Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2014

CEE Eurobonds – The ‘Sweet Spot’

CEE sovereign bond market is fifth largest in Europe with approx. EUR 400bn total

market cap. CEE sovereign bonds outperform 5Y German and French

counterparts. Romania emerges as CEE regional champion among local currency

bonds; Hungary best regional performer among Eurobonds. Increasing investor

interest in CEE bonds due to more balanced distribution of upward/downward risks

and attractive yields vs. most Euro Area bonds. Cash position of CEE governments

generally comfortable.

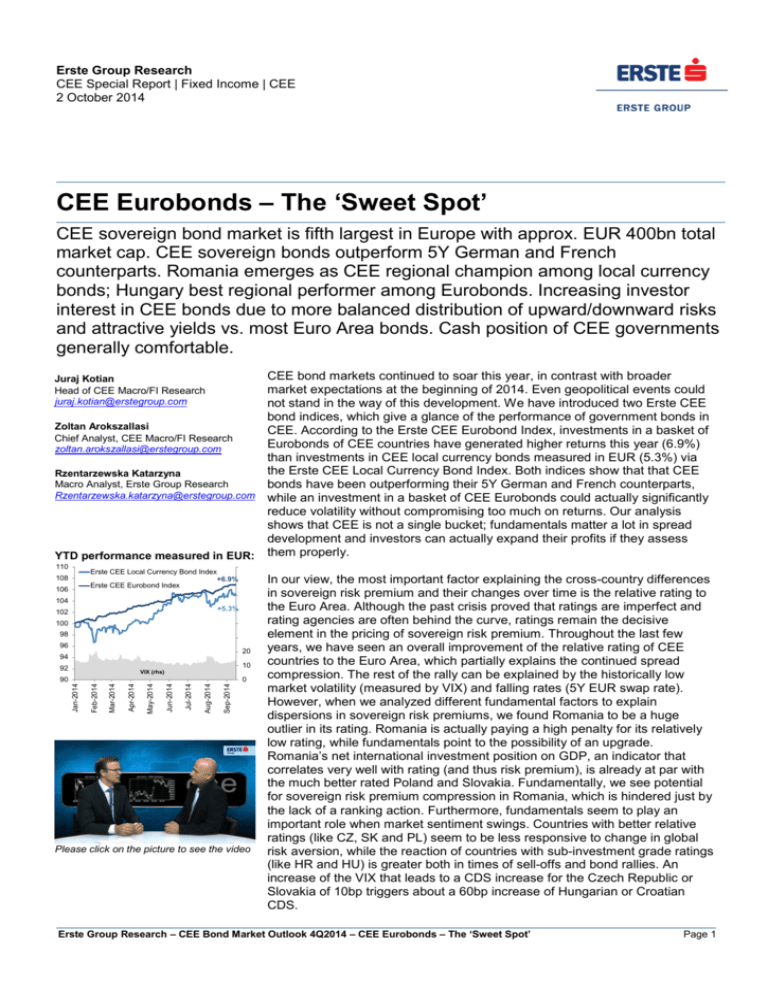

CEE bond markets continued to soar this year, in contrast with broader

market expectations at the beginning of 2014. Even geopolitical events could

not stand in the way of this development. We have introduced two Erste CEE

bond indices, which give a glance of the performance of government bonds in

Zoltan Arokszallasi

CEE. According to the Erste CEE Eurobond Index, investments in a basket of

Chief Analyst, CEE Macro/FI Research

Eurobonds of CEE countries have generated higher returns this year (6.9%)

zoltan.arokszallasi@erstegroup.com

than investments in CEE local currency bonds measured in EUR (5.3%) via

the Erste CEE Local Currency Bond Index. Both indices show that that CEE

Rzentarzewska Katarzyna

Macro Analyst, Erste Group Research

bonds have been outperforming their 5Y German and French counterparts,

Rzentarzewska.katarzyna@erstegroup.com while an investment in a basket of CEE Eurobonds could actually significantly

reduce volatility without compromising too much on returns. Our analysis

shows that CEE is not a single bucket; fundamentals matter a lot in spread

development and investors can actually expand their profits if they assess

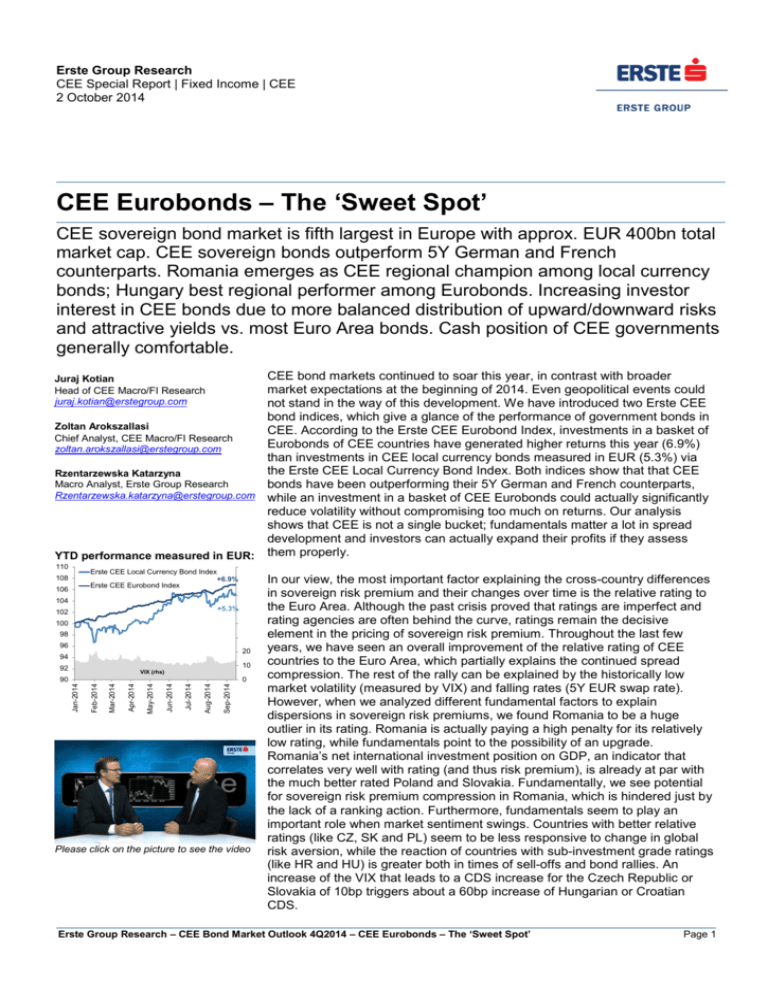

YTD performance measured in EUR: them properly.

Juraj Kotian

Head of CEE Macro/FI Research

juraj.kotian@erstegroup.com

110

80

Erste CEE Local Currency Bond Index

+6.9% 70

Erste CEE Eurobond Index

60

108

106

104

102

+5.3% 50

100

40

98

30

96

20

94

10

92

VIX (rhs)

Sep-2014

Aug-2014

Jul-2014

Jun-2014

May-2014

Apr-2014

Mar-2014

Jan-2014

0

Feb-2014

90

Please click on the picture to see the video

In our view, the most important factor explaining the cross-country differences

in sovereign risk premium and their changes over time is the relative rating to

the Euro Area. Although the past crisis proved that ratings are imperfect and

rating agencies are often behind the curve, ratings remain the decisive

element in the pricing of sovereign risk premium. Throughout the last few

years, we have seen an overall improvement of the relative rating of CEE

countries to the Euro Area, which partially explains the continued spread

compression. The rest of the rally can be explained by the historically low

market volatility (measured by VIX) and falling rates (5Y EUR swap rate).

However, when we analyzed different fundamental factors to explain

dispersions in sovereign risk premiums, we found Romania to be a huge

outlier in its rating. Romania is actually paying a high penalty for its relatively

low rating, while fundamentals point to the possibility of an upgrade.

Romania’s net international investment position on GDP, an indicator that

correlates very well with rating (and thus risk premium), is already at par with

the much better rated Poland and Slovakia. Fundamentally, we see potential

for sovereign risk premium compression in Romania, which is hindered just by

the lack of a ranking action. Furthermore, fundamentals seem to play an

important role when market sentiment swings. Countries with better relative

ratings (like CZ, SK and PL) seem to be less responsive to change in global

risk aversion, while the reaction of countries with sub-investment grade ratings

(like HR and HU) is greater both in times of sell-offs and bond rallies. An

increase of the VIX that leads to a CDS increase for the Czech Republic or

Slovakia of 10bp triggers about a 60bp increase of Hungarian or Croatian

CDS.

