CATCHING UP WITH GLOBAL TRENDS: REVISED SCHEDULE VI

advertisement

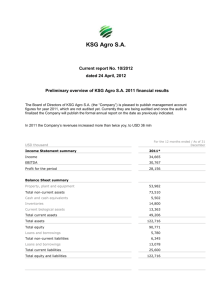

CATCHING UP WITH GLOBAL TRENDS: REVISED SCHEDULE VI PETROFED 13 July 2011 CONTENTS REVISED SCHEDULE VI: AN OVERVIEW GENERAL INSTRUCTIONS BALANCE SHEET STATEMENT OF PROFIT AND LOSS CERTAIN IMPLEMENTATION ISSUES IFRS AND REVISED SCHEDULE VI 2 AN OVERVIEW 3 REVISED SCHEDULE VI: AN OVERVIEW Existing Schedule VI : no major overhaul for more than 3 decades MCA released the text of revised Schedule VI to the Companies Act Effective for financial years commencing on or after 1April 2011 Revised Schedule would apply to all companies following Indian GAAP until such companies are required to follow Ind-AS. A very small percentage, initially would follow Ind-AS. Majority would continue following the presently notified Standards by the Companies Rules. Requirements of accounting standards and the Companies Act will override the revised Schedule, if inconsistent. 4 REVISED SCHEDULE VI: AN OVERVIEW Information to be mandatorily given on the face of financial statements, - Limited only to broad and significant items Details by way of notes Part IV of the existing Schedule VI dispensed with Format of cash flow statement not prescribed - Illustrative formats per AS 3 Disclosure requirements of various accounting standards apply additionally 5 REVISED SCHEDULE VI: AN OVERVIEW Specified nomenclature in revised Schedule VI should be followed as far as possible: ̶ Ensure uniformity ̶ Avoid perceived non-compliances Recent MCA notification granting exemptions ̶ Apply to existing Schedule VI only and not for revised Schedule VI ̶ Relaxation from certain disclosures 6 REVISED SCHEDULE VI: AN OVERVIEW Compatibility with Clause 41 of the Listing Agreements ̶ Financial information on quarterly basis per requirements of Clause 41 ̶ Statement of Assets and Liabilities at the end of half year per Clause 41: based on existing Schedule VI ̶ To continue till Listing Agreement is amended 7 REVISED SCHEDULE VI: AN OVERVIEW STANDALONE OR CONSOLIDATED FINANCIAL STATEMENT Prescribed in the context of standalone financial statements Would apply equally to CFS Requirements of AS-21 “Consolidated Financial Statements” ̶ CFS should be presented to the extent possible in the same format as adopted for the presentation of standalone financial statements Additional items, having no bearing on true and fair view of CFS are not needed ̶ Say CIF value, foreign currency expenditure, etc. 8 REVISED SCHEDULE VI: AN OVERVIEW SIGNIFICANT CONCEPTUAL CHANGES Current and Non-current distinction Primacy of the requirements of Accounting Standards Significant effort to move closure to international practices - Though it does not adopt international standards entirely Appears to be modernising and simplifying the schedule to make it more relevant to the present needs May need substantial changes in the accounting systems and procedures 9 REVISED SCHEDULE VI: AN OVERVIEW STRUCTURE GENERAL INSTRUCTIONS ̶ Applicable to both Balance Sheet and Statement of Profit & Loss PART I : BALANCE SHEET ̶ Format of Balance Sheet: Only vertical form (No horizontal form) ̶ General instructions for preparation of Balance Sheet PART II : STATEMENT OF PROFIT & LOSS ̶ Format of Statement of Profit & Loss (unlike existing Schedule VI) ̶ General instructions for preparation of Statement of Profit & Loss ̶ Expense classification by nature 10 REVISED SCHEDULE VI: AN OVERVIEW STRUCTURE NO FORMAT FOR CASH FLOW STATEMENT ̶ Follow AS-3 format(s) MEANINGS OF TERMS USED ̶ Meanings as assigned in respective Accounting Standards ̶ Unlike existing Schedule VI, no definitions of provision, reserve, trade, quoted, etc. PART IV OF EXISTING SCHEDULE VI ̶ Balance Sheet abstract and general business profile dispensed with 11 GENERAL INSTRUCTIONS 12 GENERAL INSTRUCTIONS Primacy of Accounting Standards and other