Tax Year 2015 H&R Block Tax Software State Forms

advertisement

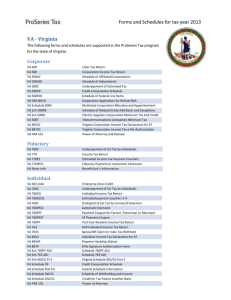

Tax Year 2015 H&R Block Tax Software State Forms Alabama 40 40-Sch A 40-Sch B & DC 40-Sch D 40-Sch E 40NR 40NR-Sch A 40NR-Sch BDE 40V 8453OL Sch AATC Sch CR Sch NTC Sch OC Individual Income Tax Return Itemized Deductions Interest & Div/Donations Net Profit or Loss Supplemental Income and Loss (From Pensions, Royalties, Partnerships) Individual Income Tax Return - Nonresident Itemized Deductions - Nonresident Interest and Dividend Income etc Electronic Individual Income Tax Payment Voucher EL-Individual Income Tax Declaration for Online Filing Alabama Accountability Tax Credit Credit For Taxes Paid To Other States Net Tax Calculation Other Credits Arkansas 1000-Sch AR3 1000-Sch AR4 1000ADJ 1000CO 1000D 1000F 1000NR 1000V 1075 8453OL ARDD AROI Itemized Deduction Schedule Interest/Dividend Income Schedule Schedule of Other Adjustments Schedule of Check-off Contributions Capital Gains Schedule - Individual Individual Income Tax Return Nonresident & Part-Year Resident Tax Return Individual Income Tax Return Payment Voucher Tuition Credit EX-On-line Declaration for Electronic Filing Direct Deposit Information Other Income / Depreciation Differences Arizona 140 140-Sch A 140A 140ES 140NR 140NR-Sch A 140PTC 140PY 140PY-Sch A 140PYN-Sch A 140V Resident Personal Income Tax Itemized Deduction Adjustments Resident Personal Income Tax Short Form Individual Estimated Tax Payment Nonresident Personal Income Tax Itemized Deductions - Nonresident Property Tax Refund/Credit Claim Part-Year Resident Personal Tax Itemized Deductions - Part-Year Itemized Deductions - Part-Year Electronic Filing Payment Voucher 201 204 221 301 321 322 323 8879 Renters Certificate of Prop Taxes Application for Filing Extension Underpayment of Estimated Tax - Individual Nonrefundable Credits and Recap Contributions to Charities Credit for Fees to Public Schools School Tuition Contribution Credit E-File Signature Authorization California 3506 3514 3519 3526 3540 3582 3800 3801 3803 3805P 3885A 4803e 540 540-Sch CA 540-Sch D 540-Sch G1 540-Sch P 540-Sch S 540ES 540NR-Long 540NR-Sch CA 540NR-Sch D 540NR-Sch P 540X 5805 5805 Worksheet 8453OL Schedule W-2 Child and Dependent Care Expense Earned Income Credit Automatic Extension for Individuals Investment Interest Expense Deduction Credit Carryover Summary Electronic Payment Voucher Tax Computation for Children Passive Activity Loss Limitations Parent's Election to Report Child's Interest and Dividend Income Additional Tax Qualified Ret Plans Depreciation and Amortization Adjustments Head of Household Schedule Individual Income Tax - Resident Adjustments - Residents Capital Gain & Loss Tax on Lump-Sum Distributions AMT & Credit Limitations Other State Tax Credit Estimated Tax for Individuals Part-Year/Nonresident Income Tax Return - Long Form Adjustments – NR / PY Capital Gain or Loss Adjustment AMT & Credit Limitations – NR / PY Amended Individual Income Tax Underpayment of Estimated Tax Underpayment of Estimated Tax Worksheet On-line e-file Return Authorization Wage and Withholding Summary Colorado 104 104AMT 104CR 104EP 104PN 104PTC DR-0347 Individual Income Tax Return Alternative Minimum Tax Schedule Individual Credit Schedule Estimated