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 1

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Taking a look at the deficit outlook and cash position of CEE governments,

many countries do not need to rush with new bond issuance. However,

Croatia, Serbia, Romania and Turkey can take advantage of the favorable

market sentiment and do some pre-financing in 4Q14. The Czech Republic,

Hungary, Poland, Slovakia and Slovenia will most likely abstain from issuing

on international markets in 4Q14, with Poland and Slovakia preferring to tap

international markets only in 1Q15. Given that the ECB is trying to inflate its

balance sheet via asset purchases and liquidity provision, the interest rate

and yields in CEE should remain cemented at low levels, with ‘some’

downward potential remaining. That should keep investments in CEE bonds

attractive for investors. That is also because many CEE bonds still offer a

more balanced distribution of upward/downward risks and associated reward

in terms of yield against most Euro Area counterparts.

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 2

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Juraj Kotian

Head of CEE Macro/FI Research

Introduction of CEE Bond Indices

392

358

353

218

159

117

114

96

84

61

60

36

35

25

16

1146

838

Italy

France

Germany

Spain

CEE

Netherlands

Belgium

Austria

Poland

Portugal

Ireland

Finland

Greece

Czech Republic

Hungary

Slovakia

Romania

Slovenia

Croatia

2000

1800

1600

1400

1200

1000

800

600

400

200

0

1803

1554

Market capitalization of bond

markets (EUR bn, 2Q 2014)

Source: Bloomberg, Erste Group Research

2014Q2

2014Q1

2013Q4

2013Q3

2013Q2

2013Q1

2012Q4

2012Q3

2012Q2

2012Q1

2011Q4

2011Q3

Long-term sovereign ratings

Euro Area (S&P)

CEE Local Currency Bonds

CEE Eurobonds

AAA

AA+

The CEE government bond market has taken on more significance over the

last few years. The low interest rate environment is forcing institutional

investors to look beyond their traditional markets, as the possibilities have

dwindled regarding where to find any reasonable yield to compensate for the

risks. At the beginning of this year, there was a general consensus that, with

economic recovery in Europe and the Fed’s tapering, yields should be heading

north, which would have ended the rally in government bonds. Conversely, due

to low inflation and bleak economic outlook for Eurozone yields have been

dropping and thus contributing to the positive performance of CEE government

bonds. Even the Ukraine-Russia conflict has not halted this trend.

CEE is the fifth largest government bond market in Europe

Apart from Poland, the bond markets of individual CEE countries are relatively

small in the international context. However, pooling them together creates the

fifth largest government bond market in continental Europe. The market

capitalization of the CEE government bond market is worth almost EUR 400bn

and is larger than the Dutch, Belgian or Austrian government bond markets.

CEE bonds still provide a decent yield relative to their fundamentals or ratings.

Actually, the relative rating of CEE countries vs. the euro area has improved in

recent years. This is not only because of massive downgrades in the euro

area, but is also thanks to the fact that some countries have been upgraded

(i.e. Romania).

In order to better describe the performance of government bond markets in

CEE, we have introduced two Erste CEE Bond Indices. The first, the Erste

A+

CEE Local Currency Bond Index, simulates investment in 5Y government bond

A

paper issued in local currency and calculates the total return in EUR including

Acurrency gain/loss. Given that some investors do not want to take any currency

BBB+

risk, we also launched the Erste CEE Eurobond Index, which calculates the

BBB

performance of investments in euro-denominated Eurobonds with maturity of

Source: Bloomberg, Erste Group Research

about five years. The CEE countries included in those indices are Croatia, the

Note: weighted average rating, CEE ratings Czech Republic, Hungary, Poland, Romania, Slovenia and Slovakia, while the

are composite ratings (S&P, Moody’s, Fitch)

last two are omitted from the Erste CEE Local Currency Bond Index, given that

they are both euro area members.

Since the beginning of this year up to September 15, investments in CEE local

Year-to-date total return from

investments into 5Y government currency bonds and Eurobonds with a maturity of around 5Y were yielding a

total return measured in EUR of about 5.3% and 6.9%, respectively. The

bonds (return in EUR, %)

12

performance of CEE local currency bonds was much more volatile and

10

negatively affected by the weakening of CEE currencies, in particular the

8

Hungarian forint. But even taking the negative exchange rate effect into

account, CEE local currency bonds were outperforming investments in the 5Y

6

German Bund or French bond, which yielded in the same time period just

4

3.8% and 4.6% (YTD, including capital gains), respectively.

2

AA

1.3

2.4

3.8

4.3

4.6

5.0

5.2

5.3

6.8

6.9

7.6

8.5

9.0

9.2

9.2

9.4

9.8

10.0

AA-

HU (LCY)

CZ (LCY)

DE

SK

FR

CZ

PL

CEE (LCY)

PL (LCY)

CEE

HR

HR (LCY)

IT

RO

ES

SI

RO (LCY)

HU

0

Source: Bloomberg, Erste Group Research

Note: period Jan 1st 2014-Sep 15th 2014,

LCY = 5Y local currency bonds (generic),

otherwise 5Y EUR denominated bonds

(Eurobonds for CEE)

Among local currency bonds, Romanian 5Y bonds, with a 9.8% total return,

outperformed the whole region by far. This is mainly because its currency has

not weakened (as it has been well anchored by the central bank) and the

liquidity surplus brought yields downs. While HUF-denominated bonds were

underperforming our Erste CEE Local Currency Bond Index, Hungarian

Eurobonds were the best performers in broader terms, with their 10% annual

return beating even Italian, Spanish and Slovenian bonds. Hungarian

Eurobonds have benefited most from the further spread compression of

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 3

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

sovereign bonds in Europe. Later in this report, we analyze which factors

influence sovereign risk premiums and attempt to check the potential for

further compression or risks of reversal. For more on sovereign risk premium,

please read ‘What influences sovereign risk premium in CEE?’.

Total Return vs. volatility

Total return

(Jan 1st 1014- Sep 15th 2014, % )

12

10

HU

RO

IT

8

Erste CEE

Eurobond

Index

6

ES

CEE Eurobonds: reducing risk without compromising much on

returns

PL

CZ

SK

4

SI

HR

FR

Bund 5Y

2

0

0

0.05

0.1

0.15

Volatility

0.2

0.25

0.3

Source: Bloomberg, Erste Group Research

Note: period Jan 1st 2014-Sep 15th 2015

Volatility = stad. dev. of daily changes

5Y government bond yields

th

(as of Sep 15 2014)

3.5

3.6

3.7

4.0

3.5

2.4

2.5

2.7

3.0

2.0

2.0

2.5

1.5

1.0

0.5

0.2

0.4

0.4

0.7

0.7

0.9

1.1

1.1

1.1

1.3

2.0

DE

FR

CZ LCY

CZ

SK

PL

ES

SI

IT

CEE

RO

HU

CEE LCY

PL LCY

HR

RO LCY

HR LCY

HU LCY

0.0

CEE Eurobonds have also been performing very well in risk adjusted terms.

By buying a basket of CEE Eurobonds, investors could actually significantly

reduce volatility without compromising too much on returns. The volatility of

the Erste CEE Eurobond Index, as measured by standard deviations of daily

changes, was lower than that of individual CEE countries or even Germany.

When it comes to the outlook and performance of CEE bonds in 4Q14, the

development of the external environment will play a crucial role here. Given

that the ECB is trying to inflate its balance sheet via asset purchases and

liquidity provision, the interest rate and yields should remain cemented at low

levels, with ‘some’ downward potential remaining. But when looking at current

yield levels across Europe, it is clear that risks are distributed asymmetrically

– the potential for any further drop is yields is nearly at an end for many

countries, while the current yield level (in many countries this is sub 1% on 5Y

bonds) does not adequately price in any upward risk. From this perspective,

many CEE bonds still offer a more balanced distribution of upward/downward

risks and associated reward in terms of yield. Furthermore, we see some

opportunistic potential for short-term currency gains in Hungary and Poland

ahead of year-end, which could boost the performance of the Erste CEE

Local Currency Bond Index.

