2011 TC-40, Utah Individual Income Tax Return

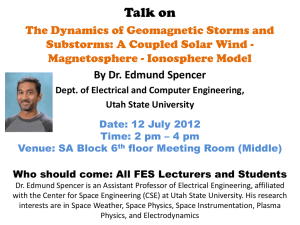

advertisement