requirements of the Act ̶ If necessary to amend, add, substitute or delete any head/sub head, revised schedule VI shall stand modified Minimum requirements of disclosures ̶ On the face of Balance Sheet and Statement of Profit and Loss ̶ In the Notes 13 GENERAL INSTRUCTIONS Additional disclosures required by Accounting Standards and Act ̶ By means of Notes, unless required on the face A balance to be maintained between: ̶ providing excessive details, not relevant; and ̶ not providing important information as a result of too much aggregation Comparatives for immediately preceding reporting period: ̶ For all items shown in the Financial Statements ̶ Including for Notes (CLARIFIED) 14 GENERAL INSTRUCTIONS FIRST YEAR OF APPLICATION OF REVISED SCHEDULE VI ̶ Comparatives to be given ̶ Additional effort to recast comparatives ̶ Auditors to perform procedures ̶ Notes to disclose fact of reclassification / regrouping ̶ If certain comparative figures not available: disclose the fact 15 GENERAL INSTRUCTIONS: ROUNDING OFF 16 BALANCE SHEET 17 BALANCE SHEET SIGNIFICANT AMENDMENTS ONLY VERTICAL FORM SIGNIFICANT BROAD LEVEL CHANGES ̶ Existing vertical form purports to show aggregate of “Sources of funds” and “Application of funds”: 3 Current liabilities/provisions deducted from current assets 3 Debit balance in Profit & Loss is shown on asset side 3 No general distinction between “Current” and “ Non current” 18 BALANCE SHEET SIGNIFICANT AMENDMENTS ̶ REVISED FORM CONCEPTUALLY MORE SOUND 3 Indicates total assets 3 Indicates total equity and liability 3 Losses are reduced from equity 3 Assets and liabilities are classified properly as “Current” and “Non-current” 3 No items like “Misc expenditure to be written off” 19 BALANCE SHEET FORM OF BALANCE SHEET EQUITY AND LIABILITIES Shareholders’ funds* Share application money pending allotment Non-current liabilities* Current liabilities* ASSETS Non current assets* Current assets* * WITH FURTHER SUB-DIVISIONS 20 CURRENT VS NON-CURRENT CURRENT ASSETS ̶ expected to be realized in, or intended for sale or consumption in, the company’s normal operating cycle; or ̶ held primarily for the purpose of being traded; or ̶ expected to be realized within 12 months after the reporting date; or ̶ cash or cash equivalent, unless it is restricted from being exchanged or used to settle a liability for at least 12 months after the reporting date ALL OTHER ASSETS SHALL BE CLASSIFIED AS NON-CURRENT 21 CURRENT VS NON-CURRENT CURRENT LIABILITIES ̶ expected to be settled in the company’s normal operating cycle; or ̶ held primarily for the purpose of being traded; or ̶ due to be settled within 12 months after the reporting date; or ̶ does not have an unconditional right to defer settlement of the liability for at least 12 months after the reporting date. Terms of a liability that could, at the option of the counterparty, result in its settlement by the issue of equity instruments do not affect its classification. ALL OTHER LIABILITIES SHALL BE CLASSIFIED AS NON CURRENT 22 CURRENT VS NON-CURRENT COMPANY’S NORMAL OPERATING CYCLE: “ an operating cycle is the time between acquisition of assets for processing and their realisation in cash and cash equivalents. Where the normal operating cycle cannot be identified, it is assumed to have a duration of 12 months” 23 FEW INSTANCES CURRENT – NON CURRENT ? Liabilities payable on demand Substantive breach of payment terms of a long term loan Current portion of a long term provision Deferred taxes Advance received for software development ̶ If the software takes 6 months ̶ If the software takes 2 years Option of conversion of debentures into equity in next year ̶ Option with the Company ̶ Option with the debenture-holder Advance given for G&G activity 24 FEW INSTANCES CURRENT – NON CURRENT Liabilities payable on demand C Substantial breach of payment terms of a long term loan C Current