bridging the gap between accounting education and accounting in

advertisement

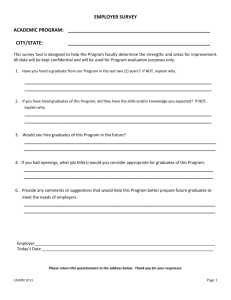

Special Issues, December 2014 BRIDGING THE GAP BETWEEN ACCOUNTING EDUCATION AND ACCOUNTING IN PRACTICE: THE CASE OF UNIVERSITAS MAHASARASWATI DENPASAR I Gusty Ary Suryawathy I Gede Cahyadi Putra ISSN 2087-4499 Asia Pacific Journal of Accounting and Finance Special Issues: “The Accounting Profession towards ASEAN Economic Community“ BRIDGING THE GAP BETWEEN ACCOUNTING EDUCATION AND ACCOUNTING IN PRACTICE: THE CASE OF UNIVERSITAS MAHASARASWATI DENPASAR I Gusti Ary Suryawathya, I Gede Cahyadi Putrab Universitas Mahasaraswati Denpasar Emaila: ary.suryawathy@unmas.ac.id Emailb: cahy4dini@yahoo.com Abstract The implementation of ASEAN Free Trade Agreement in 2015 will challenge accounting graduates to secure their accounting positions. The level of the qualification possessed by the graduates depends up on the knowledge and skills the graduates have learnt during their studies. Thus, to create job-ready graduates, it is important for higher education to keep updating their curriculum in accordance with current business practice. This study aims to discover the extent to which the accounting curricula meets the needs of accounting profession in Balinese context. The sample in this study is the academics, alumni and final year students and professional accountants .Mixed method is employed in this study. Quantitative data collected by administering a five point Likert scale questionnaires and was analyse statistically; whereas qualitative data accumulated by open-ended questionnaires and interview and was analyse by content analysis. This study reveals that the curricula of the School of Accountancy at Universitas Mahasaraswati Denpasar is relevant to the accounting profession; however, a few course contents and subjects taught needs to be revisited to accord with current business practice. To create job-ready graduates in Balinese context, English had become a major issue besides IFRS and Information Technology. Further, adding new subjects such as Corporate Governance, International Business and Computer-based Audit to the curricula is critical, as these subjects are technical competence that accountants must able to demonstrate according to IES 2. This study suggests that comparative case studies, internship in accounting-related companies and focus groups discussions are learning method to be developed to enhance graduates’ technical and nontechnical skills. Keywords: accounting curricula, learning approaches, technical competence, non-technical skills. 60 Asia Pacific Journal of Accounting and Finance Special Issues, December 2014, 59-72 1. RESEARCH BACKGROUND Higher education should ensure that there is transfer of knowledge a good learning environment (Vroeijenstijn 1995). When these are present, higher education can create graduates with the conceptual knowledge and critical thinking necessary for the workforce, including being an accountant. Unfortunately, accounting education in tertiary education is perceived as being problematic with concerns over course content and curriculum, pedagogy, skill development, the use of technology, faculty development and reward structure (Albrecht and Sack 2000). Albrecht and Sack further argue that curricula designed is too narrow and often not updated, driven by the interests of faculty not the market demand. The pedagogy lacks creativity which impedes students’ ability to learn. Several studies suggest that accounting education is in crisis with a gap between accounting education and accounting in practice (Turner et al. 2011, Albrecht and Sack 2000, Wally-Dima 2011, Watty 2005). Wally-Dima (2011) suggests that the accounting education of universities puts more emphasis on teaching students for qualification examinations rather than advancing students’ professional skills. She further argues that the graduates produced by universities are ill-equipped to handle the needs of the accounting profession. Given the research findings above, this study aims to evaluate the accounting education delivered in the School of Accountancy of Economic Faculty at Universitas Mahasaraswati Denpasar. In the last three years, the School of Accountancy has experienced a significant growth in numbers of accounting students. For example, taking 2011 as the base year, accounting students increased by 92per cent in 2012, in 2013 by 126 per cent and in 2014 by 248per cent. Since the popularity of the School of Accountancy is rising, the authors perceived it is important to evaluate the accounting education being delivered in accordance with accounting practice to ensure that students are work-ready after graduation. The quality of the graduates will become a major issue when the regional ASEAN Free Trade Agreement is implemented. This could have a huge impact on future graduates because the mobility of skilled labour will become wide open. Global and regional trade agreements widen the access for the transfer of skilled labour and allow employers to seek qualified workers across national borders (OECD 2002, Plimmer 2002, Allsop et al. 2009). Therefore, concerns emerge about whether graduates from Bali can compete in the changing environment of cross border agreement. Thus this study attempts to evaluate the gap between accounting education delivered in the School of Accountancy and the needs of accounting in practice in Bali. In particular, this study attempts to discern the relevant subjects and learning approaches that need to be embedded in the accounting program. This paper will be outlined as follows: the next section discusses the literature review; followed by the research method. The findings will be in section 4; and the last section is the discussion and conclusion. 