Source: Erste Group Research

LCY = 5Y local currency bonds (generic),

otherwise 5Y EUR denominated bonds

(Eurobonds for CEE)

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 4

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Katarzyna Rzentarzewska

Macro analyst, Erste Group Research

What influences sovereign risk premium in

CEE?

Relative rating to Eurozone and

level of spreads

Over the last few years, we have been observing compression of credit

default spreads across CEE countries. To some extent, it has been

associated with the fact that the global index of risk (VIX) has been steadily

dropping and the premium for risky assets has been going down. Despite the

common downward trend in all CEE countries, the differences in credit default

spread levels are not negligible. Although the region tends to be seen as a

homogenous area and its markets are prone to co-move in response to

changes in global sentiment, the diverse level of fundamentals seems to

explain why the level of credit default spreads vary across the region.

Moreover, it appears to affect the magnitude of responses to increases in risk

aversion.

Source: Bloomberg, Erste Group Research

Response to increase in global

risk aversion

Source: Bloomberg, Erste Group Research

Country

CZ

PL

HU

RO

SK

Credit Default Spread 5Y Relative rating to Eurozone International Investment Position

86.1

-0.4

-48.6

133.7

2.5

-66

362.2

6.4

-105.2

6.5

263.4

-65.2

137.5

1.4

-64

As far as global factors are concerned we identify risk-free interest rate (10Y

Euro Swap) and attitude toward risk (VIX index) as significantly related to the

spread level. Further, fundamental factors, such as the current account

balance and relative rating to the Eurozone are directly linked to credit default

spreads, so that improvement of a country’s economic conditions is

associated with a downward move in the credit default spread level. The lower

the relative rating is (i.e. the difference to the Eurozone is smaller) and the

smaller the current account deficit the country has, the lower the level of CDS.

Moreover, a country’s rating seems to have indirect effects as well, as better

fundamentals induce a smaller response to changes in global risk aversion. In

particular, countries with better relative rating to the Eurozone, should

experience smaller increases in credit default spread levels than countries

with worse ratings when global risk aversion increases.

In other words, we find that countries with strong fundamentals (low relative

rating) remain more resilient to global turmoil. Thus, when risk surge suddenly,

such countries as Slovakia or Czech Republic should experience increase in

the CDS level by roughly 10bp (i.e.20% higher from current level), while

Romania or Hungary may experience widening the spreads by around 60bp

(i.e. more than 30% higher from current level).

Romania as an outlier in terms

of rating position

Source: Eurostat, Erste Group Research

While we think of the level of the risk-free interest rate and changes in risk

aversion as common factors impacting CDS moves in all CEE countries,

differences in fundamentals seem to drive the dispersion between CDS levels

across CEE. In our view, the most important factor explaining the changes

between the CEE CDS levels is the relative rating to the Eurozone. The rating

is considered to be a reflection of a country’s riskiness. In other words, it

should incorporate the influence of the main macro indicators reflecting the

condition of the economy, and in particular the international investment

position. In this respect, the relative rating to the Eurozone seems to reflect

the fairly current level of fundamentals in all CEE countries, apart from

Romania. Romania is a clear outlier – countries such as Poland and Slovakia

that have similar international investment positions have better ratings than

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 5

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Romania (the lower the number, the smaller the difference between the

country’s rating and the Eurozone). Naturally, we expect that an improvement

in rating is linked to a drop of spreads. Our model shows that, given the

current level of global risk aversion, improvement in the relative rating by 1

notch should be associated with the CDS level dropping by roughly 30bp on

average. Intuitively, the changes in the current account deficit are expected to

have similar effects on the CDS levels, though, in our view, to a lower extent

(reducing the current account deficit by 1pp should be on average related with

a 6bp drop in CDS).

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 6

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Cash position of CEE governments generally

comfortable

Zoltan Arokszallasi

Chief Analyst,

CEE Macro/FI Research

Primary market in 4Q14: no rush to increase supply

CZ and SI showing robust cash

positions

120%

100%

80%

Budget deficit figures altogether in CEE should decrease slightly from this

year. The tendency is a decline of deficit figures where the levels were

exceeding the 3% of GDP threshold, while in other countries, the deficits are

at a relatively low level. Altogether, the budget deficit for the CEE region

should decline to around 3% in 2015 (from somewhat above 3% this year, if

we consider that the Polish deficit could have been above 3% of GDP this

year without the takeover of pension fund assets).

60%

40%

20%

0%

HR CZ HU PL RO RS SK SI TR

Cash buffer / 12m redemptions

Compl. of planned financing 2014

Taking a look at the redemption situation and cash buffers in CEE countries

and Turkey, several countries should not be in a particular rush to increase

supply. Some countries are actually expected to reduce the amount of public

debt in 4Q either via buybacks or a lower amount of primary issuance, in order

to comply with their debt-brake rules (Slovakia, Hungary). Other countries

have a very high level of cash buffer (the Czech Republic, Slovenia), which

allows them to have a net issuance of zero in 4Q14 and even beyond. As for

other countries, however, pre-financing 2015 redemptions could be a viable

option (e.g. Poland), while some countries need to carry out substantial

financing still this year, due to their not being able to complete the financing

plan, or having a very low level of cash buffer (the most notable example of

the latter is Romania).

As for foreign issuance, we expect the Croatian, Serbian, Romanian and

Turkish governments to tap foreign markets in order to do some pre-financing

for 2015, while Poland and Slovakia may tap foreign markets in early 2015.

Demand side should remain supportive

Yields to notably increase only

in Romania in 4Q14

1.00

0.80

0.60

0.40

0.20

0.00

-0.20

-0.40

-0.60

Forecasted change of l/t

yields vs. current levels

HR

CZ

In the past few years, the demand for local currency government paper in the

region soared by non-resident investors. Despite the Fed’s expected

tightening, the ECB’s additional steps should help foreign demand remain

supportive of local bond markets. As for banks, their appetite should also

remain pronounced, given the high liquidity in the banking systems generally

in CEE. One exception could be Hungary, where the conversion of FX loans

into HUF loans could increase the demand for HUF liquidity, and thus,

decrease the appetite of banks for government securities.

HU

PL

Yields to generally remain low

RO

Central banks in the region should continue to pin down the short end of the

yield curve, keeping policy rates low (or even cutting them further in Poland).

Inflation figures are expected to remain rather muted in CEE, with an average

of below 2% in 2015, after the muted 0.4% predicted for 2014. Overall,

moderate supply, the expected support from ECB measures, low inflation and

a generally accommodative monetary policy should help keep yields relatively

low in CEE on the government bond markets. An exception for the short run is

Romania, where political risks could increase spreads in the fourth quarter,

while the relatively low level of cash reserves and a demanding roll-over

structure could lift yields. On the other side of the spectrum, the Czech

Republic should see yield levels remain pinned down at current rates, and

(given the favorable cash position, no plans for net issuance and solid

fundamentals) the spread vs. Bund yields could even become negative in

2015.

SK

SI

RS

4Q14 1Q15 2Q15 3Q15

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 7

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Rainer Singer

Senior Economist, US & Eurozone

Major Markets

Stellar performance of

Eurozone bond yields in 2014

Eurozone bond markets have shown a stellar performance in the course of

this year, with yields declining and spreads of peripheral countries tightening.

Indeed, the environment could not have been more supportive for fixed

income securities. Only a few months after the onset of the Ukraine crisis,

economic indicators for the Eurozone started to worsen and inflation rates

continued their decline, triggering interest rate cuts by the ECB and additional

liquidity providing measures. All these factors brought sovereign long-term

yields (significantly) below historic lows. Geopolitical risks, namely the standoff between Russia and Western countries, which affects the Eurozone

significantly, cannot be predicted. In our baseline assumption, we do not

expect an acceleration of the crisis, as the political and economic price to be

paid would be too high. Accordingly, we would see the influence on bond

markets subsiding from this side during the last months of this year.

10y Sovereign Bond Spreads, in %

8

7

6

5

4

3

2

1

0

02.10

02.11

IT

02.13

02.12

DE

ES

02.14

AT

Source: Bloomberg

Economic indicators are expected to remain weak for the coming months.