portion of a long term provision C Deferred taxes NC Advance received for software development ̶ ̶ If the software takes 6 months C If the software takes 2 years C ̶ Option of conversion of debentures into equity in next year NC ̶ Option with the Company Option with the debenture-holder 25 SHAREHOLDERS’ FUNDS ON THE FACE OF THE BALANCE SHEET: SHAREHOLDERS’ FUNDS ̶ Share capital ̶ Reserves and surplus ̶ Money received against share warrants 26 SHARE CAPITAL Notes in addition to the existing disclosures to be given: ̶ reconciliation of shares outstanding at the beginning and at the end ̶ Shares held by holding company or ultimate holding company including shares held by or by subsidiaries or associates of the holding company or the ultimate holding company in aggregate ̶ No. of shares held by each shareholder holding more than 5% shares ̶ Shares reserved for issue under contracts / commitments ̶ Aggregate no. and class of shares bought back (for 5 years) ̶ Terms of any securities convertible into equity/preference shares issued alongwith the earliest date of conversion in descending order, starting from the farthest such date. 27 SHARE CAPITAL NOTES NO LONGER REQUIRED ̶ Shares allotted as fully paid pursuant to contracts without payment being received in cash “beyond 5 years” ̶ Shares allotted as fully paid up by way of bonus shares “beyond 5 years” ̶ “Sources” of issue of bonus shares 28 RESERVE AND SURPLUS BALANCE IN PROFIT AND LOSS ACCOUNT ̶ Existing Schedule VI ̶ 3 the remaining debit balance in profit & loss account, after deducting uncommitted reserves, are disclosed on assets side Revised Schedule VI 3 show as negative figure under reserves and surplus 3 net resulting figure may continue to be negative 29 RESERVE AND SURPLUS SHARE OPTIONS OUTSTANDING ̶ Separate item under reserves and surplus ̶ As per existing guidance note: a separate head between “Share Capital” and “Reserves and Surplus”, as a part of Shareholders’ funds ̶ Only AS overrides Revised Schedule VI and not a guidance note RESERVE SPECIFICALLY REPRESENTED BY EARMARKED INVESTMENTS ̶ shall be termed as a ‘fund’ (say Site Restoration) 30 MONEY RECEIVED AGAINST SHARE WARRANTS MONEY RECEIVED AGAINST SHARE WARRANTS To be shown as a part of shareholders’ funds No specific requirement under existing Schedule VI 31 SHARE APPLICATION MONEY PENDING ALLOTMENT (AND NOT DUE FOR REFUND) ̶ Separate line item on the face ̶ Not a part of shareholders’ funds ̶ Disclose 9 Terms and conditions 9 No. of shares to be issued and premium, if any 9 Period by which shares to be allotted 3 Whether sufficient authorised capital exists 3 Period for which outstanding, beyond the stipulated allotment period 3 Reasons for delays in allotment 32 SHARE APPLICATION MONEY APPLICATION MONEY DUE FOR REFUND ̶ Other current liabilities, alongwith interest accrued 33 NON-CURRENT LIABILITIES : ON THE FACE LONG TERM BORROWINGS DEFERRED TAX LIABILITIES (NET) OTHER LONG TERM LIABILITIES LONG TERM PROVISIONS 34 NON-CURRENT LIABILITIES: IN THE NOTES LONG TERM BORROWINGS 3 Classified under sub-heads 3 Bonds/debentures, with interest rate/terms (in decreasing order of maturity/conversion starting from farthest redemption/conversion date) 3 Loans and advances from related parties 3 Portions of debts and finance lease that are non current 3 Period/amount of continuous defaults on Balance Sheet date in loans and interest 3 Loans guaranteed by “directors or others” unlike the present requirement of by “directors or managers only” 35 NON-CURRENT LIABILITIES: IN THE NOTES DEFERRED TAX LIABILITY 9 Non-current liability 9 “Net” disclosure OTHER LONG TERM LIABILITIES 9 Trade payables (long term), that are due for goods purchased or services received LONG TERM PROVISIONS 9 Provision for employee benefits: non-current portion. 