2. LITERATURE REVIEW Accounting has become a key discipline because it functions as ‘the language of business’ (Burritt and Tingey-Holyoak 2011). Considering the importance of accounting, Suryawathy, Putra, Bridging the Gap between Accounting Education….. 61 accounting education delivered in higher education should be in accordance with accounting in practice. Unfortunately, the bond between accounting education and accounting in practice has been heavily criticized (Burritt and Tingey-Holyoak 2011), particularly since the fall of the global accounting firm, Arthur Andersen after Enron (Singh 2004). Several research findings have revealed the challenges to accounting education. For example, Singh (2004) evaluated the accounting courses offered by the professional bodies and universities in India and found that accounting education in India had failed to meet the changing nature of business. This is because accounting education in India lacked coordination between academics and industry and remained fragmented. He concluded there was a need to update colleges’ and universities’ course curricula in accordance with current business’ requirements. Yucel et al. (2012) carried out research on 245 students of Economics and Administrative Faculty of Uludag University. They found the major problem faced by students as future accountant candidates is lack of accounting course content and practices, which lead to estrange students from accounting professions. They further argued that creating “fully furnished” students with a lot of theoretical knowledge was not effective. Accounting education should provide students with basic accounting knowledge and ensure they have the ability to create, measure and analyse information for decision making. To broaden graduates’ skills, they promoted more training course opportunities should be given to students to enhance their communication and problem-solving competencies. De Lange (2006) surveyed 310 graduates from two universities in Victoria Australia and revealed they lack most of the generic skills desired by the professions, particularly interpersonal, communication and information technology skills. Turner et al. (2011) argue that accounting professionals and educators have been aware of the need to revise the curricula for decades. In designing the syllabus, accounting educators have to choose what to cover and how it aligns with the needs of the specific cultural and business environment (Allison 2007). The change in the business environment with the impact of globalization and the implementation of regional and global free trade may need to see developments or harmonization in education. Indeed, Sa’ and Gaviria (2011) reveal that the mobility of skilled labour arising from the North American Free Trade Agreement has harmonized higher education in Mexico with the Professional Mutual Recognition Agreement employed in global and regional trade agreements. Mexico underwent major changes in the regulation of its professions and introduced processes for quality assurance, academic accreditation and the licensing of university graduates of engineering, accounting and architecture programs. The implementation of the ASEAN Free Trade Agreement may also lead to harmonization in education. The members of ASEAN have agreed to a Mutual Recognition Agreement framework on accountancy services to promote efficiency and quality standards of the accountancy profession (ASEAN MRA on Accountancy Service 2014). This means that every nation in ASEAN has to improve their accountancy education to meet the international standards of accountancy profession and Article Number III (3.5) sets the International Federation of Accountants (IFAC)’s standards as the benchmark, taking into consideration the Domestic Regulations of each ASEAN Member State (ASEAN MRA on Accountancy Service 2014).International Accounting Education Standards Boards (IAESB) has issued its International Education Standards (IES) to “develop 62 Asia Pacific Journal of Accounting and Finance Special Issues, December 2014, 59-72 education standards, guidance and information papers on pre-qualification education, training of professional accountants and continuing professional education and development” (IAESB 2014). IESs are designed for IFAC member bodies and other stakeholders who support the learning and development in accounting professions, such as educational organizations, employers, regulators and the government. In regard to professional knowledge, IES 2 prescribes the knowledge that accountants are required to demonstrate as shown in Table 1. Besides the professional knowledge as prescribed in IES 2, Turner et al. (2011) as certain that whatever