Leading indicators lead us to expect a decline of economic output in the

Eurozone in the third quarter and modest growth in the in the last quarter of

the year. Additional support for low-yield levels will come from liquidity

operations. 8 TLTRO operations over two years and asset purchases covering

the ABS and covered bond markets will provide banks access to additional

liquidity The maximum amount possible for the first two TLTRO operations is

EUR 400bn, for the asset purchase programs it is difficult to estimate before

details will be announced at the beginning of October. In any case,

considerable amounts of additional liquidity will be provided to markets before

year-end, supporting the high valuations of sovereign Eurozone bonds. As a

mid-term aim, ECB President Draghi has mentioned the ECB’s previous

balance sheet high, which is equivalent to an expansion by EUR 1trn from the

current level. Weighing all these factors, we would expect German yields to

remain roughly unchanged until year-end, as current market expectations will

be confirmed, but do not want to rule out further spread compression of

Eurozone peripheral bonds, as additional liquidity should rather flow into

spread markets.

Draghi: ECB balance sheet to

grow to historical high

ECB Balance Sheet, EUR bn

3500

3000

2500

2000

1500

1000

500

0

Jan-08

Jul-08

Jan-09

Jul-09

Jan-10

Jul-10

Jan-11

Jul-11

Jan-12

Jul-12

Jan-13

Jul-13

Jan-14

Jul-14

EUR 1 trn

Source: ECB

Next year, we expect the Eurozone economy to stabilize, showing a stable albeit moderate - recovery. Economic factors should trigger a moderate

upward movement of yields, but valuations will remain high. However, should

the current extremely low rate of inflation remain at these current low levels

too long, there would definitely be more of a chance for the ECB to enter into

broad-based asset purchases, i.e. government bonds, next year, which would

dampen any reaction of yields to better economic data.

Looking across the Atlantic, we expect the US economy to continue on its

growth path, justifying a first rate hike in March 2015, with further hikes to

follow during the year and beyond. Accordingly, Treasury yields are set to rise

and shorter maturities should be more affected than longer-dated ones. The

latter could possibly be supported through capital inflows from the Eurozone,

courtesy of the ECB’s liquidity supply.

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 8

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Alen Kovac

Chief Economist of Erste Bank Croatia

Croatia

Fiscal prospects remain gloomy

0

-1

-2

-3

-4

-5

-6

-7

-8

-9

90

80

70

60

50

40

30

20

10

0

2010

2011

2012

2013

2014f 2015f

Govt. budget balance (% of GDP)

Public debt (% of GDP) RHS

Source: MoF, CBS, EBC

Supply and demand factors

A demanding funding profile is certainly no big news. Croatia tops its regional

peers, with funding needs in the vicinity of 20% of GDP. Nevertheless, the

2014 financing operations YTD have run rather smoothly, and as far as 2014

is concerned, the final quarter is set for a smooth T-bill rollover, and the MoF

may yet opt for a smaller (up to EUR 500mn) bond placement on the local

market. We see very limited room for negative surprises there.

Moving on to 2015, gross financing needs remain elevated and close to 22%

of GDP. Once again, the large maturing T-bills stock (approx. 9% of GDP) are

inflating the refinancing needs, although it should also be vivid on the bonds

side, with three bonds due in 2015. We are working with a budget gap

estimated at 4.5% of GDP for 2015, i.e. we are anticipating approx. 1pp of

GDP consolidation effort under the EDP next year. We are currently in the

dark when it comes to any tangible details surrounding financing plans. We

would expect a full T-bill debt rollover, a fairly limited focus on the expansion

of financing via traditional credit and a more aggressive focus on bond

financing. Our best guess here would be that the MoF would opt for some prefinancing in 4Q14, given the Eurobond (EUR 750mn) maturing early in 1Q15

and a favorable moment to close a proportion of funding needs for 2015. Later

in 2015 we expect to see more activity on the local market, given close to

EUR 1.1bn in maturities on the local market.

On the demand side, banks remain essential for smooth T-bill and credit

rollover, although the recent track record suggests a likely limited appetite for

further exposure increase. Therefore, pension funds remain the segment with

the healthiest sovereign debt appetite, although some one-offs could curtail

demand (transfer of part of the assets from the second pillar to the first would

trim the liquidity position by approx. EUR 350mn p.a. in 2014 and 2015, the

regulatory framework encourages more equity exposure, and the pending

highways concession). Consequently, a reliance on external funding remains

clear. The risks here remain balanced: fundamental underperformance related

to mediocre growth prospects and a lack of fiscal consolidation weigh on the

risk profile, but an accommodative ECB monetary policy works in the opposite

direction. In our baseline scenario, we continue to see financing options as

viable and the markets once again providing more maneuvering room for

policy makers.

Foreign ownership on the rise

45%

43%

41%

39%

37%

35%

33%

31%

29%

27%

25%

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

T-bills/bonds

owned by the

foreign investors

Source: CNB

Other factors

On the privatization side, the above-mentioned highway monetization process

may result in EUR 2.4-3.2bn in one-off revenues. At the moment, it remains

hard to attach any exact likelihood to these revenues, as the process remains

politically sensitive. The process gains importance with the ESA2010

adoption, with highway-related debt feeding into public debt figures (a one-off

upside effect slightly close to 10% of GDP). Therefore, monetization receipts

may be used to offset a proportion of the related one-off shock.

As for yields, we see the current market drivers offsetting the fundamental

vulnerabilities and therefore see HRK yields close to the 3.5% mark. Ample

market liquidity, and a comfortable CNB and ECB stance support the investor

focus shifting to the longer end of the curve and supporting the ongoing low

yield environment. However, vulnerability to monetary policy course shifts and

more fundamentally-driven investor focus remains a clear mid-term downside

risk.

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 9

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Czech Republic

David Navrátil

Chief Economist of Ceska sporitelna

Jan Šedina

FI analyst at Ceska sporitelna

Supply and demand factors

Absorption capacity of banks to

buy govies is high

Absorption capacity (CZK bn)

1,400

1,200

The most important recent message from the Czech MoF relating to its

issuance activity is its aim to stabilize the total amount of the central

government debt at the current levels (CZK 1.68trn; regardless of the

development of the business cycle) at least until the end of 2015 (no new debt

issuance in both 2014 and 2015). As a result of the considerable improvement

in liquidity management, the MoF will be able to comfortably cover both 2014

and 2015 deficits by excessive cash reserves (CZK 286bn as of June 2014).

1,000

800

600

400

200

0

2002

2004

2006

2008

2010

2012

2014

Absorption capacity

FI securities held

Liquidity surplus (deposits and issued securities minus loans)

Source: CNB

This year’s gross financing needs (CZK 264.9bn, without the 2.0% expected

central government deficit) are estimated to decline to 6.6% of nominal GDP,

from 8.0% in 2013. Regarding the recent more extensive incorporation of

lending facilities helping to cover the state’s borrowing requirement, the total

amount of outstanding T-bill as well as T-bond stock is expected to

moderately decrease at the end of 2014 compared to the previous year. In

2014, the MoF will also refrain from rolling over in total CZK 83.6bn in

Eurobonds, resulting in a decline in the share of foreign bond issues in total

government securities to roughly 15%, from 20% at the end of 2013.

However, the share of foreign investors’ holdings in total outstanding

government bonds remains rather stable (at 11.3% as of July, compared to

12.3% in January 2014).

On the demand side, the main buyers are banks, which hold nearly half of the

LCY debt. We expect the loan to deposit ratio to be stable around 74% and

assets growing by ~5%. This means business as usual, allowing banks to

absorb an additional CZK 50bn. One should also add the still increased

liquidity through the 2-day intervention done by the CNB in 2013, which

increased the liquidity surplus by CZK 200bn. Although the high share of

bonds in banks’ balance sheets (21%) could limit appetite for local govies,

there does not seem to be any attractive alternative. Pension funds and

insurance companies hold ¼ of LCY govies and their (new) demand in 2015

should be roughly CZK 40-50bn.

Other factors

Banks have lots of liquidity

placed at CNB

Total Amount of Domestic Banks'

Deposits with Central Bank (CZK mln)

800,000

As the CNB is unlikely to proceed with withdrawing the CZK 200bn in liquidity

poured into the Czech financial sector (in late 2013) before the start of 2016

(with respect to the CNB promise to keep the EURCZK above 27 as well as

the key refinancing rate at technical zero at least until 2016), monetary policy

will maintain its supportive role in keeping yields at low levels.