9 Other items: to specify nature 36 CURRENT LIABILITIES : ON THE FACE SHORT-TERM BORROWINGS TRADE PAYABLES OTHER CURRENT LIABILITIES SHORT-TERM PROVISIONS 37 CURRENT LIABILITIES: IN THE NOTES SHORT TERM BORROWINGS 3 Further sub-classification 3 Disclosure as to defaults 3 Loans and advances from related parties TRADE PAYABLES 3 Current portion of payable for goods purchased or services received in normal course of business OTHER CURRENT LIABILITIES 3 Further sub-classification 3 Disclosure of current portion of respective liabilities 3 Share application money due for refund 38 CURRENT LIABILITIES: IN THE NOTES SHORT-TERM PROVISIONS 3 Classify “provision for employee benefits” and “others” (to specify nature) 3 No specific disclosure as to proposed dividend 3 However, presently AS-4 requires provision for proposed dividend, and thus would override Schedule VI 39 NON-CURRENT ASSETS: ON THE FACE FIXED ASSETS (ALONGWITH SUB-CLASSIFICATION) NON-CURRENT INVESTMENTS DEFERRED TAX ASSETS (NET) LONG-TERM LOANS AND ADVANCES OTHER NON-CURRENT ASSETS 40 NON-CURRENT ASSETS: IN THE NOTES TANGIBLE FIXED ASSETS (SUB-CLASSIFIED) 3 Classification between tangible/non tangible 3 Office equipment, a new category 3 Assets under lease: specify under respective class of assets 3 Disclose business combination and impairments separately INTANGIBLE FIXED ASSETS (SUB-CLASSIFIED) 3 Disclosure requirements similar to tangible assets NON-CURRENT INVESTMENTS (SUB-CLASSIFIED) 3 AS-13 to prevail for current/non current classification 3 Non current investment to be classified as “trade” and “others” 41 NON-CURRENT ASSETS: IN THE NOTES 3 NON CURRENT INVESTMENTS TO FURTHER DISCLOSE: → Names of bodies corporate → Whether “subsidiaries”, “associates”, “joint ventures” or “controlled special purpose entities (SPE)” not defined → If investments in the capital of partnership firms: Name of the firm (with the names of each partner, total capital and shares of each partner) INVESTMENTS PURCHASED/SOLD DURING THE YEAR: -DISCLOSURES NO LONGER REQUIRED 42 NON-CURRENT ASSETS: IN THE NOTES LONG TERM LOANS AND ADVANCES 9 Capital advances (SEM/FCM?) 9 Security deposits 9 Loans and advances to related parties 9 Others 9 Sub-classification as secured/un-secured/doubtful, to continue COMPANIES UNDER THE SAME MANAGEMENT: 9DISCLOSURES NO LONGER REQUIRED 43 NON-CURRENT ASSETS: IN THE NOTES OTHER NON-CURRENT ASSETS 9 Long term trade receivables 9 Others (specify nature) 9 Requirements of security, etc., to continue 44 CURRENT ASSETS: ON THE FACE CURRENT INVESTMENTS INVENTORIES TRADE RECEIVABLES CASH AND CASH EQUIVALENTS SHORT-TERM LOANS AND ADVANCES OTHER CURRENT ASSETS 45 CURRENT ASSETS: IMPORTANT POINTS TO NOTE Similar disclosures for investments as in non-current investments (No investment properties) No significant change in: 9 inventories, except for clear categorisation 9 trade receivables, except for no disclosures for companies under the same management 9 requirements as to secured/doubtful, etc. 9 receivable from director/officer/firm or private company in which director is a partner/director/member, etc. Current trade receivables outstanding for more than 6 months to be disclosed “from the date they are due for payment” 46 CURRENT ASSETS: IMPORTANT POINTS TO NOTE CASH AND CASH EQUIVALENTS 9 Earmarked balances with banks to be disclosed 9 Deposits with maturities of more than 12 months (anomaly) 9 No requirement to show “Scheduled”/“Other” bank balances SHORT TERM LOANS/ADVANCES TO RELATED PARTIES OTHER CURRENT ASSETS 9 Residual heading Separate disclosures for bills of exchange, balances with excise, customs, port trust, etc., no longer required 47 CONTINGENT LIABILITIES, COMMITMENTS AND OTHER NOTES A clear distinction between ̶ Contingent liabilities ̶ Commitments In addition to existing requirements ̶ Disclose other commitments Other notes ̶ Unutilised amounts out of issue of securities, made for specific purpose ̶ Board’s opinion as to realisable value