Clarifying Head of Household Issues - Webs!

advertisement

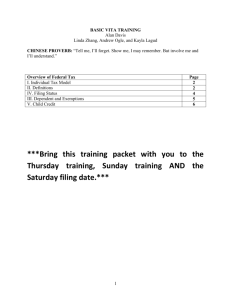

T A X A T I O N federal taxation Clarifying Head of Household Issues By James M. Hopkins T axpayers who are not married or who are considered unmarried may be able to file a tax return as head of household (HOH) if certain conditions exist. HOH filing status gives the taxpayer a higher standard deduction and lower tax rates that fall between the rates for filing jointly and the higher rates for filing singly. In the 2004 tax year, 19.6 million HOH returns were filed, representing 14.9% of all returns filed in that year. For 2008 (the most recent year for which data are available), 21.1 million HOH returns were filed, which was 14.8% of all returns filed that year (IRS, “Individual Income Tax Returns,” Publication 1304, Table 1.2). The following is a brief review of the HOH filing status, focusing on the definition of qualifying person, which allows a person who might otherwise have to file as a single taxpayer to file using HOH status. Other HOH issues—including multiple heads of household in the same residence, itemized or standard deductions when a HOH claimant is deemed “unmarried,” and the results of a disallowed HOH filing status—are also discussed. Definition of Head of Household An individual will be considered a “head of household” if that individual— ■ is not married or is considered “unmarried” at the close of the taxable year; ■ is not considered a surviving spouse, as defined in IRC section 2(a); ■ maintains a household as her home that constitutes, for more than one-half of the taxable year, the principal place of abode of a qualifying person (temporary absences, such as for school or vacation, are not considered in determining the halfyear requirement if the person absent is expected to return); 42 ■ furnishes more than one-half the cost of maintaining the household during the taxable year; and ■ is not a nonresident alien. There are three categories of qualifying persons for HOH purposes: a qualifying child, a qualifying relative who is the taxpayer’s parent, and a qualifying relative other than the taxpayer’s parent. Each of these categories is discussed separately below. Qualifying Child A qualifying child (QC) for exemption purposes must satisfy the qualifying child tests defined in IRC section 152(c). In brief, to meet these tests one must 1) be a child of the taxpayer or a descendant of such child (or the brother, sister, stepbrother, or stepsister of the taxpayer, or a descendant of any such relative); 2) be under 19 at the end of the year and younger than the claimant taxpayer, or under 24 at the end of the year, a full-time student, and younger than the taxpayer (this test does not apply if the child is permanently and totally disabled); 3) live with the taxpayer for more than one-half of the year; 4) not provide more than one-half of his own support; and 5) not file a joint return with another taxpayer for the year, except to claim a refund (as described in examples 6 and 7, below). A QC who is single and satisfies all of the above tests is considered a qualifying person, regardless of whether the taxpayOCTOBER 2011 / THE CPA JOURNAL er can claim her as an exemption. The examples below illustrate how the tests work in practice. Example 1. A taxpayer’s unmarried son is under 19 at the end of the year, lived with the taxpayer for the entire year, did not provide more than half of his own support, and is not a QC of any other taxpayer. This son satisfies all of the QC tests and, accordingly, is a QC for his parent’s HOH filing status. In addition, this son can also be claimed as the taxpayer’s exemption. Example 2. If the son were over 18 at the end of the year, not a full-time student, and had gross income in excess of the personal exemption amount ($3,650 in 2010), then he would be too old to meet the QC definition and have too much income to meet one of the qualifying relative (QR) tests (discussed below). He would not be a qualifying person for HOH purposes. Example 3. If the son were under 19, graduated from high school, and moved out of the parent’s residence—thus failing the more than half-year residence test— he would not be a QC. He would have to satisfy the QR tests and be claimed as an exemption to qualify the parent for HOH purposes. Example 4. Assume that the son is under 19, unmarried, and lives with his mother (also over age 18) and grandmother OCTOBER 2011 / THE CPA JOURNAL in the grandmother’s home, provided entirely by the grandmother. The son is not the QC of the father. The son can be a QC of the mother and grandmother if he meets all five tests for both individuals. When a child is the QC of more than one person, special tiebreaker rules apply. The tiebreaker rules apply in this scenario because the son is a QC of two or more people. Such rules generally assign the son as a QC of the parent. But another tiebreaker rule states that if a parent can claim a child as a QC but does not do so, the child can be claimed by another person—the grandmother, in this case—but only if her adjusted gross income (AGI) is higher than the parent’s AGI. (Although not applicable in this example, if the son’s parents filed jointly, the parents’ AGI is split equally between the two parents, then compared to the AGI of the nonparent to determine if the nonparent can claim the QC as an exemption.) If the parent’s AGI is higher than the grandmother’s AGI, the grandmother cannot claim the grandson as a QC (see IRS Publication 17, “Your Federal Income Tax 2010,” p. 29, examples 1 and 2). If the parent’s AGI were higher, neither individual could utilize HOH filing status, as the parent did not contribute to the cost of the household. Observation. Having one