P2JW301000-2-A00200-1--------XA

A2 | Wednesday, October 28, 2015

* *

THE WALL STREET JOURNAL.

U.S. NEWS

NewHealthEnrollmentPushFacesStruggle

BY LOUISE RADNOFSKY

When the latest push to

sign up people for insurance

under the Affordable Car Act

begins, the workers and volunteers charged with helping

them enroll would seem to

have a relatively low bar to

clear, given the modest goals

the Obama administration set

for 2016.

That doesn’t mean they

have it easy.

In this third enrollment period, which begins on Sunday,

the health-law boosters will

have to help people who have

already signed up adapt to

premium increases in the

most popular plans in some

parts of the country. Officials

are also wrestling with verification problems on HealthCare.gov—the federal site administering the law’s key

provisions in most parts of

the country—that have forced

hundreds of thousands of enrollees off their plans already.

At the same time, volunteers and workers are still

trying to win over some of the

most skeptical uninsured customers who have resisted

signing up. And they will have

to do all of those things together to hold enrollment

numbers steady and stop

them from backsliding.

The administration has set

expectations fairly low. Federal officials say they will

count it a win if 10 million

people are still enrolled in

private insurance through

HealthCare.gov or state equivalents at the end of 2016. That

would be only a slight increase on the 9.1 million expected to have coverage

through the online exchanges

at the end of this year.

Data from polls, the federal

government and the Congressional Budget Office indicate

at least 29 million people nationwide are still uninsured,

of whom the largest group is

people forgoing private insurance they could buy on their

own or through an employer.

To get some of those people

covered, while keeping the ones

they have, sign-up workers

have adjusted their strategies.

One of the most high-profile sign-up groups, Insure

Central Texas in Austin, is

starting a phone bank to

warn about 3,000 households

they have helped enroll

about changing prices, and

to encourage them to come

back to the federal site and

look for other options.

If people don’t come back

to review coverage, they will

likely see their plans automatically renewed, which

could make for unpleasant

surprises—and dropouts—

when bills come in January.

The Austin group has also

been working on at least 400

cases where people have

been threatened with losing

their coverage, or subsidies

to help pay for it, because

they can’t document their

immigration status or income to HealthCare.gov’s

satisfaction. They have devised a template letter to

help people explain their situations, intended to be read

and processed quickly by

contractors reviewing the

cases.

In Dallas, local leaders

have stopped trying to sign

up people after church, a tactic touted by backers of the

health law in its early days.

They say they learned it

wasn’t working, and have

started asking pastors to direct the uninsured to places

like libraries to sign up later

in the week instead.

Global Slowdown Seen in Weak Durable Orders

BY JEFFREY SPARSHOTT

A strong dollar, weak commodity prices and slow global

growth are restraining U.S.

factories, highlighting a deepening divide between the

American service sector and

manufacturers exposed to international turmoil.

New orders for durable

goods—turbines, trucks and

other products designed to last

at least three years—offered

the latest evidence of malaise

at factories. They declined a

seasonally adjusted 1.2% in

September from a month earlier, the Commerce Department

said Tuesday, the second consecutive monthly drop.

“More than at any time in

this expansion, the fortunes of

the key sectors of the economy

DEAL

Continued from Page One

in August.

Drug makers, hospital

chains, health insurers and

others have already struck

some $427 billion of merger

deals in the U.S. this year, according to Dealogic, as the Affordable Care Act and other

factors spur them to seek more

leverage with their suppliers

and cut costs. By combining

their drugstore networks,

which together include roughly

13,000 U.S. stores, Walgreens

and Rite Aid, which have both

been pinched by drug-price inflation, could reap considerable savings.

Rite Aid, based in Camp

Hill, Pa., has about 4,600 drugstores in 31 states. Walgreens

has roughly 8,200 U.S. stores,

while CVS Health Corp. has

more than 7,800.

Both Rite Aid and Walgreens have a major presence

are diverging,” said Stephen

Stanley, chief economist at Amherst Pierpont Securities.

