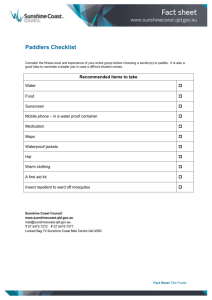

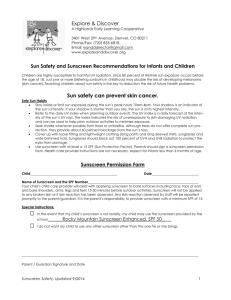

sun protection for everyday

advertisement