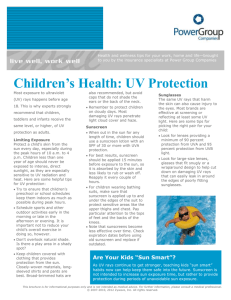

sun protection for everyday

advertisement