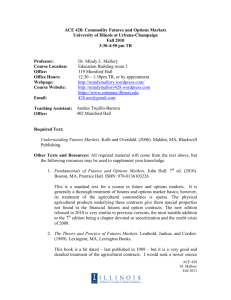

Introduction to Commodity Trading

advertisement

Introduction to Commodity Trading C OMMODITY TRADING allows producers and processors to market commodities by using four basic approaches. Each approach has its advantages and disadvantages. The approaches differ in risk and price potential. Objective: þ Describe methods of marketing commodities. Key Terms: Ñ basis basis contract cash sale deferred pricing agreement forward contract futures contract option on a futures contract Commodity Trading The methods of marketing commodities are cash sales, forward contracts, futures contracts, and options on futures contracts. A cash sale is a sale that occurs at the point of delivery in which the seller receives immediate payment for a commodity at the price in effect that day. A forward contract is a contract in which a buyer and a seller agree to the purchase and sale of a definite quantity and quality of commodity at a specific price on a specific date of delivery. This allows the price to be set, or locked in, thus providing protection from price changes. A futures contract is a contract commonly made through a brokerage house that transacts the trading for an individual. This contract allows the individual to buy or sell a commodity at a future date. An option on a futures contract is the right, but not the obligation, to buy or sell a futures contract at a specific price before a specific time. Options provide price protection and the opportunity to benefit from favorable price changes. E-unit: Introduction to Commodity Trading Page 1 u www.MyCAERT.com Copyright © by CAERT, Inc. — Reproduction by subscription only. E060061 CASH SALE A cash sale occurs at the point of delivery to the cash market, with payment at the price in effect that day. A cash market is any physical location where a product is bought or sold for cash. A producer can deliver hogs to a packer or grain to an elevator and get cash right away. This type of transaction is easy but is one of the riskiest marketing choices. Cash sales have both advantages and disadvantages. Advantages of cash sales for producers are: FIGURE 1. In a cash sale, payment can be received quickly when the producer delivers grain to an elevator. t They are easy to transact. t They provide immediate payment. t There is no set quantity. Disadvantages of cash sales for producers are: t They maximize risk. t There is no price protection. Deferred Pricing Agreement A deferred pricing agreement is another avenue for making a cash sale. The commodity is delivered, but the price is set later. This allows grain producers to deliver grain, reduce the physical risk of holding the grain (corn, wheat), and reduce the storage cost without having to agree to the current price. A producer may deliver wheat to a processor at the end of harvest in October and then choose a price at a later time—for example, between date of delivery and February. FORWARD CONTRACTING In a forward contract, the buyer and the seller agree to the purchase and sale of a definite quantity and quality of commodity at a specific price on a specific date of delivery. This allows the price to be set, or locked in, thus providing protection from price changes. E-unit: Introduction to Commodity Trading Page 2 u www.MyCAERT.com Copyright © by CAERT, Inc. — Reproduction by subscription only. E060061 Forward contracting allows a producer and a buyer to negotiate price for a later delivery. This marketing approach provides price protection if an unfavorable price change occurs but provides no benefits if a favorable price change occurs. The negotiated price still applies whether the price goes up or down. Besides price, the written agreement should include quantity, quality, delivery time, and location. Like cash sales, forward contracts have both advantages and disadvantages. Advantages of forward contracts for producers are: t They are usually easy to understand. t They minimize risk. t They guarantee the sale of a given quality and quantity of a commodity. t They provide price protection. t They allow the computation of profit once production costs are determined. FIGURE 2. Forward contracting provides a producer with protection from falling prices. Disadvantages of forward contracts for producers are: t They require delivery of a given quality and quantity of a commodity. t There is no benefit from better prices. FURTHER EXPLORATION… ONLINE CONNECTION: Trading Futures Trading futures or options can be challenging to the beginner. Trading requires time, knowledge of price movement, and experience. With today’s electronic trading opportunities, many individuals are giving commodity trading a try. The CME Group has put together several online short courses that will allow an individual to learn more about the process. For information about trading futures and options, visit the link below: http://www.cmegroup.com/education/interactive/webinars-archived/intro-to-futures.html E-unit: Introduction to Commodity Trading Page 3 u www.MyCAERT.com Copyright © by CAERT, Inc. — Reproduction by subscription only. E060061 Elements of a Contract Because a contract is a legally binding agreement, it should be developed by a lawyer and carefully reviewed by both parties before signing. A contract should include: t The names and addresses of the buyer and the seller t The date of delivery t The price of the product t The quantity of the product t The quality of the product and how it will be determined t Exactly how and when payment will be made t Penalties if either party defaults t The signatures of both parties BASIS Basis is the relationship between the local cash market price and futures market price. The cost of delivery of a commodity to a specific place is reflected in the futures price. The cost of delivery of a commodity to a different place is mirrored in the cash price. Each of these costs includes transportation, storage charges, and marketing costs. Therefore, the basis can vary from one market or location to another. Basis can be seen as consistently positive or consistently negative and can change during the futures contract length. Knowledge of basis patterns and attention to local basis patterns is essential in understanding the impact of basis on the market. The basis is calculated by subtracting the price of the nearby futures contract from the local cash market price. If the cash price for soybeans is $7.50 and the futures price is $7.70, the basis is $7.50 – $7.70 = –$0.20, or 20 cents under. If the cash price for corn is $4.25 and the futures price is $4.22, the basis is $4.25 – $4.22 = +$0.03, or 3 cents over. As a basis value approaches positive integers, it is said to be strengthening. As a basis value becomes less positive, it is said to be weakening. Basis Contracting Basis contracting is another form of forward contracting. A basis contract is a contract that allows a producer to lock in a basis that is related to a specified futures contract. At the point of delivery, the price received is the current price of the specified futures contract adjusted by the basis that was agreed upon. E-unit: Introduction to Commodity Trading Page 4 u www.MyCAERT.com Copyright © by CAERT, Inc. — Reproduction by subscription only. E060061 Summary: 2 Four main methods are used to trade commodities: cash sales, forward contracts, futures contracts, and options on futures contracts. Advantages of cash sales for producers are the following: easy to transact; immediate payment; no set quantity. Disadvantages are the following: maximize risk; no price protection; not very flexible. Advantages of forward contracts for producers are the following: usually easy to understand; minimize risk; guarantee the sale of a given quality and quantity of a commodity; provide price protection; allow the computation of profit once production costs are determined. Disadvantages are the following: require delivery of a given quality and quantity of a commodity; no benefit from better prices. Basis is the relationship between the local cash market price and futures market price. The basis is calculated by subtracting the price of the nearby futures contract from the local cash market price. Checking Your Knowledge: ´ 1. What is a cash sale? 2. What is the difference between a forward contract and a futures contract? 3. How does a deferred pricing agreement work? 4. How is the basis calculated? 5. When is the basis strong? Expanding Your Knowledge: L Research the impact of the basis on the market. Visit a local grain elevator to witness trading and interview grain buyers. Web Links: : CME Group http://www.cmegroup.com/education/ A Short Course Introducing Commodity Markets & Futures Trading http://futures.tradingcharts.com/tafm/index.html Agricultural Career Profiles http://www.mycaert.com/career-profiles E-unit: Introduction to Commodity Trading Page 5 u www.MyCAERT.com Copyright © by CAERT, Inc. — Reproduction by subscription only. E060061