structure or curricula is designed, it must be able to produce graduates who are able to be successful in the changing environment. They further explained that to encourage students to be aware of current business events, there is a need to introduce basic research skills, for example, for undergraduate students to explore the legal tax process rather than just learning specific rules. The teaching methods used are important to instill students’ understanding about a particular subject. According to Howeison (2003) and Singh (2004), case study approach is the best to develop critical thinking on problem solving, stimulate students’ interests and link course material to practice. Not only advantageous for students, case study also can respond to the academics challenge on its practical relevance and contribute to the development of the knowledge (Cooper and Morgan 2008). In contrary, Crawford et al. (2010) reveal that case study and group work are less popular with academics. The most common teaching method used in across 12 countries is lectures, followed by tutorials/workshops. Essays and report writing are the next commonly most used, seminars by external speakers and students’ presentations were even less likely. Different type of case studies can be developed depends on the type of questions we are going to answer. Table 2 indicates the type of case studies generated by Yin (1989) in Cunningham (1997) Each type of case studies provides different knowledge and information. For instance, for narrative, explanatory and interpretive cases tend to be used to summarize information, focused on questions, criteria or sequence occurrences; while tabularize, comparative, diagnostic and experimental action research cases cover more detailed data; and survey cases are used for establishing proof or verifying propositions (Cunningham 1997). According to Singh (2004), in order to strengthen the computational and conceptual skills of students, there is a need to replace theoretical knowledge and numerical problems with conceptual knowledge and also link with technology. In line with Singh (2004), WallyDima (2011) emphasizes the need to embrace computer technology and business decision making for the development of accountants. Additionally, to make accounting teaching more effective, various teaching methods need to be developed, for instance case studies, projects and market surveys, role play, group discussion and the use to technology aids such as projector and audio-video techniques (Singh 2004). Howeison (2003) suggests interactive group work within tutorials works better rather than simply presentations by students. When they have interactive group work within tutorials, they can have live discussions and share ideas. To investigate accounting education delivered by the School of Accountancy at Universitas Mahasaraswati Denpasar and the needs of accounting in practice in the Balinese context; this study aims to discover the extent to which the accounting curricula meets the needs of the profession. Suryawathy, Putra, Bridging the Gap between Accounting Education….. 63 3. RESEARCH METHODOLOGY This study involved: (1) the academics of the School of Accountancy at Universitas Mahasaraswati Denpasarwith a total of 18 accounting lecturers; (2) alumni and final year students of the School of Accountancy at Universitas Mahasaraswati Denpasar who work in accounting departments. Snowball sampling method was used to determine the sample of the alumni and purposive sampling method was used to determine the sample of final year students. (3) Professional accountants from registered Public Accountant Association and from tax and financial consultants in Denpasar area. Total registered public accountant firms in Denpasar is ten, and each firm asked for different number of questionnaires ranging from two to fifteen questionnaires. This study employed a mixed method research. Quantitative data collected by closedended questionnaires to confirm the relevance/importance of subjects and teaching methods, measured on a five point Likert scale ranging from 5 (very relevant/important) to 1 (very irrelevant/unimportant), and was analyzed with statistical analysis; whereas, qualitative data accumulated through open-ended questionnaires and interviews to obtain detailed information, and was analyzed with content analysis. The demographic of the respondents summarized in Table 3. 4. FINDINGS To be graduated with a Bachelor Degree in the School of Accountancy of Economic Faculty at Universitas Mahasaraswati Denpasar, 43 subjects have to be passed. Table 4 shows the 43 subjects and the responses from 166 respondents on how relevant each topic is to the profession. Academics viewed 25 subjects as very relevant and 18 subjects as relevant for the accounting profession. The academics ranked Introduction to Accounting, Taxation (practice) and Audit (practice) were most relevant subjects with similar mean scores of 4.93. The academics argued that those three subjects were the core technical competence for being accountants. In Introduction to Accounting, students learn the basic accounting knowledge, debit and credit. While in real accounting work, besides dealing with journals and financial statements, graduates