700,000

600,000

500,000

400,000

300,000

200,000

100,000

0

1994

1998

Source: CNB

2002

2006

2010

2014

In summary, with respect to the government’s effort to not to take on new debt

at least until the end of 2015, the public debt-to-GDP ratio is expected to

decline to 43.1% in 2015 (from 46.0% in 2013). As the supply of government

debt is going to remain rather stable in the coming quarters, the abundant

liquidity within the Czech financial sector, expected further acceleration of

Czech GDP growth (2.7% in 2015) and the government’s large cash reserve

should act as the dominant factors keeping yields compressed in 2015.

Therefore, we see the yields of 10Y T-bonds at 1.25% at the end of 2015

(unchanged compared to their current levels), with the spread to German 10Y

papers turning negative in the course of 2015 (-0.3pp at the end of 2H15).

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 10

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Gergely Gabler

Macro Analyst of Erste Bank Hungary

Hungary

Supply and demand factors

Investor structure of HUF

denominated government paper

(2Q14)

Local currency bond supply is expected to be strong, as the budget deficit is

expected to grow next year, given the already known fiscal loosening

measures (e.g. further tax relief for 2-child families, tax deductions for banks

on FX Mortgage Relief, etc.). Furthermore, the government plans no FX issue

next year; FX redemptions should thus be covered by HUF issues as well.

8.1%

14.3%

33.1%

12.3%

32.2%

Foreign investors

Pension Funds

Other

Banks

Retail investors

Source: Govt Debt Mgmt Agency

This year, Hungary has to cover a total of EUR 5.4bn in FX redemptions. Next

year, FX redemptions will only amount to EUR 2.4bn. However, the

government plans no Eurobond issues for the whole year, and the demand for

local EUR-denominated bonds will drop significantly, as only retail investors

will be eligible for them. The demand for local currency bonds, however, could

fall notably next year. On one hand, foreigners have built up a massive

position in HUF bonds, while the depreciation of the forint may discourage

these investors from renewing the maturing bonds. On the other hand, local

demand may drop as well, as the ample forint liquidity of banks could drop

significantly next year. Firstly, the conversion of FX mortgages (EUR 12bn,

HUF ~3800bn) will swipe a substantial amount of the HUF 4800bn in extra

liquidity of banks (two-week deposits at the central bank). Secondly, the signs

of intensifying lending activity after a few years of coma should also reduce

bank demand for government bonds.

The importance of pension funds is still very low after the destruction of the

mandatory private pension fund system. The remaining voluntary pension

funds also lack strong fund inflows. As for mutual funds, the fund inflow was

rather strong in the last few years, as their ex-post returns were far more

attractive than the ex-ante interest rates of bank deposits. However, this

process will likely turn back, as the central bank rate cuts have finished and

the banks will need more liquidity.

10 year bond yield development

7

USA

Germany

Hungary

6

5

These factors will likely lead to increasing bond yields next year, in spite of the

extremely loose monetary policy and QE measures by the ECB. We expect

10-year bond yields to stay at 4.8% by end-2014, while they may increase to

5.0% by end-2015.

4

Other factors

3

Besides these factors, we have to note that the central bank’s so-called SelfFinancing Plan was quite successful in increasing the demand for local bonds

and decreasing long-term bond yields. However, the flow effect (shift from

two-week bills to govies) of this measure ended in August, so the additional

demand is declining significantly. This has already resulted in a correction of

long-term bond yields.

2

1

0

Jan-14

Mar-14

May-14

Source: Bloomberg

Jul-14

Sep-14

It is also an important factor that many foreign investors in Hungary consider

dollar bonds as a benchmark for HUF bonds. The increasing expectations of

a Fed rate hike in 1H15 have already resulted in an upward shift in the 10year US bond yield (2.56% vs. the 1.04% Bund yield). A further increase in

US rates could force Hungary’s long-term bond yields higher, in spite of the

record-low German rates.

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 11

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Katarzyna Rzentarzewska

Macro analyst, Erste Group Research

Poland

Supply and demand factors

Poland has already finished financing this year’s borrowing needs and in

4Q14 it should start to pre-finance next year’s financing needs. The Ministry of

3.5

Finance plans an increase of next year’s gross borrowing needs to PLN

yield curve, current

yield curve, year-end

154.8bn, i.e. around 9% of GDP (from PLN 127bn this year). This includes

3

PLN 100.8bn in maturing debt, while net borrowing needs constitute roughly

2.5

one third (PLN 54bn vs. PLN 47bn in 2014). The increase mainly reflects the

2

setting of the maximum level of the budget deficit in the amount of PLN 48bn

(vs. a budget deficit of PLN 34bn this year) and the budget deficit of European

1.5

funds at EUR 3.5bn (EUR 391mn in 2014). Although we see some downward

risk to the economic growth and inflation rate assumptions of the Ministry of

Finance (3.4% and 1.2% on average, respectively), in our view, the expected

Source: Bloomberg, Erste Group Research revenues and expenditures are planned cautiously, and we see overshooting

of the planned deficit as unlikely. As there is little maneuvering space left to

increase government spending (if Poland wants to exit EDP in 2016), the

supply of bonds should remain limited.

10Y

5Y

2Y

3MWIBOR

Yield curve development

Foreign investors are the main buyers of Polish papers (they hold almost two

thirds of debt) and we expect them to keep that role in the near future. These

are mostly stable and long-term investors (such as central banks, pension

and investment funds) looking for attractive - but still safe - returns. The Polish

bond market should continue to offer these conditions. The high share of

foreign investors, however, bears a risk of capital withdrawal in the case of

market turbulence, but their long-term character (roughly half of the securities

held have an average maturity above seven years) reduces the roll-over risk

compared to short-term maturity papers. Thus, the strategy to extend the

average maturity (T-bills are already withdrawn) attracts such investors and

may discourage domestic banks from buying, as they prefer shorter maturity.

Other buyers include investment funds and insurance companies (nonbanking sector) and we expect their share to increase only in the long-term

perspective.

Other factors

Foreign investors’ holdings

increased

100%

80%

60%

40%

20%

00%

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Foreign investors

Banks

Pension Funds

Other

Source: MinFin, Erste Group Research

Despite the expected increase of borrowing needs for the next year, the

overall supply of bonds dropped when the pension system reform was

introduced earlier this year, which should support a lower level of yields.

Moreover, the reform changed the currency and debt-holder structure of the

debt. First, the share of debt denominated in foreign currency increased from

32% to 35%. The strategy, however, assumes a targeted share of 30%, which

implies lower net issuance of Eurobonds in the near future. Further, the

absence of Open Pension Funds that had played the role of ‘market stabilizer’

could make the Polish bond market more sensitive to global trends and core

markets’ behavior. If German Bunds remain stable until the end of the year, as

we currently expect, we should not see any major upward move on the long

end, as domestic factors (expectations for rate cuts in Poland) favor a low

level for yields as well. All in all, we currently see 10Y yields close to 3% at the

end of the year, which makes the market conditions attractive for prefinancing. We expect the Ministry of Finance to have around 15% of next

year’s borrowing needs pre-financed by the end of the year. In particular, for

the medium term, we expect 10Y yields to moderately increase toward 3.2%

in 1H14, as we presume a steepening of the curve, due to the improving

economic outlook (both in the Eurozone and Poland).

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 12

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Romania

Dumitru Teodor Dulgheru

Senior Analyst

5-year ROGB yields

Russian annexation

of Crimea after

referendum

5.0

4.8

5.0

4.8

4.6

4.6

EU extends

sanctions

against Russia;

Russia bans

EU/US imports

4.4

Local political

crisis; ruling

coalition

break-up

4.2

4.0

3.8

3.6

3.4

Protests

flare up

violently in

Ukraine

3.2

4.4

4.2

4.0

3.8

Malaysian

flight shootdown; US

announced

announces

new sanctions

against Russia

3.6

3.4

3.2

3.0

Jul-14

Aug-14

Jun-14

May-14

Apr-14

Mar-14

Jan-14

Feb-14

Dec-13

3.0

Although the international context, especially that on the eastern border of

Romania, has been anything but calm this year, the country has enjoyed a

visible rally of its asset prices. Being a NATO and an EU member counted

significantly in its favor when investors fleeing the East were making the

decision whether or not to invest. The uptrend in prices was reinforced by the

S&P agency decision to increase Romania to investment grade in mid-May,

and by the JP Morgan announcement in mid- to late-July that new Romanian

benchmark bonds were being added to their investment grade emerging

market index. However, no one could contend that Romania is immune to the

external environment, all the more so as the escalating conflict in neighboring

Ukraine has every now and then clearly sent shivers down investors’ spines

(see the upper chart on the left-hand side). 5-year ROGB yields hit their

lowest in early- and late-July (3.2%) on the secondary market; yields have

been drifting up and down ever since, without reaching their all-time low.

