Hire-Purchase (Further Amendment) Act 1997

advertisement

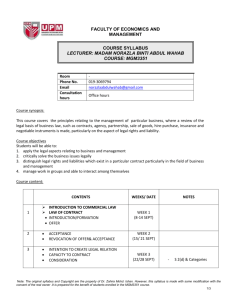

Hire-Purchase (Further Amendment) Act 1997 Act No. 74/1997 TABLE OF PROVISIONS Section Page PART 1—PRELIMINARY 1. 2. 1 Purposes Commencement 1 2 PART 2—AMENDMENT OF HIRE-PURCHASE ACT 1959 3. 4. Application of Hire-Purchase Act 1959 Definitions PART 3—AMENDMENT OF GOODS ACT 1958 5. 3 3 4 5 New Part V inserted in Goods Act 1958 5 PART V—RIGHTS OF HIRERS UNDER HIREPURCHASE AGREEMENTS 5 120. Definitions 121. Hirer's right to surplus if goods repossessed by owner ═══════════════ NOTES 5 6 9 i Victoria No. 74 of 1997 Hire-Purchase (Further Amendment) Act 1997† [Assented to 25 November 1997] The Parliament of Victoria enacts as follows: PART 1—PRELIMINARY 1. Purposes The purposes of this Act are— (a) to amend the Hire-Purchase Act 1959 to limit its application to certain hire-purchase agreements; 1 Hire-Purchase (Further Amendment) Act 1997 Act No. 74/1997 (b) to amend the Goods Act 1958 to provide that a hirer of goods may recover any surplus if the goods are repossessed by the owner. 2. Commencement (1) This Part comes into operation on the day on which this Act receives the Royal Assent. (2) Subject to sub-section (3), the remaining provisions of this Act come into operation on a day or days to be proclaimed. (3) If a provision referred to in sub-section (2) does not come into operation before 1 July 1998, it comes into operation on that day. _______________ 2 s. 2 s. 3 Hire-Purchase (Further Amendment) Act 1997 Act No. 74/1997 PART 2—AMENDMENT OF HIRE-PURCHASE ACT 1959 3. Application of Hire-Purchase Act 1959 No. 6531. Reprint No. 3 as at 27 November 1991. Further amended by Nos 41/1995, 35/1996 and 19/1997. In section 1 of the Hire-Purchase Act 1959, for sub-section (4) substitute— "(4) Subject to sub-sections (4A) and (4B), this Act does not apply to a hire-purchase agreement or any agreement made in connection with a hire-purchase agreement entered into on or after the commencement of Part 2 of the Hire-Purchase (Further Amendment) Act 1997. (4A) This Act applies to a hire-purchase agreement and any agreement made in connection with a hire-purchase agreement entered into and in operation immediately before the commencement of Part 2 of the Hire-Purchase (Further Amendment) Act 1997. (4B) Sections 24 and 25 apply to a hire-purchase agreement for farm machinery and any agreement made in connection with such an agreement if the agreement is entered into within 2 years after the commencement of Part 2 of the Hire-Purchase (Further Amendment) Act 1997 and so apply as if a reference to a notice in the form of the Fourth Schedule were a reference to a notice in the form required under the agreement. (4C) An owner must not repossess farm machinery under a hire-purchase agreement to which sub-section (4B) applies unless the owner gave to the hirer at the time that the agreement was made a copy of sections 24 and 25, receipt of which was acknowledged in writing by the hirer.". 3 Hire-Purchase (Further Amendment) Act 1997 Act No. 74/1997 4. Definitions In section 2 of the Hire-Purchase Act 1959 insert— ' "farm machinery" means— (a) a harvester, binder, tractor, plough or other agricultural implement; (b) a motor truck used for the purposes of a farming undertaking or any other business involving the cultivation of the soil, the gathering of crops or the rearing of livestock;'. ————————— 4 s. 4 s. 5 Hire-Purchase (Further Amendment) Act 1997 Act No. 74/1997 PART 3—AMENDMENT OF GOODS ACT 1958 5. New Part V inserted in Goods Act 1958 No. 6265. Reprint No. 8 as at 22 January 1992. After Part IV of the Goods Act 1958 insert— 'PART V—RIGHTS OF HIRERS UNDER HIREPURCHASE AGREEMENTS 120. Definitions (1) In this Part— "hire purchase agreement" includes— (a) an agreement for the hire or letting of goods with an option to purchase; and (b) an agreement for the purchase of goods by instalments (whether the agreement describes the instalments as rent, hire or otherwise)— but does not include an agreement— (c) to which the Hire-Purchase Act 1959 applies; or (d) under which the property in the goods comprised in the agreement passes at the time of the agreement or any time before the delivery of goods; or (e) that is a regulated contract within the meaning of the Credit Act 1984; or (f) that is a credit contract within the meaning of the Consumer Credit (Victoria) Code. 5 Hire-Purchase (Further Amendment) Act 1997 Act No. 74/1997 "owner" means a person who lets, hires or agrees to sell goods under a hirepurchase agreement and includes a person to whom the owner's property in the goods or any of the owner's rights or liabilities under the agreement have passed by assignment or by operation of law; "hirer" means a person to whom goods are let, hired or agreed to be sold under a hire-purchase agreement and includes a person to whom the hirer's rights or liabilities under the agreement have passed by assignment or by operation of law. (2) A reference in this Part to taking possession by an owner of goods comprised in a hirepurchase agreement does not include a reference to taking possession by the owner as a result of the voluntary return of the goods by the hirer. 121. Hirer's right to surplus if goods repossessed by owner (1) If an owner takes possession of goods comprised in a hire-purchase agreement and the agreement is neither reinstated nor finalised by the hirer, the hirer may recover from the owner— (a) if the owner sells or disposes of the goods, an amount equal to the proceeds of the sale of the goods; or (b) if the owner does not sell or dispose of the goods or fails to sell or dispose of the goods as soon as reasonably practicable after taking possession of the goods (or such other time as the 6 s. 5 s. 5 Hire-Purchase (Further Amendment) Act 1997 Act No. 74/1997 owner and the hirer agree), an amount equal to the value of the goods at the time that the owner took possession of the goods— less any amounts which the owner is entitled to deduct from those proceeds under this section. (2) An owner who sells or disposes of goods under sub-section (1) is entitled to deduct from the proceeds of sale or the value of the goods, as the case requires, only the following amounts— (a) the total amount owed by the hirer under the hire-purchase agreement at the time the owner took possession of the goods, not being an amount greater than the amount required to discharge the agreement; and (b) the reasonable expenses of the owner incurred in taking possession of the goods; and (c) any amount reasonably incurred by the owner on the storage, repair or maintenance of the goods; and (d) the reasonable expenses incurred in selling or disposing of the goods, whether or not the goods have subsequently been sold or disposed of by the owner. (3) In this section "value of the goods" means the best price reasonably obtainable by the owner at the time the owner took possession of the goods. (4) The onus is on the owner to prove that the price obtained for the goods was the best 7 Hire-Purchase (Further Amendment) Act 1997 Act No. 74/1997 price reasonably obtainable at the time that the owner took possession of the goods.'. ═══════════════ 8 s. 5 Hire-Purchase (Further Amendment) Act 1997 Act No. 74/1997 Notes NOTES † Minister's second reading speech— Legislative Assembly: 18 September 1997 Legislative Council: 29 October 1997 The long title for the Bill for this Act was "to amend the Hire-Purchase Act 1959 and the Goods Act 1958 and for other purposes." 9