Income Tax Voucher PY/NR Tax Calculation Schedule Property Tax / Rent / Heat Rebate Child Care Expenses Tax Credit DR-0900 DR-158 I DR-8453 Electronic Payment Voucher Extension Payment Voucher Declaration for Electronic Filing Connecticut 1040 1040-EFW 1040AW 1040ES 1040EXT 1040NR-CT-SI 1040NR/PY 1040V 1040WH 1040X 2210 2210 - Sch A 2210 - Sch B 6251 CT-EITC Resident Income Tax Return Connecticut Electronic Withdrawal Payment Record Part Year Resident Allocation Estimated Income Tax Payment Application for Extension of Time Nonresident or PY Resident Schedule NR/PY Income Tax Return Electronic Filing Payment Voucher Income Tax Withholding Amended Individual Income Tax Return Underpayment of Estimated Tax Annualized Income Installment Schedule Schedule B Interest Calculation Alternative Minimum Tax Return - Individuals Earned Income Tax Credit District of Columbia D-40 D-40-Sch S D-40E D-40P Sch H Sch I Sch U Resident Income Tax Return with Worksheets Dependents and additional information EL-Individual Income Tax Declaration for Electronic Filing Payment Voucher Homeowner and Renter Property Tax Credit Additions & Subtractions from Federal AGI Additional Miscellaneous Credits and Contributions Delaware 200-01 200V 329 8453OL Resident Schedules I, II, III Individual Resident Income Tax Electronic Payment Voucher Special Tax Comp Lump-Sum On-line Declaration for ELF Delaware Resident Schedules Georgia 500 500ES 500UET 525TV GA-8453 IND-CR Individual Income Tax Return Declaration of Estimated Tax Underpayment of Estimated Tax Electronic/Telefile Payment Voucher Declaration of Electronic Filing Individual Credit Form Hawaii N-11 N-200V Sch X - N11, N13, N15 Res Individual Income Tax Return Individual Income Tax Payment Tax Credits for Residents Idaho 39NR 39R 40 40V 43 Supplemental Schedule – NR / PY Supplemental Schedule - Resident Individual Income Tax Return Electronic Payment Voucher PY/NR Income Tax Return Illinois 1040 1040-Sch CR 1040-Sch G 1040-Sch ICR 1040-Sch M 1040-Sch NR 1040ES 1040V 1040X 2210 4562 505-I 8453 Individual Income Tax Return Credit for Tax Paid Other States Schedule G Illinois Credits Other Additions and Subtractions Computation of Tax - NR and PY Estimated Income Tax Voucher Payment Voucher for Individuals Amended Individual Income Tax Computation of Penalties Special Depreciation Automatic Extension Payment Declaration for Electronic Filing Indiana ES-40 IN-DEP IT-40 IT-40 Schedule 1 IT-40 Schedule 2 IT-40 Schedule 3 & 4 IT-40 Schedule 5 IT-40 Schedule 6 IT-40 Schedule 7 IT-40ES IT-40PNR IT-40PNR Schedule A IT-40PNR Schedule B IT-40PNR Schedule C IT-40PNR Schedule D & E IT-40PNR Schedule F IT-40PNR Schedule G IT-40PNR Schedule H IT-40X Estimated Tax Payment FORM Additional Dependent Child Information Full Year Resident Individual Return Add-Backs Deductions Exemptions Credits Offset Credits Additional Required Information Individual Estimated Income Tax Voucher Part-Year or Nonresident Return Income or Loss Proration Section Add-Backs Deductions Deductions and Credits Credits Offset Credits Residency Information Amended Individual Return IT-8453OL IT-9 PFC Sch CC-40 Sch CT-40 Sch CT-40PNR Sch IN-2058SP Sch IN-529 Sch IN-EDGE Sch IN-EDGE-R Sch IN-EIC Sch IT-2440 Sch TC-SP40 Declaration of Electronic Filing Application for Extension