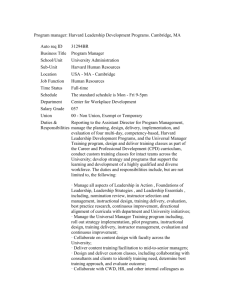

IBM 6014

advertisement

Syllabus and Course Description Fall/Spring Semester of the Academic Year of Fall, 2010 Department/ Institute of Business Course Title:(Chinese) 財務管理 Institute and Management Permanent Course (English) Financial Management IBM 6014 ID Instructor: Fen-may Liou Year of Students (for undergraduate courses) Required competence or courses that must be previously taken by students: None Credits Required/ Elective 3 Course Descriptions and Objectives: The objective of this course is to give students the capacity to understand the theory and apply the techniques that have been developed in corporate finance. The course touches on all areas of finance, including the business objective and the agent problem, financial statement analysis, the trade-off between risk and expected return, the project worth, the financing decision, and the dividend policy. All these things fitting together leads to final firm valuation. The course also draws Harvard case studies to guide managerial decisions. Textbooks (please specify titles, authors, publishers and year of publication) Damodaran, Aswath 2006. Applied Corporate Finance: A User's Manual, 2nd ed., John Wiley & Sons, Inc. http://pages.stern.nyu.edu/~adamodar/ Brealey, Richard A., Stewart C. Myers and Franklin Allen 2008. Principles of Corporate Finance, 9th ed., 2008, McGraw-Hill. Course Contents Topics Outlines 1.Objective of financial management and agent I. Introduction problems 2. Corporate governance around the world Hours DemonLectures stration 1. Ratio analysis and competitive advantage of the firm 2. Financial planning 12 III. Risk and Return CAPM and other risk and return models 9 1. Capital structure: Theory, models and applications 2. Payout policy Remarks 6 II. Financial Statement Analysis IV. Financing and Payout Policy Experiment Othe rsi Harvard Case: Enron Selling Recommendati on Harvard Case: Refinancing of Shanghai GM (A) 15 Linear Technology: Dividend Policy Harvard Case: V. Valuation 1. Time value of money 2. Project worth 3. Firm valuation Seagram Greater China Office Relocation in HK 12 Valuation: Spyder Active Sports Description of Course Details: 1. Homework and Assignments: Group work: Term paper; Harvard cases 2. Exams and Quizzes: Evaluation and Grading Policy: Term paper 40%; Harvard case presentation 30%, discussions 15% 3. Class participation: 15% 4. Pedagogy and other supplementary information (websites, TAs, handouts and/or databases): Time Slot Location Contact Information Office Hours NCTU Taipei Campus, Email mayliou@mail.ypu.edu.tw 4F, Teacher’s Lounge msn: mayliou@so-net.net.tw subject to reservation Syllabus Week Contents/Topic Date 1 Course Introduction and Term Paper requirements 2 Objective in corporate finance and agent problems 3 Corporate governance in the world Ratio analysis and competitive advantage 4 Time value of money, Investment valuation: decision criteria 5 Investment valuation: case illustration 6 Harvard case 1: Enron: Sell Recommendations 7 CAPM and other risk and return models 8 From cost of equity/debt to cost of capital 9 Harvard case 2- Seagram Greater China Office Relocation in HK 10 Financing mix: Theory, models and applications 11 Financing mix: Moving to optimal financial structure (Term paper first part due) 12 Payout policy 13 Harvard case 3- Refinancing of Shanghai GM (A) 14 Firm valuation 15 Harvard case 4: Linear Technology: Dividend Policy 16 Harvard case 5: Spyder Active Sports 2004 17 Knowing Wall Street (Term paper due) 18 Wrap-up Remarks: 1、Inclusive of visiting institutes/organizations outside the NCTU or other academic events. 2、Please adhere to pertinent regulations/laws on intellectual property rights. Do not use pirated textbooks. 附件三