QC allows for an exemption, child tax credit, possible HOH filing status, credit for dependent child care and related income exclusion for dependent care benefits, and earned income credit, if otherwise available. Tax preparers should carefully analyze this situation if the grandmother’s AGI is greater than the parent’s AGI, allowing the parent to forgo the QC and related benefits and giving them to the grandmother. These benefits cannot be divided between a parent and grandparent. The taxpayer taking the QC as an exemption gets all of the benefits if she qualifies for them. It is also important that all tax returns be prepared by one professional in order to maximize all potential tax benefits. Example 5. Special rules apply to taxpayers with dependents who are divorced, separated, or live apart. A dependent is usually considered the QC of the custodial parent because of the residency test. HOH status is available to a custodial parent who releases the dependency exemption to the noncustodial parent (the requirements in Form 8332), provided all other HOH requirements are satisfied. The noncustodial parent is not allowed to use HOH status when the dependency is released to him or her. A single dependent allows HOH status to only one taxpayer and cannot be 43 EXHIBIT Head of Household (HOH) Flowchart Are you unmarried or considered unmarried1 at the end of the tax year? No Yes Did you pay more than half the cost of keeping a home for the year for a qualifying child (QC)2 or a qualifying relative (QR)3? You do not qualify for HOH filing status. No Yes Is the QR a parent? Yes No You can claim HOH filing status if you can claim parent as a dependent, even if parent does not reside with you. Did the unmarried qualifying child or nonparent relative live (as defined below) with you for more than half the year? See below if child is married.4 Yes If person is a QC, taxpayer, qualifies for HOH regardless of ability to claim person as exemption.5 QR person must be related to taxpayer and live with taxpayer more than half the year to qualify taxpayer for HOH filing status. Unrelated QR who lived with taxpayer for entire year is not a qualifying person for HOH filing status.6 1. A person is considered unmarried on the last day of the tax year if all of the following tests are satisfied: 1) one files a separate return; 2) one pays over half the costs for keeping up a home for the tax year; 3) a spouse did not live with you during the last six months of the tax year (temporary absences are considered living together); 4) the home was the main home for a child, stepchild, or foster child for more than half of the year; 5) one can claim an exemption for the child, except when the dependency exemption is released to a noncustodial parent (in cases of children of divorced, separated, or parents who live apart). 2. A qualifying child is defined in IRC section 152(c), which includes a taxpayer’s child or child’s descendant, stepchildren, siblings, stepsiblings, or their descendants, adopted children and their descendants, and foster children. The QC must meet all the QC tests for exemption purposes. 3. A qualifying relative is defined in IRC section 152(d), which includes all those defined as a qualifying child and the following additional individuals: parents and their direct ancestors, brothers/sisters of the father or mother (aunts and uncles), stepparents, brothers/sisters, stepbrothers/sisters, and certain in-laws (son, daughter, father, mother, brother, and sister). The QR must meet all the QR tests for exemption purposes. 4. The taxpayer must be able to claim the married child as a dependent in order to qualify for HOH. 5. This alternative applies when the custodial parent releases a dependent to the noncustodial parent, allowing the custodial parent—not the noncustodial parent—to qualify for HOH filing status. 6. A member of a taxpayer’s household for the entire year, but someone not related to the taxpayer, is considered a QR for possible exemption purposes; however, such a person does not allow the taxpayer to file as HOH. 44 OCTOBER 2011 / THE CPA JOURNAL counted a second time to allow someone else to qualify for HOH filing status. This is one of the few situations when a taxpayer—the custodial parent, in this case—can claim HOH filing status without showing a dependent on the tax return. Observation. IRS Publication 17 (p. 22, table 2-1) states that a qualifying child is a qualifying person for HOH filing status even if she is not claimed as an exemption. This can imply that in the facts of Example 4, above, the grandmother could claim HOH filing status, while the daughter could claim the other benefits for a QC. This is not the case, however, as all the benefits of a QC exemption must be claimed by the person claiming the exemption. Publication 17 (p. 22, point 5) allows HOH filing status only when an exemption can be claimed for the child, unless the exemption is released to the noncustodial parent for parents that are divorced, separated, or live apart. A QC who is married and can be claimed by the taxpayer as an exemption is considered a qualifying person. Example 6. This situation arises when a child is married during a taxable year, and thus the marriage affects the HOH status that the parent may have used in the past. If the married child files a tax return with his spouse only as a refund claim and no income tax is shown on the return, the married child meets this test and must satisfy the other four QC tests in order for the parent to claim the married child as an exemption. If the married child is claimed as an exemption on the parent’s return, then the child will be a qualifying person for HOH purposes as a result. A QC who is married and cannot be claimed as an exemption