of Time Payment Filing Coupon College Credit County Tax Schedule County Tax Schedule for PY / FY Nonresident Nonresident Military Spouse Earned Income Deduction Indiana's CollegeChoice 529 Education Savings Plan Credit Economic Development for a Growing Economy Credit Economic Development for a Growing Economy Retention Credit Earned Income CreditSch IN-OCC Other Certified Credits Disability Retirement Deduction 21st Century Scholars Credit Iowa 104 1040 1040-Sch A 1040-Sch B 1040V 126 130 148 6251 8453-IND WS-ATC WS-TR Itemized Deductions Worksheet (41-104) Individual Income Tax Return (41-001) Itemized Deductions (41-004) Interest and Dividend Income (41-004) Individual Tax Payment Voucher NR and PY Resident Credit Out-of-State Credit Computation Tax Credits Schedule Minimum Tax Computation Declaration for Electronic Filing Alternate Tax Calculation Worksheet Tax Reduction Worksheet Kansas K-210 K-40 K-40ES K-40V Sch S Individual Underpayment of Estimated Tax Individual Income Tax - PC ES-Estimated Tax Individual Income Tax Payment Voucher Supplemental Schedule Kentucky 2210K 5695-K 740 740-NPR 740-Sch A 740-Sch M 740-Sch P 740NP 740NP-Sch A 740NP-Sch ME 740V Underpayment of Estimated Tax Energy Efficiency Products Tax Credit Individual Income Tax Return Income Tax Return - Nonresident - Reciprocal State Itemized Deductions Federal AGI Modifications Pension Income Exclusion Nonresident / Part-Year Resident Return NR / PY Residents Itemized Deductions Moving Expense Reimbursement Electronic Payment Voucher 8863-K 8879-K Education Tuition Tax Credit Declaration for Electronic Filing Louisiana IT-540 IT-540ES Nonrefundable Child Care Cr Wrksht R-540V R-8453OL Refundable Child Care Credit Wrksht Refundable School Readiness Cr Wrksht Resident Schedules School Expense Deduction Worksheet Individual Income Tax - Resident Estimated Tax Vouchers Resident Nonrefundable Child Care Credit Worksheet Electronic Filing Payment Voucher On-line Declaration for ELF Resident Refundable Child Care Credit Worksheet Ref School Readiness Credit Worksheet for Residents Resident Schedules School Expense Deduction Worksheet for Residents Maine 1040-Sch 1 1040-Sch 2 1040-Sch A 1040-Sch A WS 1040-Sch CP 1040-Sch NR 1040ES 1040EXT-ME 1040ME 1040ME-PV Schedule PTFC Worksheet A & B for PY / NR Worksheet C Schedule 1 - Income Modifications Schedule 2 - Itemized Deductions Adjustments to Tax Taxes paid to another jurisdiction Voluntary Contributions & Purchase of Park Passes Nonresident, Part-Year Resident Credit ES-Estimated Income Tax Extension Payment Voucher for Individual Income Tax Individual Income Tax Long Form Individual Income Tax Payment Voucher Property Tax Fairness Credit Worksheet A & B - Residency Info Worksheet for PY / NR Worksheet C for EE Apportionment Worksheet - PY / NR Maryland 500DM 502 502 DEP 502B 502CR 502D 502E 502SU 502UP 505 505NR 505SU EL 101 EL 102 Decoupling Modification Resident Income Tax Return Income Tax Payment Voucher Maryland Dependents Information Income Tax Credits for Individuals Estimated Tax Payment Voucher Application for Extension of Time Subtractions from Income Underpayment of Estimated Tax Nonresident Income Tax Return Nonresident Income Tax Calculation Subtractions from Income Declaration for Electronic Filing Payment Voucher for E-filers