The global turmoil and domestic manufacturing slowdown haven’t infected U.S.

households much so far. Consumer spending has been

steady, for instance, helping to

buoy the U.S. auto industry

with sales on pace to match

volumes last seen in the early

2000s. In the durable-goods

report, new orders for motor

vehicles rose 1.8% last month.

International troubles may

be starting to bleed into other

areas of the economy. The

Conference Board’s measure of

consumer confidence fell from

September to October, the

group said Tuesday, though it

remained above levels that

were typical in 2014.

And a gauge of the service

sector, which makes up the

bulk of the economy, declined

this month. The Markit services purchasing managers index, also released Tuesday, fell

to 54.4 this month from a final

The government will

offer its first read on

third-quarter growth

in GDP on Thursday.

reading of 55.1 in September.

Taken together, economic

signals have many companies

wary. “I’m not yet willing to

predict a U.S. or global recession

in the next 15 months, but there

is ample evidence of an economic and market slowdown,”

Scott Wine, chairman and chief

executive of Polaris Industries

Inc., told investors last week.

Mr. Wine said he expects

sub-3% growth in the U.S.,

slower growth in China and

Europe to improve, “albeit not

at a pace that will matter

much” for the maker of offroad vehicles, snowmobiles and

other transport equipment.

The U.S. government will offer the first broad snapshot of

the nation’s third-quarter economic growth on Thursday,

when it releases gross domestic product figures. J.P. Morgan

Chase economists now believe

the economy expanded at 0.6%

seasonally adjusted annual

rate, down from an earlier estimate of 0.8%. A Barclays tracking estimate fell two-tenths of

a percentage point to 1%.

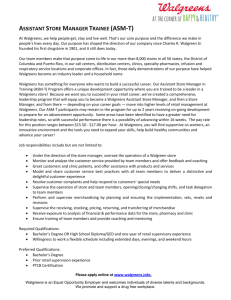

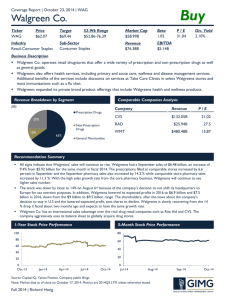

Pharmacy Fusion

A combination of Walgreens

and Rite Aid would

dwarf rival CVS.

2014 U.S.

market share

($216 billion market)

U.S. stores

Combined

46.5%

Walgreens

34.2%

CVS

30.9%

Rite Aid

12.3%

Walgreens and Rite Aid have hundreds

of stores each in these states.*

= 100 stores

1,214 total

Walgreens - 8,100 Rite Aid - 4,600 CVS - 7,800

Sources: Euromonitor (marketshare), the companies

in states like California, New

York and Massachusetts, while

in others, including Florida,

Texas and Illinois, there isn’t

any overlap.

It happens. Especially when you’re flying in the

Bombardier Global 6000 offered by NetJets. That’s

because it’s the largest business jet capable of accessing

the world’s most difficult-to-reach airports, like Aspen

and London City. Offering unparalleled luxur y and

uncompromising performance, the Global 6000 truly

rises above the rest. To learn more, visit aworldabove.com

California

*As of Feb. 28, 2015

And Walgreens and Rite Aid

would be likely to argue to

regulators that they compete

not just with other traditional

drugstore chains, but also with

companies such as groceries

and club stores.

In terms of market value,

Rite Aid is much smaller than

Walgreens and CVS, which

both have a market capitalizations of more than $100 billion. Rite Aid had revenue of

$26.5 billion in the fiscal year

ended in February. In the fiscal year ended in August 2014,

Walgreens had revenue of

$76.4 billion. CVS had 2014

sales of $139.4 billion.

Rite Aid, like its rivals, has

sought to broaden its business

lines to boost sales amid increased competition. The company has expanded its RediClinics, walk-in centers that

can give flu shots and tend to

ailments. It also has built a

portfolio of 1,859 wellness

stores, which offer organic

food and natural personal-care

products and feature consultaTHE WALL STREET JOURNAL

(USPS 664-880)

(Eastern Edition ISSN 0099-9660)

(Central Edition ISSN 1092-0935)

(Western Edition ISSN 0193-2241)

Editorial and publication headquarters:

1211 Avenue of the Americas,

New York, N.Y. 10036

Published daily except Sundays and general legal

holidays. Periodicals postage paid at

New York, N.Y., and other mailing offices.