Supply factors

Source: MinFin, BCR Research

As of end-September, the MinFin had covered around 82% of its total funding

needs for this year, thanks to the three outings in January and April (22% of

FY14 funding needs). They have also helped local yields remain, in general,

on a downtrend up until now, as the MinFin borrowed less from the local

market (the average yield on the primary market fell to 3.7% in the first eight

months of 2014, from 4.7% in 2013). True to its strategy, the MinFin has

managed to lengthen maturities, which is why gross funding needs for 2015

have dropped to around RON 50bn; around 22-23% thereof could be tapped

from abroad, while the balance will be sourced domestically.

Demand factors

RON public debt by type of

holder

40

Local banks, investment and pension funds will be the main buyers of

government notes in 2015, with an increase in net exposure of around RON

6bn. Although a fledgling industry in Romania, private pension funds have in

only a few years become one of the main investors in state bonds, accounting

for more than 9% of the total market. Although European quantitative easing

may spill over some money into Romania and drive assets prices slightly

higher, we see rather limited growth potential for non-resident exposure in

2015 (especially after the stuffing of their fixed income portfolios in 2013 and

to a lesser extent in 2014). Non-residents started to vigorously bulk up their

portfolios in early 2013 and are now claiming more than 20% of the total local

bond market.

20

Other factors

140

120

Non-residents

Other residents

Local banks

100

80

60

0

2011

2012

2013

2014e

Source: MinFin, BCR Research

2015f

The central bank cut the key rate further to 3% this fall, and it has already

signaled that it is ready to bring money market rates closer to the key rate,

adding that local banks need to work in a more stable interest rate

environment (interest rates have been strikingly lower than the key rate since

early 2014). The 3M ROBOR rose to 2.8% from less than 2.1% less than a

month ago. Presidential elections are around the corner (early November)

and the whiff of populist measures is growing stronger and stronger. On the

European front, the QE which is expected to fire up lending could be thwarted

by the spillover effects in other type of assets and by the lack of fiscal reforms

in some big European economies. This, combined with an already slowing

Eurozone and smothering conflict on the Easter borders, could make

investors contemplate higher return investments across the pond. We see 5year ROGB drifting up to 4.1% in December 2014 and then gradually nudging

lower towards 3.7% as of end-2015.

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 13

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Serbia

Milan Deskar-Skrbic

Macroeconomic Analyst

Erste Bank Croatia

Supply and demand factors

Fiscal risks very much alive

0

-1

-2

-3

-4

-5

-6

-7

-8

80

70

60

50

40

30

20

10

0

Gross financing needs in 2014 are relatively high, standing at around 18% of

GDP (EUR 6.7bn), and incorporating a planned budget deficit of 7% of GDP.

Although we saw no limitations to a smooth rollover of public liabilities, Serbia

is one of the few CESEE countries that have not yet fully secured funding

needs for 2014 (hitting around 80% of total needs at end-August, including a

USD 1bn UAE bilateral loan). The YE indication is that we may see the MoF

tapping the Eurobond market, most likely going for volume in the region of

around EUR 750mn. The timing, in our view, remains determined by the

progress in the upcoming IMF talks and expected positive investor feedback

on the eventual progress to set up a new precautionary standby deal.

2009 2010 2011 2012 2013 2014f 2015f

Govt. budget balance (% of GDP)

Public debt (% of GDP) RHS

Source: SORS, MoF, EBC

Looking to 2015, we expect the financing needs to move to above 20% of

GDP, based on our revised YE15 growth forecast of 1% (vs. the previous call

of 2%), 5.5% of GDP deficit and expected T-bills and bonds maturity of above

RSD 600bn. As for the financing, we see the government keeping its 2014

behavior pattern and trying to roll over the T-bills and T-bonds on the

domestic market, while for deficit and international bond maturity (EUR 500mn

in 2Q15), external debt markets and potential new bilateral deals (such as the

2014 10Y UAE loan with a 2% interest rate) would represent our best guess,

as we are still awaiting details on the 2015 budget and financing profile.

On the demand side, banks remain the key local player and already high

exposure to govies imply some limitations. Foreign investors, IFIs and

bilateral deals remain an essential financing channel. Therefore, we see the

main factors shaping investor demand in 2015 as the commitment and

credibility of the government in the implementation of fiscal consolidation and

structural reform programs. That is also pretty much on the IMF agenda, and

thus striking a new deal with the IMF would anchor policy uncertainty and

internal risk drivers. However, the ECB move towards further monetary

stimulus clearly supports the funding situation.

Other factors

Yields holding steady

8

USD 2020

7

USD 2021

6

The monetary policy outlook is becoming more uncertain, with fiscal risks and

geopolitics hurting the FX outlook and demanding a more active approach

from the NBS. In combination with less room to maneuver in terms of inflation

in the period ahead, we see the NBS as being increasingly more likely to

remain on hold, i.e. we are not anticipating any more aggressive rate cuts in

the quarters ahead, thus supporting the interest rate differential.

5

4

Sep-13

Oct-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jun-14

Jul-14

Aug-14

Sep-14

3

Source: Bloomberg

Although there are no formal details, in the medium term, we could see some

intensification in the privatization process, as the new privatization law was

put in motion and the Privatization Agency (PA) published a list of 502 public

companies (the PA expects approx. RSD 12bn from the sale of additional

spectrum to mobile providers at the beginning of 2015). We take the

privatization plans with a grain of salt; still, in the upcoming period, we could

hope to see an increasing share of “other funding” sources. All that said, we

see Serbian USD yields moving gently below the 5% mark, with the main

downside risks coming from fiscal slippages, additional delays in structural

reforms and a bleaker economic outlook. On the other hand, we see the main

upsides as being the long-awaited progress concerning the IMF deal – which

could be seen as a hard policy anchor – ECB easing and stabilizing

geopolitical tensions.

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 14

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Slovak Republic

Michal Musak

Analyst at Slovenska sporitelna

Supply and demand factors

Debt and deficit trajectory

Public debt (% of GDP, right axis)

-14

60

Fiscal deficit (% of GDP)

-12

50

-10

40

-8.0-7.7

-8

30

-6

-5.1

-4.5

-4

-2.8

-2.8-2.5

-1.6

-2

0

20

10

0

For 2015, we expect Slovakia’s gross issuance to reach some EUR 5.5-6bn

(vs. EUR 4.3bn in 2014 by September) and net issuance around EUR 1.52bn. Most of the new issues will be used to roll over old debt and finance the

deficit, while the government also expects sizeable privatization proceeds.

Due to the maturity profile, the new issuance should be significantly skewed

towards the beginning of the year. In 2015, the debt agency will face roll-over

needs of about EUR 4bn, but it is likely that it will buy back part of this volume

already in 2014, using its cash reserve and debt issuance. Besides interest

savings, the state has an additional motivation to repay bonds early, due to

constraints on the public debt imposed by the local debt brake rule.

1999 2002 2005 2008 2011 2014

2014-16 figures are based on draft of next

year’s budget

Source: StatsOffice, MinFin, SLSP

The debt brake stipulates that once the public debt exceeds 55% of GDP, the

next budget proposal cannot include an increase of public expenses (with

some exceptions). Slovakia broke this threshold in 2013. More seriously, at

57% of GDP, the government would be obliged to propose a balanced

budget, which would require a big chunk of extra consolidation (please note

that the Parliament might alter the proposal, but at political costs and possibly

a higher cost of financing). Hence, the government is motivated to keep the

debt as low as possible.

The government also plans the privatization of a minority 49% stake in Slovak

Telekom, which is expected to net about EUR 1bn (1.3% of GDP) in 2015.

Most of the proceeds should be used to lower the debt.

Other factors

Yields declined considerably

Yield-to-maturity at 2020 bonds

7

6

DE 2020

5

SK 2020

4

spread

3

2

1

0

Jan-11

Jan-12

Jan-13

Jan-14

7-day moving averages

Source: StatsOffice, MinFin, SLSP

The state sees little financing pressures and we also see no imminent

problems going forward. 10Y yields stand at 1.6%, while 4Y yields go as low

as 0.3% on the secondary market. Amid the low interest rate environment, the

agency has avoided T-bills recently. The debt agency has increasingly used

private placements, in order to broaden the client base. While hedged, these

have often been issued in foreign currencies. Out of the EUR 4.3bn issued by

September 2014, EUR 1.5bn was a single syndicated issue, EUR 1.9bn was

issued in regular tap auctions in total and the rest was in private placements.