will definitely deal with tax and audit. For instance, they have to calculate employees’ and entity’s tax levy and report them monthly and annually; or if they work in a public accountant firm, they must understand audit. From public accountants’ perspective, 24 subjects as very relevant and 19 subjects as relevant. Audit (practice) ranked first, followed by Audit (theory) and Financial Accounting with means of 4.74, 4.66 and 4.63 respectively. They claimed that being public accountants, mastering audit theoretically and practically have become key requirements. Graduates, who will be future accountants or auditors, have to understand the concept of audit, what to be audited and how to audit. They further argued graduates must well knowledgeable of financial statements including its accounts and its measurement as this is the main object for accounting profession. Alumni and final year students identified 21 subjects as very relevant and 22 subjects as relevant. Most relevant subject was Financial Accounting, followed by Analysis of Financial 64 Asia Pacific Journal of Accounting and Finance Special Issues, December 2014, 59-72 Statements with means of 4.72 and 4.69 respectively. The alumni and final year students argued that even though they have learnt basic accounting knowledge in the Introduction to Accounting subject1, they have not mastered each account in detailed yet as to what they learnt in Financial Accounting2. In addition, how to interpret numbers in financial statements is highlighted by this group. The alumni and final year students explained that besides preparing financial statements, they also asked to communicate the statements by using financial ratios with their managers. Interestingly, the three groups of respondents had a similar agreement that Sociology Politics3 were ranked last out of 43 subjects. When asked about other subjects to be added to the curricula, 33 per cent of the respondents stated English-based Accounting. The academics and the alumni and final year students agreed that graduates must be fluent with accounting terminology in English, able to demonstrate their competencies and communicate in English. English proficiency has become a core professional skill in Balinese context. This is because besides being a tourist destination, Bali is also well known as an international business centre in Indonesia. Graduates will need to interact with colleagues, many of whom will be expatriates. Thus, to create jobready graduates, equipping graduates with accounting knowledge itself is not adequate. The academics emphasized that graduates with English proficiency will be valued higher than those who do not. Next subject was International Financial Reporting Standards (17 per cent). The academics and public accountants had similar perspective that incorporating IFRS content into accounting program also appears to be an issue as currently accounting system of all nations will be harmonized under the umbrella of IFRS. Updating curricula with current issue is important so the knowledge transferred is applicable to the real accounting work. Further, information technology apparently had become a major technical knowledge that needs to be incorporated (41 per cent). Even though public accountants agreed that learning customized accounting package, for instance MYOB, was excellent to broaden graduates’ competencies; the academics viewed it was not adequate enough. The academics emphasized that graduates have to be able to create a simple accounting system, even in a spreadsheet, besides mastering MYOB. The ability to create a simple accounting system demonstrates the graduates’ understanding of accounting cycle and its underlying concepts. Other subjects should be added in the curricula were Corporate Governance, Computer-based Audit, Social Accounting and International Business. This findings confirms that the courses offered by the School of Accountancy are relevant for the accounting profession; however, a few course contents and subjects taught should be updated to meet current business practice. The learning approaches in the School of Accountancy are case study, class seminars, presentation by the students and guest lecturers. Table 5 shows the level of importance of each learning approaches from 166 respondents. All learning approaches are important as their mean scores above 3.01. If analyze from the level of importance, case study appears to be the most important learning approaches 1 Introduction to Accounting covers accounting cycle, business types and transactions, journals, balance sheet. Financial Accounting covers conceptual framework of financial accounting; financial statements; detailed of each accounts such as assets, liabilities and equity; and issues in accounting. 3 Sociology Politics mainly covers about politics in Indonesia, including the history of politics in Indonesia, the role of the state agency, community organizations in Indonesia, political parties and other political issues 2 Suryawathy, Putra, Bridging the Gap between Accounting Education….. 