Annual Financial Report 05 - State University of New York

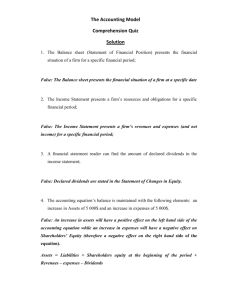

advertisement