate actively in the discussion of the topics and numerical

problems. For any additional practice questions, you should refer to your problems and

question sets (with solutions) at the end of each chapter of your textbook.

My teaching is most effective when students actively participate in class. This means that

students must think along with me during class sessions. There must be substantial studentteacher interaction-- typically through student questions, comments, and answers to my

questions. Students should have a strong impact on the class session.

I expect all of us in the class to behave responsibly. Laptops/notebooks/Mobile phones &

devices cannot be used during classes. Students, who behave irresponsibly, imposing

costs on others (for example, talking in class or using the mobile devices continuously),

should expect to bear the consequences of their action. If the student persistently fails

to abide by the rules, he/she will be reported to the university administration and the

student will have to withdraw from the course with a fail grade (no exceptions will be

made on this).

Non-Programmable Financial calculators will be used in this course.

2

Detailed class schedule, 1st – 15th week:

Date of class

Week 1

9 Sep

Week 2

16 Sep

Week 3

23 Sep

Week 4

30 Sep

Week 5

7 Oct

Week 5

14 Oct

Week 6

21 Oct

Week 7

28 Oct

Week 8

4 Nov

Topics to be discussed, readings required for the class

Lecture 1: Introduction to Corporate Finance: Taking the mystery out

of Corporate Finance

- The Corporate firm and Goals of the firm

- Corporate securities as claims on the firm

- Financial markets

BD Chpt 1

Class Exercise

Lecture 2: Time value of Money I

- Review of time value of money concepts

- Present and Future values

- Annuities, Annuities Due, Perpetuities

BD Chpt 4

Class Exercise

Lecture 3: Time value of Money II

- Applications on Time value of Money concepts – retirement,

investments & savings

BD Chpt 4

Class Exercise

Lecture 4: Financial Statements Analysis

- Review of financial statements

- Financial statement analysis

BD Chpt 2

Class Exercise

Lecture 5: Bond Valuation

- Bond valuation calculations

- Bond pricing and risks

BD Chpt 8

Class Exercise

Lecture 6: Stock Valuation

- Stock valuation calculations

- Growth estimates, payout ratios and Return on Equity

BD Chpt 9

Class Exercise

Lecture 7: Risk & Return

- Risk free rates and risk premiums

- Betas and Capital Asset Pricing Model

BD Chpt 10 & 12

Class Exercise

Mid term exam (covering Lectures 1-6)

Review of mid term exam

Lecture 8: Corporate Investment Decisions using the Net Present

Value rule I

- Net Present Value

- Other methods for valuing investments: Internal Rate of Return,

Profitability Index, Payback Period

BD Chpt 6

3

Week 9

11 Nov

Week 10

18 Nov

Week 11 & 12

25 Nov & 2 Dec

Week 13

9 Dec

Week 14

16 Dec

Week 15

(Date be advised)

Class Exercise

Lecture 9: Corporate Investment Decisions using the Net Present

Value rule II

- Mutually Exclusive Projects and Project Interactions

- Equivalent Annual Cost and Capital Rationing

- Why NPV leads to better investment decisions than other criteria

BD Chpt 7; Keown Chpt 9

Class Exercise

Lecture 10: Corporate Investment Decisions using the Net Present

Value rule III

- Discounted and incremental cashflows

- Cashflows and inflation

BD Chpt 7

Class Exercise

DUE: Group report submission & Project presentation

Lecture 11: Cost of Capital and Capital structure

- Weighted average cost of capital

- Determining individual cost of capital

Keown Chpt 11

Class Exercise

Revision Lecture & Class Exercise

Comprehensive Final Exam (covering Lectures 1-11)

Assignments:

Group Project (20 points)

A group assignment will be handed to you in week 3 and you will be required to work in groups

of 4 or 5 and submit the findings in a hard-copy report submission as well as a group

presentation in Week 11. This report and presentation will comprise of 15 points and 5 points

respectively of your total grade. Each member of the group may be asked to assess each

other’s contribution to the group project and hence, the report grades may be scaled depending

on peer assessment. Presentation grades, however, will be individually assessed by the

instructor.

Proper referencing and plagiarism rules are strictly enforced for all written

assignments.

Assessment, grading:

The assessment for the course comprises of 4 parts, with the following weights:

10 points Home assignments & Class participation

20 points Project & Presentation (see above)

30 points Mid term exam

40 points Final exam *

Grading is based on the total score in line with standard grading patterns in the ISP. * To pass

the course, you will need to pass the final exam.

Final Exam (40 points) & Mid term Exam (30 points)

The dates for the exams are in accordance with the ISP academic calendar.