65 agreed by all respondents. The alumni and final year students argued that by having case study they will not merely memorize and visualize. They can apply theoretical knowledge into practice. Similar opinion arouse from the academics and public accountants. They believed by giving a related case can test students’ understanding on a particular topic. The professional accountants emphasized that the academics should be able to design a specific case study that applicable or reflect to the real working environment. In designing the case study, the academics mirror from the theoretical framework and literature review of the latest academic journals, then the content of the case study is adjusted with the surrounding circumstances within Indonesia, or more specifically, within Balinese context. The aim is that students can analyzed and implement theory to the specific circumstances. For example, for entrepreneurship course, the case study given is “how to develop traditional Balinese products for international market”. The underpinning theory of how to conduct international business can be gained from marketing theory, and the implementation will look down to Bali environment. This case study can also be answered by comparing similar variables analyze in different places, for instance taking Malaysia as the comparison of Bali. Both places are international tourist destinations with similar Asian characteristics. What has been done in Malaysia in term of marketing local product internationally can also be adopted into Balinese context. Case study also can be done in taxation and audit. The task is how to calculate entities’ and employees’ tax and fill in the real tax forms or doing audit in a spreadsheet. Calculating cost of product can also be a case study. Usually big manufacture companies are taken as the example in the case study provided in the textbook. But in this case, try to make it simpler by, for example, calculating cost of product of a simple local product –nasi jinggo-. Thus, besides learning about how accounting applied for big firms, students also will learn how to applied accounting for small or home industries. Next very important learning approach is guest lecturers. Both the academics and the alumni and final year students agreed that guest lecturers will bring new insight on current accounting issues. However, public accountants had different opinion on the second ranked of very important learning approach. They viewed class seminars slightly more important than guest lecturers. They argued that the academics have been experiencing a continual study which made them mastered a particular course. Thus, having an explanation from the academics can in still students’ understanding better. When asked about other learning approaches considered important to be developed, two third of the respondents stated internships. During the internships program, students should be given access to handle a particular client- the same firm- within a minimum internships period of six months. For instance, if internships conduct in an audit firm, students should do the audit alone but still under supervision of the audit manager. The audit will be on general journals, ledgers, reconciliation, income and loss statements and balance sheet. Another example, students can be asked to prepare monthly tax reports for a particular client, which includes company tax report and employee tax report. Students’ ability to handle one particular client within six months demonstrates their understanding on how to record accounting transactions and the flow of accounting cycles. Another point highlighted by the professional accountants is that choosing the proper companies for internships program. They suggested that better for 66 Asia Pacific Journal of Accounting and Finance Special Issues, December 2014, 59-72 accounting students to do internships in public accountant firms or in financial consultants, so they can learn accountancy at the accounting-related companies. When students pick any companies, sometimes they may end up in an administrative or customer service or marketing departments; as a consequent, they will not reap the rewards of the internships that is to deepen their skills as accountants. In addition, internships was also considered important to develop their non-technical skills, for example communication, team work, critical thinking, problem-solving and interpersonal skills. Other learning approaches suggested was focus group discussion. Generally, it is hard to get ideas from students when they are asked alone. However, things happen differently. When students are in groups, they are likely speaking. Therefore, to brainstorms ideas, having focus groups is the best approaches according to the academics and the professional accountants. They highlighted that the maximum member in a group is five students. If the group’s member more than five students, they apparently will end up in chatting. Additionally, the member of each group should be rolled up. The advantages of being rolled up are to develop students’ communication skill, team work and ability to adapt with new colleagues. They emphasized that focus group discussions can make a live class and creates more active and critical students. The last suggestion for study method is comparative study to other universities 5. DISCUSSIONS AND CUNCLUSION The findings above indicates that the curricula