Massachusetts 1 1-ES 1-NR/PY 1-Sch B 1-Sch C 1-Sch CB 1-Sch D 1-Sch HC 1-Sch HC/HCCS 1-Sch INC 1-Sch NTS-L-NR/PY 1-Sch R/NR 1-Sch X/Y M-2210 M-4868 M-8453 PV Sch DI Sch E Sch E1 Sch E2 Sch E3 Sch Z/RF Resident Income Tax Return Estimated Tax Payment Vouchers NR/PY Resident Income Tax Interest and Dividend Profit or Loss from Business Circuit Breaker Credit Long-term Capital Gains and Loss Schedule HC Health Care Information Health Care Information W-2 and 1099 Information No Tax Status and Limited Inc Credit Resident / Nonresident Worksheet Other Income / Other Deductions Underpayment of Estimated Tax Application for Automatic Extension of Time to File Declaration for Electronic Filing Income Tax Payment Voucher Dependent Information Supplemental Income and Loss Real Estate and Royalty Income Loss Partnership and S Corporation Income and Loss Estate, Trust, REMIC and Farm Income and Loss Other Credits Michigan 4884 4973 MI-1040 MI-1040-CR MI-1040-CR2 MI-1040-CR7 MI-1040-Sch 1 MI-1040-Sch NR MI-1040-Sch W MI-1040ES MI-1040V MI-1040X MI-2210 MI-4642 MI-5049 MI-8453 Pension Schedule Pension Continuation Schedule Individual Income Tax Return Homestead Property Tax Credit Homestead Property Tax Credit Home Heating Credit Additions & Subtractions Nonresident & Part-Year Resident Schedule Withholding Statement Estimated Tax Michigan Payment Voucher for E-file Amended Individual Income Tax Underpayment of Estimated Tax Voluntary Contributions Schedule Worksheet for MFS and Divorced or Separated Claimants Electronic Filing Declaration Minnesota BANK M1 M1PR Direct Debit Authorization Individual Income Tax Property Tax Refund M1W M1X M60 M63 Sch M1C Sch M1CD Sch M1CR Sch M1ED Sch M1LS Sch M1LTI Sch M1M Sch M1MA Sch M1MT Sch M1NC Sch M1NR Sch M1R Sch M1SA Sch M1WFC Income Tax Withheld Amended Individual Income Tax Payment Voucher Amended Income Tax Return Payment Other Nonrefundable Credits Child and Dependent Care Credit Credit for Tax Paid Other State K-12 Education Credit Tax on Lump-Sum Distribution Long-Term Care Insurance Credit Income Additions and Subtractions Marriage Credit Alternative Minimum Tax Federal Adjustments Nonresident / Part-Year Resident Return Age 65 or Over / Disabled Subtraction MN Itemized Deductions Working Family Credit Mississippi 80-105 80-106 80-107 80-108 80-205 80-401 80-491 8453 Resident Income Tax Return Individual Tax Payment Voucher Individual W-2 Data Sheet Other Income or Losses NR / PY Resident Income Tax Return Income Tax Credit Summary Schedule Additional Dependents Individual Income Tax Declaration for Electronic Filing Missouri AGI Worksheet MO-1040 MO-1040ES MO-1040V MO-60 MO-8453 MO-A MO-CR MO-NRI AGI Worksheet Individual Income Tax Return Estimated Tax Payment Vouchers Income Tax Payment Voucher Application for Extension of Time EL-Declaration for Electronic Filing Individual Income Tax Adjustments Credit for Taxes Paid Other State Nonresident Income Percentage Montana 2 2 Worksheets 2441-M 2EC IT Individual Income Tax Return Individual Income Tax Worksheets (Form 2) Child and Dependent Care Credit Elderly Homeowner/Renter Credit Montana Income Tax Payment Coupon Nebraska 1040N 1040N - Sch I, II, III 1040NV 4868N 8453N Individual Income Tax Return Schedules I II and III Income Tax Payment Voucher Nebraska Application