POSTMASTER: Send address changes to The Wall

Street Journal, 200 Burnett Rd., Chicopee, MA 01020.

All Advertising published in The Wall Street Journal is

subject to the applicable rate card, copies of which are

available from the Advertising Services Department, Dow

Jones & Co. Inc., 1155 Avenue of the Americas, New York,

N.Y. 10036. The Journal reserves the right not to accept

an advertiser’s order. Only publication of an

advertisement shall constitute final acceptance of the

advertiser’s order.

Letters to the Editor:

Fax: 212-416-2891; email: wsj.ltrs@wsj.com

NEED ASSISTANCE WITH

YOUR SUBSCRIPTION?

CONTACT CUSTOMER SUPPORT.

Bombardier and Global 6000 are trademarks of Bombardier Inc. or its subsidiaries. © 2015 Bombardier Inc.

All rights reserved. NetJets is a Berkshire Hathaway company. Aircraft are managed and operated by NetJets

Aviation, Inc. NetJets is a registered service mark. © 2015 NetJets IP, LLC. All rights reserved.

By web: customercenter.wsj.com

By email: wsjsupport@wsj.com

By phone: 1-800-JOURNAL

(1-800-568-7625)

Or by live chat at wsj.com/

livechat

1,090

473

New York

Ohio

THE WALL STREET JOURNAL.

tion rooms for discussions

with pharmacists.

This year Rite Aid bought

pharmacy-benefit manager Envision Pharmaceutical Services, or EnvisionRx, for about

$2 billion. Pharmacy-benefit

managers process prescriptions for the groups that pay

for drugs, usually insurance

companies or corporations,

and use their size to negotiate

better deals with drug makers

and pharmacies. They often

also operate mail-order pharmacies.

In September, Rite Aid cut

its earnings outlook in part

because of costs associated

with the EnvisionRx deal. That

had contributed to a nearly

20% reduction in Rite Aid’s

share price this year before

news of the Walgreens talks

leaked. That decline might

help explain the above-average

share-price premium Walgreens is paying.

Walgreens, which is to report its results Wednesday, is

the product of acquisitions,

That would mark a sharp

slowdown from the second

quarter’s 3.9% growth pace,

leaving the economy on a familiar trajectory of slow but

steady annual growth somewhere between 2% and 2.5%.

The drag from cheaper oil

and a strong dollar are expected to abate in the coming

months, though for now demand remains soft. Through

the first nine months of the

year, overall durable orders

are down 4.6% compared with

the same period in 2014.

Last month’s drop reflected

in part a fall in demand for aircraft, a component of the report

that climbs and dives along with

monthly orders for Boeing Co.

passenger jets. The company

said it received 29 orders last

month versus 52 in August.

giving it more than 13,200

stores in 11 countries. The

company, based in Deerfield,

Ill., operates under the Walgreens and Duane Reade banners, and in the U.K. and elsewhere as Boots. It also has one

of the largest pharmaceutical

wholesale and distribution

networks in the world. Walgreens was founded in 1901

when Charles R. Walgreen Sr.

purchased the Chicago drugstore where he had worked as

a pharmacist.

Last year, Walgreens acquired the part of European

drugstore chain Alliance Boots

GmbH that it didn’t already

own. Under pressure from

shareholders, including activist investor Jana Partners LLC,

Walgreens considered using

the acquisition to relocate

overseas in a so-called “tax inversion”—a type of deal that is

used to make a U.S. company

more tax-efficient. Walgreens

ultimately decided against relocating.

The company’s chief executive is Stefano Pessina, a septuagenarian Italian billionaire

who took the role on a permanent basis in July and served

as executive chairman of Alliance Boots before the merger

with Walgreens.

Mr. Pessina hasn’t been shy

about his desire to do big

deals. “We can clearly see the

need or the opportunity for

horizontal and vertical consolidation in our industry,” he

said on a conference call in

July.

