Redstone plc - Overview - Castleton Technology PLC

advertisement

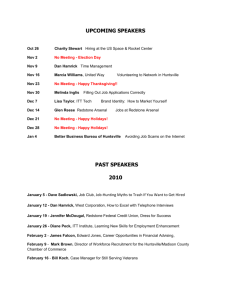

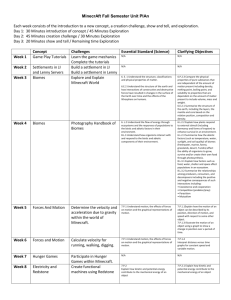

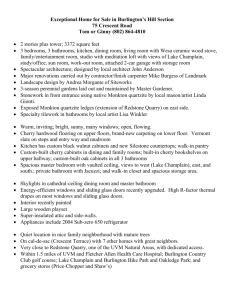

Redstone plc - Overview Martin Balaam – CEO March 2007 Redstone plc “Redstone is uniquely positioned as the only IT & Communications provider within the UK and Ireland to be able to offer all core competencies in house.” people who innovate Redstone Overview & Strategy Voice IP Solutions Telecoms IP Telephony Enterprise Server IP Network OneNet Internet ISP & Management people who innovate Redstone plc Core Competences Technology 6% Managed 6% Telecoms 31% Fixed Line Telecoms Mobile Telecoms IP Networks/Convergence Converged 39% ISP/Security/Microsoft Mobile 18% Enterprise Server & Storage IT Services: Telecoms 51%:49% people who innovate Redstone plc people who innovate Market Participants IT/Telecom Competitive Landscape Telecoms Mobile Converged Solutions Managed Solutions Technology BT O2 BT RM IBM Carphone W Vodafone Affiniti Ramesys EMC C&W Orange Di Data Synetrix Thus T-Mobile Azzurri Phoenix AT Comms 3 Logicalis Lynx Redstone Redstone Redstone Redstone Redstone “Redstone is uniquely positioned as the only IT & Communications provider within the UK and Ireland to be able to offer all core competencies in house. Each principal division is recognised as a market leader in its own right” people who innovate Redstone Telecom Fixed Line Telephony Service Redstone Network owned and managed by BT Wholesale Outbound, Inbound, Premium Rate, Calling Cards, Follow-Me Numbers Hosted IP Telephony, ‘Skype’ type IP telephony Competition: BT, C&W, Thus, Kingston Growth Opportunities Existing Redstone customer base Other Redstone products through 400 strong UK dealer network Bundled products targeting SME’s people who innovate Redstone Mobile Service provider for O2 and Vodafone Distributor for all 5 major networks - O2, Vodafone, 3, Orange and T-Mobile Competition: as a stand alone product – all major network operators as a combined business product – none Growth Opportunities Existing Redstone customer base – minimal penetration Other Redstone products through 400 strong UK dealer network Bundled products targeting SME’s people who innovate Redstone Converged Solutions IP Networking Solutions - expertise in contact centres, voice and video, IP Networks, wireless & mobility Cisco Gold, Avaya Gold, Mitel Platinum, BT Gold partner A market leader in Intelligent Buildings Competition – BT, Affiniti, Logicalis, Dimension Data, Azzurri Growth Opportunities IP convergence becoming mass adoption Cross selling into Redstone customer base Move into large multi year contract – BSF, Retail Developments people who innovate Redstone Managed Solutions ISP, IT Outsourcing, Remote Hosting, Co-Location, Applications Development, Network Security & Management Microsoft Gold Certified Partner Bespoke application development, focus on education Competition: education – RM, Ramesys, Synetrix, Northgate other – fragmented market Growth Opportunities Redstone customer base Network security and management people who innovate Redstone Technology Enterprise Server, “mainframe”, Storage Area Networks HP Elite Partner HP Outsourced technical skills to Redstone in Ireland Competition – IBM, EMC/Dell Growth Opportunities Expansion into UK Redstone corporate customer base IBM solutions people who innovate Redstone plc Major Shareholders in Redstone are Blue Chip Fund Managers: Schroder VG Investment Management – 20% Gartmore Investment Management – 15% Cycladic – 10% Stephens Bank Inc – 6% Canada Life Investment Management – 5% Society Generale Asset Management – 3% Artemis Investment Management – 5% Herald Investment