for Extension of Time Declaration for Electronic Filing New Hampshire DP-10 DP-10-ES DP-59-A Interest and Dividends Tax Return Estimated Interest & Dividends Payment Voucher & Extension App New Jersey NJ-1040 NJ-1040ES NJ-1040NR NJ-1040NR-V NJ-1040V NJ-2440 NJ-2450 NJ-630 NJ1040 Worksheet F Sch ABC Sch NJ-BUS-1 for NJ-1040 Sch NJ-BUS-1 for NJ-1040NR Sch NJ-BUS-2 for NJ-1040 Sch NJ-BUS-2 for NJ-1040NR Individual Income Tax Return Estimated Tax Payments Nonresident Income Tax Return NJ gross income tax NR payment voucher ELF Payment Voucher Accident / Health Plan Exclusion Excess WD / HC & Disability Contribution Application for Extension of Time to File Property Tax Deduction / Credit Credit for Taxes Paid to Other States Business Income Summary Schedule Business Income Summary Schedule Alternative Business Calculation Adjustment Alternative Business Calculation Adjustment New Mexico PIT-1 PIT-1-RC PIT-8453 PIT-ADJ PIT-B PIT-CG PIT-CR PIT-D PIT-PV PIT-S RPD-41317 RPD-41326 RPD-41329 Personal Income Tax Return Rebate & Credit Schedule EL-Electronic Filing Declaration Schedule of additions and deductions Allocation & Apportionment of Income Caregiver Worksheet Non-Refundable Credit Schedule Refund Donation Form Payment Voucher Dependent Exemptions Solar Market Development Tax Credit Rural Health Care Practitioner Tax Credit Sustainable Building Tax Credit New York IT-112R IT-114 IT-182 Resident Tax Credit Claim for Family Relief Credit Passive Activity Loss Limitations IT-201 IT-201-D IT-201ATT IT-201V IT-201X IT-203A IT-203 IT-203-D IT-203ATT IT-203B IT-203C IT-203X IT-209 IT-2105 IT-2105.9 IT-212 IT-213 IT-214 IT-215 IT-216 IT-217 IT-219 IT-220 IT-222 IT-225 IT-230 IT-241 IT-245 IT-255 IT-256 IT-258 IT-272 IT-280 IT-360.1 IT-370 IT-398 IT-399 IT-601 IT-603 IT-604 IT-606 IT-639 IT-641 Y-203 NYC-200V NYC-202 NYC-208 Resident Income Tax Return Resident Itemized Deduction Schedule Other Tax Credits and Taxes Payment Voucher for Income Tax Returns Amended Resident Income Tax Nonresident Business Allocation Schedule NR and PY Resident Tax Return Nonresident and Part-Year Resident Itemized Deduction Schedule Other Tax Credits and Taxes NR / PY Income Allocation/College Tuition Deduction NR or PY Spouse's Certification pg 1 Amended Nonresident and Part-Year Resident Income Tax Return Claim for Noncustodial Parent Earned Income Credit ES-Estimated Income Tax Payment Voucher - NYS / NYC / Yonkers Underpayment of Estimated Income Tax Investment Credit Claim for Empire State Child Credit Real Property Tax Credit Claim Claim for Earned Income Credit Claim for Child/Dependent Care Credit Claim for Farmers’ School Tax Credit Credit for New York Unincorporated Business Tax Minimum Income Tax General Corporation Tax Credit New York State Modifications Separate Tax on Lump-Sum Distributions Claim for Clean Heating Fuel Credit Claim for Volunteer Firefighters' and Ambulance Workers' Credit Solar Electric Generating Equipment Credit Claim for Special Additional Mortgage Recording Tax Credit Nursing Home Assessment Credit Claim for College Tuition Credit for New York State Residents Nonobligated Spouse Allocation Change of City Resident Status Application for Automatic Extension of Time to File for Individuals New York State Depreciation Schedule for Sec. 168(k) Property