Loans and deposits should cause a negative funding gap for local banks and

the appetite for leverage is limited. No other local sector is a significant net

buyer of bonds either. Hence, the government relies more on foreign

investors. At the end of 2009, foreign investors held 10% of Slovak debt. It is

50% at present. In the past, a retail issue was mulled, but this has never

come to fruition and the talk faded out.

With little domestic pressures, we expect Slovak government yields to mainly

follow the developments in the Eurozone. Reflecting the increase of German

10Y bond yields in 2015, we see a similar size growth of Slovak 10Y yields

from September’s 1.6% to 2.3% at the end of 2015. A downside risk is a

milder development in the Eurozone. In contrast, should the state miss the

57% of GDP debt threshold this year and then renege on the balanced budget

(e.g. if the Parliament significantly alters the proposal), this could put some

extra pressure on yields. However, we see the latter as a low-probability

scenario. Overall, the risks to our forecast are probably skewed to the

downside (milder growth of yields).

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 15

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Alen Kovac

Chief Economist of Erste Bank Croatia

Slovenia

Supply and demand factors

Public debt expected to stabilize

0

-2

-4

-6

-8

-10

-12

-14

-16

90

80

70

60

50

40

30

20

10

0

2009 2010 2011 2012 2013 2014f 2015f

Following a more demanding funding profile in 2014 (gross financing needs at

approx. 14.5% of GDP), 2015 looks more comfortable, with the figure around

the 10% of GDP mark. On top of the approx. EUR 2.5bn debt rollover needs,

we are working with a 3.5% of GDP budget gap forecast. Financing

construction for 2014 was closed early in 2014, as the MoF was eager to

move and utilize favorable momentum following the successful round of

banking sector recaps and the supportive market environment. Consequently,

no surprises are anticipated looking towards YE14, as the anticipated

financing needs of around EUR 2bn represent approx. 40% of the available

cash buffer (robust 13.6% of GDP).

Govt. budget balance (% of GDP)

Public debt (% of GDP) RHS

On the supply side, the focus is expected to remain on market instruments (Tbills/bonds). The maturity profile indicates most action happening in 1Q (EUR

1.1bn maturing), and therefore we may again see the MoF opting to quickly

mitigate the risks and close the vast majority of the funding needs early in

2015 and aiming to keep the cash buffer high. With regard to the cash buffer,

Slovenia is currently financed well into 2015, with approx. 70% of gross

financing needs covered.

Source: SORS, MoF, EBC

As far as demand is concerned, two segments remain essential: banks on the

local market and foreign institutional investors that were steadily growing their

exposure. Local exposure, in our view, is not looking endangered, especially

as credit is set to remain weak and banks’ liquidity is fairly ample and

supportive towards sovereign exposure. Foreign demand looks a bit more

complex. Demand in recent quarters has first been fueled by the fairly

attractive yields and afterwards by subsiding banking sector risks allowing for

yields convergence. Going forward, the ongoing hunt for yields continues to

provide strong backing for financing actions and practically erases all the risks

concerning market access. Nevertheless, yields and new deal pricing should

be fine-tuned by the new government policy actions, with the spotlight on

fiscal austerity efforts and corporate restructuring, i.e. pursuing privatization

commitment. This is not only important from the risk profile side, but would

also support the financing side. The Ljubljana Airport privatization is wrapped

up and we expect approx. EUR 150mn impact in the near future. Other

important privatization stories may be Telecom Slovenia and NKBM (secondlargest bank in Slovenia) – although these have as of yet an uncertain

timeline and financial impact.

Strong yield convergence

8.5

IT

PT

ES

Other factors

SI

7.5

6.5

5.5

4.5

3.5

2.5

Jul-14

Sep-14

May-14

Jan-14

Mar-14

Nov-13

Sep-13

Jul-13

May-13

Jan-13

Mar-13

1.5

Political risks have subsided for the time-being, although the recent track

record suggests that we should take political stability with a grain of salt. The

reform agenda of the upcoming government remains unclear, although with

the pensioners (DeSUS) crucial for majority support in the parliament, we

remain slightly reserved. However, as far as yield expectations are

concerned, the risk profile is looking quite sound and policy is more of a

‘medium-term’ concern. The ECB is signaling further easing down the road,

and we see room for further yield compression towards 2.5-2.6% and a

subsequent gradual move upwards, owing to expected Bund trajectory.

Source: Bloomberg

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 16

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Turkey

Nilufer Sezgin

Chief Economist of Erste Securities

Istanbul

Supply and demand factors

Government debt redemption

outlook

25

Central govt. dept redemption (TRY bn)

Payment

projections

Payments

20

15

10

5

0

External debt*

Although the Treasury planned to issue TRY 135bn (8% of GDP) in domestic

debt instruments in 2014, we calculate that the realization will be some TRY

10bn short of that amount. The Treasury is set to complete 81% of the whole

year’s targeted domestic borrowing as of 3Q, with the debt roll-over ratio at

81% surfacing significantly below the planned 86%. The Treasury will

probably issue TRY 16.5bn (1% of GDP) more domestic debt in 4Q, covering

76% of the redemptions. This is even less than half of the previous quarters’

issue size, meaning that the supply side will be unlikely to put pressure on

yields. The lower than expected issue size this year is related to the solid

fiscal performance. Although the government was planning to produce a 1.9%

budget deficit by the end of the year, the deficit is still limited at 1.3% as of

August. Even if the government opts for some fiscal expansion in 4Q, the

cash buffer could prevent any increase in the roll-over.

Domestic debt

There will be a more material drop in the issue size in 2015, as the total year’s

domestic debt redemption will be 40% lower than in 2014. This decline will

especially be felt in 2H15. Although the exact impact of this decline should

depend on the planned roll-over ratio, the drop in the fresh issue size should

help tame the upside pressure on yields, especially if non-residents’ appetite

for bonds remain low. Foreign investors have not been net buyers in the bond

market YTD and their share remained stable vs. 2013 at around 22%.

* External debt payments are shown in

TRY based on a constant USD/TRY of

2.20

For the hard currency bonds, the Treasury will be completing (or even slightly

surpassing) this year’s USD 6.5bn (0.08% of GDP) Eurobond issue target as

of 3Q with the pending Samurai bond mandate. Nevertheless, the Treasury

may plan to tap international markets with a new issue through the end of the

year for pre-financing of 2015. Foreign appetite for Eurobonds has been

rather limited this year, with a net inflow of a tiny USD 154mn.

Real interest rate vs. inflation

gap

14

Real Interest Rate* (%)

12

Gap between inflation and target

10

8

6

E

r

s

t

e

F

o

r

e

c

a

s

t

4

2

0

-2

-4

-6

Jan-04

Other factors

Jan-06

Jan-08

Jan-10

Jan-12

Jan-14

* The real interest rate is the CBT’s

average funding cost discounted by the 12month forward-looking inflation expectation

The global interest rate outlook, the inflation trend in Turkey and the monetary

policy together will be the main determinants of yields in the next few

quarters. We expect only a mild decline in inflation in 4Q, to 9%, from the

current 9.4%. Moreover, the risk appetite could be weak, as markets become

more preoccupied with the Fed’s exit strategy. Therefore, we expect the twoyear bond yield to remain elevated at 9% as of the end of the year. Inflation is

set to drop more visibly starting from 1Q15, which could open room for some

decline in yields towards 8.8%, but we are nevertheless cautious about 2Q15,

when the Fed’s first rate hike is expected to come and when Turkey will

probably be going through general elections. We believe that yields could go

up to 9.4% by 2Q15, but relief back towards 9% is very likely for the

remaining part of the year, as the decline in inflation acts as a buffer to

prevent nominal yields from rising, despite the higher real interest rate

pressure globally. We continue to incorporate another 25bp policy rate cut for

4Q14, while we do not foresee any rate change in 2015. However, we believe

that the CBT should rely on liquidity tightening and lift the funding cost to

above the policy rate during 2015.