Mr. Pessina transformed a

small family business into Alliance Boots, a European drug

retailing and wholesaling powerhouse, through a series of

takeovers. In 2007, he took the

company private in an $18.5

billion leveraged buyout with

KKR & Co. At year-end, KKR

still owned about 4.6% of Walgreens stock.

California officials say

they are trying to emphasize

the benefits of coverage sold

through the state’s version of

HealthCare.gov, Covered California, including a requirement specific to the state

that plans cover several doctor visits a year before deductibles kick in.

Such a rule doesn’t exist

for HealthCare.gov plans,

where deductibles are expected to be a big part of

people’s financial calculations about insurance.

Covered California officials say that like the federal

government, they are also

anticipating customer turnover and only a slight expansion as a result.

U.S.

Watch

TRADE

House Reauthorizes

Export-Import Bank

The House on Tuesday approved reauthorizing the ExportImport Bank, with a majority of

Republicans joining nearly all

Democrats to demonstrate a

broad bipartisan coalition to revive the export-finance agency.

The measure passed 313-118.

The vote showed that an aggressive campaign by conservative critics to close the bank had

done little to turn GOP lawmakers away, and marked a victory

for business groups that had

fought to secure its revival.

The bank was unable to process new business this summer

after its charter expired in July.

GOP leaders held up legislation

that would have reauthorized the

agency’s charter with some

changes. The House bill copied

language in a Senate amendment

that passed with 64 votes in July.

Opponents say the Ex-Im

Bank puts taxpayers at risk and

allows the government to pick

winners and losers.

—Nick Timiraos

HOUSING

Index Shows Prices

Climbed in August

Home-price growth was

strong in August, according to a

report released Tuesday, underscoring the market’s momentum

heading into the final months of

the year.

The S&P/Case-Shiller Home

Price Index, covering the entire

nation, rose 4.7% in the 12

months ended in August, slightly

greater than a 4.6% increase in

July. The 10-city index gained

4.7% from a year earlier, while the

20-city index gained 5.1%. San

Francisco and Denver recorded

double-digit price increases for

the year, both gaining 10.7%.

—Laura Kusisto

MARYLAND

Ex-Bishop Sentenced

To 7 Years in Crash

The former No. 2 leader of the

Episcopal Diocese of Maryland

was sentenced Tuesday to seven

years in prison for fatally crashing into a bicyclist while she was

driving drunk and texting last December, then leaving the scene.

Former Bishop Heather Cook,

59 years old, pleaded guilty last

month to auto manslaughter and

other charges in the death of

Thomas Palermo, a 41-year-old

software engineer and married

father of two. Circuit Judge Timothy Doory sentenced Ms. Cook to

20 years but suspended 13 years.

—Scott Calvert

CORRECTIONS AMPLIFICATIONS

A photo of ValueAct Capital Management LP President

G. Mason Morfit accompanied

a Money & Investing article

Tuesday about ValueAct and

Valeant Pharmaceuticals International LP. In some editions, the caption incorrectly

identified the man shown as

ValueAct Chief Executive Jeffrey Ubben.

The online magazine Vox

is one of Facebook Inc.’s partners with its new Instant Articles feature. An interview with

Chris Cox, Facebook’s chief

product officer, in Tuesday’s

WSJ.D Live Journal Report incorrectly gave the partner’s

name as Box.

In some editions Tuesday,

Keystone Light beer was incorrectly called Kaystone Light in

a Business & Tech article

about how Anheuser-Busch

InBev NV’s planned takeover

of SABMiller PLC could benefit Molson Coors Brewing Co.

The blessed bread used in

the Greek Orthodox Mass is

called antidoron. A Money &

Investing article Tuesday

about an Orthodox priest who

runs a hedge fund incorrectly

called it Antidotum.

The Taylor Swift song

“Shake It Off” was incorrectly

called “Shake It Up” in some

editions Tuesday in a Personal

Journal article about songs that

get stuck in people’s heads.

The McLaren 570S’s powertrain has rear-wheel drive

and brake-based torque vectoring. A box accompanying

Saturday’s Rumble Seat column in Off Duty incorrectly

said it also has limited slip differential.

Readers can alert The Wall Street Journal to any errors in news articles by emailing wsjcontact@wsj.com or by calling 888-410-2667.