New York State Depreciation Schedule Claim for EZ Wage Tax Credit Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit Claim for QEZE Tax Reduction Credit Claim for QEZE Credit for Real Property Taxes Minimum Wage Reimbursement Credit Manufacturer's Real Property Tax Credit Yonkers Nonresident Earnings Tax Return Payment Voucher for Returns and Extensions Unincorporated Business Tax Return New York City Enhanced Real Property Tax Credit North Carolina D-400 D-400TC D-400V D-410 D-422 D-429 NC-40 Schedule S Individual Income Tax Return Individual Tax Credits Electronic Payment Voucher Application for Extension for Filing Individual Income Tax Return Underpayment of Estimated Tax Credit for Disabled Taxpayers Estimated Tax Payment Vouchers Supplemental Schedule North Dakota ND-1 ND-1CR ND-1NR ND-1SA ND-1TC ND-1UT ND-1V Individual Income Tax Return Credit for Other State Tax Paid Tax Calculation for Nonresident and Part-Year Resident Filers Statutory Adjustments Tax Credits Underpayment Penalty Electronic Return Payment Voucher Ohio IT-1040 IT-1040ES IT-1040X IT-2023 IT-2210 IT-40P IT-40PX Schedule J Income Tax Return ES-Estimated Income Tax Payments Amended Individual Income Tax Income Allocation and Apportionment Underpayment of Estimated Tax Income Tax Payment Voucher Income Tax Payment Voucher – Amended Returns Dependents Oklahoma 511 511 Sch A-H 511CR 511EF 511NR 511NR Sch A-G 511TX 511V 538H 538S 561 561NR Resident Individual Income Tax Supporting Schedules for 511 Other Credits Form Declaration for Electronic Filing NR/PY Resident Tax Return Supporting Schedules for 511NR Credit for Tax Paid to Other State Individual Income Tax Payment Voucher Claim Credit / Refund Property Tax Claim Credit / Refund Sales Tax Oklahoma Capital Gain Deduction Capital Gain Deduction (PY and NR) (filing Form 511NR) Oregon 40 40-ESV Individual Income Tax Return Estimated Income Tax Payment Voucher 40N 40P 40V EF ESV Worksheet Sch OR-529 Sch OR-529-N/P Sch OR-ASC Sch OR-ASC-N/P Sch OR-D Sch WFC Portland ARTS NR Individual Income Tax PY Resident Income Tax Return Income Tax Payment Voucher Declaration for Electronic Filing Estimated Tax Worksheet OR 529 CSP Direct Deposit for Form 40 Filers OR 529 CSP Direct Deposit for Form 40N/40P Filers Oregon Adjustments for Form 40 Filers Oregon Adjustments for Form 40N and 40P Filers Oregon Charitable Fund Donations Working Family Credit-40 and 40S City of Portland Arts Tax Pennsylvania PA-40 PA-40 ES PA-40 Sch A PA-40 Sch B PA-40 Sch C PA-40 Sch D PA-40 Sch E PA-40 Sch G-L PA-40 Sch J / T PA-40 Sch O PA-40 Sch OC PA-40 Sch SP PA-40 Sch UE PA-40 W-2S PA-8453 PA Statement CLGS-32-1 Scannable Individual Income Tax Return EL-Declaration of Estimated Personal Income Tax Interest Income Dividend Income Profit or Loss from Business Sale Exchange or Disposition Rents and Royalties Income (Loss) Other State Tax Credit Estate and Trust Income / Gambling and Lottery Winnings Other Deductions PA Schedule OC Special Tax Forgiveness Allowable Employee Business Exp Wage Statement Summary EL-Declaration for Electronic Filing PA Statement Local Earned Income Tax Return Rhode Island 1040 1040NR 1040V 2210 4868 Sch II Sch III Sch M Sch U Sch W Individual Income Tax Return NR Income Tax Return Electronic Filing Declaration Voucher Underpayment of