in the School of Accountancy at Universitas Mahasaraswati Denpasar is relevant to the needs of accounting profession; however, a few course contents and subjects taught needs to be reviewed. To meet current practice requirements, updating accounting programs is critical (Albrecht and Sack 2000, Wally-Dima 2011, Singh 2004, Yucel et al. 2012, Turner et al. 2011). The academics and the alumni and final year students highlighted the importance of English proficiency to secure accounting profession in the Balinese context. Even though English language already included in the curricula of the School of Accountancy, the content should be updated to be more accounting-business related and more practice need to be conducted. Graduates can demonstrate their competencies better to their colleagues, whom most of them are expatriates, when they proficient with English; thus, they will valued higher than those who do not. Similarly, incorporating IFRS to certain accounting subjects had become an issue. This finding is consistent with Muntel and Reckers (2009) who note that IFRS content should be added to the curricula. Currently, accountants’ role had experienced a dramatic transition from bookkeepers or tax preparers to strategic business advisors (Holtzman 2004). Thus, graduates must be able to apply and prepare financial statements based on IFRS and communicate the financial statements (IES 2 IAESB 2014, Barth 2008). Further, accounting education should embrace information technology (Yucel et al. 2012, Wally-Dima 2011). The development of information and technology has reduced the need of bookkeeping with online financial reporting and extensible Business Reporting Language where information can be accessed anywhere (Dunne et al. 2013). Other subjects suggested to be added to the curricula are Corporate Governance, International Business, Social Accounting and Computer-based Audit. Those suggested subjects are technical competence that accountants must demonstrate Suryawathy, Putra, Bridging the Gap between Accounting Education….. 67 according to IES 2 (IAESB 2014). This indicates that to create job-ready graduates, updating curricula at the School of Accountancy is a must to accord with current practice. In regard to learning methods, all respondents agreed case study is the best learning approach. The academics should be able to design a specific case study based on real accounting work, so it is applicable and reflects on real circumstances. The case study can be in form of intensive cases, comparative cases or action research (Cunningham 1997). For instance, a comparative case study can be built when developing entrepreneurship course on “how to develop traditional Balinese product for international market” by comparing the characteristics, what is happening and being done in a one place and compare it to our place. Case study has been successfully promoted professional skills in accounting (Merwe 2013 Howeison 2003, Singh 2004). Next, internships was suggested as the important learning approach by two third of the respondents. Professional accountants suggested that better for accounting students to do internships in accounting-related firms within six months. Under the supervision of the accounting manager of a particular firm, students can experience accounting skills when they handle the accounting process of that firm. Internships mentor or supervisor, in this case is the accounting manager, plays important role in shaping students’ accounting skills. Students’ learning quality depends on the learning experiences that is designed and facilitated by the supervisors (Alderman and Milne 2005).The advantageous of internships program are give students the opportunity to exposure with real-life accounting practice within a longer period (Wally-Dima 2011) and develop students’ non-technical skills, for example communication, team work, critical thinking, problem-solving and interpersonal skills, that required for the profession (Yucel et al. 2012, Carr et al. 2006, Klibi and Oussii 2013, IES 3 IAESB 2014). Other learning method suggested is focus group discussion with a maximum member of each group is five students and this group’s members should be rolled up. Focus group discussion can create a more live class and generate more active and critical students. The contribution of this research is that accounting education should be improved for graduates can secure their accounting jobs especially after ASEAN Free Trade Agreement in 2015 is implemented. This paper only evaluates accounting education from a private university in Bali. Further research should evaluate the accounting education delivered in public universities and vocational schools, so the findings can be compared and be implemented to improve graduates’ skills. Further research can include the quality of academics and the infrastructure such as the library, the learning environment and the access to international journals. 