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 17

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Forecasts

Governm ent bond yields

current 2014Q4 2015Q1 2015Q2 2015Q3

Croatia 7Y

3.59

3.50

3.50

3.75

3.75

Czech Rep. 10Y

1.12

1.11

1.15

1.19

1.22

spread (bps)

22

1

-25

-31

-48

Hungary 10Y

4.58

4.80

4.86

4.95

5.04

spread (bps)

368

370

346

345

334

Poland 10Y

2.97

3.00

3.10

3.20

3.45

spread (bps)

207

190

170

170

175 FX

current 2014Q4 2015Q1 2015Q2 2015Q3

Rom ania 5Y

3.40

4.10

3.85

3.75

3.70

7.64

7.65

7.65

7.55

7.60

Slovakia 10Y

1.45

1.80

2.10

2.20

2.25 EURHRK

forw ards

7.75

7.85

7.84

7.90

spread (bps)

55

70

70

70

55

27.47

27.50

27.50

27.50

27.50

Slovenia 10Y

2.58

2.70

2.90

3.00

3.20 EURCZK

forw ards

27.37

27.22

27.05

26.98

spread (bps)

167

160

150

150

150

309.8

307.0

311.0

310.0

310.0

Serbia 10Y

5.15

4.75

5.00

5.00

5.00 EURHUF

forw ards

310.6

311.4

312.4

313.9

spread (bps)

425

365

360

350

330

4.18

4.16

4.15

4.13

4.09

Turkey 2Y

9.55

9.05

8.79

9.41

8.99 EURPLN

forw ards

4.20

4.21

4.23

4.25

Germ any 10Y

0.90

1.10

1.40

1.50

1.70

EURRON

4.41

4.50

4.47

4.46

4.45

3M Money Market Rate

forw ards

4.44

4.46

4.48

4.51

current 2014Q4 2015Q1 2015Q2 2015Q3

EURRSD

118.9

117.0

117.5

118.0

118.5

Croatia

1.16

0.85

0.85

0.85

0.90

forw ards

3M forw ards

USDTRY

2.28

2.23

2.27

2.31

2.35

Czech Republic

0.35

0.35

0.34

0.33

0.32

forw ards

2.3

2.4

2.4

2.5

3M forw ards

0.33

0.32

0.32

0.36

EURUSD

1.26

1.24

1.22

1.20

1.20

Hungary

2.09

2.10

2.20

2.20

2.30

3M forw ards

2.18

2.27

2.33

2.37 Key Interest Rate

Poland

2.27

1.95

1.95

2.00

2.00

current 2014Q4 2015Q1 2015Q2 2015Q3

3M forw ards

1.87

1.80

1.82

1.86 Croatia

6.00

6.00

6.00

6.00

6.00

Rom ania

3.01

2.60

2.50

2.50

2.50 Czech Republic

0.05

0.05

0.05

0.05

0.05

3M forw ards

2.71

2.42

2.23

2.57 Hungary

2.10

2.10

2.10

2.10

2.10

Serbia

7.78

7.50

7.50

7.50

7.50 Poland

2.50

1.75

1.75

1.75

1.75

3.00

3.00

3.00

3.00

3.00

3M forw ards

- Rom ania

8.50

8.00

8.00

8.00

8.00

Turkey

10.66

8.75

8.75

9.00

9.25 Serbia

8.25

8.00

8.00

8.00

8.00

3M forw ards

11.01

10.95

10.60

10.02 Turkey

0.05

0.05

0.05

0.05

0.05

Eurozone

0.08

0.15

0.15

0.15

0.15 Eurozone

Real GDP grow th (%) 2013 2014f 2015f 2016f

Croatia

-0.9 -0.5 0.0

0.8

Czech Republic

-0.9 2.5

2.7

2.7

Hungary

1.1

3.3

2.3

1.6

Poland

1.6

3.1

3.0

3.6

Romania

3.5

2.3

3.3

3.5

Serbia

2.4 -0.5 1.0

2.0

Slovakia

0.9

2.2

2.5

3.0

Slovenia

-1.1 1.4

1.4

1.6

Turkey

4.1

3.4

4.0

5.0

CEE7 average

1.2

2.7

2.8

3.1

CEE7+Turkey

2.3

2.9

3.2

3.8

Public debt (% of GDP 2013 2014f 2015f 2016f

Croatia

67.4 73.4 77.4 80.3

Czech Republic

46.0 44.8 43.1 43.0

Hungary

79.2 79.1 78.8 78.2

Poland

57.0 48.8 50.1 49.5

Romania

39.1 39.7 40.3 40.8

Serbia

64.4 71.4 73.3 74.5

Slovakia

55.4 56.8 56.0 55.2

Slovenia

71.7 80.8 82.1 82.4

Turkey

36.2 35.4 33.8 32.1

CEE7 average

58.2 55.1 55.5 55.2

CEE7+Turkey

48.0 46.0 45.8 44.5

Average inflation (%) 2013 2014f 2015f 2016f

Croatia

2.3

0.2

1.2

2.0

Czech Republic

1.4

0.5

2.1

1.9

Hungary

1.7

0.1

3.0

3.6

Poland

0.9

0.1

0.9

1.8

2.9

Romania

4.0

1.3

2.8

Serbia

7.9

2.4

4.3

5.0

Slovakia

1.4

0.5

1.5

2.3

Slovenia

1.8

0.3

0.8

1.4

Turkey

7.5

9.0

6.9

6.0

1.8

0.4

1.7

2.3

CEE7 average

4.0

3.8

3.7

3.8

CEE7+Turkey

C/A (%GDP)

2013 2014f 2015f 2016f

Croatia

0.9

1.0

1.4

1.0

Czech Republic

-1.4 0.0

1.4

1.2

Hungary

4.2

4.1

3.2

2.2

Poland

-1.5 -1.1 1.6

-2.4

Romania

-1.1 -1.4 -1.6

-1.8

Serbia

-6.5 -6.9 -6.7

-6.8

Slovakia

2.1

2.9

2.6

2.5

Slovenia

6.3

6.2

6.6

7.0

Turkey

-7.9 -6.1 -6.4

-6.3

CEE7 average

-0.2 0.2

1.5

-0.5

CEE7+Turkey

-3.3 -2.3 -1.6

-2.8

Unem ploym ent (%) 2013 2014f 2015f 2016f

Croatia

17.3 18.0 18.5 18.8

Czech Republic

7.0

6.7

6.3

5.9

Hungary

10.2 7.8

7.3

7.0

Poland

13.9 12.5 11.9 11.7

Romania

7.2

7.2

7.1

7.0

Serbia

22.1 21.8 21.3 20.7

Slovakia

14.2 13.5 13.2 12.9

Slovenia

10.1 10.1 9.9

9.7

Turkey

9.7

9.8

9.6

9.2

CEE7 average

11.9 11.0 10.6 10.3

CEE7+Turkey

10.8 10.3 10.0

9.6

Budget Balance (%GD 2013 2014f 2015f 2016f

Croatia

-4.9 -5.5 -4.5 -4.0

Czech Republic

-1.5 -1.7 -2.0 -1.8

Hungary

-2.4 -2.7 -2.9 -2.9

Poland

-4.4 4.8 -3.0 -2.5

Romania

-2.3 -2.7 -3.0 -3.0

Serbia

-5.0 -7.0 -5.0 -4.5

Slovakia

-2.8 -2.6 -2.5 -1.5

Slovenia

-14.7 -4.5 -3.5 -3.0

Turkey

-1.2 -2.2 -1.8 -1.3

CEE7 average

-3.8 0.4 -3.0 -2.6

CEE7+Turkey

-2.7 -0.7 -2.4 -2.0

Erste Group Research – CEE Bond Market Outlook 4Q2014 – CEE Eurobonds – The ‘Sweet Spot’

Page 18

Erste Group Research

CEE Special Report | Fixed Income | CEE

2 October 2013

Statistical Appendix

Weights in Erste CEE Indices

Erste CEE Local Currency Index

HR

CZ

HU

PL

RO

3%

22%

17%

49%

9%

weights

(2Q14)

CZ

9%

HR

8%

Erste CEE Eurobond Index

PL

HU

RO

18%

40%

11%

SK

6%

SI

8%

Debt, deficit and growth figures (percent of GDP)

Croatia

100

80

Czech Republic

10

100

7.8

90

6.4

5.0

70

4.9

7

5.5

4.5

60

Public debt to

GDP (lhs)