of assets (other than fixed assets and non-current investments) in ordinary course ̶ MSMED related disclosures to continue since mandated by a separate Act 48 STATEMENT OF PROFIT AND LOSS 49 STATEMENT OF PROFIT AND LOSS FORM ̶ Prescribes a form of statement of profit and loss ̶ Specific line items on the face of Statement of P&L CLASSIFICATION BY NATURE ̶ Continuation of present practice ̶ Simpler to apply unlike functional classification CONCEPT OF COMPREHENSIVE INCOME ̶ Not introduced 50 STATEMENT OF PROFIT AND LOSS MINIMUM INFORMATION ON THE FACE Revenue from operations Other income Expenses (Specific line items on the face) Profit before exceptional and extraordinary items and tax Exceptional items Profit before extraordinary items and tax Extraordinary items Profit before tax (contd….) 51 STATEMENT OF PROFIT AND LOSS MINIMUM INFORMATION ON THE FACE (contd….) Profit before tax Tax expense: current, deferred Profit for the period from continuing operations Profit from discontinuing operations Tax expense of discontinuing operations Profit from discontinuing operations after tax Profit for the period Earnings per share: basic; diluted 52 STATEMENT OF PROFIT AND LOSS: NOTES GENERAL PRINCIPLES ̶ Detailed disclosures in notes for various line items ̶ Details of exceptional and extraordinary items ̶ Any item of income/expense to be separately disclosed, if it exceeds higher of the 1% of “revenue from operations” or Rs.1 lakh. 53 STATEMENT OF PROFIT AND LOSS: NOTES OTHER INCOME (additional disclosures) ̶ Dividend from subsidiaries ̶ Other non-operating income (net of expense directly attributable) FINANCE COST ̶ Interest ̶ Other borrowing cost ̶ Applicable net exchange gain / loss PRIOR PERIOD ITEMS ̶ Presently on the face of P&L ̶ For revised Schedule VI, show in the notes ̶ Additional disclosures as necessary under AS-5 54 STATEMENT OF PROFIT AND LOSS OTHER EXPENDITURE ̶ Items exceeding higher of 1% of operating revenue or Rs.1 lakh EXCEPTIONAL ITEMS ̶ On the face of Statement of P&L ̶ Follow AS-5 EXTRAORDINARY ITEMS ̶ On the face of P&L ̶ Follow AS-5 MANAGERIAL REMUNERATION ̶ No specific disclosure required ̶ Follow AS-18, Related Party Disclosures 55 STATEMENT OF PROFIT AND LOSS CERTAIN DISCLOSURES DISPENSED WITH 9 Breakup of turnover, i.e. quantities of each class of goods 9 Split of income from “trade” and “other” investments 9 Nature of interest income and TDS on interest/investment income 9 No quantitative disclosures of materials consumed, purchased, etc. 9 Capacity and actual production 56 CERTAIN IMPLEMENTATION ISSUES 57 CERTAIN IMPLEMENTATION ISSUES (FEW INSTANCES) FORMAT PRESCRIBED FOR OFFER DOCUMENT - SEBI (Issue of Capital & Disclosure Requirements) Regulations DISLOSURES - Capital advances; Capital and other commitments - More than 5 percent shareholding; level of disclosure for ADR/GDR - Employee benefits: current/non-current - Unamortised items - Share issue expenses, discounts and premium on borrowings - Broad heads of (RM, FG, WIP) BREACH OF LOAN COVENANTS Vs. CURRENT – NON CURRENT CLASSIFICATION EARLY ADOPTION IN CASE OF DIFFERENT FINANCIAL YEARS INTERIM FINANCIAL STATEMENTS 58 IFRS AND REVISED SCHEDULE VI 59 HOW FAR FROM IFRS…………… FEW THOUGHTS CONCEPT OF OTHER COMPREHENSIVE INCOME - Changes in revaluation surplus (IAS 16/IAS 38) - Actuarial gains/losses on defined benefit plans (IAS 19) - Gains/losses on translation of foreign operations (IAS 21) - Gains/losses from investments in equity instruments measured at fair value (IAS 39) - Gains/losses on hedging instruments in effective cash flow hedges (IAS 39) STATEMENT OF CHANGES IN EQUITY CONCEPT OF RESTATEMENT/RECLASSIFICATION FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES 60 THANK YOU FOR YOUR KIND ATTENTION The information contained herein is of general nature and for discussion only 61 KAUSHAL KISHORE kaushalkishore@kpmg.com +91-9811103133 62