Estimated Income Tax Application for Automatic Extension of Time to File Rhode Island Individual Income Tax Return Nonresident Tax Calculation Part Year Resident Tax Calculation Modification to Federal AGI Use Tax W2 & 1099 withholding info – RI-1040, RI-1040NR South Carolina 1040 1040-Sch NR 1040ES 1040TC 1040V 4868 8453 I-319 I-330 I-335 I-360 Individual Income Tax Return Nonresident Schedule Estimated Tax for Individuals Tax Credits Electronic Payment Voucher Request for Extension of Time Declaration for Electronic Filing Tuition Tax Credit Contributions for Check-offs I-335, I-335A (Wksht 1), and I-335B (Wksht 2) Classroom Teacher Expenses Credit Tennessee INC-250 Report of Debts Base Form Individual Income Tax Return Report of Debts Utah TC-40 TC-40A TC-40B TC-40C TC-40S TC-40W TC-546 TC-547 Resident Income Tax Return Income Tax Supplemental Schedule Nonresident or Part-year Resident Utah Income Schedule Retirement Credit Schedule Credit for Income Taxes Paid to Other State Utah Withholding Tax Schedule Income Tax Prepayment Income Tax Payment Coupon Vermont HI-144 HS-122 IN-111 IN-112 IN-113 IN-116 IN-117 IN-119 IN-153 IN-154 Household Income Homestead Declaration and Property Tax Adjustment Claim Income Tax Return Tax Adjustments and Credits Income Adjustment Schedules Income Tax Payment Voucher Credit for Income Tax Paid to Other State or Canadian Province Tax Credits Capital Gains Exclusion State/Local Income Tax and New Motor Vehicle Tax Addback Virginia 760-Sch ADJ 760-Sch FED 760/IP/CG 760CG 760ES/CG 760PMT 760PY Schedule ADJ Individual Income Tax Return Schedule FED Individual Payment for Automatic Extension Individual Income Tax Return Estimated Tax Payment Coupon Electronically Filed Returns Part-Year Resident Individual Income Tax 760PY ADJ 760PY INC 763 763 ADJ 8453 ADWS CU-7 Contribution Wkst SCH INC/CG Sch A WS Sch CR Sch OSC/CG Sch VAC Subtraction and Deduction Wkst WS-FDCWS Virginia Schedule 760PY ADJ Virginia Schedule of Income Nonresident Income Tax Return VA Schedule 763 ADJ Declaration for Electronic Filing Age 65 and Older Age Deduction Worksheet Consumer's Use Tax Voluntary Contributions Worksheet Schedule INC / CG (Reporting W2-1099R) Schedule A - Itemized Deductions Worksheet Credit Computation Credit for Tax Paid to Other State Contributions Other Subtraction and Deduction Worksheet Fixed Date Conformity Worksheet West Virginia 140 140V 140W 8453-OL Recap Sch A Sch H & Sch E Sch M Sch UT WV/FTC-1 Individual Income Tax Return Electronic Payment Voucher WV Withholding Tax Schedule Declaration for Electronic Filing Tax Credit Recap Schedule WV Schedule A WV Schedule H and Schedule E WV Schedule M WV Use Tax Family Tax Credit Worksheet Wisconsin 1 1-Sch H 1-Sch I 1-Sch WD 1ES 1NPR EPV I-827 Rent Certificate Sch CF Sch CR Sch CS Sch M Sch MA-A Sch MA-M Sch OS Sch PS Sch R Income Tax Homestead Credit Claim Adjustments to Convert Fed AGI Capital Gains and Losses Estimated Tax Voucher NR and PY Income Tax Return Electronic Payment Voucher Legal Residence Questionnaire Rent Certificate Carryforward of Unused Credits Other Credits College Savings Additions to and Subtractions from Income Wisconsin Agricultural Credit Wisconsin Manufacturing Credit Credit for Net Tax Paid to Other State Private School Tuition Wisconsin Research Credits