68 Asia Pacific Journal of Accounting and Finance Special Issues, December 2014, 59-72 REFERENCES Albrecht, W.S. and Sack, R.J. “Accounting Education: Charting the Course through a Perilous Future”, Accounting Education Series, Vol. 16 (2000), American Accounting Association, Sarasota, FL. Allison, M. “A commentary on Professionalizing Claims and the State of UK Professional Accounting Education: Some Evidence”, Accounting Education An International Journal Vol.16 No.1 (2007): 23-26. Allsop, J., Bourgeault, I., Evetts, J., Le Bianic, T., Jones, K. and Wrede, S. “Encountering Globalization”, Current Sociology, Vol.57 No.4 (2009): 487–510. ASEAN. “Mutual Recognition Arrangement Framework on Accountancy Services.” (2014), http://www.asean.org/communities/asean-economic-community/item/asean-mutualrecognition-arrangement-framework-on-accountancy-services-3 (September 1, 2014). Barth, M. E. “Global financial reporting: Implications for U.S. academics”, Accounting Review, Vol.83 No. 5 (2008): 1159–1179. Burrit, R. and Tingey-Holyoak, J. “Sustainability Accounting Research and Professional Practice: Mind the Gap”, Bridging the Gap between Academic Accounting Research and Professional Practice (2011),, The Institute of Chartered Accountants in Australia and Centre for Accounting, Governance and Sustainability University of South Australia: Australia. ISBN No: 978-1-921245-85-5. Carr, S., Chua, F. and Perera, H. “University accounting curricula: the erceptions of an alumni group”, Accounting Education: an International Journal, Vol. 15 No. 4 (2006): 359– 376. Crawford, L, Helliar, C, Monk, E, Mina, M, Teodori, C, Veneziani, M, Wanyama, S. and Falgi, K. ”IES Compliance and the Knowledge, Skills and Value of IES 2,3 and 4”, IAAER/ ACCA Research Project (2010). Cooper, D.J. and Morgan, W. “Case Study Research in Accounting”, Accounting Horizons, Vol. 22 No. 2 (2008): 159. Cunningham, J.B. “Case Study Principles for Different Type of Cases”, Quality and Quantity, Vol. 31 (1997): 401 – 423. De Lange, P., Jackling, B. and Gut, A. M. “Accounting Graduates’ Perceptions of Skills Emphasis in Undergraduate Courses: An Investigation from Two Victorian Universities”, Accounting and Finance, Vol. 46 No. 3 (2006): 365–386. Dunne, T., Helliar, C., Lymer, A. and Mousa, R. “Stakeholder engagement in internet financial reporting: The diffusion of XBRL in the UK”, The British Accounting Review, Vol. 45 (2013): 167 – 182. Holtzman, Y. “The Transformation of Accounting Profession in the United States: From Information Processing to Strategic Business Advising”, The Journal of Management Development, Vol. 23 No. 10 (2004): 949 – 961. Howieson, B. “Accounting Practice in the New Millennium: Is Accounting Education Ready to Meet the Challenge?”, The British Accounting Review, Vol. 35 No. 2 (2003): 69-103. Suryawathy, Putra, Bridging the Gap between Accounting Education….. 69 International Accounting Education Standards Board. International Education Standard (IES) 2: Initial Professional Development – Technical Competence (Revised), 2014. International Accounting Education Standards Board. International Education Standard (IES) 3: Initial Professional Development – Professional Skills (Revised), 2014. Klibi, M.F., Oussii, A.A. “Skills and Attributes Needed for Success in Accounting Career: Do Employers’ Expectations Fit with Students’ Perceptions? Evidence from Tunisia, International Journal of Business and Management, Vol. 8 No. 8 (2013): 118 – 132. Merwe, V.D.N. “An Evaluation of an Integrated Case Study and Business Simulation to Deveop Professional Skills in South African Accountancy Students”, International Business and Economics Research Journal, Vol. 12 No. 10 (2013): 1138 – 1156. Munter, P. and Reckers, P.M.J. “IFRS and Collegiate Accounting Curricula in the United States: 2008 A survey of the current state of education conducted by KPMG and the Education Committee of the American Accounting Association”, Issues n Accounting Education, Vol. 24 No.2 (2009): 131. OECD. Service Providers on the Mover: Mutual Recognition Agreements No. TD/TC/ WP(2002)48/FINAL) Paris, France: OECD, 2002. Plimmer, F. “Mutual recognition of professional qualifications”, Property Management, Vol.20 No.2 (2002): 114–136. Sa´, C and and Gaviria, P. “How Do Professional Mutual Recognition Agreements Affect Higher Education? Examining Regional Policy in North America”, Higher Education Policy, Vol.24 (2011): 307–330. Singh, G. “Emerging Dimensions of Accounting Education and Research in India”, Vol. 10 No.22 (2004): 24. Turner, K.F, Reed, R.O and Greiman, J. “Accounting Education in Crisis”, American Journal of Business Education, Vol.4 No.12, 2011: 39-44. Vroeijenstijn, T.I. “Quality assurance in medical education”, Academic Medicine, Vol.70, No.7 (1995): 59-67. Wally-Dima, L. “Bridging the Gap between Accounting Education and Accounting Practice: The Case of the University of Botswana”, The IUP Journal of Accounting Research & Audit Practices, Vol. X No. 4 (2011): 7-27. Watty, K. “Quality in Accounting Education: What say the academics?”,Quality Assurance in Education, Vol. 13 No. 2 (2005): 120-131. Yucel, E., Sarac, M. and Cabuk, A. “Accounting Education in Turkey and Professional Accountant Candidates Expectations from Accounting Education: Uludag University Application”, Business and Economics Research Journal, Vol. 3 No.1 (2012): 91-108. Asia Pacific Journal of Accounting and Finance Special Issues, December 2014, 59-72 70 APPENDIX Table 1: IES 2 Knowledge No 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Professional