by the taxpayer is not considered a qualifying person in order for the taxpayer to qualify for HOH status. Example 7. If a married child’s joint tax return shows any income tax, it is not a claim for a refund. As a result, the married child fails this QC test and is not a qualifying person for HOH purposes. Qualifying Relative: Parent A qualifying person who is the taxpayer’s parent does not have to live with the taxpayer, but the taxpayer must be able to claim the parent as an exemption and must pay more than one-half of the cost to maintain the parent’s main home for the entire OCTOBER 2011 / THE CPA JOURNAL taxable year. The parent’s home can be a rest home or home for the elderly. In order for the taxpayer to claim an exemption for a parent, the parent must meet the tests for a QR exemption in IRC section 152(d). In brief, to meet the QR tests, a parent must 1) not be a QC of any taxpayer, 2) meet a relationship test (satisfied by a parent), 3) must have gross income less than the amount of the personal exemption ($3,650 for 2010), and 4) have more than one-half of her total support for the taxable year provided by the taxpayer. While a QR does not have to live with the taxpayer to meet the relationship test, she must live with the taxpayer for more than half of the year—unless the person is the taxpayer’s parent—in order to be considered for HOH filing status. Social Security benefits and other agency-provided funds that are used for a parent’s support are considered provided by the parent and not by the claimant taxpayer. If the taxpayer cannot claim the parent as an exemption, the parent is not a qualifying person for HOH purposes. The ability to claim a parent as an exemption and claim HOH status does apply to a grandparent. Qualifying Relative: Nonparent The broader QR definition in the IRC section 152(d) relationship test includes the following: children, step- and foster children, descendants of any such children, grandparents, stepparents, siblings, half/step-siblings, nieces and nephews, aunts and uncles, and certain in-laws (son, daughter, father, mother, brother, and sister). In addition, the relationship test includes unrelated household members who resided with the taxpayer for the entire year who may qualify for exemption purposes but do not qualify a taxpayer for HOH filing status. The following examples illustrate how these tests work in practice. A nonparent QR must satisfy the four QR tests mentioned above with regard to parent QRs. Example 8. If a child was over 18 at the end of the year and not a full-time student, he is too old to meet the QC definitions. If the child satisfies all four QR tests, then he can be claimed as an exemption. In addition, a child must live with the taxpayer for more than half of the year in order to qualify the taxpayer for HOH filing status. An unrelated individual or a distant relative, such as a cousin, who lives with a taxpayer for the entire year, may qualify for an exemption if all QR tests are satisfied; however, she would not be a qualifying person for HOH purposes. Example 9. If a taxpayer’s girlfriend satisfies all four QR tests, the taxpayer may claim an exemption for her; however, she is not a qualifying person for HOH purposes. If the girlfriend has a child who is not biologically related to the taxpayer, the child is a QC of the mother but is not a QC of the taxpayer and not a qualifying person for HOH purposes. If the girlfriend does not have to file a return, or if she files for a refund and no tax is shown on the return, the child could qualify as a QR of the taxpayer if all of the QR tests are satisfied (IRS Publication 17, p. 30, examples 1 and 2; see also IRS Notice 2008-5, 2008-2 IRB 1, effective for tax years beginning after December 31, 2004). Other Issues Multiple HOH status. How is HOH filing status applied when two unmarried individuals, each having dependent children, live in one household? Must one file as single and the other as HOH, or can both file as a HOH? With proper planning, each of the individuals can qualify for HOH status. There are two supporting authorities for separate HOH status in this situation. The first authority appears in In Estate of Fleming v. Comm’r, (33 T. C. Memo 619, 1974, acq.). The Fleming case involved two parties or families. The Flemings consisted of a mother who was deceased prior to the filing of the Tax Court case and her unmarried daughter. The second party, the Merckes, consisted of the deceased woman’s married daughter, her husband, and their three children. The costs of maintaining a household consist of rent, mortgage interest, real estate taxes, house insurance, repairs, utilities, and food eaten in the home. The two parties contributed equally to maintenance of the residence, interest on the property, property taxes, repairs and upkeep, insurance, replacement costs, and yard care. The costs for food, utilities, and servant pay were one-third paid by the Flemings and twothirds paid by the Merckes. 