sharing expertise - B. Braun Malaysia

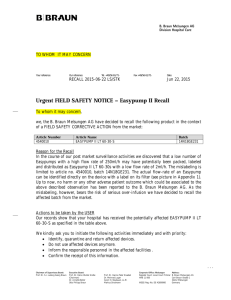

advertisement