Knowledge Level of Proficiency Financial accounting and reporting (IFRS) Management accounting Finance and financial management Taxation Audit and assurance Governance, risk management and internal control Business law and regulation Information technology Business and organizational environment Business strategy and management Economics Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Foundation Sources: IES 2(2014) Table 2: Different type of case study Purpose Assumption Situation Types Intensive cases To develop theory from intensive exploration Comparative cases To develop concepts based on case comparisons Creativity through comparison with existing theory Usually evolves out of researcher’s intensive experience with culture or organizations Narrative, tabulation, explanatory, interpretive Comparison of cases leads to more useful theory Action research To develop concepts which help facilitate the process of change Theory emerges in the process of changing Usually concepts are developed from one case to another case Developing theory to assist practices and future social science Case comparisons, case survey, interpretive comparisons Diagnostic, experimental Sources: Yin (1989) in Cunningham (1997) Table 3: Demographic of the respondents Description Questionnaires: • Distributed • Returned • Response rate Education background: • Doctorate degree • Master degree • Bachelor degree Academics Alumni and Final year Students Professional Accountants 18 15 83 per cent 75 75 100 per cent 100 76 76 per cent 2 (13 per cent) 13 (87 per cent) 0 0 0 75 (100 per cent) 0 2 (3 per cent) 74 (97 per cent) Suryawathy, Putra, Bridging the Gap between Accounting Education….. Academics Alumni and Final year Students Professional Accountants 7 (46 per cent) 8 (54 per cent) 14 (19 per cent) 61 (81 per cent) 39 (51 per cent) 37 (49 per cent) Description Gender: • Male • Female 71 Sources: Data processed from 166 respondents (2014)4 Table 4: Curricula design No Subjects Academic Accountants 4.93 Mean Score Alumni / Final year Students 4.57 Public Accountants 4.59 1. Introduction to accounting 2. Financial accounting 4.53 4.72 4.63 3. Advance financial accounting 4.40 4.57 4.61 4. Cost accounting 4.60 4.48 4.34 5. Management accounting 4.60 4.24 4.25 6. Taxation (theory) 4.93 4.60 4.38 7. Taxation (practice) 4.93 4.65 4.38 8. Audit (theory) 4.87 4.36 4.66 9. Audit (practice) 4.93 4.36 4.74 10. Forensic audit 4.07 3.64 4.28 11. Internal audit 4.47 4.15 4.39 12. Ethic for accountant 4.47 4.21 4.36 13. Public sector accounting 4.20 3.89 4.05 14. Analysis of financial statements 4.80 4.69 4.25 15. Accounting information system 4.67 4.28 4.17 16. Accounting theory 4.20 4.27 4.11 17. Accounting for banking and local credit institutions 4.27 4.07 4.04 18. Behavioural accounting 4.00 4.19 3.88 19. Computer accounting application 4.60 4.64 4.22 20. Hotel accounting 4.00 3.81 4.09 21. International accounting 3.87 3.93 3.97 22. Accounting seminars 3.93 3.96 3.89 23. Moral education 3.40 3.12 3.78 24. Sociology politic 3.07 3.07 3.63 25. Civic education 3.27 3.07 3.63 26. English language 4.53 4.33 4.12 4 The instrument used in this research is valid and reliable. The validity test for curricula is ranging from 0.000 to 0.025 and learning approaches is 0.000 which is lower than α = 0.05; while the reliability test for curricula and learning approaches is 0.968 and 0.779 respectively which is higher than 0.7. 72 Asia Pacific Journal of Accounting and Finance Special Issues, December 2014, 59-72 Mean Score Alumni / Final year Students 3.84 Public Accountants 3.96 28. Introduction to micro economic Academic Accountants 3.67 29. Introduction to macro economic 3.60 3.83 3.96 30. Indonesian language 3.60 3.47 3.76 31. Statistic economic 3.73 3.93 3.96 32. Quantitative analysis application 3.87 4.16 3.86 33. Introduction to business 3.67 3.85 3.82 34. Introduction to management 3.67 3.71 3.80 35. Introduction to business law 3.67 3.57 3.87 36. Financial management 4.13 4.28 4.04 37. Business communication 4.00 3.85 3.84 38. Portfolio theory and investment analysis 3.93 3.95 3.78 39. Cooperation and SMEs 3.93 3.73 3.74 40. Entrepreneurships 4.20 4.11 3.82 41. Tourism business 3.60 3.48 3.83 42. Business feasibility study 4.13 3.56 4.00 43. Thesis 4.13 3.96 4.14 No Subjects Note: The mean scores reflect a five point Likert Scale where 5 = extremely relevant, 4 = relevant, 3 = neutral, 2 = irrelevant, 1 = extremely irrelevant. Sources: Data processed from 166 respondents (2014). Table 5: Learning Approaches Mean Score No Learning approaches Academic Accountants Alumni / Final year Students Public Accountants 1 Case study 4.87 4.35 4.01 2 Class seminars 4.47 4.27 3.95 3 Presentation by students 4.53 3.95 3.75 4 Presentation by guest lecturers 4.73 4.29 3.84 Note: The mean scores reflect a five point Likert Scale where 5 = very important, 4 = important, 3 = neutral, 2 = unimportant, 1 = very unimportant. Sources: Data processed from 166 respondents (2014). ASIAPACIFIC JOURNAL OF ACCOUNTING AND FINANCE ASIA PACIFIC JOURNAL OF ACCOUNTING AND FINANCE Department of Accounting, Faculty of Economics, Universitas Indonesia Depok, Indonesia Phone : +62-21-7272425, Fax: +62-21-7863558 Email : apjaf@ui.ac.id