Management – 1% UBS Investment Management -5% F&C Asset Management – 1% Morley Fund Management – 3% Lloyds TSB Development Capital – 3% people who innovate Redstone plc Institutional Shareholders yield financial strength: •In April 05 Redstone raised £26m cash from shareholders to fund the acquisition of the Xpert Group. •In July 06 Redstone’s major shareholders invested an additional £20m cash to fund the acquisition of Symphony plc and Tolerant Ltd •In Feb 07 Redstone raised £40m to acquire IDN telecom plc and Comunica people who innovate Redstone plc Redstone plc Board Non Execs Executives Alan Coppin – Chair Martin Balaam – CEO David Payne - NED Tim Perks – CFO Oliver Vaughn - NED Gerry Spencer - NED Tim Sherwood - NED people who innovate Redstone plc Alan Coppin - Chair Previous Roles •CEO of Princes Trust •CEO of Royal Palaces •CEO Wembly plc •NED Carrillion plc Current NED Roles •Dinoptra plc •Capital & Regional plc •Berkeley Group plc people who innovate Redstone plc Martin Balaam - CEO Previous Roles •CEO of Xpert Group •Lloyds Development Capital •President Hays IMS Inc •FD Hays IMS UK •Deloittes Background •Chartered Accountant people who innovate Redstone plc Tim Perks - CFO Previous Roles •CFO of Staffware plc •CFO of Baltimore Tech plc •FD Leading Tech Ltd •PWC Background •Chartered Accountant people who innovate Redstone plc Locations: Edinburgh Thornaby Huddersfield Belfast Dublin Wicklow Warrington Stoke Birmingham Cambridge Ipswich Hemel London, City Wokingham people who innovate Redstone plc - partners We only partner we the worlds leading manufacturers: people who innovate Redstone plc - customers Department Of Social & Family Affairs Ireland’s National Police Service people who innovate Redstone plc - customers people who innovate Redstone plc - customers Selected Customers people who innovate Redstone – Revenues & GM 50 45 40 £ million 35 30 Revenue 25 Gross Profit 20 15 10 5 0 H2 05 H1 06 H2 06 H1 07 people who innovate Highlights H1 2007 Revenue increased by 41.7% to £47.4m; primarily a result of acquisitions* EBITDA increased to £2.9m from a loss of £2.0m* ** Net Cash generated from operating activities £1.8m Acquisition of Symphony and Tolerant in July 2006 Integration of acquisitions complete Significant customer wins – Lancashire BSF, Foxtons, TSC * Compared with six months ended 30 September 2005 ** Before IFRS 2 charges and holiday pay accrual people who innovate Acquisition Funding Equity Pre Acquisitions Debt £89m* £11.1m Cash Total £8m £92.1m £13m IDN Bank Debt £13m Comunica Shares £3.5m £3.5m Comunica Placing £18m £18m Costs & Increased W/cap £7m £110.5m £31.1m * Market Capitalisation on 24 January 2007 based on a share price of 7.88p and an issued share capital of 1,140,259,263 ordinary shares of 1p each £7m £8m £133.6m people who innovate Summary - Delivering on Objectives ‘06 Status Added Mobile offering 9 Added scale to Fixed Line business 9 Added Indirect Channel for SME market 9 Strengthened Managed Solutions Business 9 Develop long term project opportunities for Converged Solutions 9 Extend customer base and increase cross selling 9 people who innovate Core Objectives ‘07 Integrate IDN and Comunica acquisitions Drive cross selling through whole group - organic growth Improve revenue visibility – win more large long term contracts Review enlarged group spending and identify procurement savings Expand Managed Solutions & Technology business within UK Develop SME channel people who innovate Outlook Continued organic growth - profit & cash Drive down costs Key customer/contract wins Increasing revenue visibility Selective M&A to add scale and customers Sector consolidation to continue people who innovate Redstone plc - Overview Thankyou