45 The Tax Court held for the taxpayer, allowing her to use HOH filing status. The court concluded that “the extent of a ‘household’ is not determined solely by physical or tangible boundaries; instead we must look at all facts in any particular situation.” The court found that the entire residence was built by the parties involved, had separate areas for each of the parties, and also common areas for use by both parties. The court also interpreted the statute mentioning “household” in a favorable, reasonable manner because it lacked a precise meaning. The case did not mention the Merckes’ filing status, which presumably was married filing jointly. The IRS wanted to treat the household as one and not allow two separate households. A second authority appears in SCA (Service Center Advice) 1998-041. This guidance was issued about 14 years after Fleming. In SCA 1998-041, two single parents, X and Y, each with their own dependent children, shared a dwelling. Neither parent was a surviving spouse or a nonresident alien. The kitchen and other living areas were common areas, but the adults had separate bedrooms. X and Y maintained joint accounts from which they paid household bills. X itemized deductions, while Y took the standard deduction. Each parent claimed HOH status, relying on Fleming. The IRS concluded that each parent could use HOH filing status if each provided more than one-half of the cost of maintaining their respective households, regardless of the shared physical space. In planning to use HOH filing status for separate families residing in one residence, the following issues are important: ■ There must be common areas for all household members and separate adult areas. ■ The residence must be a home for each family and be a principal place of abode for one or more of each family’s children. ■ Each family must act independently in non–household-related matters, such as separate phone lines, Christmas cards, magazine subscriptions, and the like. ■ Each party must show that he contributed over one-half of the household expenses jointly contributed by each party and related children, but the parties do not need to show that they contributed over 46 one-half of the total expenses of maintaining a shared dwelling. The key to having two heads of household within a single residence is the existence of two taxpayers with separate families. Two unmarried persons—especially if boyfriend and girlfriend—living together with common children or children from prior relationships in the same household would probably not satisfy these requirements. Itemized and standard deductions for married HOH filers. Consider the following scenario: Two taxpayers are married at the end of the tax year. They do not file a joint return; however, one taxpayer qualifies to file as HOH, while the other files as married filing separately. The taxpayer who qualifies for HOH filing status elects to itemize deductions. The spouse who files as married filing separately is not eligible for a full standard deduction but, instead, is limited to itemized deductions. If the other spouse files as married filing separately and elects to itemize deductions, the spouse who can file as a HOH can use the full standard deduction available for HOH status. (See IRS Letter Ruling 200030023 and IRS Publication 501, Exemptions, Standard Deduction, and Filing Information, p. 6, 2010.) Failed HOH filing. In Afi Abdi v. Comm’r (T.C. Summary Op. 2010-175), the taxpayer claimed HOH filing status. The IRS determined that the taxpayer’s filing status was “married filing separately” and that he was not entitled to the earned income credit for two dependent children. The court determined that the petitioner was actually married before 2008, and was married for the entire 2008 year. Moreover, he resided with his wife the entire year. The court denied both HOH filing status and the earned income credit, not discussing the married filing separately determination. Could Abdi have filed a joint return for 2008? IRC section 6013 allows a married couple who file separate returns to switch to a joint return after the normal due date of the return if the joint return is filed within three years of the original due date (without extension) and neither spouse filed a suit for refund, petitioned the Tax Court regarding a notice of tax deficiency, or entered into a closing agreement with respect to the previous separate returns. HOH filing status is not discussed in IRC section 6013; however, HOH filing status and section 6013 are mentioned by the IRS in Chief Council Notice (CC-2006010), which discusses situations where taxpayers file a separate return or as head of household and want to amend such return to married filing jointly. The notice cited Blumenthal v. Comm’r (86 T.C. Memo, 1986-737), in which the Tax Court held that the taxpayer could not file an amended return changing an original HOH filing status to married filing jointly. Blumenthal filed an amended return, trying to change his filing status more than three years after the last date prescribed for filing such return; moreover, he also filed a timely Tax Court petition related to a notice of deficiency. Both of these limitations in IRC section 6013 prevent such an amended return. As Abdi filed a Tax Court petition and lost his case, he was not able to amend his return to claim married filing jointly. He is locked into married filing separately for 2008, based on the limitations of section 6013. The notice mentions that the limitations of IRC section 6013(b)(2) do not apply, as a result of Glaze v. United States (641 F.2nd 339, 5th Cir. 1981), which the IRS announced it would not follow (see Revenue Ruling 83-183, 1983-2 C.B. 220). Glaze concluded that such limitations apply only to individuals who erroneously file as married filing separately and not to either erroneously filed “single” or “head of household” returns. Accordingly, any cases that would be appealable to the 5th Circuit or the 11th Circuit, which also adopted the Glaze precedent, may have a different outcome than other circuits. A Complex Determination The HOH filing status is used in about 15% of all tax returns processed by the IRS. At times, it can be confusing on who is a qualifying person necessary to elect HOH status. The discussion above is meant to shed light on the qualifying person concept and other issues related to ❑ HOH filing status. James M. Hopkins, CPA, is a professor of accounting at Morningside College, Sioux City, Iowa. OCTOBER 2011 / THE CPA JOURNAL