4

This course has ONLY one mid term and one final exam. The final exam is a closed-book

cumulative exam, covering the material expounded during the whole course. The grade

obtained for the course is marked against the standards of the ISP and as such, is final and

non-negotiable. No emails/conversations on trying to better your score will be entertained after

the exam.

You must take the exams during the allotted timeslots. Exams are scheduled well in

advance so that you can plan around these dates. Do not ask to be excused from exams

for matters of personal convenience. An unexcused absence without supporting

documentation (e.g., doctor’s note or police report) will result in an F grade.

According to Corvinus University regulations, there might be a RESIT exam. Do note that you

will have to take the FIRST SCHEDULED FINAL EXAM, and having failed it will you be

permitted to take the resit exam. The resit exam is comprehensive in its coverage and,

incrementally tougher (and it will replace all your earlier grades). The best grade you could

receive for a resit exam is a Grade C-.

The course grades will be curved based on relative performance if the class average is below

Hungarian Grade 3/ISP Grade C- (this is not likely). Otherwise a straight scale will be used with

the +/− system. You will be treated fairly in all matters pertaining to your grade.

Home assignments (5 points) and Class participation (5 points)

Home assignments will be distributed after each lecture. You will need to complete the home

assignments for submission in the next seminar class. All home assignments attempted will be

noted and this will comprise of 5 points. The rationale for assigning homework is that there is a

strong correlation between good grades and completing home assignments. Most students

who fail this course (usually about 10-15% of the students fail each semester) because

they do not attempt the assigned homework during the semester and instead, try to

cram in the week before the exams. This is a futile attempt. Finance cannot be learnt in a

week. You need be consistent in your study efforts throughout the entire semester. If you fail to

submit your home assignments on more than 3 occasions (unless you have a valid medical

reason with supporting documentation), you will obtain 0 points for your home assignment

grades.

Class participation comprises of 5 points. You can easily obtain 5 points if you offer your

solutions in class (by writing on the board), asking relevant questions, providing answers to

questions asked. Almost all participation noted by the instructor will increase the student’s class

participation grade, but negative class participation includes disrupting class (e.g. by

coming in late), talking in class, not paying attention during a student presentation,

other forms of rudeness toward your fellow students, and a lack of cooperation with

methods to ensure that no cheating occurs during exams will result in a deduction of

points (which might exceed 10 points depending on the extent of disruptive behavior).

Grading class participation is necessarily subjective and no subdivision of the grade will be

available to students.

Do note that the coursework component is a bonus to you and can significantly improve

your overall score. Most students who submit home assignments and participate in class will

obtain between 8-10 points. In similar vein, if you have not participated in class, you will obtain

a zero grade.

5

Do note that every point is earned, not negotiated.

Compulsory readings:

There are two textbooks used in this course:

Jonathan Berk & Peter DeMarzo, Corporate Finance –Global Second Edition (2010), Pearson

Addison-Wesley

Keown, Arthur J., Martin, John D., Petty, J.William, Scott, David F. Jr., Foundations of Finance

– 5th Edition, Prentice Hall, 2006

Lecturer’s Handouts

Video recording of Class lectures available at

http://ondemand.homburgacademy.org/course/corporate-finance/

Recommended readings:

Students could also use, as reference, R. Brealey and S. Myers, Principles of Corporate

Finance, McGraw-Hill, (or any other earlier/later editions of Brealey & Myers). This is a classic

textbook that everyone serious about a career in finance should own. It does an excellent job

explaining institutional details and established theories.

Students should read “The Wall Street Journal Europe,” “Financial Times,” “The Economist” or

other business publications every week, and look for real world examples that relate to class

topics.

Note: This syllabus is subject to revision before or during the course at the discretion of the instructor.

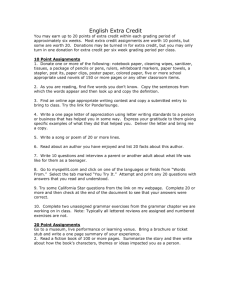

Hungarian and ECTS grading scale

Percentage achieved 87-­‐100 International grading scale

Hungarian ECTS Explanation for the Hungarian grade equivalent grade 5 A Excellent Percentage achieved 97-­‐100 International grade A+ 94-­‐96 A 77-­‐86 4 B Good 90-­‐93 A-­‐ 67-­‐76 3 C Satisfactory 87-­‐89 B+ 60-­‐66 2 D Pass 84-­‐86 B 0-­‐59 1 F Fail 80-­‐83 B-­‐ DNA Did not attend (no credit) 77-­‐79 C+ I C 70-­‐73 C-­‐ 67-­‐69 D+ Megtagadva R Incomplete (no credit) Signed (no credit) Refused (no credit) 74-­‐76 Nem jelent meg Nem vizsgázott Aláírva 64-­‐66 D 60-­‐63 D-­‐ 0-­‐59 F S 6